Summary:

- Nike is about to report its Q1 2024 earnings.

- Nike’s valuation is currently below its 10-year average, presenting a potential buying opportunity.

- We need to assess if the stock is dropping because of temporary headwinds or deteriorating fundamentals.

Robert Way

Introduction

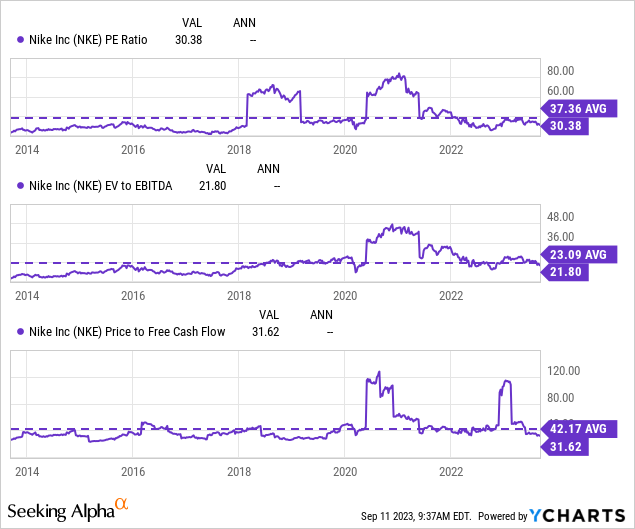

Let’s start the other way around this time. Take a look at these three charts about NIKE (NYSE:NKE) and its valuation over the past decade.

Yes. Nike is trading well below its 10 year average: a 30.38 PE vs. a 37.36; 21.8 EV/EBITDA vs. 23.09; 31.62 vs. 42.17 price to FCF.

Could it be the time to take advantage of current weakness and scoop up some shares? In this article, I will give my take, offering a preview of what we may see in the upcoming Q1 FY2024 earnings report. Nike’s fiscal year, in fact, ends May 31 and its Q1 therefore goes from June to August of each year.

Summary of previous coverage

When I bought my first shares of Nike, I shared the research supporting this buy with the SA community. The main elements I considered key were the following:

- strong franchise value

- high ROIC (above 45%)

- strong compounding effect

- the growing demand of athletic gear for physical activities

- the casualization of fashion as another driver of new demand

- its constant appeal to younger consumers and its pricing power coming from it

- unlevered balance sheet (net debt/EBITDA of 0.15 at the end FY2022).

On the other hand, there were some concerns on two issues: margin compression as a consequence of high inventories and share buybacks partially offset by increasing SBC (stock-based compensation), which has almost doubled from 2019 amounting to 22% of FCF at the end of FY 2022.

Considering the stock was trading just a bit above $100 a share, I gave two scenarios (bear and bull) and saw the stock’s fair value between $87 and $144 at the two ends. However, I also pointed out how buying Nike to me meant I was buying a stock I want to hold for many years to come. With its compounding strength, it is not absurd to believe this stock will 2x or 3x in a decade.

FY23 Financial Highlights

Nike made it. It crossed – a year in advance – its target of $50 billion in revenues. To be precise, the company closed FY23 with revenues of $51.22 billion, up 10% YoY. Gross profit was $22.3 billion, 4% more than 2022. However, Nike did see margin compression as its gross margin was 43.5% vs. 46% in FY22. EBIT was $6.2 billion (12.1% margin) while net income came in 16% lower YoY at $5.1 billion (9.9% margin). This shows how Nike’s expenses increased more than its top-line.

In particular, as Nike reports

Selling and administrative expense increased 11 percent to $16.4 billion. ◦ Demand creation expense was $4.1 billion, up 5 percent compared to prior year, primarily due to advertising and marketing, and sports marketing expense.

In other words: having high inventories, Nike had to spend more to clear them, either through ads or through promotions.

Another expense that increased significantly was operating overhead expense, up 12% YoY.

A negative note came from ROIC, which came in only at 31.5% vs. 46.5% of FY 2022, as a consequence of lower net income and higher invested capital (due to a reduction of $2.35 billion in cash and short-term investments).

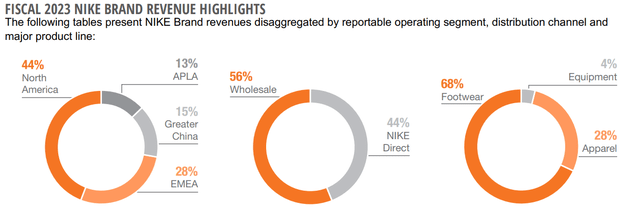

Going back to the top-line, if we look at the revenue breakdown we see how the company’s sales work.

Nike 2023 Annual Report

Around 44% of its sales took place in North America, compared to 40% and 39% for the two previous fiscal years. Nike’s direct sales are growing and are now at 44%. In terms of product line, footwear – as many may expect – has the lion’s share with 68%.

FY24 Kicks In – What I am expecting

Brand power

As we have seen, Nike has just left behind a tough fiscal year compared to its normal performance. In addition, its industry has been recently been shaken by concerning news:

- Footwear and sporting goods retailers such as Foot Locker (FL) and DICK’S (DKS) sunk after very weak Q2 earnings.

- Some analysts are expecting weaker sales in China. Over the last 90 days, as SA reports, all 12 EPS revisions on Nike have been on the downward side.

On the other side, though bad news usually catch most of the attention, we have also had some good news during other earnings calls. For example, Academy Sports and Outdoors (ASO) surprised investors that were expecting margin compression. Academy reported that, though it had lower sales, its “best performing business during the quarter was Sports & Recreation, Apparel was the second best performing division with a negative 3.7% decrease”. In addition, the company openly said that “Nike also continues to perform well for us along with our private label business”.

Now, it is no secret that sportswear is a highly competitive industry. We have seen many new brands coming in and becoming a consumer favorite for some time to then fall (for example, Under Armour). Yet, Nike has been able, despite strong competition, to remain the leading brand, with a market share much above that of Adidas or Puma (for footwear, estimates see Nike around 25%, vs. Adidas’ 14% and Puma’s 3%).

With a recent survey showing how Nike is by far the most popular clothing brand amongst teenagers in the U.S., with a 33% (American Eagle is second with 7%), I don’t think this upcoming report will show us a weakening brand power. And this is a core fact, because a big part of Nike’s strengths – which can then be seen in its financials – comes from its enduring appeal.

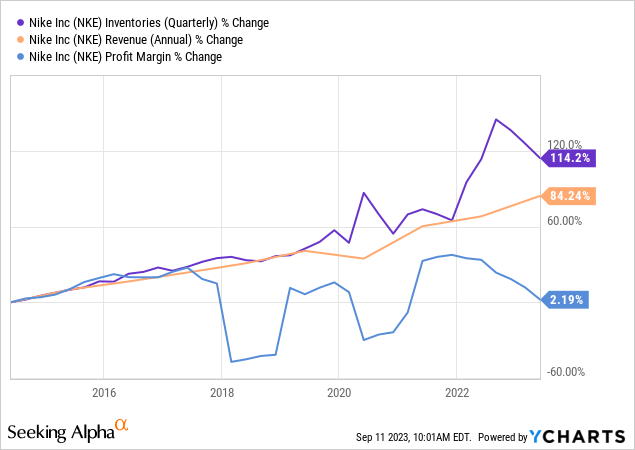

Inventories and margins

Another factor to consider is what led to recent margin compression.

If we zoom out from the latest annual report and look at Nike’s overall trajectory, we can understand how this past year was really impacted by high inventories. Looking at the larger picture, we see inventories now reversed to the mean, with a level more in line with the overall company’s growth in terms of revenue. In addition, the graph below shows the almost inverse correlation between inventories and profit margin. We should soon see profit margin come up once again, now that inventories have stabilized, as Nike reported during its last earnings call:

we return to healthy inventory ahead of our competition. Our inventory is flat year-over-year in value and down in units versus 12 months ago. […] Nike inventory dollars are flat versus the prior year, with units down double-digits across both footwear and apparel. Apparel units are down more than 20% versus the prior year. Our mix of in-transit inventory has normalized, and days in inventory show improvement versus the prior quarter and the prior year.

We also have to consider, as far as margin expansion will go, that Nike is still ramping up its app in many key markets, such as Korea. Here, for example, the app launch drove 2.5 million downloads and $100 million in incremental demand within its first quarter, as the company reported during the earnings call. Nike is also launching its app in Argentina and Peru, as well as in India.

This will lead to more direct online sales, where margins are higher.

Nike’s Q1 24 Guidance

Nike also wanted to disclose its guidance for this new fiscal year and, in particular for the first quarter, where visibility was, of course, greater.

Here are the main points Nike stated:

- prioritizing healthy full price growth

- improved marginal cost of growth, expanding profitability and higher returns on invested capital.

- FY24 reported revenue should grow mid-single-digits, (including approximately 4 percentage points of headwinds from FY23 from wholesale shipment timing and accelerated liquidation activities).

- structural gains from focusing on price value, including low-single-digit price increases in FY2024,

- ongoing benefits from the shift to a more direct business.

- these benefits will be partially offset by higher product costs.

- SG&A is expected to grow slightly above revenue as the company wants to increase investment in demand creation; Nike wants, in any case, SG&A to remain below pre-COVID levels as a percentage of revenue.

Regarding Q1, Nike gave the following guidance:

- revenue growth should be flat to up low-single-digits,

- 25 to 50 basis points of operational gross margin expansion, (excluding the negative impact of a 100 basis points of foreign exchange headwinds).

- SG&A up low double digits on a reported basis

What should we think of these words? I think they are rather conservative. By this, I mean Nike doesn’t want to inflate investors’ expectations in a tightening economic environment where it is hard to have an extended visibility into the future.

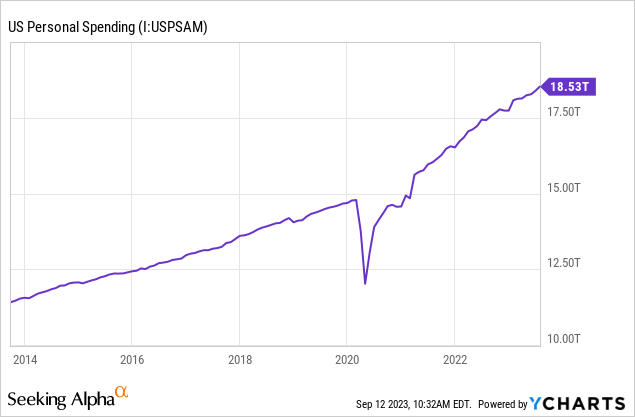

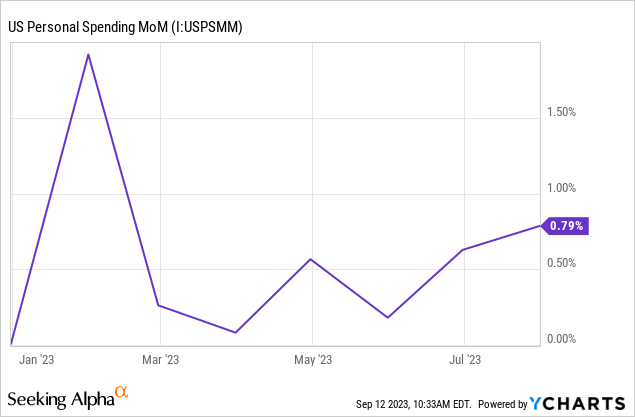

Now, the latest available data on US Personal Spending shows an ongoing increase which confirms the long-term trend we talked about.

However, if we look at US Personal Spending MoM, we can clearly see how, starting in March, we have had a few months of rather flat grow. Yet, in August, spending picked up a little speed once again and is now 0.79% above January’s levels.

These macroeconomic data make me assume we won’t probably see neither an exceptional growth nor a concerning decline in sales for the quarter.

Looking at Nike’s quarterly revenues since FY 2013, we see a clear pattern of growing revenues every two quarters. Traditionally, the strongest quarter is Q2 (ending in November), followed by Q4 (spring season).

Considering Nike reported Q1 earnings last year of $12.69 billion in revenues and a gross profit of $5.62 billion (44.3% margin), I think it is reasonable to expect a $13 billion quarter – in line with consensus estimates – and a gross profit margin of 44.5%. This means we should have a gross profit around $5.8 billion and a net income around $1.2 billion, which would translate into EPS of $0.78. Any surprise much above or below this number could trigger a big price movement. Considering FY24 could end with $54 billion in revenues and a gross profit margin around 45% that would give a gross profit of $24.3 billion, we could end up with earnings around $5.8-6 billion. Without considering the impact of stock buybacks, we would have a FY24 EPS of $3.84, 17% above FY23. This means the stock is actually trading at a fwd PE of 25 which is 5 points lower compared to what we have seen in the graph at the beginning of the article. Now, though this may still seem a rather high PE, for a company whose track record and franchise value is so strong, I would consider it a rather interesting opportunity. Not seeing any concerning headwinds apart from the temporary issues we have discussed, I rate Nike as a buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NKE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.