Summary:

- Box, Inc. shares retreated slightly after posting a strong Q1 earnings print, which also featured a slight boost to the company’s full-year outlook.

- The company continues to excel at pushing multi-product sales, especially with the launch of the company’s new Hubs product which incorporates AI features.

- Q1 revenue growth accelerated over Q4, even though FX continues to be a huge headwind for Box.

- BOX stock trades at very reasonable multiples of revenue and earnings.

ngkaki

With the S&P 500 (SP500) continuing to hover near all-time highs, the nervous attitude in the markets is palpable. From a broader macro perspective, I believe we’ll see continued sideways action in the major indices and end the year lower than where we’re at today. With valuation multiples at multi-year highs amid persistently high interest rates, I just don’t think the YTD rally has much steam left.

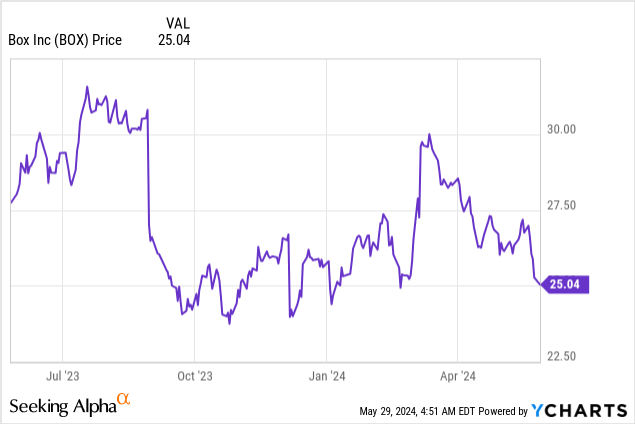

To position our portfolios for potential downside, I continue to favor investing in “growth at a reasonable price” stocks that are trading at beaten-down valuation multiples. Box, Inc. (NYSE:BOX) is one of the best candidates in this regard, as the cloud storage and file-sharing company has continued to achieve significant fundamental improvements amid ~flat share price action. The company just released Q1 results that showed an acceleration in top-line metrics – despite this, the strong earnings print failed to get a meaningful reaction, which is a classic example of broad under-appreciation for Box as a safe tech asset.

I last wrote a bullish article on Box in March, back when the stock was trading at similar ~$25 levels. With flattish share price action amid stronger growth metrics, I remain bullish on Box post-Q1 earnings.

Some observations to note here. First, growth is accelerating, even if FX headwinds from a strong dollar are having the effect of masking these results. The company continues to grow both short-term and long-term remaining performance obligations (RPOs), a critical measure for Box. Management notes that not only does multi-product Suites sales continue to outperform, but clients are also signing up for longer contract durations, which spells a breath of relief in an otherwise tighter macro environment that has largely depressed enterprise buying activity.

Second – we can’t ignore the fact that while Box is hardly the poster child for an exciting tech growth stock, it also enjoys secular tailwinds from AI. In particular, generative AI and automation capabilities brings exciting possibilities in being able to sort, index, and search for content. Box Skills, the company’s AI framework, has already been in place for years, but now that AI is running into the mainstream, the company is beginning to realize sales tailwinds from more enterprises wanting to unlock more value out of their resting data. Box isn’t letting up on the innovation front: in Q1, it announced AI integration for Box Hubs, which helps users to both summarize information stored in Box and to create new content based on files that are already loaded to Hubs.

As a reminder for investors who are newer to Box, here is my full long-term bull case for Box:

- Major $74 billion TAM as Box continues to expand its product portfolio. Despite competition, Box cites a massive $74 billion market across storage, content collaboration, and data security. That’s a big enough space for multiple incumbents, and also suggests Box is only currently ~2% penetrated into this overall market. Recent portfolio additions like Box Sign have greatly expanded Box’s potential.

- Multi-product strategy is driving attractive cross-sell. More than two-thirds of Box’s new deal bookings come from Box Suites customers who are purchasing more than one Box product. Additions like Box Sign continue to pave the way for incremental revenue growth.

- Founder-led. Though many Silicon Valley startups have been passed over from their founders to professional CEOs, Box remains led by its co-founders Aaron Levie and Dylan Smith as CEO and CFO, respectively.

- Best-in-breed for enterprise users. Of all of its well-known competitors, Box is the only company that is enterprise-focused. The company touts its security features plus advanced capabilities like Box Skills as a key differentiator versus the likes of Dropbox (DBX).

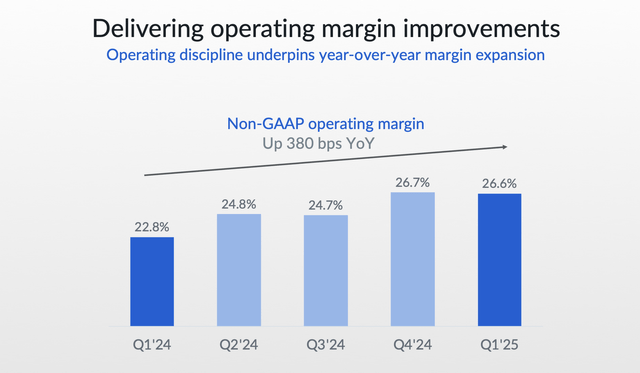

- Steady upward march in profit margins. Box expects to hit a 27% pro forma operating margin in FY25, up from 24% in FY24. Cross-sell and current customer expansion will drive top-line efficiencies, while the company’s ongoing move to public cloud servers will drive gross margin expansion.

The bottom line here: Box’s muted post-earnings reaction is typical of a stock that has failed to garner meaningful excitement in a sea of faster-growing, flashier AI tech peers. I continue to ignore the mainstream under-appreciation of Box and encourage investors to leverage the mainstream pessimism to pick up shares of Box on the cheap.

Box Q1 Earnings Results

Let’s now go through Box’s latest quarterly results in greater detail. We’ll start with the revenue highlights below:

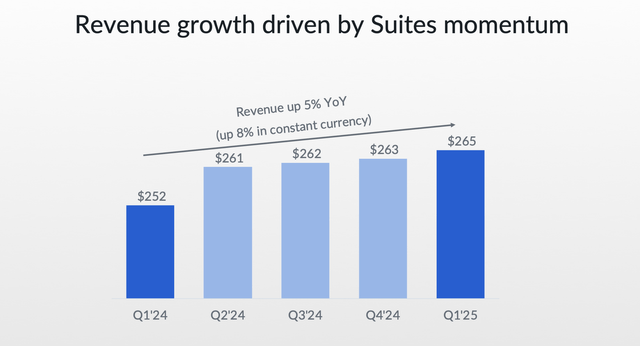

Box revenue trends (Box Q1 earnings deck)

Box’s revenue grew 5% y/y to $264.7 million, accelerating over Q4’s 2% y/y growth pace, as well as beating Wall Street’s expectations of $262.0 million (+4% y/y). Note as well that constant-currency growth rates were far stronger, at 8% y/y.

Again, strong performance for multi-products Suites deals, as well as longer contract durations, were a positive factor driving top-line results for Box in Q1. Suites now forms 56% of total revenue, versus 55% in Q4 and 47% in the prior-year Q1. That being said, the billings picture was rather mixed, with billings falling -1% y/y on a nominal basis to $190 million this quarter:

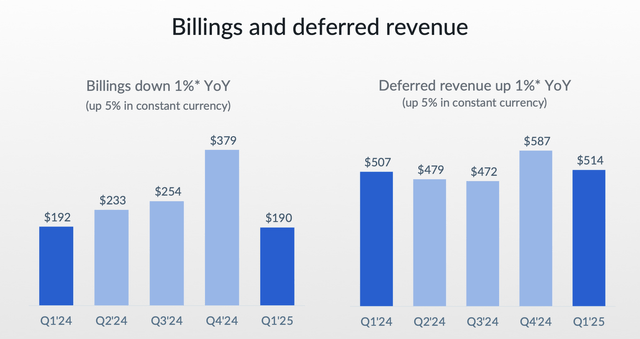

Box billings trends (Box Q1 earnings deck)

Though certainly not a cause for celebration, we note several things. First: Q1 is a typical seasonal low for billings. Box follows a typical enterprise buying seasonality pattern in which it sees aggressively large Q4 deals as IT departments look to exhaust their annual budgets, and then a seasonal compression in Q1. We note that Box saw huge billings outperformance in Q4 (+10% y/y), which likely pulled in some deals from Q1.

Second: we can’t understate how much of a headwind FX is here. On a constant currency basis, Box management notes that growth would have been 5% y/y. One third of Box’s revenue is international, and of that, 60% of international revenue is denominated in Japanese Yen. The Yen has been one of the most volatile international currencies this year, as dovish BoJ (Bank of Japan) policies vis-à-vis the U.S. treasury has driven a sharp appreciation of the dollar against the yen, deeply impacting Box’s reported metrics.

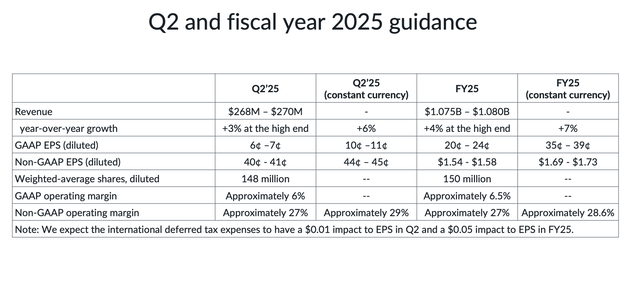

With the sharper negative impact on the Yen on this year’s results, Box management has updated its full-year outlook to include 250bps of negative FX y/y impact; from a prior view of 170bps. Still, the company’s latest revenue of $1.075-$1.080 billion revenue range for the year represents a $3 million constant-currency increase from the company’s prior outlook. We note as well that revenue guidance for Q2 implies 6% y/y constant currency growth, roughly in line with Q1 and better than the prior Q4.

Box outlook (Box Q1 earnings deck)

We also can’t ignore Box’s tremendous gains in profitability. Q1 pro forma operating margins, as shown in the chart below, expanded 380bps y/y to 26.6%.

Box operating margins (Box Q1 earnings deck)

230bps of this increase was from gross margin expansion alone. Recall that Box made moves last year to move more and more of its infrastructure away from its own datacenters and into the public cloud, which has reduced its overall infrastructure costs. Alongside economies of scale from its new deal signings, Box has a powerful platform for further profit expansion down the line. We note that with ~27% pro forma operating margins and ~8% constant-currency revenue growth, Box isn’t far at all from hitting the “Rule of 40” – something the company barely gets any credit for.

Box’s pro forma EPS of $0.39 in the quarter also beat Wall Street’s expectations of $0.36 and grew 22% y/y versus $0.32 in the year-ago quarter.

BOX stock valuation, risks and key takeaways

At current share prices near $25, Box trades at a market cap of $3.64 billion. After we net off the $566.1 million of cash and $371.3 million of debt on Box’s most recent balance sheet, the company’s resulting enterprise value is $3.44 billion.

Against the midpoints of Box’s guidance ranges for this year, the stock trades at:

- 3.2x EV/FY25 revenue

- 16.0x FY25 P/E.

We note as well that if we adjust for both the FX impact on Box’s EPS (the company’s FY25 EPS guidance on a constant-currency basis would be $1.69-$1.73), and for the significant net cash on Box’s balance sheet, the company’s ex-cash, FX-adjusted P/E ratio would be ~14x.

Box’s discount to the broader market, of course, comes with some risks. Competition is the biggest one for the company, as it constantly has to deal with aggressive competition from both Dropbox and Google Drive. Currently, Box has retained its crown as the best enterprise-grade storage solution, but Dropbox in particular is ramping up its enterprise capabilities.

Second, net revenue retention rates have been low: though multi-product Suites deals are now common for new signups, the company has had trouble with seat expansion for existing clients to counterbalance a stable ~3% churn rate, in particular as SMB clients struggle with a tougher macro.

Still, I believe Box, Inc.’s combination of a cheap valuation, strong profit margin gains, encouraging revenue/billings metrics and full-year guidance boost give us plenty of reasons to continue being bullish on this stock. Stay long here.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BOX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.