Summary:

- Broadcom’s strong 3Q24 results and substantial pullback present a compelling contrarian buying opportunity, especially for dividend-growth investors.

- The company enjoys enormous sales momentum and high margins, driven by AI-tailored hardware products and positive effects from the VMware merger.

- Broadcom’s impressive dividend growth and consistent profit returns make it a valuable long-term investment, with a current yield of 1.3%.

- Despite a recent 10% stock price decline, Broadcom’s anticipated profit growth and AI-driven business tailwinds justify a higher valuation, making it a bargain buy.

Thomas Barwick

The market does not seem to have much love for AI-themed growth stocks right now, and this includes hardware company Broadcom (NASDAQ:AVGO) (NEOE:AVGO:CA), a dividend-growth stock par excellence.

Broadcom is going through quite a substantial pullback and investors, particularly those with an eye on durable dividend growth, may want to double down on the IT company as a long-term investment: Broadcom’s 3Q24 results were very strong, and the stock is much cheaper than it was just two months ago.

In my view, we are dealing with a rather compelling, contrarian buying opportunity and I don’t see Broadcom’s growth story ending any time soon.

My Rating History

Powerful AI-driven business tailwinds led to a stock classification of Buy for Broadcom. The semiconductor and networking company in enjoys considerable sales momentum and is producing a boatload of profits that the company returns to investors via a quickly growing dividend.

I think that the pullback creates a more compelling risk/reward relationship and the discount now available relative to Broadcom’s valuation from 2 months ago is nothing to scoff at either.

Broadcom Has Enormous Sales Momentum And High Margins

The semiconductor and networking company is sitting at the spear of the AI revolution with its AI-tailored hardware products. Broadcom is an IT business with a broad portfolio that encompasses storage, networking, broadband, wireless, cybersecurity and cloud infrastructure products.

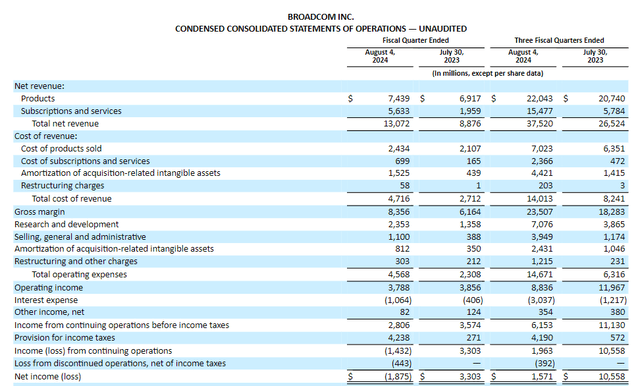

Broadcom’s sales hit a record of $13.1 billion in the third quarter, reflecting a YoY increase of 47% amid accelerating demand for the company’s semiconductor and infrastructure software products and services.

Broadcom’s sales growth in 1Q24 was 43%, so the company’s growth is accelerating at a time when investors appear to have turned a little bit more hesitant towards fast-growing AI stocks.

Broadcom’s gross margins skyrocketed 36% YoY to $8.4 billion. In the last three quarters, the hardware company produced a gross margin of $23.5 billion, reflecting YoY growth of 29%.

Double-digit growth in gross margins and acceleration in sales growth attest to the strength of demand for Broadcom’s portfolio, as well as positive effects from the VMware merger that I mentioned in my last piece on the hardware company.

Condensed Consolidated Statements Of Operations (Broadcom)

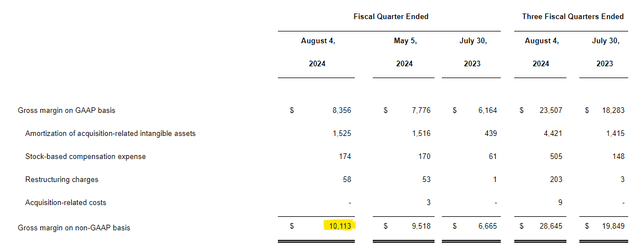

High gross margins are the single best reason to buy Broadcom, in my view: Broadcom’s non-GAAP based gross margins adjust for intangible assets that were acquired and are being amortized, amongst other expenses, such as those related to compensation or restructuring.

In 3Q24, Broadcom’s non-GAAP gross margin was $10.1 billion, or 77% in percentage terms. A year ago, Broadcom’s adjusted gross margin was 75%. In the long-run, Broadcom has consistently managed to grow its gross margins.

Gross Margin On Non-GAAP Basis (Broadcom)

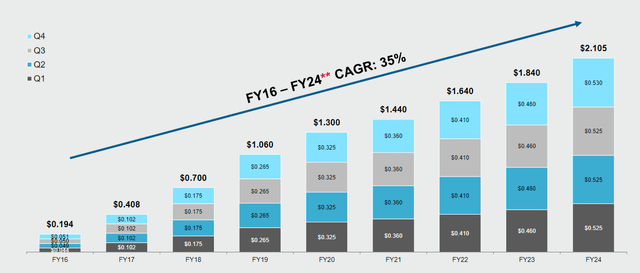

Dividend Growth Value For Passive Income Investors

Investors should consider buying Broadcom partially because of its impressive long-term growth record as far as the company’s dividends are concerned. Broadcom’s dividend has skyrocketed in the last couple of years and the IT company raised its dividend this year, a solid 14% rise compared to last year.

Broadcom is also the only major AI company that I am aware of that profits from accelerating investments in the AI realm and at the same time distributes gains from this spending splurge to investors on a regular basis. Presently, an investment in Broadcom yields 1.3%, but chances are that the yield on cost is going to substantially expand in the future.

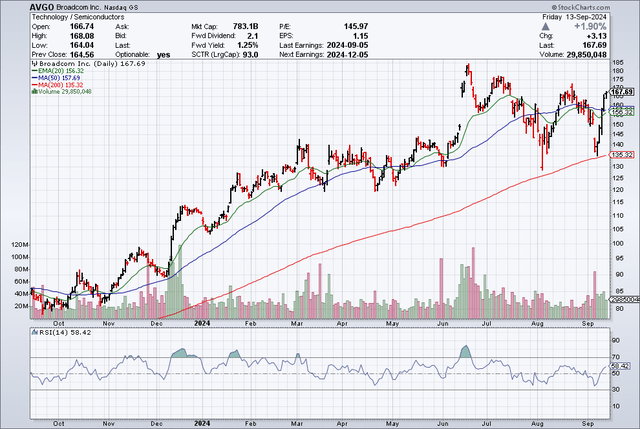

Contrarian Buying Opportunity (Technical Analysis)

Broadcom is in a text-book consolidation pattern after topping out at $185 in late June. The stock has started to gather new strength and momentum after a September drop and bounced off of the 200-day moving average line, which acts as a major support for the stock’s long-term up-channel.

From a technical point of view, Broadcom is in neutral territory, but the chart picture is overall bullish, particularly as far as the 200-day moving average line is concerned. AI stocks have recently cooled off a bit as of late, but the launch of Nvidia’s Blackwell GPUs at the end of the year could breathe some new life in the AI chip sector.

Moving Averages (StockCharts.com)

Broadcom Is A Bargain After 10% Stock Price Decline

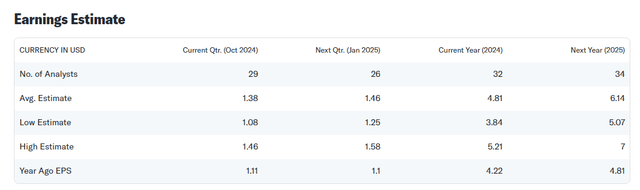

Broadcom is presently anticipated to produce profits in the amount of $6.14 per share next year which reflects a YoY profit growth rate of 28%.

Broadcom’s stock, at the time of writing, is selling for $167.40, reflecting a 27x profit multiple. Broadcom completed its 10-for-1 stock split in July, so all profit metrics have been restated.

NVIDIA Corp. (NVDA), which is still the hottest piece in the AI market, is selling for 30x next year’s estimated profits. Both companies are poised to profit from the ongoing AI revolution, and I own both companies for the long haul.

Taking into account Broadcom’s upswing in profits and margins, I think a 30x profit multiple would also be defensible, reflecting back to us an intrinsic value of $185. This would probably be regarded as a low-range estimate as Broadcom is anticipated to grow its earnings much faster than the average S&P 500 company.

Earnings Estimate (Yahoo Finance)

What Could Go Wrong

The main threat to the investment thesis, in my view, is a possible reduction in AI spending in the coming years if companies in the market for AI hardware don’t see a reasonable return on their investments.

If spending on AI hardware cannot be justified from an ROI perspective, there is a considerable chance that companies will reduce their capital outlays for AI investments, which may take at least some wind out of the sails of Broadcom’s present momentum.

My Conclusion

I am strongly recommending to buy the dip for Broadcom as the semiconductor and networking company is doing a great job growing its sales and profits. Most importantly, estimates don’t indicate that this growth is coming to stop in the near-future and analyst presently anticipate an almost 30% YoY jump in profits next year.

With companies around the world also scaling up spending on AI-tailored hardware, I would make the case, as I did in the past, that spending on artificial intelligence is a potentially multi-decade investment opportunity for investors and, of course, for Broadcom.

So while Broadcom’s stock may appear to be expensive at first glance with a leading profit multiple of 27x, I think a company that grows profits at 20-30% per annum and returns a boatload of cash to shareholders isn’t really that expensive. Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AVGO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.