Summary:

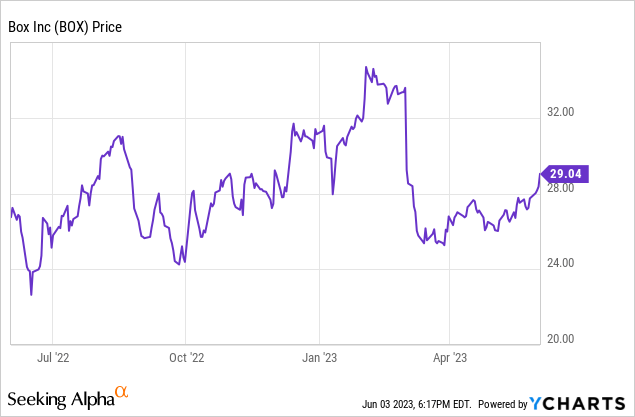

- Shares of Box are down -7% year-to-date despite strong earnings growth.

- BOX stock trades at a <4x forward revenue multiple and a <1x PEG ratio.

- Continued product development in the AI space may help to generate incremental revenue growth (and potentially help the stock re-rate upward).

- Gross and operating margins are seeing substantial economies of scale, leading to strong EPS and FCF gains.

ngkaki

When Box (NYSE:BOX) first went public, investors shunned the stock because it was famously referred to as a money-losing “house of horrors“. Yet now, nearly ten years after the company’s IPO, Box’s file-sharing service remains the gold standard in enterprise collaboration, and the business has grown tremendously profitable on the back of its recurring-revenue base and high gross margins. Box is proof that software companies are right to chase growth early on, then focus on margins in a later, more mature phase.

In this volatile market, we should look out for these mature, reasonably valued tech stocks that have demonstrated admirable earnings leverage like Box. Year to date, the stock is down ~7% (despite many SaaS peers seeing YTD gains), and in my view, it’s a great time to build a position in this stock or double down on an existing one.

I remain bullish on Box. In my view, the competitive landscape in this space has solidified among the top three players (Box, Dropbox (DBX), and Google Drive (GOOG) (GOOGL)); and among these three, Box is the clear winner in enterprise. Now, Box’s path forward is all about encouraging upsell to tertiary products while leveraging its economies of scale to drive margin expansion.

Here is my full long-term bull thesis on Box:

- Box’s product portfolio expansion has led to a $74 billion market. Despite competition, Box cites a massive $74 billion market across storage, content collaboration, and data security. That’s a big enough space for multiple incumbents, and also suggests Box is only currently ~2% penetrated into this overall market. Recent portfolio additions like Box Sign have greatly expanded Box’s potential.

- Multi-product strategy is winning. More than two thirds of Box’s new deal bookings come from Box Suites customers who are purchasing more than one Box product. Additions like Box Sign continue to pave the way for incremental revenue growth.

- Founder-led. Though many Silicon Valley startups have been passed over from their founders to professional CEOs, Box remains led by its co-founders Aaron Levie and Dylan Smith as CEO and CFO, respectively.

- Enterprise orientation. Of all of its well-known competitors, Box is the only company that is enterprise-focused. The company touts its security features plus advanced capabilities like Box Skills as key distinguishers versus the likes of Dropbox.

- Growth plus profitability in one package. Box touts “growth + FCF margin” as its key metric for balancing revenue and profitability; and this has marched steadily upward to 37% in FY23. Box hopes to hit 40-42% by FY25.

- Possibility of an acquisition. Buyout speculation started brewing for Box in 2021, and chatter on Dropbox picked up in 2022 as well. Though a deal may not be imminent, the company’s product fits neatly into one of the other software giants’ portfolios (Salesforce (CRM) or Oracle (ORCL)) and its free cash flow also makes it an accretive target.

Valuation, meanwhile, remains quite modest. At current share prices near $29, Box trades at a market cap of $4.21 billion. After we net off the $517.0 million of cash and $369.8 million of debt on Box’s most recent balance sheet, the company’s resulting enterprise value is $4.06 billion.

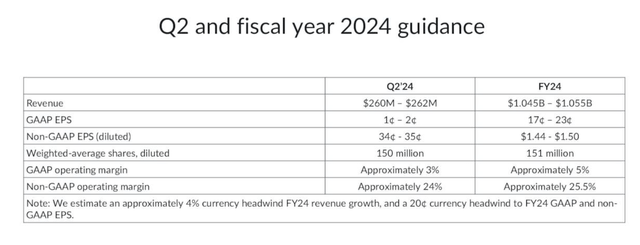

Meanwhile, for the current fiscal year FY24 (the year for Box ending in January 2024), Box has guided to $1.045-$1.055 billion in revenue (+6% y/y), and $1.44-$1.50 in pro forma EPS (20-25% y/y growth):

Box guidance (Box Q1 earnings deck)

This puts Box’s valuation multiples at:

- 3.9x EV/FY24 revenue

- 19.7x FY24 P/E ratio

I especially like the fact that Box’s PEG ratio, using the 23% y/y EPS growth midpoint of Box’s guidance range, stands at 0.85x – indicating that Box is undervalued for its earnings growth potential.

The bottom line here: Box is in a relatively mature phase of its product growth, but the “wow” factor from here on out comes from margin expansion that is leading to double-digit earnings growth, not top-line growth. Don’t ignore this stock as it continues to juice up its EPS.

Q1 download

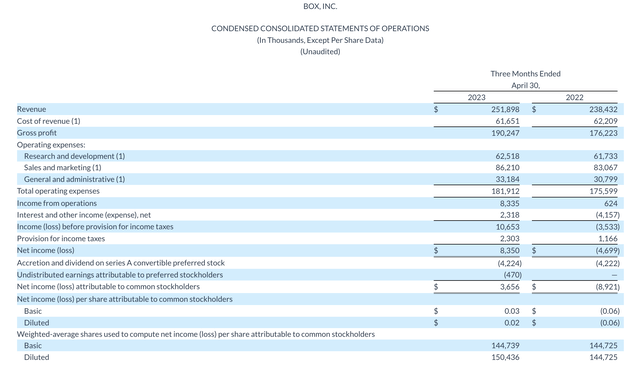

Let’s now go through Box’s latest quarterly results in greater detail. The Q1 (April quarter) earnings summary is shown below:

Box Q1 results (Box Q1 earnings deck)

Box’s revenue grew 6% y/y to $251.9 million, beating Wall Street’s expectations of $249.3 million (+5% y/y). Foreign currency movements continue to be a big drag here; on an FX-neutral basis, Box’s revenue would have grown at 10% y/y.

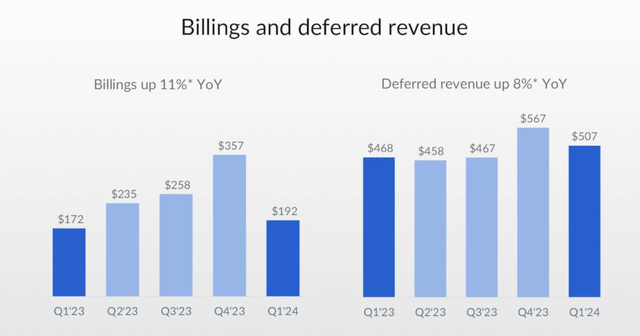

Billings, however, performed much better. As seasoned software investors are aware, billings represents a better long-term picture of a company’s growth trajectory, as it captures deals signed in the quarter that will be recognized as revenue in future quarters.

Box billings (Box Q1 earnings deck)

As shown in the chart above, billings grew 11% y/y to $192 million (+15% y/y on a constant-currency basis), which may indicate that re-acceleration in revenue is possible.

It’s important to note that despite being a more mature product, Box is still capable of driving growth in new areas such as AI (into which Box was an early entrant with Box Skills). Here is helpful commentary from CEO Aaron Levie’s prepared remarks on the Q1 earnings call, detailing the company’s vision for AI development:

As we look forward into FY ‘24 and beyond, our pace of innovation continues to accelerate. We are at the beginning stages of a new era of software. Similar to how cloud and mobile changed the technology landscape forever, AI has the opportunity to completely change how work gets done. As highlighted by the meteoric rise of ChatGPT, we’ve recently begun to see a huge breakthrough in the potential of Large Language Models or LLMs, which are now capable of bringing human-level reasoning to a large number of tasks. However, the real power of these new AI models is when you use their intelligence to help you work securely with your own proprietary data set […]

With Box AI, customers can ask questions of their content or generate new information leveraging Box Notes […] Ultimately, as a core platform capability, Box AI will be used throughout the product to continue to transform how we work with our content in a variety of ways. We can imagine in the future being able to use AI to automatically classify content in even more specific ways, automatically extract data using a Relay workflow, use platform APIs to interact with AI models from a variety of providers, and being able to ask a question of a larger set of documents on a specific topic.

And as a platform-neutral vendor, we will also be AI-neutral, which means as new AI breakthroughs emerge from more vendors over time, we’ll be in a position to bring the full power of their technology to Box and our customers. In addition to our collaboration with OpenAI, we recently announced that we are building on our strategic partnership with Google Cloud to integrate Google’s advanced AI models into Box AI to create new ways for joint customers to work smarter and more productively with generative AI.”

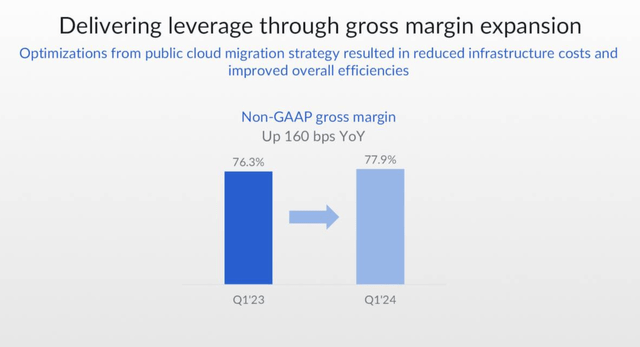

Box also drove continued margin expansion. The company’s pro forma gross margins expanded 160bps y/y to 77.9%, driven by economies of scale:

Box gross margins (Box Q1 earnings deck)

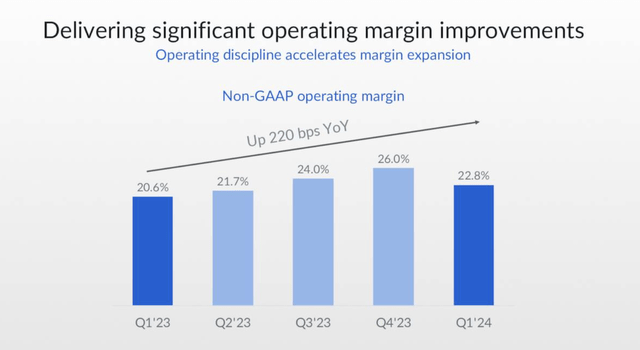

Additional leverage on opex helped Box grow pro forma operating margins by 220bps y/y to 22.8%:

Box operating margins (Box Q1 earnings deck)

Pro forma EPS also grew 39% y/y to $0.32, handily beating Wall Street’s $0.27 expectations with 19% upside. Box’s free cash flow also jumped 19% y/y to $102.8 million.

Key takeaways

With economies of scale helping to drive double-digit earnings and cash flow growth, and potential top-line upside from incremental AI innovation underway, I see very little downside in investing in Box at a <4x revenue multiple and <20x P/E ratio. Stay long here and wait for the stock to re-rate upward.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BOX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.