Summary:

- Boston Beer continues to struggle with stagnant growth as the weak seltzer market and other brands’ weakness negate continued Twisted Tea momentum.

- Margins have risen well despite stagnant growth as gross margins have recovered partly from the 2021 low.

- Speculation around potential M&A transactions has heated up, potentially providing investors a lifeline. I still believe that a buyout isn’t a very likely base scenario.

- Unless the company merges or is bought out, I believe that the stock is still overvalued by a fair margin.

vicm

The Boston Beer Company, Inc. (NYSE:SAM) continues to work towards a recovery into better growth as seltzer sales have broken the prior very high growth, but no signs of a recovery are yet seen. Speculation around potential M&A transactions has also heated up, recently sending the stock up well.

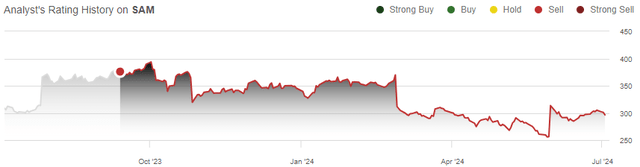

My previous article on the company, “Boston Beer: Needs To Brew Stronger Financials”, focused on the company’s weakly performing earnings and the stock’s way too high valuation. Since the previous article was published on the 13th of September in 2023, the stock has lost -21% of its value whereas the S&P 500 has returned 24%.

My Rating History on SAM (Seeking Alpha)

There’s No Growth Recovery in Sight Yet

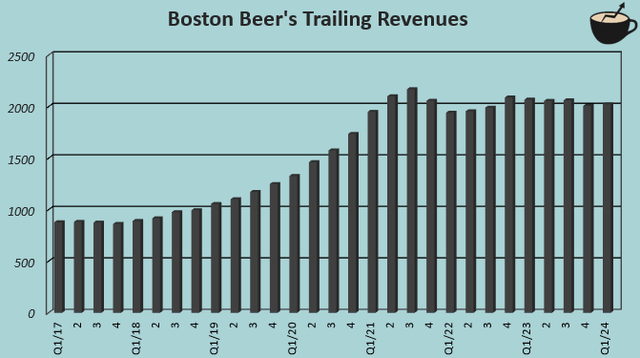

Boston Beer has recently continued to mainly report a stagnant top line – while Q3 showed a slow revenue growth of 0.9%, Q4 followed with a -12.0% revenue decline ending 2023 revenues at a negative growth of -3.9%. Afterwards, 2024 has started with a growth of 3.9% in Q1 as the strongly performing Twisted Tea brand continued showing momentum with a 21% sales growth in Q1, communicated in the quarter’s earnings call.

For 2024, Boston Beer continues to guide for depletions and shipments percentage change to be flat at the guidance’s mid-point, with price increases attributing 1-2% into revenue growth to show nominal top line growth – the better Q1 growth isn’t expected to carry forward into the rest of 2024 with many other brands continuing to post volume declines.

Author’s Calculation Using TIKR Data

The Truly Hard Seltzer brand, driver of both Boston Beer’s prior growth and more recent declines, continued to post lower shipment volumes in Q1 – no end is yet in sight for the seltzer brand’s demand recovery as the hard seltzer market’s fast growth has turned upside down. Statista estimates US hard seltzers’ at-home sales to decline by -2.3% in 2024, and to continue falling slowly until a slow recovery from 2027 forward. The seltzer category’s volumes for Boston Beer are expected down in the low teens in 2024 as told in the Q1 earnings call.

With a continued weak seltzer market and a weak volume growth guidance in sight for 2024, a growth recovery shouldn’t be expected anytime soon. The Twisted Tea brand’s growing scale should eventually aid total growth as the brand becomes a larger share of total sales volume, but high growth shouldn’t be expected with many of Boston Beer’s brands underperforming.

Margins See Leverage Despite Continued Weak Volumes

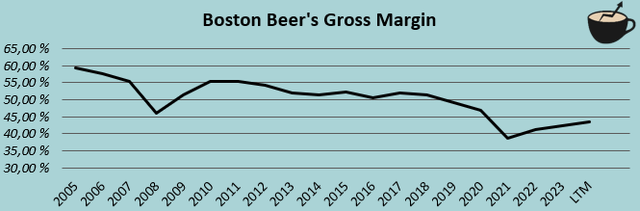

Despite the stagnating revenues, Boston Beer has been able to manage its margins well as SG&A has stayed nearly flat despite high overall inflation, and as the gross margin has been increased very well from the low of 38.8% in 2021 into a current trailing 43.6%. The operating margin has now been expanded into a trailing 7.5%.

The gross margin leverage is attributed to price increases, prior weak gross profit from Truly Vodka Soda, prior third-party contract brewery, and savings in procurement and processing – many of the benefits should be sustainable as Boston Beer has now better adapted to weak demand for the Truly brand.

Author’s Calculation Using TIKR Data

The mediocre growth should pressure margins over the long term if a growth recovery isn’t achieved, but I believe that good margin leverage is still ahead at least in the short- to mid-term as the trailing gross margin is still way below the historical level. Investors should still note the long-term gross margin deleverage though.

M&A Speculation Heats Up

On the 31st of May, Boston Beer’s stock rose over 30% at one point as a report came out that Japanese whiskey-maker, Suntory (OTCPK:STBFY), is interested in acquiring Boston Beer. Suntory quickly afterwards told to Bloomberg that the company isn’t in talks to acquire Boston Beer, and Boston Beer put out a press release that the company doesn’t comment on rumors, and focuses on working as an independent company. Boston Beer’s stock only ended up falling by -3% after the rumor was denied by Suntory.

The M&A speculation is still ongoing, as Heineken (OTCQX:HEINY) and Molson Coors (TAP) are speculated to also potentially be interested in merging with Boston Beer. Green Thumb (OTCQX:GTBIF) has expressed interest in a merger, but with more questionable synergies between a cannabis company and alcoholic beverage company, an M&A deal with a company in the same industry is thought to be more likely.

With the heating M&A speculation, Boston Beer’s shareholders could see a way out with some good upside. The stock has been left at a higher level than prior to the speculation arising, though, likely making a potential transaction’s upside weaker for investors. With Boston Beer focusing on working as an independent company, I don’t believe that investors should make M&A upside a base scenario.

The Stock Has Some Downside, Still

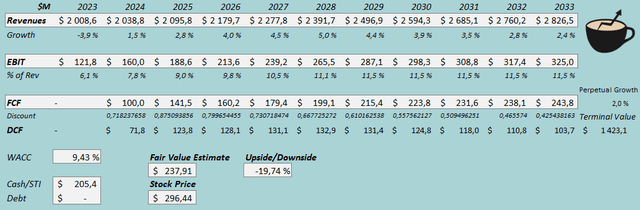

I updated my discounted cash flow [DCF] model to update my fair value estimate. I now estimate slightly lower growth at a CAGR of 3.5% from 2023 to 2033 due to the continued stagnant outlook, and 2.0% perpetual growth afterwards.

For the EBIT margin, I estimate leverage into 11.5% through elevated gross margins and some eventual operating leverage from recovering volumes. The estimate is down from 13.0% previously. Boston Beer’s cash flow conversion still looks to be quite good with larger growth investments already mainly behind.

DCF Model (Author’s Calculation)

The estimates put Boston Beer’s fair value estimate at $237.91, 20% below the stock price at the time of writing. The stock still has downside after a significant fall as growth is still stagnant. Potential M&A transactions could still pose upside, but as the company has communicated to be focused on working as an independent company, I don’t believe that M&A upside should be investors’ base scenario. Also, as I estimate the stock to have an overvaluation, Boston Beer’s attractiveness to a potential buyer could be low at the current level.

CAPM

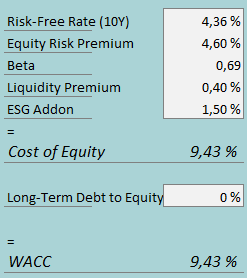

A weighted average cost of capital of 9.43% is used in the DCF model, down significantly from 12.50% before due to a lower equity risk premium and beta estimate. The used WACC is derived from a capital asset pricing model:

CAPM (Author’s Calculation)

I continue estimating no long-term debt. To estimate the cost of equity, I use the 10-year bond yield of 4.36% as the risk-free rate. The equity risk premium of 4.60% is Professor Aswath Damodaran’s estimate for the US, updated on the 5th of January. For the beta, I now use the average of Seeking Alpha’s estimates of Boston Beer’s 1.04, Constellation’s (STZ) 0.60, and Molson Coors’ (TAP) 0.42, creating a total beta of 0.69, as I believe that the prior 1.07 estimate was too high. With a liquidity premium of 0.4% and an ESG addon of 1.5%, the cost of equity and WACC stand at 9.43%.

Takeaway

Boston Beer’s growth looks to continue halted in 2024 as well with seltzer category sales still posing much lower volumes year-over-year, partly negated by continued great Twisted Tea growth. The company has also recently had speculation around it regarding a potential merger or sale of the company, but Suntory has already denied talks with Boston Beer. While the stock has fallen, I believe that it still has downside from my previous article in a base scenario. While the potential of a buyout poses a lifeline and an upside risk, I still note the stock to have a relatively bad risk-to-reward. As such, I remain with a Sell rating for Boston Beer.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.