Summary:

- Box, Inc. is a leading cloud content management platform for businesses, emphasizing collaboration and security.

- Despite challenges from COVID and inflation, the Company has demonstrated consistent revenue growth and improved net margins.

- The introduction of BOX AI and a usage-based pricing model are expected to drive revenue and enhance user engagement.

gremlin

Summary

Box, Inc. (NYSE:BOX) is a leading cloud content management platform for businesses. It centralizes content storage, ensuring secure access from any device. Beyond storage, BOX emphasizes collaboration with tools like real-time editing and integrates with popular business applications like Microsoft Office and Salesforce. With a strong focus on security and compliance, BOX caters primarily to enterprises, offering tailored solutions across various industries globally. Its recent advancements include automation and AI features to enhance the user experience and content management.

From 2020 to 2023, BOX has demonstrated a steady revenue growth, boasting a CAGR of approximately 10%. Despite challenges posed by COVID and inflation, its annual growth rate has remained remarkably consistent. This consistency underscores the resilience of BOX’s business model in the face of macroeconomic turbulence. In the current climate of economic uncertainty, exacerbated by ongoing inflation, BOX appears well-equipped to navigate these challenges. When examining net margins, the company’s trajectory is commendable. Rising from a mere 0.6% in 2020 to an impressive 18.2% in 2023, BOX is clearly on a path toward enhanced profitability.

My investment thesis for BOX is rooted in the company’s robust financial performance, strategic initiatives, and competitive positioning. BOX’s second quarter earnings highlighted a year-over-year increase in revenue, demonstrating resilience and operational efficiency. The company is not only navigating but thriving amidst macroeconomic challenges, with a focus on innovation and expansion. The introduction of BOX AI and the shift to a usage-based pricing model are pivotal developments anticipated to drive revenue and enhance user engagement. From the analysis derived from my DCF model, BOX’s present stock price does not offer a sufficient margin of safety. Consequently, I advise maintaining a hold position on the stock.

Investment thesis

BOX reported its second quarter earnings with a revenue of $261 million, marking a 6% increase year-over-year. When adjusted for currency fluctuations, this represents 9% growth from the previous year. The company’s billings for the quarter stood at $233 million, a slight decrease of 1% year-over-year. However, when viewed on a constant currency basis, there was a modest 1% increase. This billing result was influenced by an unusually high volume of early renewals in the first quarter and was further impacted by foreign exchange headwinds, especially from the U.S. dollar to Japanese yen exchange rate, therefore creating tougher comparisons.

The net retention rate [NRR] at the end of the second quarter was reported at 103%. This dip was attributed to increased budget scrutiny, which affected the expansion of seats within their existing customer base. However, BOX did note a year-over-year improvement in the price per seat, largely driven by customers transitioning to their Enterprise+ offering. The company’s annualized full-churn rate remained consistent at 3%. In terms of margin, the company achieved 25% operating margins, up 3.1% from the previous year, reflecting operational discipline amidst a challenging macro environment.

Management emphasized the importance of managing, securing, automating, collaborating, and bringing intelligence to information. He stated that BOX is uniquely positioned to help enterprises address these challenges and transform their work processes. BOX is targeting a market worth more than $74 billion with its content cloud platform. A joint report with IDC revealed that 90% of a company’s data is unstructured, growing by 28% to over 73,000 exabytes in 2023. With BOX AI, they aim to transform customers’ ability to gain productivity and insights from their data.

In a joint report we recently released with IDC, IDC found that 90% of the company’s data is in unstructured information, and that number is growing by 28% to over 73,000 exabytes in 2023.” 2Q24 earnings results call

Based on BoxWorks IR Day 2023, BOX is launching a new pricing structure based on usage for its BOX AI feature. Initially, users will get 20 queries per month for each user, with an additional pool of 2K queries available at the company level. For those needing more, extra credits can be bought in batches of 10K, though the specific pricing for these hasn’t been disclosed yet. More information on this is expected in the fourth quarter. This new pricing approach could serve as another avenue for growth, in addition to expanding the number of users in the Enterprise+ category. The company believes that the AI functionalities in the Enterprise+ tier will prompt another surge in upgrades to Enterprise+. They anticipate that the AI features will encourage Core+ users, who currently make up about 21% of last quarter’s revenue, to switch to Enterprise+ or the suite packages. Previously, the primary reason for users to upgrade to the suite packages was to access BOX Shield. Now, BOX AI offers another reason for users to consider this upgrade. Notably, those on the suite packages contribute to an average annual recurring revenue [ARR] that’s four times higher than non-suite users. An internal survey by BOX revealed that a significant 96% of their current customers showed interest in BOX AI. Therefore, I anticipate it as a key growth driver for BOX.

Valuation

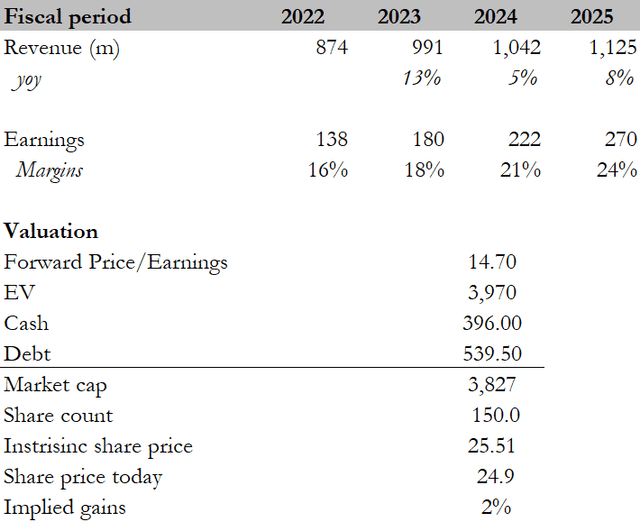

I believe the target price for BOX, based on my model, is $25.51. First and foremost, the FY24 assumption is aligned with guidance provided by the company’s management. The sustained revenue growth and robust, consistent margins observed in the recent quarterly results also underpin my assumptions. The company’s impressive NRR and low churn rates further bolsters my assumptions. Most significantly, the introduction of usage-based pricing for the BOX AI feature plays a pivotal role in my forecast. Additionally, the AI enhancements in the Enterprise+ tier are likely to stimulate a wave of upgrades to Enterprise+, amplifying revenue due to the revamped pricing strategy. Given these factors mentioned, I expect FY25 to trend towards a 5-year CAGR of 10%.

One of BOX’s competitors is Dropbox (DBX). When we look at the forward P/E multiples, DBX stands at 13.58, while BOX is slightly higher at 14.70x. DBX anticipates a Next Twelve Months [NTM] growth rate of 7% and boasts an EBITDA margin of 17.64%. In comparison, BOX projects an 8% NTM growth rate but has a slightly lower EBITDA margin at 14.51%. The higher expected NTM growth rate for BOX, a crucial metric for evaluating growth tech firms, justifies its elevated P/E multiple compared to DBX, even though BOX’s margins are somewhat leaner.

With BOX’s current valuation, the target stock price stands at $25.51. Given the narrow margin of safety, it appears the current share price has already factored in the advantages of BOX AI and its new pricing model. Consequently, I recommend a hold rating on the stock and consider buying only if there’s a dip in the share price, offering a more favourable entry point.

Risk

A potential risk to my hold recommendation is the possibility that the new pricing model and the expected transition of Core+ users to Enterprise+ might exceed both the management’s and the market’s current forecasts. If BOX’s revenue growth surpasses its historical CAGR, this could lead to an increase in share price.

Conclusion

BOX’s recent earnings report showcases a company that is navigating the challenges of the current macro environment with resilience. The consistent growth in revenue, combined with operational discipline, has positioned BOX favourably in a market with a potential worth of over $74 billion. The introduction of usage-based pricing for the BOX AI feature, coupled with the anticipated surge in upgrades to the Enterprise+ tier, underscores BOX’s innovative approach to capturing more market share and driving revenue. My target price for BOX suggests that the market has already accounted for the positive outlook of BOX AI and its new pricing strategy in the stock’s current valuation. Therefore, while BOX presents a compelling growth story, the current valuation suggests a limited margin of safety. As a result, I recommend a hold rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.