Summary:

- Boston Beer Company is facing issues with revenue growth and margins, as many of the company’s brands are facing declining interest from customers.

- The company’s Twisted Tea brand is growing, but Truly Hard Seltzer is struggling with demand.

- Boston Beer’s current valuation doesn’t reflect the issues the company is facing, with a forward price-to-earnings of 42.6.

Stockah/iStock via Getty Images

The Boston Beer Company (NYSE:SAM) manufactures and sells alcoholic drinks in the United States. The company is currently facing issues in both revenue growth and its margins. As I believe that the valuation doesn’t represent the mentioned issues at any level, I believe the stock provides a very poor risk-to-reward – I have a sell rating for the stock.

The Company

Boston Beer produces alcoholic drinks in the United States. The company owns craft beer brands such as Samuel Adams and Dogfish Head. Boston Beer’s brands also include Twisted Tea, Angry Orchard, and Truly Hard Seltzer which sell different low-gravity alcoholic drinks such as siders and alcoholic iced tea. The company also owns local breweries in Los Angeles and New York with Angel City and Coney Island.

The company’s Twisted Tea brand is the company’s fastest-growing, as the brand had a growth of 38% in Q2 according to CEO David Burwick. The brand is trying to achieve further growth through product innovation and marketing.

Twisted Tea’s Cans (twistedtea.com)

On the other hand, Boston Beer has issues selling seltzers – Truly Hard Seltzer is facing significant issues in the brand’s demand.

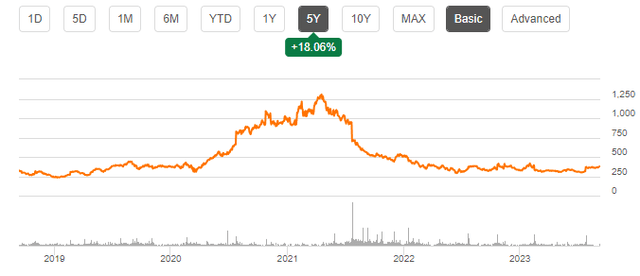

Boston Beer’s stock had a massive run in 2020 and 2021, as the company achieved high growth in the years. With deteriorating financials since the period, the stock has cooled down losing the majority of its value from the stock’s high:

The stock reached a high of around $1350 – the current price of around $377 represents a fall of 72% from the high.

Financials

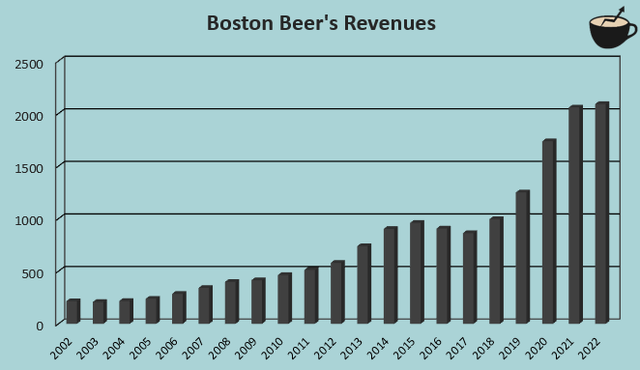

Boston Beer has achieved a very good amount of growth with minimal acquisitions – from 2002 to 2022, the company only has around $222 million in cash acquisitions, and has been able to grow at a compounded annual rate of 12.0% in the same period:

Author’s Calculation Using TIKR Data

Although the long-term growth is impressive, I am concerned about the company’s future growth – in 2022, the company only grew by 1.6% despite high inflation. In the first half of 2023, the company’s revenues have even decreased – in Q2, the company’s revenues were 2.1% lower compared to the previous year’s period.

The revenue decreases seem to be fundamentally due to a declining interest by customers in the company’s offering – Boston Beer’s main brand Samuel Adams had decreasing revenues in addition to decreases in brands such as Truly Hard Seltzer and Angry Orchard. Other companies don’t seem to have had such issues in recent quarters – for example, Budweiser had a growth of 7.9% in Q2, Anheuser-Busch had a Q2 growth of 2.2%, and Constellation Brands, a stock that I recently wrote an article on, had a growth of 6.4% in their most recent quarter.

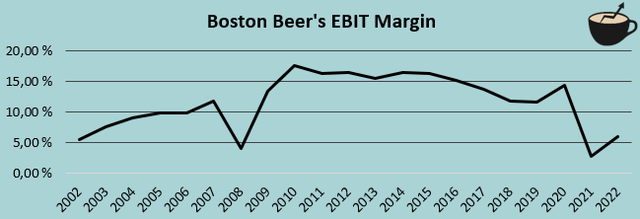

In recent years, Boston Beer has had issues with the company’s EBIT margin – in 2022, the company achieved a margin of 6.0%, well below the company’s typical figures of above ten percent:

Author’s Calculation Using TIKR Data

The issues are related to a decreasing demand as well as unoptimized operations – the company mentioned in its Q2 earnings call that it is looking for savings in costs such as materials and packaging, a better balance in internal and external production, and logistics. The company still communicates towards a margin expansion in the future – I believe that such a turnaround could happen, as the savings seem to be extensive.

Boston Beer has no interest-bearing debt, and hasn’t had a significant amount in its recent years – the company seems to operate on a safe basis. The company also has a cash balance of around $208 million.

Valuation

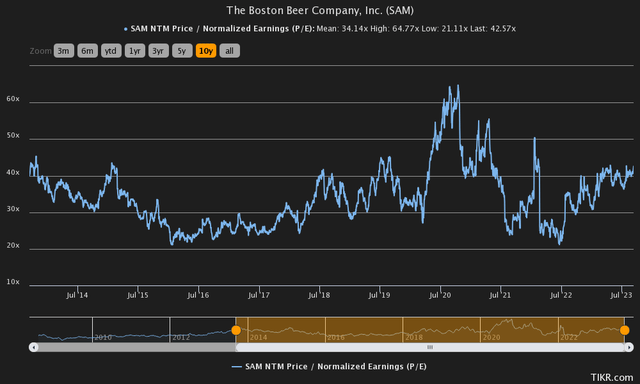

Currently, Boston Beer is trading at a forward price-to-earnings ratio of 42.57:

The ratio is higher than the company’s ten-year mean of 34.14. As Boston Beer is facing issues in their demand and has had issues regarding the company’s operating margin and revenue growth, in my opinion, the P/E of 42.57 seems way too high.

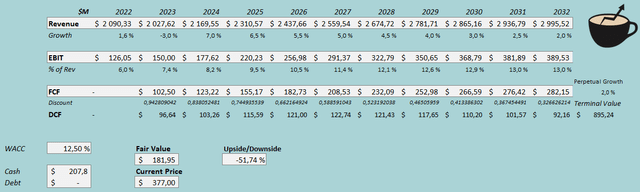

To further analyse the stock’s valuation, I constructed a discounted cash flow model in my usual manner. In the model, I expect Boston Beer to have a revenue decrease of -3%, in line with the first half. Going further, my model expects Boston Beer’s demand to do a turnaround – I expect a growth of 7% in 2024, which goes down slowly in steps into a perpetual growth of 2%.

The DCF model also expects Boston Beer to expand its EBIT margin back to a level that’s more in line with the company’s history – although for 2023 the model only has an EBIT margin of 7.4%, the margin slowly grows into a margin of 13.0% in the upcoming years. I believe this increase shouldn’t necessarily be an investor’s baseline scenario, as the company is still facing issues. To illustrate the valuation, though, I modelled a scenario in which the company’s financials recover.

These assumptions along with a cost of capital of 12.50% craft the following DCF model scenario, with an estimated fair value of $181.95, around 52% below the current price:

DCF Model (Author’s Calculation)

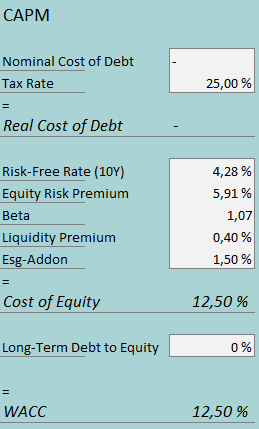

The used cost of capital is derived from a capital asset pricing model:

CAPM (Author’s Calculation)

As Boston Beer hasn’t held significant long-term debt in a very long time, I estimate that the company won’t leverage debt. On the cost of equity side, I use the United States’ 10-year bond yield of 4.28% as the risk-free rate. The used equity risk premium of 5.91% is Professor Aswath Damodaran’s estimate made in July. Usually, alcohol companies tend to have a low beta, as alcohol consumption tends to stay stable throughout different economic situations. As Boston Beer has quite a low margin, though, I believe TIKR’s beta estimate of 1.07 is reasonable. Finally, I add a small liquidity premium of 0.4% and an ESG-addon of 1.5%, crafting a cost of equity and WACC of 12.50%.

Takeaway

At the current price, Boston Beer seems to be a bad investment. The company is facing issues due to a lower demand for many of its brands. The stock’s current price doesn’t reflect the mentioned issue with an extremely high price-to-earnings ratio and an estimated DCF model downside of 52%. For these reasons, I have a sell rating at the current price.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.