Summary:

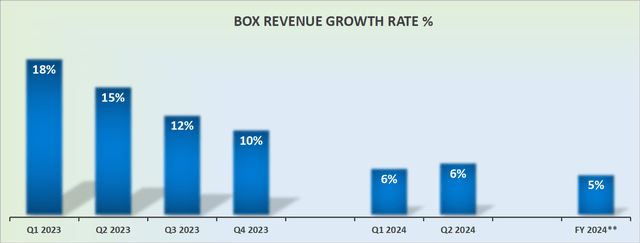

- Box’s growth rates appear to be slowing down, which raises concerns.

- Intense competition and technology issues are affecting Box’s performance.

- Concerns about the company’s balance sheet and free cash flows make it a less appealing investment option.

Nikada

Investment Thesis

Box (NYSE:BOX) is a content storage platform that has its customers from 69% of the Fortune 500. Simply put, its customers are the largest enterprises in the world. And this brings onto itself some of the most negative aspects of this investment thesis.

My contention is that Box’s growth rates are moderating as its customer base isn’t as aggressively expanding into Box’s services as its technology may becoming dated.

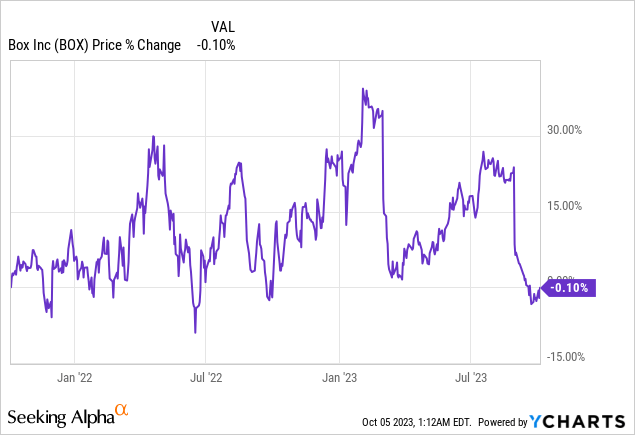

What we are left with here is a company that’s growing at mid-single digits and priced at approximately 14x this year’s free cash flow. In sum, I don’t find this alluring.

Box’s Near-Term Prospects

Box is a secure, cloud-native platform known as the Content Cloud, designed to manage the entire content lifecycle for organizations. It encompasses a wide range of content types, from videos to documents and proprietary formats. Box enables customers, including a significant portion of the Fortune 500, to securely manage content from creation or ingestion to sharing, editing, publishing, approval, classification, and retention.

It prioritizes content security while facilitating easy access and sharing across devices, both within an organization and with external partners.

The platform offers collaboration, workflow automation, data protection, and integration with numerous enterprise applications, making it a versatile solution for enhancing business processes and secure hybrid work while safeguarding critical data.

Box’s near-term prospects involve addressing challenges in a dynamic business landscape. The company continues to prioritize cost consolidation for customers by offering a comprehensive suite of services, aiming to simplify IT environments and enhance data security. As the macroeconomic environment affects IT spending and seat growth, Box seeks to navigate these challenges by focusing on delivering value through its product portfolio, including Box Sign, Box Shield, and Box Governance. Stabilization in the demand environment is a positive sign, and the company remains confident in its ability to capture opportunities as economic conditions improve. That being said, consider this quote from the earnings call,

So while our customers are still dealing with macroeconomic challenges and scrutinizing that IT spend, as we mentioned, we are encouraged by the stabilization that we’re now seeing in the demand environment and we’re also starting to see pipeline building at healthier levels than earlier in the year, but that typically takes several quarters to close given our enterprise sales cycles.

Indeed, Box’s challenges in the near term include addressing the impact of macroeconomic conditions on seat expansion, particularly as customers are prioritizing cost-effective solutions, this is translating into slower seat growth creating a near-term obstacle, which is reflected in Box’s revenue growth rates.

Revenue Growth Rates Fizzle Out

Box today is delivering around mid-single-digit growth rates. I believe there are two main reasons for this lackluster performance, the competitive environment it operates in and its underlying technology.

Firstly, competition in the cloud content management space remains intense, with well-funded competitors such as Microsoft (SharePoint) (MSFT), OpenText (Documentum), and Google (Drive) (GOOG)(GOOGL) coming to mind. This requires Box to differentiate itself through innovation and customer-centric offerings.

Secondly, while Box makes the case that it must more effectively communicate its value proposition to customers in various segments while adapting to changing customer demands, I do not believe that’s what’s keeping customers away. Pricing pressures are undoubtedly a factor for the top Fortune 500 companies, albeit they may not be the most significant ones. It has probably more to do with the fact that Box has to continuously invest in product development, which is costly and would ultimately impact Box’s underlying profitability, which we’ll discuss next.

Box’s Free Cash Flows in Focus

Box is profitable and brings in solid cash flows. Further, Box has in the past 2 years deployed significant sums to repurchase its shares outstanding. However, these share repurchases are becoming smaller with time. And the reason why they are becoming smaller is that Box’s balance sheet isn’t as strong as it once was.

In fact, as of fiscal Q2 2024 (its latest reported quarter), Box’s net cash position stands at $80 million, which will soon mean Box will have to stop repurchasing its shares and turn its focus instead towards paying down its convertible debt that is due in just over 2 years’ time.

Box’s free cash flow in the previous year reached approximately $240 million and given its performance for fiscal H1 2024, it appears that Box is on target for a similar figure this fiscal year.

Even as Box reaffirms its commitment to low-30s% free cash flow margins as part of its long-term model, Box today is on a path for closer to high 20s% free cash flow margins.

To sum it up, this leaves Box with its single-digit revenue growth rates priced at about 14x this year’s free cash flows. That’s not expensive, but it’s far from enticing either.

The Bottom Line

I’m on the fence with Box stock. It seems that Box, a content storage platform with a significant presence among Fortune 500 companies, may be facing some uncertain times ahead.

While it offers a range of content management solutions and prioritizes security, its growth rates seem to be slowing down, possibly due to competition and the need for continuous product development.

The company’s free cash flows and share repurchases have also raised concerns, as its balance sheet may not be as robust as before. Overall, there are challenges and uncertainties surrounding Box’s near-term prospects, making it a less appealing investment option in my view.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.