Summary:

- Boston Beer Company has an attractive portfolio but faces challenges in valuation, management, and market positioning, making it a tricky investment at current prices.

- Despite impressive growth in brands like Twisted Tea, the company has underperformed the S&P500 and lacks a dividend, making it less appealing.

- The company’s high P/E ratio and lack of yield present significant risks, with better alternatives available in the market offering safer fundamentals and yield.

- Given the current market conditions and valuation, I rate Boston Beer Company as a “Hold” with a price target of $306, expecting low single-digit returns.

Elijah-Lovkoff/iStock Editorial via Getty Images

Dear readers/followers,

Given that I review a lot of soda, alcohol, and spirits companies, I get requests from time to time to look at other companies in the sector. One such request was recieved a few weeks back and concerned the Boston Beer Company (NYSE:SAM). So in this article, I figured that I would be looking at what the company might generate or not generate, the fundamentals, and if we could see the company as a decent investment at today’s price.

My overall stance, looking just at the data and the early indicators on the fundamental side and valuation side, is that this is a difficult one – and I’ll show you why that is.

The company has an attractive portfolio and has obviously been around for quite a long time. One of the more popular products is also indicated by the ticker – SAM – namely Samuel Adams, a beer I’ve actually tasted and found to be a pretty good lager (being German, I’m fairly spoiled here, I’ll admit). The problems in the company are not, I would argue, related to the quality of its products, but rather the current business model (the challenges I see in focus on new, growth-oriented products as opposed to legacy), the way it’s valued, and where it’s going from here.

it’s no secret that the Alcohol/Spirits business is incredibly competitive and scale-oriented. That’s why most good companies get M&A’ed by one of the giants eventually. These giants are the ones that I invest in, including Diageo (DEO), Pernod (OTCPK:PRNDY), LVMH (OTCPK:LVMUY), Remy Cointreau, and others.

Smaller producers, which Boston Beer company is by comparison, are always a bit tricky – but let’s see what we have here.

Boston Beer Company – What upside exists for a highly valued Brewer

I’ve been investing in brewers on the NA market for some time. My history here includes Molson Coors (TAP), Anheuser Busch (BUD), and others. Action in these companies and, for the most part, sub-par (not negative) returns have caused me to be fairly careful when it comes to brewers. In today’s day and age, product quality will dictate whether your beer does well, as the BUD catastrophe in terms of marketing a few years ago showed us with $1B estimated in lost sales (Source). In today’s world, it’s about a lot more, and even events that some people characterize as trivial or even logical can cause big backlashes.

Let’s establish first of all that this company has massively underperformed the S&P500. By massively, I mean that SAM is down 25% while the S&P500 is up 34% in a year, meaning a 50%+ difference.

Seeking Alpha SAM/S&P500 (Seeking Alpha SAM/S&P500)

This means that the company might not have much further to fall (depending on what’s caused this underperformance), and we might have an upside here simply from reversal (if the company is about to perform better, or if the valuation makes more sense).

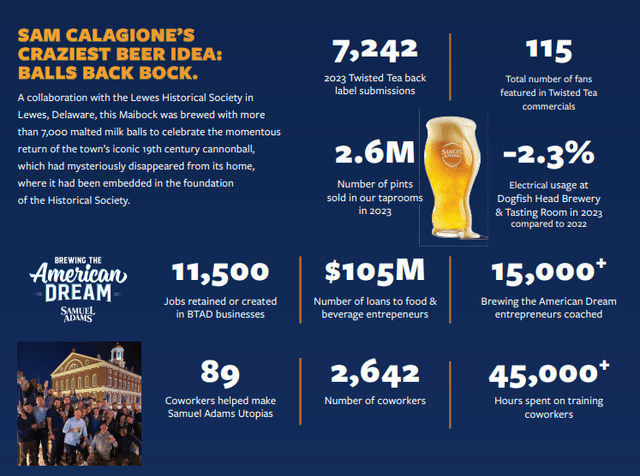

Of course, Boston Beer is much more than just Samuel Adams these days. The company has a number of alcoholic drinks under its belt, focusing on Dogfish Head, Twisted Tea, Seltzer, and the Angry Orchard Brand. It has also diversified with micro- and local breweries across key locations, such as the West Coast and NYC. Some of these brands and new products have seen truly impressive growth, which is what the premiumization of the stock’s former valuation is about in my estimate, back in 2020-2021.

Boston Beer IR (Boston Beer IR)

Twisted Tea is a very good example of this. The company is trying to lean on its legacy product strength, like Samuel Adams, while delivering growth from new products like Twisted Tea, Seltzer, and other brands. The problem is that most other companies in the same sector are approaching the growth issues in a very similar way.

Since the company peaked back in -21, it has been down over 70% since that time.

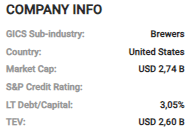

SAM Company info (F.A.S.T graphs)

Boston Beer is a company with a $2.7B market cap, generating earnings of between $5-$8/share in adjusted EPS. It lacks an IG rating or any rating, it also lacks a yield, and its current trading is at 32x P/E normalized. Without going into valuation too deeply, because we do that later, I want you to understand that this is a massive premium to the sector, where peers with far better, larger, and safer portfolios trade at almost half that while yielding over 3.5% (Such as Pernod Ricard at my time of purchase, 3.4% now, or Diageo (DEO) which despite going up is still close to 3%). So this company doesn’t exactly have a good valuation position to work from, from the get-go.

On the plus side, the Twisted Tea brand is a success story, and the 2023A period was a bit of a breakout for the brand but also required plenty of marketing capital to be pushed to work here. The company generated impressive returns due to good service levels, improvements in packaging, and other quality factors. Seltzer is “sort of” recovering, but again mostly due to aggressive marketing spend (The Truly brand). Canned Cocktails are also growing, and the company’s brands and varieties here are seeing some good growth – this is the Dogfish head brand.

Boston Beer IR (Boston Beer IR)

Overall, the latest annual results showed very good trends, and the company’s legacy segments and products also seem intact.

Boston Beer IR (Boston Beer IR)

Looking at 2Q24, the latest results we have to look at are the 2Q24 results released in late July, with 3Q24 around the corner in a few weeks. The results for this quarter were not spectacular, neither were they for the company’s 1H24.

The company, like other businesses in the same sector, saw drops in shipment revenue, net revenue, and near-double-digit decreases in net income, with YTD trends in the same spirit, with the exception of net income which for the first half of the year was up.

On the positive side, SAM is a net cash company. This means it has no debt, meaning the IG rating, or lack thereof, really isn’t an issue. The company also hasn’t been growing inorganically, which is another one in its favor, because it means it doesn’t seem to push for expensive M&A moves (even though some say the company should probably consider this, and sans this, the company might see difficulty providing growth). Ending with almost $220M in net cash, the company is in a very good fundamental position, and I wouldn’t be doing my job if I didn’t very clearly highlight this as a positive.

The company is seeing results of its margin improvement initiatives, seeing 200-250 bps improvement year-over-year, with good cash flow. So the company is acting against the weak sentiment in the current market with operational improvements. Long-term growth for this company has been impressive, and chances are good that growth will continue. However, it’s the quality or source of growth that concerns me. We’ve seen a general ,market-wide decline of interest in legacy products (beer) like, in this case, Samuel Adams, which now makes up a far lower percentage of sales. Not unique for SAM, but SAM is included here (Source).

We’re seeing some company revenue declines here especially, in addition to decreases in some, if not all of the company’s growth brands. Not all brands have these issues – and many of the EU peers have actually started growing their legacy again (Again, Pernod is a good example here). The company also isn’t exactly a winner in EBIT margins, with many companies doing better than this – and with recent figures of 5-7% being below the company’s own average as well.

On an operational basis, I can see an upside for this company and where it might go in the future. So fundamentals and operations aren’t the problem. In fact, for the right price, I would “Buy” this company.

Let’s look at valuation and put a price on it.

Boston Beer – Valuation is difficult, any peer multiple comparison makes no sense

The obvious risk of investing in a company such as this is the excessive valuation. Boston Beer has averages that go up to 30-50x P/E, and that’s not a multiple that I am paying for a company without a yield in this sector, that has seen significant historical trends of negative growth. We might indeed be approaching a point of reversion at this time, but that doesn’t mean that we should head in without knowing what we could get.

The 20-year average for Boston Beer company comes to around 35x P/E (Source: F.A.S.T Graphs Paywalled Link), which is almost 15x above the typical average for a company in this sector.

If we are to forecast the company at this multiple and would consider it fair, your estimated annualized RoR could be as high as 29% per year, or 80% RoR until 2026E. It would also however require a PT of $510/share, and that’s not something I see in the cards for Boston Beer, even if the company will deliver a fair bit of reversal and growth during the next few years.

It all comes down to whether you believe the company’s legacy and growth products will do as well as reverse the company’s earnings trends. But the current quarterly trends speak against such an excessive estimate or positivity, with declining demand for many of its legacy products. I do not believe growth-oriented products like Twisted Tea will be able to make up for the shortfall here. I believe the returns for the company will be significantly more flat than the current estimates here project.

To assist me in my conviction I have market data suggesting that analysts and forecasts go too high at least 30-45% of the time with a 10-20% margin of error on a 1-2 year basis. Add to this the fact that we lack any dividend to cover short-term shortfalls and instability as well as any sort of payout, and we’re seeing a relatively risky play here.

If I held the shares and bought at trough levels of about $265/share, I could be convinced to “Hold” here. At that cost basis, and say a 23-25x P/E, could conceivably see 15% annualized from this company, and with a high conviction we might see such share prices materialize.

Anything else does not make sense to me here. I see far better alternatives in the market with safer fundamentals, yield, and better upside.

My introductory share price for the company thus comes to $306, the 20x P/E for 2026E, but not with anything but a “Hold” despite this because the upside is lacking.

Thesis

- Boston Beer Company is an attractive mix of growth-oriented portfolio brands and legacy in the form of, among other things, Samuel Adams. The company has previously generated substantial growth and good valuation as a result of it, seeing peaks in 2020 and 2021. However, since then results have been tepid, and the market has reacted accordingly.

- We’re entering a potential growth phase, and this could support a higher share price. However, with zero yield, and EPS yield of less than 3.1%, and a 30-45% negative miss ratio here, the risk for me is too high to invest in Boston Beer Company despite a PT that goes a bit above the current share price.

- I want a 15% annualized upside to the company I invest in, and despite forecasting $306 here, the company would generate only low single-digit returns at this price. I see no scenario where I’d want to put the company higher. Consequently, this company is a “Hold” with a PT of $306 as of September/October 2024.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

If you allow a premium for the company, you can sort of see where it might go, but anything above 23-24x P/E for a beer company like this is well above excessive, and I’d forecast it at no higher than 20x, which is considerably discount to the 20-year average, but where I would “Buy”. That gives us a PT of $306, but with the way things currently are I don’t see enough of an upside to invest here. I favor other businesses.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DEO, PRNDY, LVMUY, TAP, REMYF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

While this article may sound like financial advice, please observe that the author is not a CFA or in any way licensed to give financial advice. It may be structured as such, but it is not financial advice. Investors are required and expected to do their own due diligence and research prior to any investment. Short-term trading, options trading/investment and futures trading are potentially extremely risky investment styles. They generally are not appropriate for someone with limited capital, limited investment experience, or a lack of understanding for the necessary risk tolerance involved.

I own the European/Scandinavian tickers (not the ADRs) of all European/Scandinavian companies listed in my articles. I own the Canadian tickers of all Canadian stocks i write about.

Please note that investing in European/Non-US stocks comes with withholding tax risks specific to the company's domicile as well as your personal situation. Investors should always consult a tax professional as to the overall impact of dividend withholding taxes and ways to mitigate these.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

The company discussed in this article is only one potential investment in the sector. Members of iREIT on Alpha get access to investment ideas with upsides that I view as significantly higher/better than this one. Consider subscribing and learning more here.