Summary:

- Broadcom’s strong financials, AI prospects, and sales structure updates support continued growth, justifying a “Buy” rating despite market fears of overvaluation.

- The ambitious AI market projections for 2027 have driven short-term growth, with expectations of $45 billion in AI revenue by FY 2027.

- I expect VMware’s high-margin software business to underpin AVGO’s AI semiconductors’ growth and bring robust cash flow and margin stability on a consolidated basis.

- I think Broadcom’s valuation is reasonable given current market conditions, with potential for further upside through continued EPS outperformance and share buybacks, targeting $250-255 per share by 2025.

- I decided to keep my “Buy” rating unchanged today.

G0d4ather

My Thesis Update

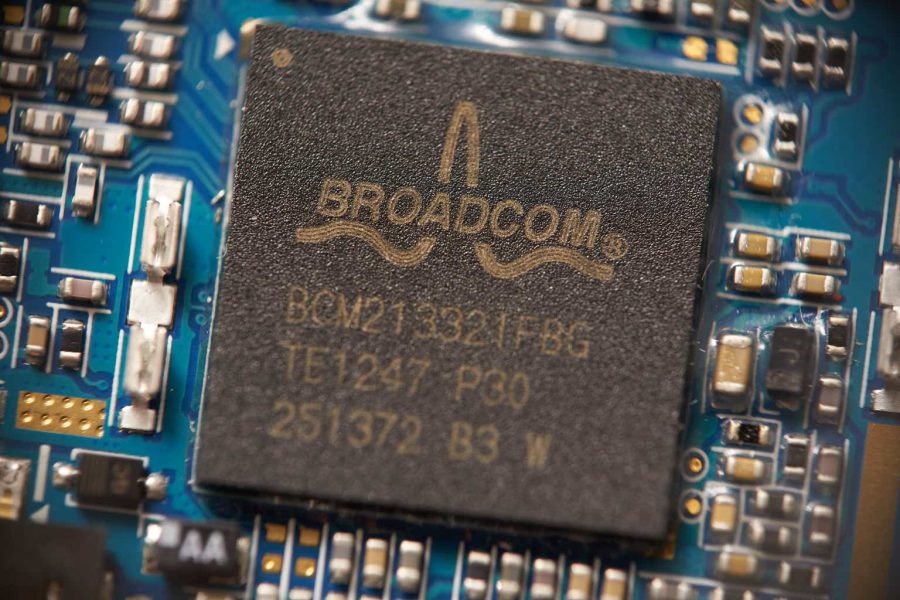

I first initiated coverage of Broadcom Inc. (NASDAQ:AVGO) on March 22, 2024, stating that “the company’s strong financials, sales structure updates, and AI prospects pointed to further outperformance in the future.”

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AVGO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to access the latest reports from banks and hedge funds?

With just one subscription to Beyond the Wall Investing, you can save thousands of dollars a year on equity research reports from banks. You’ll keep your finger on the pulse and have access to the latest and highest-quality analysis of this type of information.