Summary:

- Box continues to plow ahead and grow its top line.

- The bull case inevitably is drawn towards Box’s strong free cash flows.

- However, I argue that its free cash flows are only worthwhile, if they are properly allocated towards value accretive actions.

greenbutterfly

Investment Thesis

Box (NYSE:BOX) is a cloud platform that is primarily aimed at enterprise customers. Case in point, Box has as its customers 69% of the Fortune 500. This provides the investment thesis with some level of ”recession-resistant” growth prospects.

In fact, Box’s outlook for fiscal 2024 points to yet another year of high single digits GAAP revenues and double-digit revenue growth rates in constant currency.

That being said, the issue I have here is with Box’s use of shareholder capital. The question I put forth is this, who benefits from Box’s share repurchases?

Why Box? Why Now?

Box provides cloud content management and file-sharing services. Customers can store, view, and collaborate on files and documents within Box’s platform. Incidentally, compared with Dropbox (DBX), Box is mostly going after companies and large enterprises, rather than individuals. This provides Box with a more resilient customer base.

The bad news is that cloud content management has becomes as rapidly fragmented with new products and services as it continues to expand. For example, considering Microsoft’s (MSFT) array of products as well as Google’s (GOOG)(GOOGL) Google Drive, both mega caps have ample prospects and resources to take market share away from Box.

Nevertheless, let’s not overstress how competitive the environment is, as I believe that most readers in this space are already amply aware of that backdrop. So, let’s press ahead and discuss the bull case here.

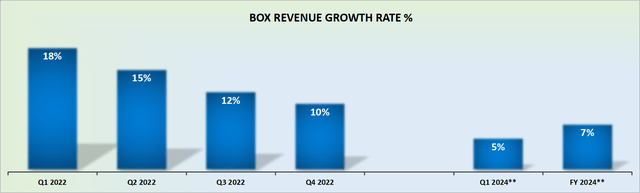

Revenue Growth Rates Remain Stable, Even Now

There’s no doubt that, throughout the IT sector, there’s significant pushback from all organizations. Even as companies continue to embrace the digital transformation and move towards public clouds, companies are more sensitive and conscientious in questioning every line of the IT budget.

For Box to continue guiding for high mid-single digits growth for the year ahead, speaks volumes of the underlying value proposition that Box continues to offer, even now.

Now, let me get to the critical aspect I have in backing this stock.

The one blemish in the Investment Thesis

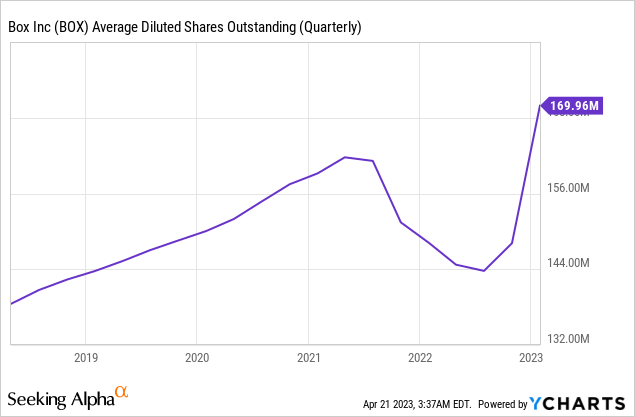

Consider the following chart.

What we can see here is that with the passage of time, the total number of shares outstanding has continued to increase. In fact, the table that follows is particularly strident.

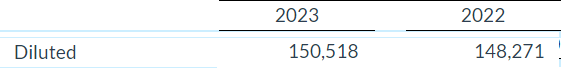

BOX Q4 2023 Y/Y comparison

What we can see above is that Box’s Q4 2023 total shares outstanding ended up after Box spent $267 million.

And this is on the back of having spent approximately $330 million in the prior year. Meaning that all together, over the past two years, Box has bought back approximately 15% of its market cap.

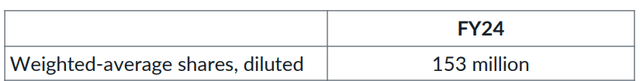

And yet, despite consistently buying back shares, Box’s shares outstanding are guided to grow further in the year ahead to 153 million.

Naturally, this begs the question, who benefits from these share repurchases?

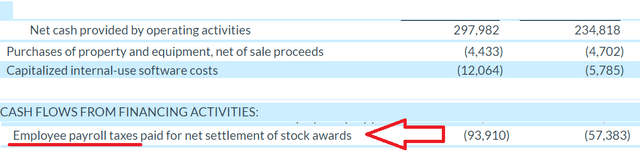

Moreover, keep in mind that Box’s free cash flow for fiscal 2023 reached very approximately $285 million (figures on the left).

Box FY 2023 on left, FY 2022 on right

But of that sum, about a third was used to pay the taxes on management’s stock-based compensation. Meaning that, when all is said and done, the business made less than $200 million of free cash flow.

And then, recall, that there’s about $350 million worth of convertibles due in less than 3 years’ time (January 2026). Even though Box carries more than $450 million of cash and equivalents, a meaningful portion of this cash will be used to pay back its convertibles.

The Bottom Line

Box is a cloud storage company that may be getting quite old, at nearly 20 years. But despite other richer and more complex cloud storage solutions existing in the market, even now, it’s still growing.

The bull case here would be to highlight that there are growing profit margins and alluring free cash flows.

The bear case highlights the frustrating fact that, despite using significant sums to buy back shares in the past 2 years, the total number of shares outstanding continues to increase with time.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.