Summary:

- Box has seen a 30%+ gain this year, outperforming the S&P 500, despite slowing growth and recent deceleration in billings.

- The Company’s strengths include a large $74 billion TAM, enterprise focus, and improving profit margins, but it faces risks from commoditization and evolving AI requirements.

- Q3 revenue grew 5.5% y/y, slightly beating expectations, but billings growth was choppy and below revenue growth, posing risks for future estimates.

- Given BOX’s fair valuation at a ~18x forward P/E and ~4x forward revenue, I recommend locking in gains on Box here, and I’m downgrading to a neutral rating.

Kenneth Cheung

We’re closing in on the end of 2024, which has been an unusually strong year for stocks and other risk assets. I continue to assert that this is not the time to be complacent, but to be an active portfolio manager: and to me, that means critically assessing the stocks that have been big winners in our portfolios.

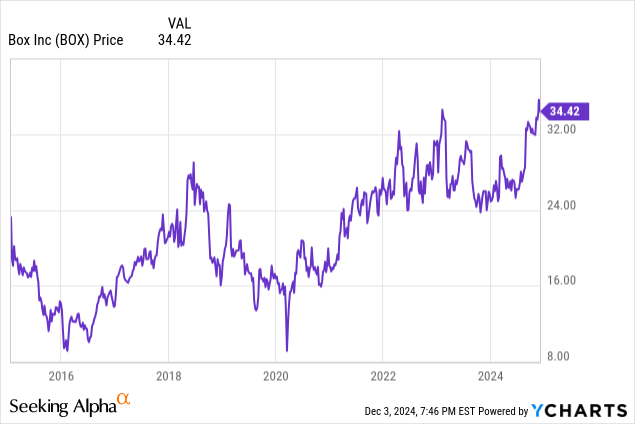

One surprise winner this year was Box (NYSE:BOX), the cloud file storage-and-sharing company that has been a laggard in the past few years due to slowing growth. Growth hasn’t materially improved this year (though Box’s growth now materially outstrips its direct rival Dropbox (DBX), implying market share expansion), but investors have awarded Box a ~30%+ gain this year, outperforming the S&P 500.

I last wrote a bullish note on Box in August, when the stock was trading closer to $29 per share. Since then, Box has rallied another ~15%, though the rally is seeming more fragile after the company’s recent Q3 earnings release that featured yet another deceleration in billings growth. In my view, though Box remains a consistent performer that is also a reliable generator of cash flow and earnings, its valuation is now seeming quite full: and since good value is my primary driver to invest in this stock, I’m downgrading my rating on Box to a neutral view.

At current share prices, I now have a more balanced view of positives and negatives for Box. On the bright side for this company:

- Large $74 billion TAM as Box continues to expand its product portfolio. Despite competition, Box cites a massive $74 billion market across storage, content collaboration, and data security. That’s a big enough space for multiple incumbents, and also suggests Box is only currently ~2% penetrated into this overall market. Recent portfolio additions like Box Sign have greatly expanded Box’s potential.

- Best-in-breed for enterprise users, cementing Box’s advantage over Dropbox. Of all of its well-known competitors, Box is the only company that is enterprise-focused. The company touts its security features plus advanced capabilities like Box Skills as a key differentiator versus the likes of Dropbox.

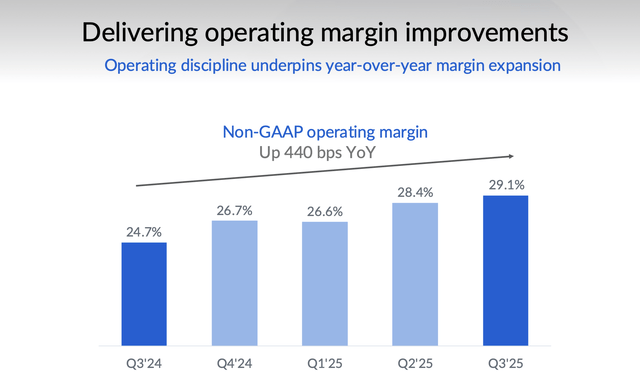

- Steady upward march in profit margins. Box expects to hit a 27.5% pro forma operating margin in FY25, up from 24% in FY24. Cross-sell and current customer expansion will drive top-line efficiencies, while the company’s ongoing move to public cloud servers will drive gross margin expansion.

However, these advantages are counterbalanced by the following risks:

- Commoditized industry. File storage has become a commoditized market, and while Box can tout security and AI as incremental features to win over new customers, it’s unlikely that this space will ever become a growth industry again. Over time, Box will continue to feel pressure on pricing, as competition from Dropbox and Google Drive continue to limit Box’s power in the market.

- Will AI change data storage requirements? Box needs to continue to keep up with the evolving AI landscape. AI requires files and data to be housed in a centralized space in order for large-language models to function. Data is being sought out in unstructured formats as well, such as the files that Box maintains: so if the company fails to assure customers that it’s keeping up with these requirements, companies may choose to shift where they store their assets.

In my view, it’s best to lock in gains on Box and invest elsewhere.

Q3 download

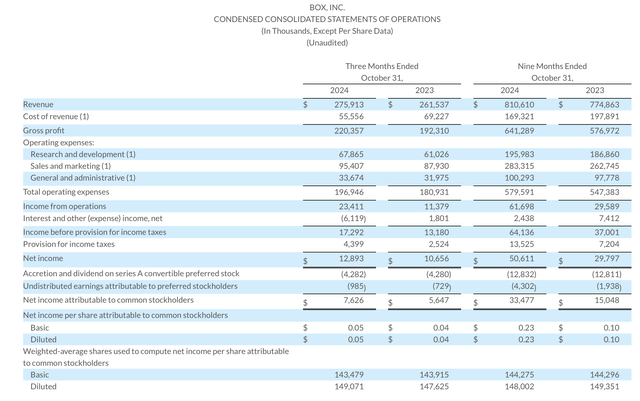

Let’s now go through Box’s latest quarterly results in greater detail. The Q3 earnings summary is shown below:

Box Q3 results (Box Q3 earnings deck)

Box’s revenue grew 5.5% y/y to $275.9 million, only slightly beating Wall Street’s expectations of $275.1 million (+5.2% y/y). We do note, however, that revenue growth accelerated two points versus 3.3% y/y growth in Q2.

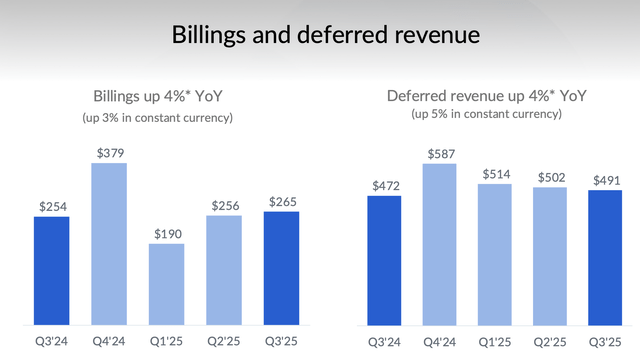

Where Box’s trends are more choppy, however, is in billings (where trends have been choppy throughout the past few quarters). Software investors understand that while billings tends to be a more lumpy metric that doesn’t show as stable quarter-over-quarter trends as revenue, it’s also the best forward-looking indicator of the company’s overall growth trajectory, as it captures deals in the quarter that will be recognized as revenue in future quarters.

Billings in Q3 grew 4% y/y to $265 million, below Box’s revenue growth pace and decelerating versus 10% y/y growth in Q2 (Q1 growth was -1% y/y). When we lump together all three quarters to date in FY24, the company’s $711 million of billings grew just shy of 5% y/y – whereas Wall Street consensus is expecting 6% y/y revenue growth for FY26 (the year for Box ending in January 2026). To me, this presents risk of Box not meeting estimates next year.

Box billings (Box Q3 earnings deck)

The good news is that the company does continue to deliver consistent profit expansion, driven by the company continuing to see healthy upsell activity in its current install base plus its own cost management efforts. Pro forma operating margins jumped 440bps y/y to 29.1%:

Box operating margins (Box Q3 earnings deck)

The company’s pro forma EPS of $0.45 also edged out over Wall Street’s $0.42 expectations.

Valuation and key takeaways

At current share prices near $35, Box trades at a market cap of $4.93 billion. After we net off the $698 million of cash and $651.8 million of debt on Box’s latest balance sheet, the company’s resulting enterprise value is $4.88 billion.

Meanwhile, for next fiscal year FY26, Wall Street analysts are expecting Box to generate $1.86 in pro forma EPS (+11% y/y), on top of 6% y/y top-line growth as previously mentioned to $1.16 billion in revenue. This puts Box’s valuation multiples at:

- 4.2x EV/FY26 revenue

- 18.3x FY26 P/E

To me, a ~4x revenue multiple for a company that is only growing its top line in the mid single digits, and a P/E multiple that’s slightly below the S&P 500 is quite appropriate for Box, and doesn’t leave much room for upside.

While I don’t necessarily think Box will fall dramatically from here on out, I don’t see the company repeating its market-beating gains in FY26 (at least not if you’re entering at current levels in the mid-$30s). With this in mind, it’s time to ditch Box and invest your capital elsewhere.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.