Box: Focus On The Free Cash Flow And Recurring Revenue For Long-Term Growth

Summary:

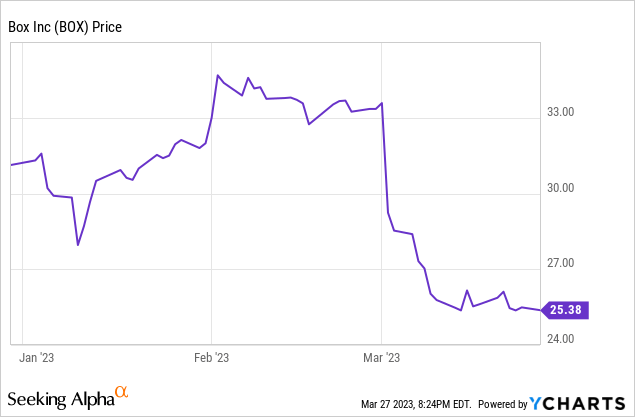

- Shares of Box have tanked after the company reported Q4 results and issued FY24 guidance, taking YTD losses to the mid-teens.

- Investors are lamenting the fact that Box expects revenue to decelerate to the mid-single digits in Q1, driven in large part by FX headwinds.

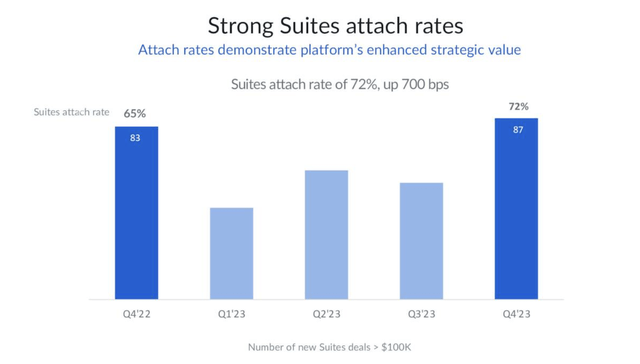

- Underneath the hood, however, Box continues to win with its cross-selling strategy, with Suites deals now representing more than two-thirds of Box’s closings.

- The company also continues to make aggressive operating margin gains and is attractively valued on an FCF basis.

Justin Sullivan

Yes, there is a lot of volatility out there in the markets right now. That doesn’t mean that the right solution is to sit out off the markets or bias our portfolios to index funds. The best way to put our money to work right now is to stock-pick aggressively, and right now, I think value tech stocks are quite an attractive buy.

Box (NYSE:BOX), for example, checks off a lot of my wish list items. The stock is down nearly 20% year to date with losses accelerating after a recent earnings release, indicating there is turnaround potential. It’s still achieving double-digit revenue growth from a constant-currency perspective, and it’s achieving large operating margin gains. And best of all, Box is also cheaply valued from both a top and bottom-line perspective. It’s a great time for investors to re-assess the bull case here.

I remain bullish on Box as a long-term hold and have added more on the recent dip. Box is one of the few cloud stocks of the “first wave” that went public in the earlier half of the 2010s, and it is also one of the few to have graduated from hyper-growth mode into sizable profitability. In spite of this shift and the fact that Box’s reliable recurring revenue stream is now spitting out troves of free cash flow, Box has still failed to find much love on Wall Street and among mainstream investors. But with such sizable profits, I’m keen to adhere to a long-time market adage – over the long run, the market is a weighing machine and not a voting machine.

For investors who are newer to Box or catching up on this stock, here is my full bullish thesis for the company over the long run:

- Box’s product portfolio expansion has led to a $74 billion market- Despite competition, Box cites a massive $74 billion market across storage, content collaboration, and data security. That’s a big enough space for multiple incumbents, and also suggests Box is only currently ~2% penetrated into this overall market. Recent portfolio additions like Box Sign have greatly expanded Box’s potential.

- Multi-product strategy is winning- More than two thirds of Box’s new deal bookings come from Box Suites customers who are purchasing more than one Box product. Additions like Box Sign continue to pave the way for incremental revenue growth.

- Founder-led- Though many Silicon Valley startups have been passed over from their founders to professional CEOs, Box remains led by its co-founders Aaron Levie and Dylan Smith as CEO and CFO, respectively.

- Enterprise orientation- Of all of its well-known competitors, Box is the only company that is enterprise-focused. The company touts its security features plus advanced capabilities like Box Skills as key distinguishers versus the likes of Dropbox.

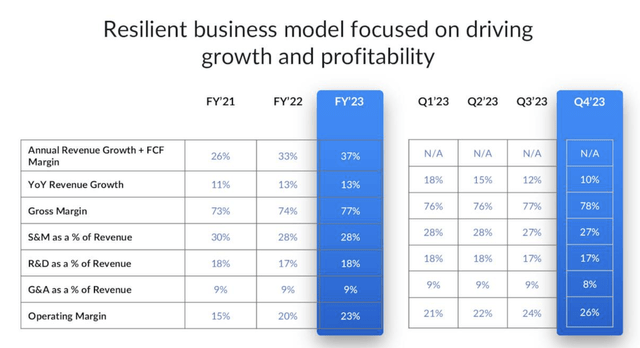

- Growth plus profitability in one package- Box touts “growth + FCF margin” as its key metric for balancing revenue and profitability; and this has marched steadily upward to 37% in FY23. Box hopes to hit 40-42% by FY25.

- Possibility of an acquisition- Buyout speculation started brewing for Box in 2021, and chatter on Dropbox picked up in 2022 as well. Though a deal may not be imminent, the company’s product fits neatly into one of the other software giants’ portfolios (Salesforce (CRM) or Oracle (ORCL)) and its free cash flow also makes it an accretive target.

Valuation check-up

The biggest draw to Box, of course, is its ultralow price. At current share prices near $25, Box trades at a market cap of $3.66 billion. After netting off the $461.3 million of cash and $369.4 million of debt on the company’s Q4 balance sheet, Box’s resulting enterprise value is $3.57 billion.

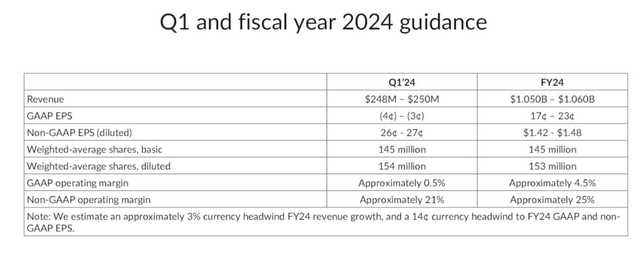

Box outlook (Box Q4 earnings deck)

For FY24 (the year for Box ending in January 2024), the company is guiding to $1.05-$1.06 billion in revenue (+7% y/y on an as-reported basis, and +10% y/y on an FX-neutral basis after accounting for an estimated 3-point headwind from currency movements). Considering Box exited Q4 at a 15% y/y growth rate in constant currency terms, this outlook may be a tad conservative.

The company is also guiding to a 25% pro forma operating margin, up from 23% in FY23.

From a revenue standpoint, Box’s valuation stands at just 3.4x EV/FY24 revenue. Due to its maturity, its cash flow based valuation may be more relevant. In FY23, the company generated $293 million of free cash flow at a 29.5% margin. If we assume Box’s two points of operating margin expansion also carries into FCF, a 31.5% margin on FY24 midpoint revenue of $1.055 billion would imply $332 million of free cash flow (+13% y/y). Against this estimate, Box trades at 10.8x EV/FY24 estimated FCF.

Any way you slice it, the theme is clear: Box sits at a fairly low-risk entry point with low expectations.

Q4 download

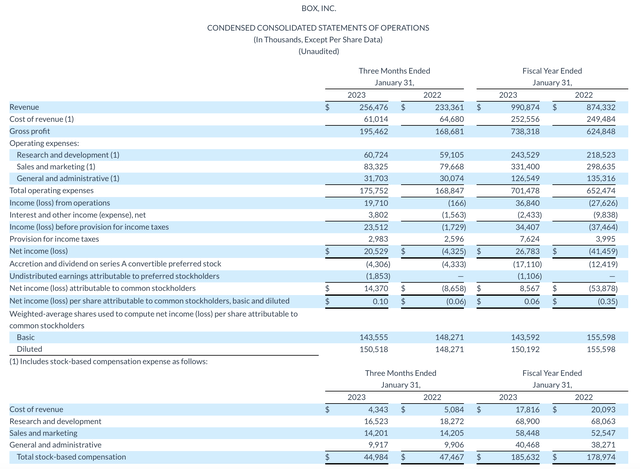

Let’s now turn to Box’s latest quarterly results in greater detail. The Q4 earnings summary is shown below:

Box Q4 results (Box Q4 earnings deck)

Box grew revenue at 10% y/y to $256.5 million in the quarter. There was substantial drag from currency fluctuations embedded here: on a constant-currency basis, Box’s revenue would have grown at 15% y/y, decelerating only two points from 17% y/y FX-neutral growth in Q3.

Cross-selling multiple products continues to be the bread-and-butter of Box’s strategy. Box Suites is now present in 72% of Box’s new deals, up from just 65% in the year-ago Q4, while overall churn remained low at 3%.

Box Suites trends (Box Q4 earnings deck)

Deal volume, admittedly, is slowing down due to the macroeconomy where all spend (including and especially IT spend) is getting more scrutiny. For this reason, billings growth clocked in at just 6% y/y (9% on a constant-currency basis).

The company is taking advantage of the slowdown to focus on margin growth. Per CEO Aaron Levie’s remarks on the Q4 earnings call:

Finally, over the past year, we have been executing on our strategy to drive long-term sustainable growth while also delivering continued operating margin improvements. As we began to see the impact from the challenging macro, we adapted to the environment and continued to deliver significant gross and operating margin expansion. Even amidst the ongoing macro dynamics, which may pressure top line results at times, we remain focused on continuing to deliver bottom line improvements. We are driving efficiency across the business, making ROI-based decisions across every area of investment from product to go-to-market initiatives, continuing to improve our gross margin by fully moving into the public cloud and driving operational excellence in everything we do.”

Gross margins improved 340bps y/y as a result of the company’s transition toward using public cloud servers, which will be fully complete by FY24. On the opex side, Box grew its sales headcount by 15% y/y in FY23, but intends to slow that down to the mid-single digits in FY24.

Operating margins clocked in at 26% in Q4, up 520bps from the year-ago quarter. Note as well in the trended charts below that operating margin has consistently expanded each and every quarter in FY23:

Box operating margin progression (Box Q4 earnings deck)

Key takeaways

Amid market volatility, it’s never a bad idea to invest in an out-of-spotlight and undervalued stock like Box that isn’t riding on overly high expectations. Sit on this company and wait for the rebound.

Disclosure: I/we have a beneficial long position in the shares of BOX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.