Summary:

- The Boston Beer Company reported its Q1 results ahead of expectations.

- Strong sales of Twisted Tea have helped balance ongoing weakness in the Truly Hard Seltzer brand.

- An outlook for climbing earnings and positive growth support a positive outlook.

vicm

The Boston Beer Company Inc (NYSE:SAM) reported its latest quarterly earnings highlighted by a growth rebound and sharply higher margins. The trends mark an important step for the “Samuel Adam’s” brewer, attempting to address what has been a challenging last few years dealing with disappointing sales and the impact of inflationary cost pressures.

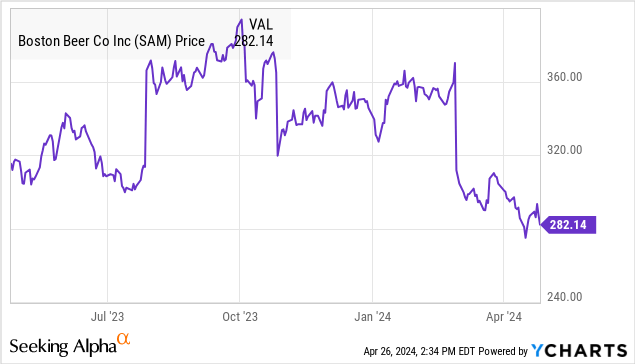

We last covered the stock in 2023, taking a bearish view citing the poor results at the time. For what it’s worth, shares are still down from that last article.

Our update today takes a more positive tone with a sense the company is finally moving in the right direction. There is still a lot of work to be done, but several efforts to improve financial efficiency appear to be working. Ultimately, we believe SAM is well-positioned to rally higher going forward.

SAM Earnings Recap

SAM Q1 EPS of $1.04 reversed a loss of -$0.73 in the period last year. Revenue of $426 million was up 3.9% year-over-year and came in $14 million above the average of Wall Street estimates.

The story this quarter was an uptick in shipments, up 0.9% year-over-year and reaching 1.6 million barrels, referring to the quantities sent out to wholesalers, driven by strong momentum from the “Twisted Tea” brand.

Group-wide depletions, describing the volumes sold from distributors to retailers were flat, with that difference between the two metrics explained by distributors moving to build up inventories ahead of the peak summer season.

The top-line growth captured a shifting sales mix and higher average pricing. The gross margin in Q1 at 43.7% improved from 38.0% in the prior year quarter, which was pressured at the time by some one-off charges related to the Trully Vodka Soda rebranding. Boston Beer is also benefiting from lower freight and logistical charges supporting profitability.

Newly appointed CEO, Michael Spillane who took over the role earlier this month projected optimism during the earnings conference call for continued financial momentum.

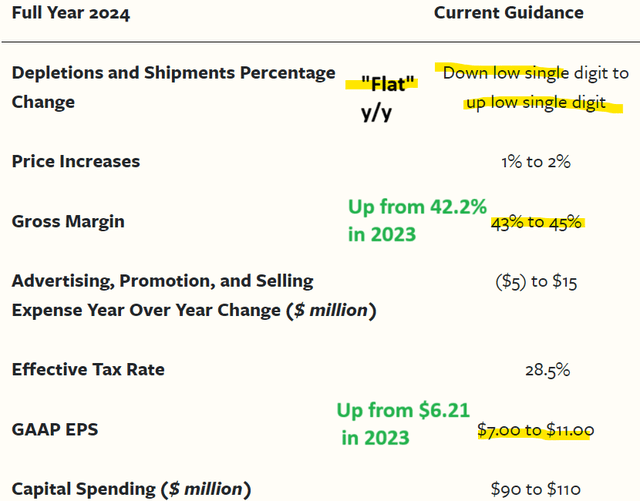

In terms of guidance, the company expects volumes to be approximately flat for the full year 2024, in a range down to up low single digits from 2023. More favorably, the outlook is for the gross margin between 43% and 45%, which compares to 42.2% last year. The EPS target from $7.00 to $11.00, if achieved at the midpoint, represents an increase of 45% from the $6.21 result in 2023.

A strong point in SAM’s financial profile continues to be its solid balance sheet. The company ended the quarter with $205 million in cash against effectively zero long-term financial debt. Underlying cash flows have supported an ongoing share repurchasing program.

Thee company has bought back $65 million in shares this year and has $202 million remaining under the existing authorization.

What’s Next For SAM?

We mentioned the difficulties Boston Beer has faced which goes back to the pandemic-era sales boom that left a high-line watermark the company has struggled to reclaim.

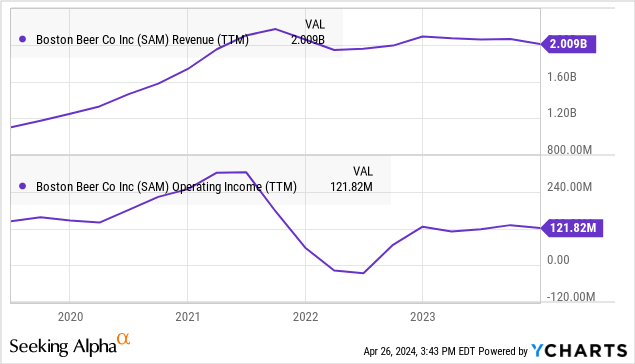

For context, sales over the last twelve months around $2 billion remain well below the 2021 peak near $2.2 billion. Similarly, the operating income run rate is less than half its record. The trend follows an industry theme where consumers globally have shifted spending patterns drinking less beer overall.

For Boston Beer, a bigger disappointment has been trends in its “Truly Hard Seltzer” brand where category sales declined by 23% in 2023, with another volume drop in “low teens” last quarter.

In this case, the hard seltzer category within beer has sort of fizzled out compared to the craze a few years ago. Truly, in particular, appears to have also lost market share in intense competition. Boston Beer described this dynamic in its last annual report:

Beginning in the latter half of 2021 and continuing into 2023, the category saw sharp declines in volume. The Company believes that the hard seltzer category comprises approximately 6% of United States beer consumption and that the volume comprising the hard seltzer category grew 13% in 2021 and then declined 15% in 2022 and 21% in 2023. This relatively sudden and sharp decline has had a significant impact on the Company’s business.

The point here is to help explain SAM’s stock price disastrous performance over the period. At the same time, the setup also points to the path forward. The company is betting on its “Beyond Beer” strategy, noting stronger growth in Twisted Tea that has at least balanced the ongoing pressures on Truly.

The effort now is to stabilize Truly by better managing the assortment of flavors and focusing on the options that are connecting with consumers. Innovations like non-alcoholic Samuel Adams and the newer “Sun Cruiser” vodka-based beverage showing early success provide upside to what remains significant market opportunities.

By this measure, the strength of Boston Beer is its relative product portfolio diversification that offers the company flexibility to focus on the options that are connecting with consumers.

SAM Stock Price Forecast

While the company is no longer the high-flying growth name it once was, the attraction now is a sense sales and earnings are finally turning the corner with the worst weakness in the past.

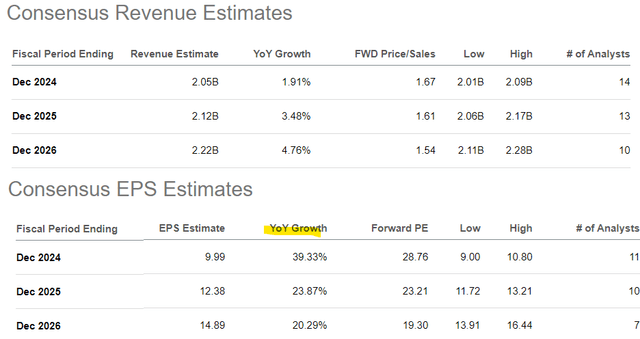

Shares of SAM are trading at nearly 30 times forward earnings, a lofty level, but with the understanding that 2024 is a transitional year for the company to get back on its feet.

The earnings multiple becomes more palatable as the top-line rebounds and EPS growth is expected to average above 20% between 2025 and 2026 according to consensus estimates.

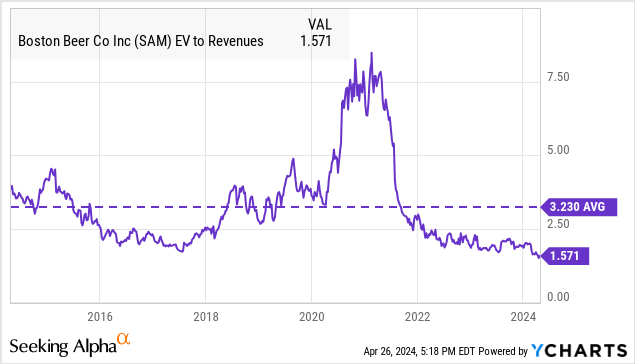

The other metric we’re focusing on is SAM’s EV-to-revenue multiple of just 1.6x, the lowest level for the company in the past decade compared to a 3.2x average.

The ability of management to deliver stronger results could go a long way at improving market sentiment and supporting an expansion of these valuation multiples as part of the bullish case for the stock.

Final Thoughts

Our message is that SAM’s outlook has improved which could set the stage for a more sustained rally in the stock. The next several quarters will be critical for the company to confirm its turnaround is making progress as part of a long road to rebuilding investor confidence.

The risks here to consider include the beer industry level challenges and uncertainties at the macro level. A deterioration of consumer spending or a broader economic slowdown would likely pressure sales and force a reassessment of the earnings trajectory. Monitoring points include trends in shipment volumes as well as the gross margin.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in SAM over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Add some conviction to your trading! Take a look at our exclusive stock picks. Join a winning team that gets it right. Click for a two-week free trial.