Summary:

- Boeing’s stock price is at one-third of its pre-Max incident highs, presenting a potential opportunity for significant gains if a turnaround occurs.

- The company has faced continuous challenges, including the Max safety issues and the Starliner spacecraft being deemed unsafe for crew return.

- Despite poor financial performance, Boeing remains a stock to watch for signs of recovery and a potential rally.

- Investors should monitor Boeing for sustained positive developments that could signal a turnaround and drive stock price appreciation.

ICHIRO

Investment thesis

Boeing (NYSE:BA) doesn’t seem able to catch a break, ever since the 737 Max safety issues surfaced in the wake of two airplanes going down at the end of last decade. Even the Starliner project, which could have provided some positive PR for the company, ended up doing the opposite as the spacecraft was deemed unsafe for its crew to return to Earth from the Space Station. Its stock price is currently at one-third compared with its highs just before the 737 Max incidents. The steep selloff may make it seem like a great buying opportunity, however comparative fundamentals, as well as a lack of evidence of a sustained turnaround, suggest otherwise. Fundamentals suggest there may still be significant downside in its stock price, even as positive sentiments toward a historically great company may continue to dampen downward momentum.

Poor financial performance keeps pouring in

In the second quarter of this year, we saw a continuation of the deterioration in Boeing’s overall financial performance. Revenues declined by 15% to $16.87 billion compared with the same quarter from a year earlier. Revenues are down by 11% for the first half of the year compared with last year, confirming that this is not just a one-time quarterly fluke. Its net loss increased by roughly 10-fold compared with the same quarter from a year earlier, to $1.44 billion. The number of planes delivered saw a significant decline for the quarter, to 92 units, from 136 in the second quarter of 2023. The backlog of orders is more than impressive, at $437 billion, or 5,400 airplanes. It would take over a decade to clear the current backlog, at current delivery levels. It stands to reason therefore that things are likely to improve in this regard, and do so dramatically as soon as all the technical and operating hiccups are addressed.

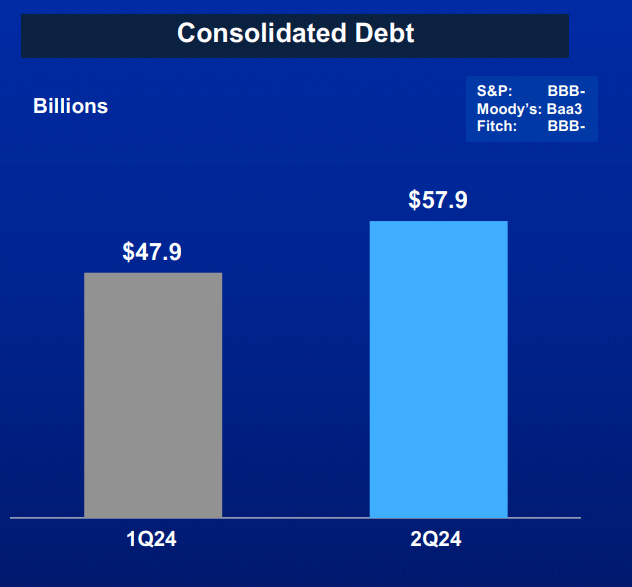

The poor financial performance is causing a worsening of Boeing’s debt situation.

Boeing

Despite the worsening debt situation, interest payments on debt remained more or less steady for the past year. On a quarterly basis, interest & debt costs increased by about 8% to $673 million. However, in the first half of the year, those costs actually declined by just over 2% compared with the same period in 2023. The costs of servicing debt are high as a percentage of revenues, coming in at 4%. It is close to the 5% threshold I tend to view as a warning signal. In the event that Boeing will get into backlog-clearing mode by increasing deliveries, we can assume that revenues will come in much higher, and that alone will greatly improve the debt servicing costs to revenues ratio. A return to profits at some point in the future might also help to bring down Boeing’s debt, which will then ease the debt-servicing costs burden.

One final aspect I want to briefly highlight is the defense segment of the company. Given the geopolitical realities of the world, the market has been bullish on the defense industry. The defense segment makes up more than one third of Boeing’s total revenues. Revenue growth in the sector remains almost stagnant. In the first half of 2024 revenues from its defense sector increased by about 2% compared with the first half of 2023. In Q2, 2024 its defense sector revenues declined by about 2% compared with the same quarter in 2023.

Odds of recovery worsened with recent failures and the machinist strike

The roots of Boeing’s problems stem from technical shortcomings, increasingly affecting traveler safety, in terms of reality as well as perception. The fact that the safety issues continue to linger, many years after the Max 737 accidents, threatens to deepen the reputational damage within an industry where safety reputation is important. After the high profile accidents that took many lives and were proven to be the fault of Boeing, the last thing that was needed was to have much mediatized incidents, such as a door flying off of a plane. Even the Starliner flight to the space station, which should have provided the company with some positive PR, ended up raising more questions about the company’s safety reliability, as the crew had to be left on the space station, because of safety concerns.

There is much that needs to be sorted out when it comes to the company’s many technical failures. Issues such as improving on its current engineering talent pool, as well as ensuring that the parts production and assembly process are free of technical or procedural flaws. All of it requires investment in its human & physical capital. The current machinist strike comes at a bad time, and it works against Boeing’s odds of achieving any improvements in the near future. The best that it can hope for is to come to an agreement with the workers, which will cost it financially going forward, but it will alleviate the immediate crisis. The added financial costs of dealing with the current crisis will make it much harder to invest in technical and operational improvements.

Global air travel demand growth shows signs of weakness, raising question marks about long-term demand for Boeing planes

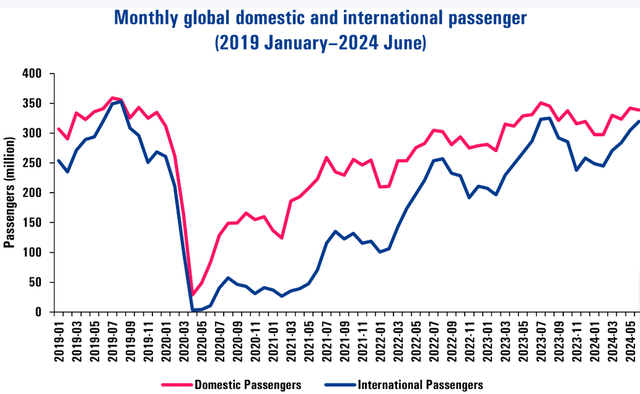

After a decent post-COVID recovery in air travel, we are now seeing a trend of what looks like stagnation, or perhaps slight decline in air travel.

Airports Council International

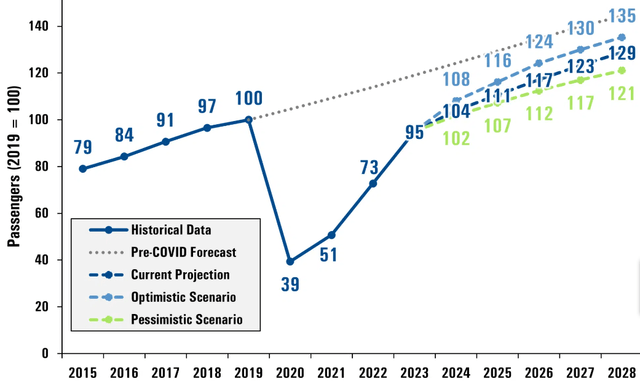

ACI World has a positive forecast out, but it remains to be seen whether it will materialize.

Airports Council International

The fact that the air travel recovery trend stagnated over the past year suggests that the pessimistic scenario presented in the forecast chart is the more likely path. Global economic growth trends also indicate that air travel is not likely to boom. A slow growth path means tourism and business travel will both struggle to pick up momentum. Other factors, such as global geopolitical frictions, make for a challenging environment for the industry. For instance, European airlines are struggling to maintain flights to Asia, due to the economic confrontation with Russia, which banned them from flying over its airspace.

Emerging competition threatens long-term sales prospects in emerging markets

The global air travel industry has thus far been dominated by two giants, namely Boeing and Airbus (OTCPK:EADSF). China’s COMAC is the first real challenge to American & European dominance. It reportedly aims to take a fifth of the global market by 2035. Unlike Russia’s aircraft industry that is increasingly self-reliant on an emerging domestic supply chain due to sanctions, COMAC is integrated into the global supply chain, which is still dominated by Western companies for key components. Therefore, it is exposed to sanctions, much like Huawei was toward the end of last decade. Given how sanctions worked out with Huawei, and more broadly with the IT tech restrictions on China, where we now see a domestic supply chain emerging, that is increasingly devoid of Western inputs, I think such measures are unlikely to happen.

Even the sanctions on Russia, which is a less capable country in terms of building competitive technologies, might backfire by the end of the decade. Russia will ultimately build planes with almost entirely domestic inputs, which will be sanctions-proof. Those planes will undoubtedly be inferior in overall performance to Boeing & Airbus planes. However, they will have one attractive feature that some nations will find preferable, namely the fact that those planes will be immune to Western sanctions. Such is the downside of over-reliance on economic sanctions in foreign affairs.

In this respect, Boeing’s problems could not have come at the worst time. Not only is it faced with the challenge from its traditional rival, Airbus, but it also provides more space for emerging market challengers to make a bid for the global market share in the airline industry. By the time Boeing will sort out its current difficulties, it will be faced with a different global market landscape. The Chinese market will be very challenging for sales, due to a preference for the emerging domestic manufacturer, as well as potential trade barriers going up due to economic and geopolitical frictions. The Russian market is lost to both Boeing & Airbus, regardless of what happens with the future of the Russia-Western World relationship. After 2030, Emerging Market sales will become more challenging for the two traditional giants of the industry due to emerging competition, even as it is the market that holds the most promise.

Investment implications

- Risks to my thesis.

There is a chance that Boeing will manage a swift turnaround from here. The labor issues will be resolved, while safety and other mishaps will disappear going forward, which will gradually lead to market worries about reliability fading. In the meantime, a combination of airline travel growth exceeding expectations, emerging challengers in the industry stumbling and failing to capture global market share, as well as perhaps Airbus facing some challenges, such as manufacturing delays and so on, could all combine to provide Boeing with a window of opportunity to execute a well-timed turnaround. If this happens, the bottom might be near, and this might be a great buying opportunity missed.

- Boeing’s stock can drop much lower based on fundamentals. Market sentiment may prevent that from happening, but there is very little fundamental upside.

Flightplan

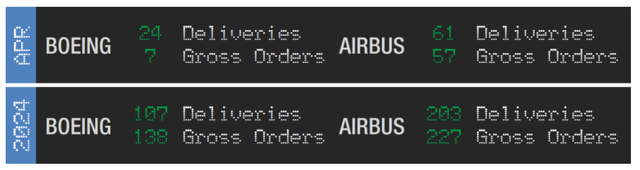

As of April of this year, Airbus was outpacing Boeing in terms of deliveries and orders by about 2 to 1. Judging by this one metric alone, the market cap of Airbus should be twice as large as Boeing’s. Forecasts suggest that Boeing will close the gap with Airbus in terms of deliveries this year, but it remains to be seen if it will be the case. The current strike might get in the way of that.

To get a better sense of Boeing’s valuation, there are many additional metrics that one can compare with its main rival, Airbus. In terms of P/E, Airbus currently has a P/E of just under 35, while Boeing is currently looking at losing almost $5/share this year.

Boeing stock price & other metrics (Seeking Alpha)

Despite the major discrepancy between the two air transport giants in terms of business volumes as well as profitability, Boeing’s market cap is currently only about a fifth lower compared with Airbus. It should be noted that Airbus itself is arguably overvalued with a P/E of 35, growth prospects that are decent, but not spectacular and a dividend of only 1.32%.

Airbus stock price & other metrics (Seeking Alpha)

None of these comparisons may be a perfect guide, but I do think that they provide some indication in regard to whether Boeing’s stock price can potentially fall much further from here. Based on what we know, it does seem like there is plenty of potential downside left if we apply some logical reasoning, if Boeing does not manage to turn things around soon.

Perhaps what may keep its stock from falling even further is its long history of air travel dominance that attracts investors to a perceived bargain, given that its stock price is currently only about 1/3 of its all-time peak. There is no telling whether this sentiment alone will be enough to keep Boeing’s stock price from declining even further. It might just be enough, or the market might see the discrepancy between Boeing’s current valuation, its current performance, and its future outlook and act accordingly. Whether there is further downside for this stock is a matter of sentiment versus fundamentals. We will see which will win. As for significant upside, sentiment alone might not do it. Concrete signs of a turnaround are needed. For now, Boeing stock remains a hold in my view. A turnaround might be swift, at which point we could see some significant upside. Therefore, it is worth keeping an eye on, but at the moment the downside risk is still more significant than the potential upside.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.