Summary:

- Boeing agreed to acquire Spirit AeroSystems in a multi-billion dollar transaction.

- The deal structure allows for exchange ratio adjustments based on Boeing’s stock price, offering potential upside for Spirit AeroSystems shareholders.

- The transaction raises concerns about cost savings and revenue growth for Boeing, with risks outweighing potential benefits.

JHVEPhoto

July 1st was definitely an interesting day for shareholders of both The Boeing Company (NYSE:BA) and Spirit AeroSystems Holdings (NYSE:SPR). Shares of both businesses moved a bit higher after both companies announced that Boeing will be acquiring Spirit AeroSystems in an all-stock transaction valued at $4.7 billion on an equity value basis and at about $8.3 billion on an enterprise value basis. This is an intriguing transaction that’s different than most deals that most companies make. Usually, the goal here is to significantly expand the revenue base of the acquirer. But this is an odd transaction because the vast majority of the revenue currently generated by Spirit AeroSystems comes from its suitor.

Looking into the deal, I can understand why Boeing would want to make this maneuver. This is almost certainly an attempt to capture significant cost savings down the road. However, there does not appear to be much evidence that this will be successful. And when you look at the transaction from a revenue growth perspective, the situation doesn’t look much better. At the end of the day, this deal does not change my overall neutral assessment of Boeing. But I do think this should be viewed favorably by investors of Spirit AeroSystems.

An interesting purchase

According to the press release issued by Boeing on July 1st, the company has agreed to acquire Spirit AeroSystems in exchange for $37.25 per share. This represents a premium of 13.3% compared to the $32.87 that the stock was trading at immediately prior to the announcement. Far more impressive is the fact that this represents a premium of 154.3% compared to the 52 week low mark that Spirit AeroSystems has traded at. This transaction initially translates to an equity value of $4.7 billion and to an enterprise value of $8.3 billion.

It is important to note, however, that the structure of this transaction means that the ultimate value that flows to shareholders of Spirit AeroSystems most likely will change between now and the time that the deal is expected to close in the middle of 2025. This is because it’s an all-stock transaction. But it’s not being done at a simple exchange ratio. The lower that shares of Boeing fall, the higher the exchange ratio that Spirit AeroSystems’ investors will receive. And the higher that shares of Boeing go, the lower the exchange ratio will end up being.

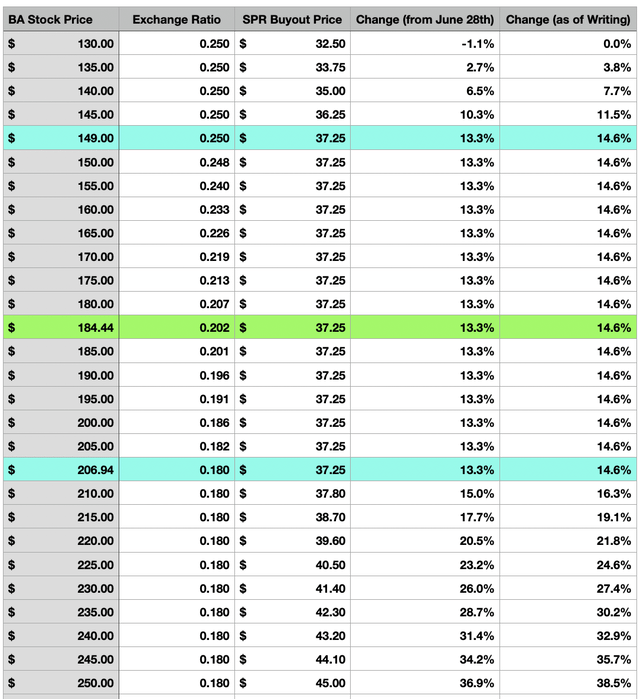

In the best-case scenario, where shares of Boeing trade at or below $149 per share, investors in Spirit AeroSystems will end up receiving 0.25 shares of Boeing for each share of Spirit AeroSystems that they currently own. And in the worst-case scenario, at or above a price of $206.94, the exchange ratio will be set at 0.18. At any point in between $149 per share and $206.94, the exchange ratio will be adjusted so that Spirit AeroSystems’ investors will receive exactly $37.25 per share in value.

This structure has certain advantages and disadvantages to it. One of the advantages is that, within the aforementioned range, it locks in the amount of value that shareholders of Spirit AeroSystems will be entitled to. Another advantage is that a slight weakening in the share price of Boeing will lead to a larger share of the conglomerate that Spirit AeroSystems’ investors will end up with. The obvious downside is that, the stronger that Boeing is between now and the time of closing, the smaller piece of the pie that investors of Spirit AeroSystems end up with. And if we see a decline in the price of Boeing below $149 per share, then the effective premium that investors in Spirit AeroSystems will receive shrinks or may even vanish entirely. In the first table of this article, you can see how all of this works out under different pricing regimes. The cells that are highlighted blue indicate the upper and lower ends of the range in question. And the cells highlighted green indicates where shares of Boeing are currently trading.

One other thing that I would like to highlight is that there are termination fees involved in this agreement. If the management team at Spirit AeroSystems decides to back out, for instance, that company will have to pay Boeing $150 million. In the event that Boeing backs out or is unable to achieve regulatory approval, it instead must pay Spirit AeroSystems the sum of $300 million. Neither of these are amounts that will make or break the businesses in question, especially Boeing. But it is some good information to have.

A look at the transaction

In some respects, the transaction that is now agreed upon makes sense for Boeing. And in other respects, it really doesn’t. To understand why this is, we should first touch on what Spirit AeroSystems does and how its financial condition appears. Operationally speaking, the company has three different segments. The largest of these, accounting for 81% of revenue last year, is its Commercial segment. Next in line, we have the Defense & Space segment. It accounts for 13% of overall sales. And lastly, we have the Aftermarket segment, which is responsible for about 6% of revenue.

Through these segments, the company provides customers with a wide array of products and solutions. For the Commercial segment, for instance, the business is engaged in the design and production of fuselage sections for aircraft, as well as other products like flight control substances, horizontal and vertical stabilizers, wing structures, struts and pylons, and more. Under the Defense & Space segment, it produces fuselage, strut, nacelle, and wing aerostructures. It even provides training, engineering analysis, and more. For missiles and hypersonics, it produces solid rocket motor throats, nozzles, re-entry vehicle thermal protection systems, and more. Lastly, under the Aftermarket segment, the company provides maintenance, repair, and overhaul services, and provides products from its other two segments to customers on an as-needed basis.

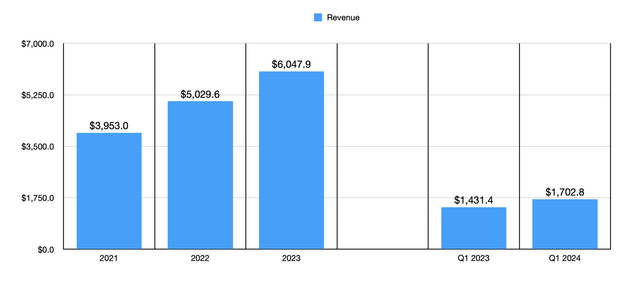

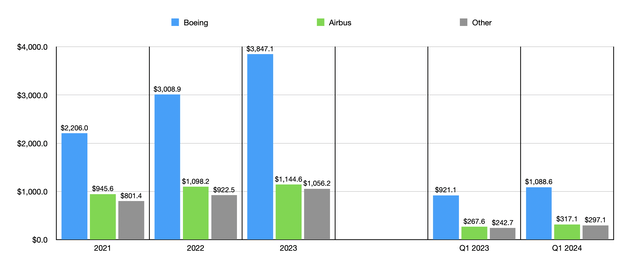

Many companies that provide these types of products and services generate a lot of their revenue from the US government. However, that is not the case here. While Spirit AeroSystems absolutely does generate some revenue from government agencies, most of its revenue actually comes from none other than Boeing. From 2021 through 2023, the company saw its revenue grow from $3.95 billion to $6.05 billion. 64% of its revenue in 2023, amounting to $3.85 billion, came from its suitor. This was up significantly from the $2.21 billion generated by business with Boeing two years earlier.

It’s the next largest customer, accounting for roughly 19% of sales last year, was Boeing competitor Airbus. Over the past three years, this customer was responsible for only a small portion of the company’s revenue growth, with sales inching up from $945.6 million in 2021 to $1.14 billion last year. The rest of the company’s revenue in 2023, about 17% in all, or $1.06 billion, was attributable to other miscellaneous customers like government agencies and other firms. This was up from $801.4 million back in 2021.

Growth for the company on the top line continued into the 2024 fiscal year. Overall revenue of $1.70 billion in the first quarter of the year beat out the $1.43 billion reported at the same time of 2023. Revenue from Boeing during this time expanded from $921.1 million to $1.09 billion. But we also saw growth from Airbus and other customers as well. Normally in a transaction like this, where the acquirer is buying a business that is already generating most of its revenue from the acquiring firm, the goal is not necessarily to generate more sales. In fact, any revenue generated by Spirit AeroSystems from Boeing after it is absorbed will ultimately be eliminated in consolidation. They are only major objective, then, would be to cut costs. But this seems to be an unlikely outcome to any significant extent.

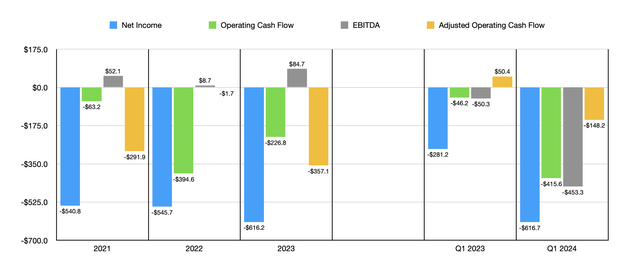

The reason why I say this is because, as the chart above illustrates, Spirit AeroSystems has generated consistent net losses and cash outflows. Yes, EBITDA has been positive, but only marginally so. The picture has even gotten worse when it comes to the first quarter of 2024 relative to the same time last year. This is the problem with a company that, using data from 2023, has a gross profit margin of only 3.4%. In the past, Boeing clearly did business with Spirit AeroSystems because it could save money compared to doing things itself. And with these significant losses and cash outflows, it’s difficult to imagine the management team at Boeing being able to cut costs by so much as to make this deal profitable.

This is not to say that some cost cutting cannot be had. There are some low hanging fruits. As of the most recent quarter, the weighted average interest rate for Boeing was only 4.75%. For Spirit AeroSystems, that number was 7.88%. This difference alone can result in $127.5 million in interest savings on an annualized basis. If we look at other expense and income items on the income statement, we might get other easy reductions of $101.3 million. It is possible that Boeing can also save materially on selling, general, and administrative costs, but it would be speculative to guess the extent to which this might be true.

This transaction also hinges on Spirit AeroSystems selling off the parts of its operations that do business with Airbus. Even if we assume that the enterprise value to sales multiple that Boeing is paying for Spirit AeroSystems is the same multiple that Spirit AeroSystems is able to get for its work with Airbus, that would reduce the effective purchase price by only $1.57 billion. This means that Boeing is ultimately paying $6.73 billion on an enterprise value basis for the prospect of some cost cuts and for revenue from other parties of about $1.06 billion. This translates to an enterprise value to net sales multiple that Boeing is paying of 6.37. That’s well above the 1.96 multiple that Boeing itself is going for. This suggests that, unless Boeing can find a way to materially cut costs, this is going to be an expensive purchase for the business.

Takeaway

Because of the lack of detail that Boeing has decided to hit investors with, we don’t really know the full value that the business is getting from this transaction. What we do know, however, is that this maneuver carries a lot of risks. The fact of the matter is that Boeing is making a large purchase for only a modest amount of incremental revenue. Unless it can cut costs significantly, which we have no evidence to justify such a hypothetical scenario, it’s likely that the firm is overpaying for the business. Obviously, this would be a net benefit for Spirit AeroSystems since they are receiving a premium over where shares were trading prior to the announcement.

For those who believe that the transaction will go through and who are simultaneously bullish on Boeing, Spirit AeroSystems is a way to get some additional upside as opposed to buying Boeing directly. Of course, this is subject to the bounds of the exchange ratio. If you think, for instance, that shares of Boeing are going to be worth around $220 or more, it does actually just make more sense to buy into it as opposed to Spirit AeroSystems. Likewise, there is some downside protection for investors in Spirit AeroSystems that is worth considering. Personally, I view all of this in a rather neutral light. I think that the probability of the transaction going through is quite high. And if that is the case, Spirit AeroSystems will essentially be a bet on the success of Boeing. But seeing as how I am neutral on Boeing, I think that rating both companies a ’hold’ makes the most sense.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!