Summary:

- Box faces competitive pressure from big tech giants like Google and Microsoft but stands out for its integration with 1,400+ apps and compliance with key industry standards.

- The stock appears undervalued by ~20% with a moderate growth outlook; expected 10% price increase over the next year despite low sentiment and long-term competitive risks.

- Financial stability concerns exist with a weak balance sheet and high debt; however, strong free cash flow supports share buybacks and debt reduction, aiding long-term prospects.

lucadp/iStock via Getty Images

Box (NYSE:BOX) is a small-cap digital file management company that has been around since 2005 and was initially funded by Mark Cuban. It has since grown to become one of the leading integrated file management companies in the U.S., but it is facing evolving pressures from big tech providers. That being said, it is navigating this by unifying varied cloud infrastructures, and so I think there is reason to be long-term bullish on BOX, even if one recognizes that over the next 12 months, returns are not likely to beat the market based on current sentiment and fundamental growth factors alone.

Content Management, Application Integration, & Big Tech Consolidation

Box specializes in cloud-based content management and collaboration tools for businesses, allowing users to store, manage and share files in an online folder system accessible from any device. It also enables file commenting, sharing, workflow application, and security and policy implementation.

The company is a popular choice, with 68% of Fortune 500 companies being clients. Part of what makes it a strong choice is its compliance with industry standards, including SOC 2 Type II, ISO 27001, FedRAMP, and HIPAA, crucial for fields like finance and healthcare, for example.

In addition, Box integrates with over 1,400 business applications, including Microsoft (MSFT) Office 365, Salesforce (CRM), and Slack. This is crucial as it greatly increases user adoption. It also facilitates collaboration internally and externally, with Box Relay for workflow automation, Box Sign for e-signatures, and Box Notes for real-time collaboration on project plans and meeting notes. Box is, therefore, a clever tool for digital administrative efficiency, in my opinion.

However, despite its strengths, Box is facing increasing competition from Google (GOOGL) (GOOG) Cloud and Microsoft Azure, which also offer file management solutions now. Box has also had only 2 years of profitability over the last 10, and despite a high net margin of over 13% at present, it is questionable if this can be sustained if big tech companies consolidate their in-house offerings more, especially as big tech AI begins to provide more pricing power for software offerings such as file management.

That being said, Box is working to innovate its platform further using ML and AI for predictive analytics, but this is unlikely to significantly counter the threat from big tech. Positively, Box is using a pay-per-user subscription pricing model, allowing it to scale revenue with the number of users, which should help the company to increase growth over the long term.

Undervaluation, Q2 Earnings Expectations, & Balance Sheet/Free Cash Flow Implications

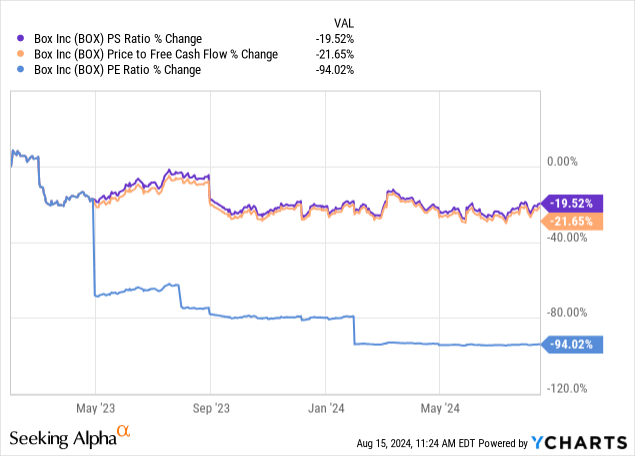

Given the rising competitive pressures in the market, arguably Box would be considered of relatively high risk operationally. Despite this, the market has valued BOX stock highly. However, it does look moderately undervalued to me when considering its historical valuation multiples. This gives some reason to be bullish on BOX despite the long-term operational pressures and the earnings and revenue growth, which does not look to be exceptional over the next few fiscal years.

BOX EPS Estimates (Seeking Alpha)

BOX Revenue Estimates (Seeking Alpha)

Based on my analysis of BOX’s future growth estimates and potential undervaluation of up to 20% (based on my 3Y valuation multiple analysis), BOX could achieve an upside of 20%+ in 12 months, but I find this somewhat speculative, as I think sentiment will remain low for BOX for some time more. Its 5Y average TTM revenue growth rate is 11.8%, but YoY is only 4.6% and this does not return to above 10% until FY27 based on consensus analyst estimates. Therefore, my base-case price target for BOX stock is 10% growth over the next 12 months in price.

Box has its Q2 results on August 27, and it has a history of beating EPS and revenue estimates. As the company has been focusing on improving margins and leveraging AI, we might expect a beat this coming quarter in EPS due to operational efficiency. This would also be important for the company in indicating it can sustain profitability.

Furthermore, investors can expect several strategic updates in the earnings call, including how it plans to continue to adopt AI and ML to compete with big tech file management options. This is what I will be looking for most acutely from management, and I think that too little emphasis on this risk factor would warrant caution from potential long-term investors. In addition, Box has been heavily buying back shares in recent years to support shareholder value, so I expect forward-looking comments from management on this strategy and whether buybacks will be scaled, maintained, or reduced in the coming years.

One area of concern is also Box’s balance sheet, which currently has an equity-to-asset ratio of 0.08, and a debt-to-equity ratio, including lease obligations, of 5.12. This is relatively concerning, especially as competitive pressures are mounting from big tech consolidation and AI. Box’s balance sheet indicates that it has less financial agility than it would potentially need to remain competitive and invest in its distinction in the market over the long term.

Box issued a lot of debt, $366.4M, around the time of the pandemic in 2021. This significantly affected its balance sheet, but thankfully, since then, it has not issued any debt. So, I do expect its balance sheet to improve if conditions remain stable for Box over the next 5 to 10 years.

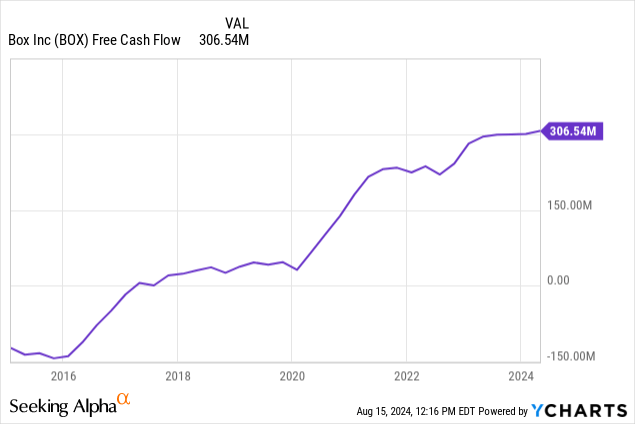

What Box has delivered, which is very promising to me, is stable, large, and growing free cash flow. While the balance sheet is somewhat weak, this free cash flow can be utilized to pay down debt more readily, but also, as management is doing strategically, to buy back shares. My concern is that more emphasis may be needed on the balance sheet and operational fortitude, as while increasing shareholder value is good in the short term, it is not worth it in the long term if the company’s operations fail to sustain fundamental growth rates.

Comprehensive Long-Term Big-Tech Consolidation-Risk Analysis

Google and Microsoft, the two leading contenders to Box’s market share, have established data center and AI capabilities, extensive cloud ecosystems, and immense pricing power as a result of their economies of scale. I believe over time, this will be challenging for Box to compete with, and it could put pressure on its margins, impacting its growth narrative and destabilizing its stock price quite significantly.

Box is also trying to innovate in advanced analytics, automation, and intelligent content management, but as we all understand, Google and Microsoft are two of the leaders in these strategies, which are fueled by AI. I believe that over time the divergence between small players in tech and large players is going to increase, and I believe we are headed toward a tech ecosystem with a consolidated monopoly of a few big tech players and then much smaller creators within these ecosystems. For small companies like Box, which are attempting to scale, I believe this presents more of an existential threat, as they are not involved in content creation but in administration, a field that, I believe, will be largely automated at scale by big tech services in the near future.

At the moment, Box integrates with Google Workspace, eliminating the need to use Google Drive, and Box also offers its services through the Google Cloud Marketplace. However, neither of these elements reduces the competitive threat that Google offers its own Google Drive service, which could make what Box offers irrelevant over time.

In addition, Box integrates with Microsoft Office 365, allowing users to edit Microsoft Office files using Microsoft editors within Box. This creates some ecosystem-agnostic capabilities and can be useful for those working amongst various cloud infrastructures, and this is what really needs to be stressed by management moving forward to retain long-term utility. It is the unification of cloud access for file management, that could lead to bullish outcomes for BOX stock long term. The integration with these widely used platforms helps Box to mitigate the risk of losing clients to tech giants, and it especially keeps customer retention strong in big organizations that might use various cloud infrastructures for operations across multiple departments.

Conclusion

Box is a compelling company that, despite facing competitive pressures from big tech, can continue to carve a niche for itself in unified file management amongst varied cloud providers. Despite this, I do not see Box as a company that can scale incredibly high, and as a result, I am only moderately bullish on this stock. In addition, based on the company’s historical growth rates, which are higher than near-term forecasts, I think sentiment could remain lower for longer despite the current undervaluation. This gives me a base-case price target roughly in line with EPS and revenue fundamental growth over the next fiscal year, which I think indicates ~10% price growth over the period.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.