Summary:

- SAM is facing slowing demand and declining margins, as the hype in the craft beer and hard seltzer market has disappeared.

- SAM looks to be a weaker member of the industry, as several brands struggle with maintaining growth.

- We suspect FY23 will be a tough year for the business as it focuses on reinvigorating growth. We do not see an avenue for a return to its pre-Covid margins.

- SAM is expensive relative to its peers, which looks unwarranted given the issues and medium-term outlook.

Justin Sullivan

Investment Thesis

Our current investment thesis is:

- SAM is experiencing slowing growth and margin deterioration, as its reliance on hard seltzer (in particular) and craft beers is weighing on the business as demand declines. The hype train has truly derailed.

- Although the market as a whole is weighing on the business, it is also seeing fundamental issues with its brands, contributing to a refresh of Truly.

- We expect struggles to continue in the coming 12-24 months, as demand remains low and margin pressures continue.

Company Description

Boston Beer Company (NYSE:SAM), founded in 1984, is an American craft brewery known for its flagship brand, Samuel Adams, and a diverse portfolio of high-quality craft beers. The company has established itself as a pioneer and leader in the craft beer movement, delivering innovative flavors and maintaining a strong commitment to quality.

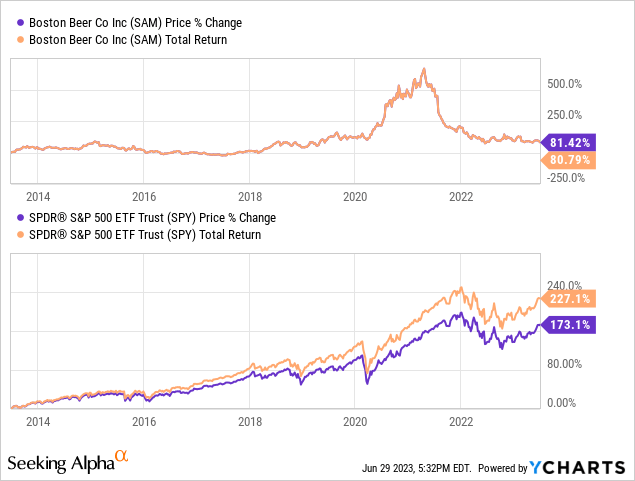

Share Price

SAM’s share price has performed poorly in the last decade, although showed significant promise in the post-Covid period. This promise was due to rapid growth across various non-traditional alcoholic beverage segments, many of which SAM operates within. This has subsequently fallen flat, as the share price illustrates.

Financial Analysis

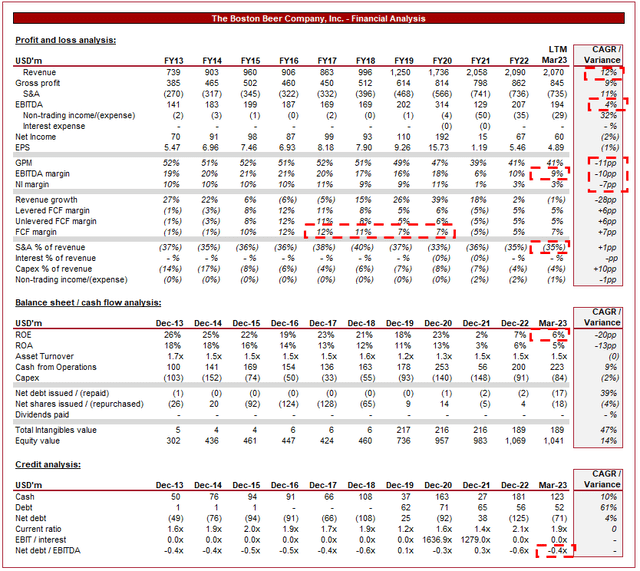

Presented above is SAM’s financial performance for the last decade.

Revenue & Commercial Factors

SAM’s revenue has grown from $739m in FY13 to $2,070m in LTM Mar23, representing a CAGR of 12%. During this period, SAM has faced volatile growth, with 4 financial years of <6% growth and 6 periods of >15% growth.

Business Model and Competitive Positioning

SAM operates as an independent craft brewer, focusing on producing and distributing a wide range of craft beers, including ales, lagers, seasonal brews, and cider products. The popularity of the business is driven by increased interest in non-traditional brands, and beverage types, with consumers demanding new flavors and premium quality.

SAM employs a multi-brand strategy, with Samuel Adams as its flagship brand, along with other well-known brands such as Angry Orchard, Twisted Tea, and Truly Hard Seltzer. This provides the business with the benefits of diversification while allowing for the exploitation of various beverage types. This said, during the historical period, the company has faced issues across various brands, contributing to the weakness. Recently, SAM has discontinued its Truly Iced Tea brand and has conducted a full refresh of Truly, in order to improve its performance.

As management has described it eloquently, the Hard Seltzer market is entering “the post-hype era” and the business has clearly been caught out. Despite the strong initial performance in the industry, Truly has rapidly fallen behind and is clearly out-of-favor. This is not the first time an improvement has been initiated and so we remain cautious until improvement is clearly shown.

Craft brewers differentiate themselves through product quality, flavor innovation, brand reputation, and unique brewing techniques. Based on our research, the general consensus is that the quality of its products is high. This implies the issue is either marketing or the segment within which it operates. Management is banking on the former, which is the reason for the revitalization of Truly. We are concerned either way. Consumers are notorious for experiencing changes in interest and so trends vary over time. The risk is that some of SAM’s brands have lost interest, which may not be easy to earn back. Either this or they have lost interest in Hard Seltzer, an area of high exposure for SAM.

Competitors vie for shelf space and taps at retail outlets, bars, and restaurants as a means of driving sales. Given the vast array of options, this is a highly competitive aspect of the industry, as direct-to-consumer is not an option. Among our many concerns is that if SAM, and hard Seltzer in general, continues to experience declining demand, we could see a rapid erosion in the offering of these products to consumers.

Operationally, SAM utilizes a combination of its own breweries and contract brewing arrangements to meet demand and maintain flexibility in production. In the most recent quarter, depletion declined 6%, with shipments declining 7.6%, implying a continued QoQ decline. Twisted Tea and Hard Mountain Dew are the only brands showing resilience.

SAM faces competition from other craft brewers such as Sierra Nevada Brewing Company, New Belgium Brewing Company, and Dogfish Head Craft Brewery, among many other micro-breweries.

Overall, there are many concerning characteristics of the current SAM operations. The brands are inherently valuable and the struggling ones cannot be wholly counted out, as trends/tastes rarely develop linearly. This said, SAM is highly exposed to a segment that currently has a hangover and its other segments are not performing that much better. This is not a beverage-wide issue, implying SAM is fundamentally struggling.

Alcoholic Beverage Industry

Without repeating what we have already discussed, the craft beer segment has been on an impressive trajectory, now encompassing a respectable portion of the alcoholic beverage market. The market is estimated to be $22.2bn in size. The reason for the rise was partially due to hype but there is an underlying quality offering here (arguably unlike Hard Seltzer). Beer is the most consumed alcoholic beverage in the world ($623bn market size) and comes second to only Water and Tea. A parallel industry to this, with a premium spin to it, should have continued success in our view. The issue is that the short-term will likely be ugly, as the industry resets to a normalized level.

One factor that could easily change a brand’s fortunes is a successful product release. With weakening financial performance, SAM should not lose sight of this and so continue to introduce new and seasonal offerings to cater to evolving consumer preferences and trends.

Increasing consumer focus on health-conscious consumption has contributed to increased demand for low-calorie alternatives, as well as no-alcohol options. Despite one of the alternatives performing poorly, namely Hard Seltzer, we believe the low-calorie/no-alcohol options could fair far better, providing an opportunity to support underlying growth.

Margins

SAM’s margins have noticeably deteriorated in recent years, falling to a GPM of 41%, EBITDA-M of 9%, and a NIM of 3%.

This rapid capitulation is a reflection of a number of negative factors combined. During this period, we have experienced inflationary pressures, with production costs materially increasing. In conjunction with this, softening demand has been damaging, pressuring the business to keep prices competitive. Further, the company has incurred some one-off costs, such as increased inventory obsolescence, as brand and product changes are made in pursuit of improvement.

Our view is that margins should improve beyond the coming 6-12 months, as operational volatility subsidies and the business attempts to succeed in its various brand pivots. This said, we see no ability to return to its FY20 levels currently, likely landing a few percent above its current EBITDA-M level.

Balance Sheet & Cash Flows

A key positive is that SAM does not utilize debt, providing the business with reduced downside risk as it experiences a difficult FY23. Further, the company has sufficient cash to buffer any issues.

SAM’s cash flows are impressive despite the performance, having shown strong consistency and a comparably high level. This implies there is hope yet with this business, as an investment in reinvigoration can come from SAM’s operations.

Outlook

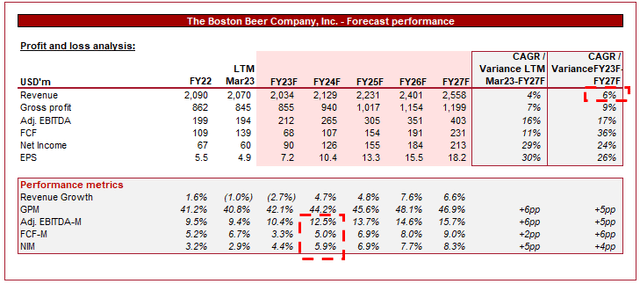

Presented above is Wall Street’s consensus view on the coming 5 years.

Analysts are expecting growth to return as early as FY24F, although not to the level achieved previously. This looks to be a reasonable estimate, as SAM can spend much of FY23 focused on revitalization. This said, the (2.7)% FY23F growth forecast remains precarious if demand falls further in Q2.

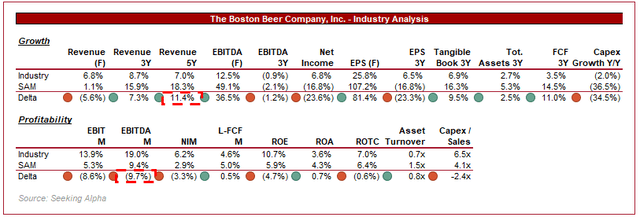

Industry Analysis

Brewery industry (Seeking Alpha)

Presented above is a comparison of SAM’s growth and profitability to the average of its industry, as defined by Seeking Alpha (7 companies).

SAM’s near-term historical growth is impressive and it is illustrated in the company’s relative performance, overperforming on both a 3Y and Y5 basis.

Profitability, however, is far less attractive. The company is operating at a noticeable deficit to the industry, with only comparability at an FCF level.

Based on this, SAM looks quite unattractive in our view. In a mature industry, profitability is usually more important than growth.

Valuation

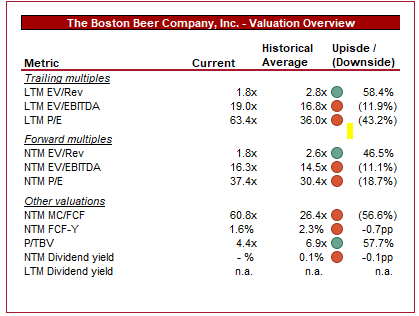

Valuation (Capital IQ)

SAM is currently trading at 19x LTM EBITDA and 16x NTM EBITDA. This is a discount to its historical average.

A discount is undoubtedly warranted in our view, as its margins have materially declined and growth is slowing to a halt.

We also believe the business is unattractive on a relative basis. The 7 peers are currently trading at an LTM EBITDA multiple of 12x, as well as a NTM P/E of 15x. This premium SAM has looks completely unjustified.

Investors are pricing in a combination of margin improvement and a significant uptick in growth. We currently believe a medium-term EBITDA-M target of 14-15% is reasonable and in conjunction with a growth rate of 5-8% (Slowing demand for non-traditional beverages), we see a 13-14x multiple as justifiable. SAM is currently at 16x on a NTM basis.

Key Risks With Our Thesis

The risks to our current thesis are:

- the potential for economic recovery-led growth. With US inflation approaching a sustainable level, we could see consumer demand improve from early 2024.

- the uncertain bottom. With the industry itself contributing to slowing demand, there is a risk to our bearish view, given the lack of visibility, that the bottom (of the seltzer / craft beer market), with improvements ahead.

Final Thoughts

SAM has performed extremely well to achieve the growth it has but its trajectory has clearly derailed. The company is struggling with both growth and profitability, and the issues are with the business as much as the segments it operates within.

Although we believe Q1’23-Q2’23 will be the bottom of its financial underperformance, improvements will be slow and the struggles will continue.

The defining factor of our sell rating is the inflated valuation, which is seemingly pricing in a strong recovery, which we cannot see.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.