Summary:

- Boston Beer Company remains a “Hold” due to its lack of dividend, high valuation, and inconsistent performance despite some growth in specific product segments.

- The company’s recent results show flat revenue, slight margin improvements, and cost redistribution, but no significant positive changes in valuation or appeal.

- The company’s growth potential is limited, with expected single-digit revenue increases, making its current high P/E ratio unjustifiable for investment.

- I recommend waiting for a price drop to around $305/share before considering investment, as current prices do not offer sufficient upside.

Elijah-Lovkoff

Dear readers/followers,

In this article, I’ll be looking at the Boston Beer Company (NYSE:SAM) again. It’s a business that I reviewed roughly 3 months back after the latest results, giving it a “Hold” rating due to what I viewed as a somewhat unimpressive investment prospect. Since that time we’ve seen a slight bit of reversal – nothing strange as such given that the company had dropped significantly prior to this, but still noteworthy in that it actually outperformed the S&P500 by a factor of 2x. It justifies a second look to see if there is a different upside than I originally expected from the business.

In this case, I invest in a lot of different beer and beverage businesses. I focus on European giants like Carlsberg (OTCPK:CABGY) as well as Heineken, both of which I consider to currently be significantly undervalued for the medium and long term, and which are decent positions in my portfolio. I also follow Molson Coors (TAP) and I keep an eye on Anheuser (BUD). Local brews like Swedish Kopparberg are also on my list, but this is really a small one.

And when it comes to spirits, wine, and liquor, well – I invest even more.

So when looking at SAM it wasn’t difficult to me to arrive at a conclusion that the company was inferior in appeal based on valuation to these former companies.

Let’s look at the company’s recent results, my PT, and the potential development to see if a change is necessary here.

Boston Beer – Plenty to like, but also many challenges

So the first challenge for this business is quite simply that you’re looking at a business without a dividend. This might seem nitpicky to some, but when you’re investing in a business without any dividend, your shareholder yield and return is going to be impacted – the money that you get. Typically as the shareholder, everything being equal, a dividend-paying company is more attractive than one that doesn’t. It’s not a no-go if it doesn’t, but it does increase your hurdle.

One of the things I wanted to look at here is if I’ve perhaps been too harsh on the company, and if it upsides trump the risks I saw in a different way than I originally envisioned. On the surface it, this is not the case though. This company’s “stats” specify it as a business that quite often, negatively misses its targets and marks. It also trades at an excessive premium completely dissociated from the typical cheap multiples we find in the sector, without a seeming justification for this being the case (a few reasons can be postulated, which I will specify later). The company’s market cap is small despite this – below $3.2B, and on the surface it, this is a comparatively small player with a few appealing brands that can be pointed to.

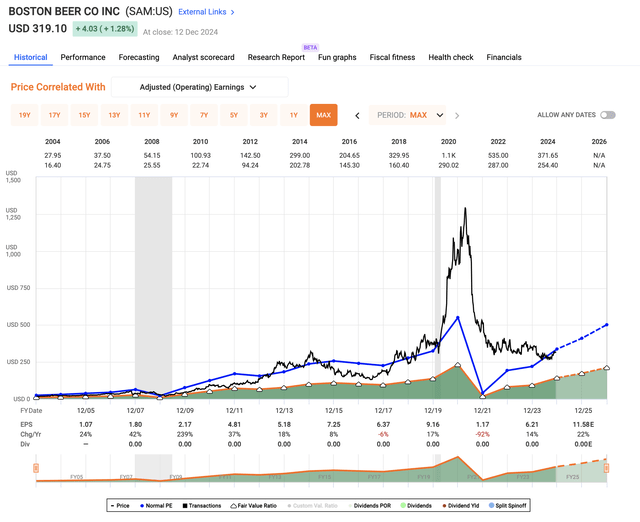

The upside comes from the company growing significantly in earnings. 13.9% adjusted EPS growth over time annualized is not in any way poor. But when combined with this business’s downright abysmal valuation history, meaning you could have lost a significant amount of money due to excessive volatility, what this implies to me is to tread carefully.

Boston Beer COmpany F.A.S.T graphs Valuation (Boston Beer COmpany F.A.S.T graphs Valuation)

The company reported 3Q24 about a month and a half ago, and it wasn’t a very good quarter overall. Net revenue was mostly flat, up 0.6%, with Gross margins at just above 46%, and non-GAAP earnings of about $5.35/share, with a non-cash impact of $2.49. However, the telling impacts were on the category side. Demand for many of the company’s products saw volatility. As management states, the typical way of returning cash to shareholders for the business is to do so by growing the business and reinvesting into it rather than payouts. This is all well and good, but a dividend typically enhances this appeal, even a small one.

The company’s guidance reflects a softer near-term picture for beer and beverages, with implementations of strategic initiatives to offset a certain growth downside. The same picture we saw in previous quarters, and also seen in other companies, is making itself known. The company’s decline in core product areas is weighted up by the upside in the company’s growth segments and products, including the aforementioned (in the last article) Twisted Tea and mixed alcoholic drinks, like Hard Mountain Dew brands.

Returns were down – revenue increased only as a product of price increases – and the same is true for the company’s gross margins, up only due to price increases as well. The company cut its advertising budget by 3%, mostly as a result of better efficiencies and cost synergies, with lower salary expenses and benefit expenses due to cuts in the workforce. In short, Boston beer is becoming more efficient, which is of course a good thing for us investors.

However, as this decreases, G&A is up almost the same amount due to increases in professional fees – so it’s more of a cost redistribution than anything else, at least at this time.

On the high level and looking at the company’s filings, things look “okay”. Nothing stands out, no significant increase in any cost item makes itself known here. That’s the good news.

The less-than-good news is that the appeal of the company remains relatively complex. By this, I mean that the valuation is not exactly improved in any meaningful way. Looking at the fundamentals, Boston Beer lacks an IG credit rating. But it’s easy to argue it doesn’t need it. The lack of any long-term debt or debt makes this a non-issue. It also means that the company is an extremely high-equity ratio business – out of $1.4B roughly of total liabilities and equity, the shareholder equity is just north of $1B. That is extremely positive, obviously. It also means that the tangible BV on a per-share basis is over $75/share. But this also highlights how expensive, relatively speaking, this company is.

The company is generally speaking a strong cash flow generator, with well over $100M of FCF every year and plenty of CFO. That CFO is used to primarily reinvest and buy back shares. Over the past 2 years, the company has bought back significant amounts. LTM, the buyback is at $200M, which in terms of shareholder yield net of issuances of common stock and debt downpayment (some remained) comes to a yield of just south of 7%. This isn’t bad, not even bad when you compare it to beer companies. In fact, if the company was trading at $200-$250 I might consider SAM a good investment at this time. As it stands though, I don’t believe the company and the market is properly accounting for the valuation risk of even a high-equity beer company trading at these multiples.

And for that reason, I remain somewhat dubious of the appeal.

Let me show you what I mean.

Boston Beer is an expensive company, especially considering the legacy risk

My issue with the company is as follows. If we assume that the company’s decline and issues with some of its legacy products like beer and Hard Seltzer (which we saw decline in 3Q), persist, then the appeal lies in growth areas, such as Twisted Tea and the like. And to be clear, analysts estimate that the company’s rate of growth from where it doubled 100% in less than 5 years, is over.

The current growth rate is expected to be less than 10% per year in revenues, and it won’t reach even $2.5B in revenues by 2028E, according to current estimates (Source: TIKR.com Paywalled Link).

In comparison, from 2017, when sales were at around $800M, the company almost tripled the sales to 2021. This is what brought about the overvaluation situation we saw earlier in the article. Betting on the company to trade at 30-40x P/E, is in my view betting on the company offering a repeat performance.

I believe this to be extremely unlikely. The company lacks the financial muscles to move in on the market on any brand that would bring this about as an M&A – at least, without tapping debt in an entirely different way than they have before. If they were, say 30-50% leveraged, then I would also lower my PT significantly. The company’s positive leverage situation is one that I have already accounted for in my valuations.

Current estimates are for the GAAP EPS due to improvement in company structure to reach 2021 levels of above $15/share in 2026E again. This might happen. But at the same time, estimates for cash flow are for it not to increase by almost anything compared to the 2023-2024 CFO even until 2027E.

I do not believe this growth journey will continue in the same way. While I do see potential for growth, to my mind this comes to a more single-digit (high) or low double-digit growth rate, and this does not justify a 30-45x P/E from a beer business. The historical valuation for SAM is distorted due to the massive overvaluation seen a few years ago, so even considering that 30-40x P/E means verifying some of this inflation in P/E.

Remember, at its peak the company’s share price was close to $1,300/share. Someone legitimately thought the company worth 114x P/E normalized, despite this being an arguably commoditized beer business – and that’s why I’m so careful. We’re talking about the company that did grow impressively, but that also fell over 90% in 2021 and has grown “okay” since.

My money is on safer producers of beer and spirits – at least at this valuation. What would compel me to invest is the company dropping to around $305/share, where my PT of $306/share would make more sense.

But at over $310/share or $320 where we are now, this company does not warrant a buy from me.

My thesis is as follows.

Thesis

- Boston Beer Company is an attractive mix of growth-oriented portfolio brands and legacy in the form of, among other things, Samuel Adams. The company has previously generated substantial growth and good valuation as a result of it, seeing peaks in 2020 and 2021. However, since then results have been tepid, and the market has reacted accordingly.

- We’re entering a potential growth phase, and this could support a higher share price. However, with zero yield, and EPS yield of less than 3.1%, and a 30-45% negative miss ratio here, the risk for me is too high to invest in Boston Beer Company despite a PT that goes a bit above the current share price.

- I want a 15% annualized upside to the company I invest in, and despite forecasting $306 here, the company would generate only low single-digit returns at this price. I see no scenario where I’d want to put the company higher. Consequently, this company is a “Hold” with a PT of $306 as of December of 2024.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansions/reversions.

If you allow a premium for the company, you can sort of see where it might go, but anything above 23-24x P/E for a beer company like this is well above excessive, and I’d forecast it at no higher than 20x, which is considerably discount to the 20-year average, but where I would “Buy”. That gives us a PT of $306, but with the way things currently are I don’t see enough of an upside to invest here. I favor other businesses, and this view remains as of 3Q24.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CABGY, HEINY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

While this article may sound like financial advice, please observe that the author is not a CFA or in any way licensed to give financial advice. It may be structured as such, but it is not financial advice. Investors are required and expected to do their own due diligence and research prior to any investment. Short-term trading, options trading/investment and futures trading are potentially extremely risky investment styles. They generally are not appropriate for someone with limited capital, limited investment experience, or a lack of understanding for the necessary risk tolerance involved. I own the European/Scandinavian tickers (not the ADRs) of all European/Scandinavian companies listed in my articles. I own the Canadian tickers of all Canadian stocks I write about. Please note that investing in European/Non-US stocks comes with withholding tax risks specific to the company's domicile as well as your personal situation. Investors should always consult a tax professional as to the overall impact of dividend withholding taxes and ways to mitigate these.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

The company discussed in this article is only one potential investment in the sector. Members of iREIT on Alpha get access to investment ideas with upsides that I view as significantly higher/better than this one. Consider subscribing and learning more here.