Summary:

- Broadcom completed a 10-for-1 stock split, making it more appealing to investors previously deterred by its high price.

- The company benefits from heavy spending in the semiconductor and data center industries, driving robust sales growth and profit tailwinds.

- Broadcom’s AI-driven business tailwinds, strong sales growth, and shareholder-friendly dividend growth make it a compelling investment option.

Erik Isakson

Broadcom Inc. (NASDAQ:AVGO) just completed its 10-for-1 stock split which makes the dividend growth stock much more compelling for investors that were previously repelled by Broadcom’s $1,000+ price.

With the stock split being completed and Broadcom driving robust sales growth, particularly in infrastructure software, I think the risk/reward relationship remains compelling.

Broadcom profits from heavy spending in the semiconductor and data center industries which has already led to substantial sales and profit tailwinds for the semiconductor and networking company in the last quarter.

With an earnings multiple of 26x, Broadcom’s stock is cheap enough for a buy stock classification, in my view.

AI-Driven Business Tailwinds For Broadcom

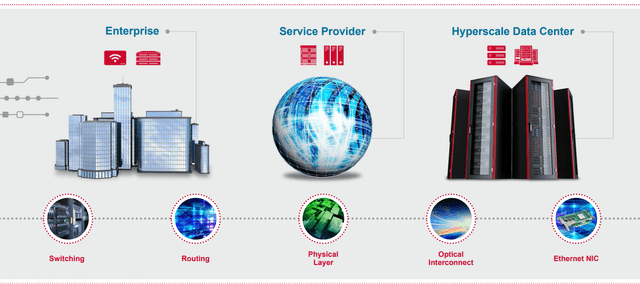

Broadcom supplies the necessary switching and routing infrastructure needed for its enterprise customers and hyperscale data centers to participate in the artificial intelligence revolution.

Broadcom is a major infrastructure player and provides key equipment solutions, including in the software market. With a market valuation of roughly $744 billion, Broadcom is one of the biggest infrastructure companies in the sector.

Switching And Routing Infrastructure (Broadcom)

The semiconductor and networking company looks back on an impressive 2Q24 which ended on May 5, 2024. Robust demand for Broadcom’s semiconductor and infrastructure software products led to 43% YoY sales growth and total net sales of $12.5 billion.

Infrastructure software has been doing really well for Broadcom in the last quarter, with the segment enjoying a 175% YoY sales uplift, thanks to strong demand for VMware’s software stack that enterprise clients use to build their own cloud solutions. VMware is a cloud computing virtualization platform that helps companies run applications leveraging the strength of a cloud environment.

VMware was acquired by Broadcom in 4Q23 in a stock-and-cash transaction valued at $69 billion. It was primarily the momentum of VMware’s software stack that caused Broadcom to raise its guidance for 2024 sales.

Broadcom’s sales and profit momentum has considerable backing as companies led by the likes of Microsoft Corporation (MSFT), Alphabet Inc. (GOOG), (GOOGL) and Amazon.com, Inc. (AMZN) are poised, according to a research piece by The Goldman Sachs Group, Inc. (GS), to spend $1 trillion on AI in the coming year. By leveraging AI technology, companies hope to generate cost efficiencies while growing their sales.

Goldman Sachs’ research note indicated, however, that there are risks to this kind of spending as companies need productivity gains in order to justify this elevated level of AI spend. MIT professor Daron Acemoglu, for example, suggested that AI will only boost productivity by 0.5% per annum moving forward and have a limited impact on GDP growth.

For now, however, the outlook for Broadcom looks healthy and the company raised its sales outlook from $50 billion (March forecast) to $51 billion in June.

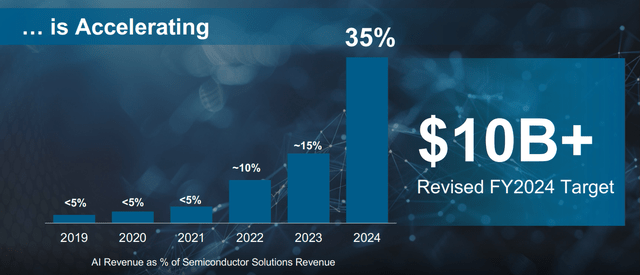

Sales growth does not exclusively come from the infrastructure software segment, obviously. AI is driving growth in Broadcom’s other segment, semiconductors, as well: Broadcom anticipates it will produce more than $10 billion in sales this year (35% of total semiconductor solutions sales) directly related to AI.

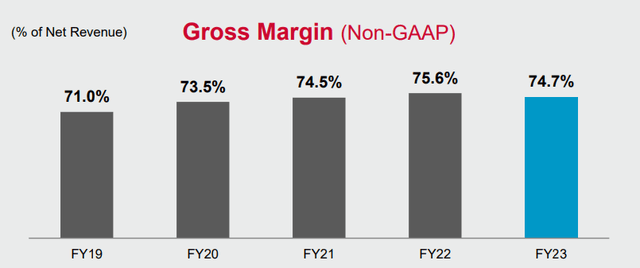

Incremental demand for Broadcom’s semiconductor solutions as well as software has created expansion potential for the company’s gross margins (gross profits as a % of net sales).

Broadcom enjoyed a gross margin uplift of 3,700 basis points to 74.7% in 2023, with 2019 being the base year for comparison. Sizzling demand for AI hardware and software products should lead to incremental margin upside for Broadcom in 2024 as well.

Non-GAAP Gross Margin (Broadcom)

Moderate Earnings Multiple For Broadcom

Broadcom’s stock has been a strong performer this year, up 44% so far in 2024, but the recent 10-for-1 stock split and the potential for sustained dividend growth (see next section) is the reason why I still see a desirable risk/reward relationship.

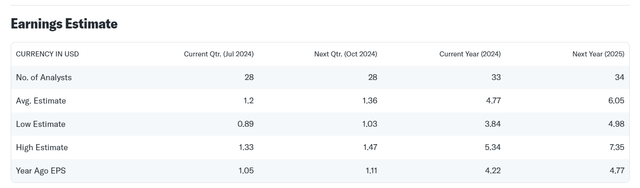

The market presently models 27% YoY growth and profits of $6.05 per share for Broadcom next year. This year, profits are estimated to go up a more moderate 13%. Post-split, AVGO is selling for 26.2x leading (next year’s) profits.

NVIDIA Corporation (NVDA), the leading beneficiary in the AI hardware market and investor darling given its impressive GPU lineup, is anticipated to see 37% YoY growth and investors price the stock at 32.3x next year’s estimated profits.

Does this mean AVGO is an absolute steal? No, obviously not. Broadcom is only a tad cheaper than Nvidia, and Nvidia has much more impressive sales and profit momentum, a key reason why I just called Nvidia a gift even at $130.

With that said, though, Broadcom’s infrastructure equipment, VMware momentum, and long-term secular demand drivers for data centers imply a favorable demand context that could reasonably be expected to equate to sustained sales and profit growth.

At the very least, I anticipate Broadcom to trade up to 30.0x earnings multiple (implied value of $190) in the long run, primarily because of the factors that I just argued support the investment thesis.

Earnings Estimate (Yahoo Finance)

A Dividend Growth Stock

What makes Broadcom a kind of unique AI-themed investment is that opposed to other companies, Broadcom has a shareholder-friendly distribution policy in place and has grown its dividend by leaps and bounds in the last couple of years.

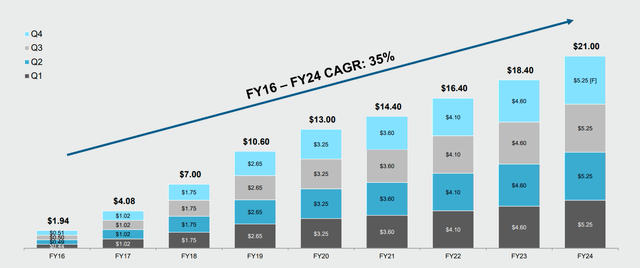

Most recently, AVGO paid a $5.25 per share per quarter dividend which equates to a yield of 1.2%. Because of the ten-for-one stock split, the dividend amounts will reset lower, but the yield, of course, will remain the same.

Broadcom has been a solid dividend grower in the last year which is the main reason why I am including AVGO in my dividend growth portfolio.

Why The Investment Thesis Might Not Work Out For Broadcom

Companies are trying to set themselves up for the age of artificial intelligence, thereby sending AI spending through the roof and creating demand surges for the kind of products that Broadcom is offering its customers. Broadcom, as a critical equipment supplier, appears poised to profit from these tailwinds.

However, there is clearly a risk that the market overestimates the benefits of the AI spending ramp which may at some point lead to more moderate sales and profit growth for Broadcom. Of course, this would pose a risk of multiple compression.

My Conclusion

Broadcom is poised to perform well in the short term as the outlook for the AI/data center industries is highly favorable.

Equipment companies like Broadcom are delivering critical infrastructure which has led to a jump in the company’s net sales in the last quarter. Companies have been ramping up their spending on processors, GPUs, AI servers, chip designs, and data centers which is poised to benefit Broadcom moving forward.

What is unique about Broadcom is that an investment in AVGO merges the AI theme with substantial dividend growth. Most AI stocks don’t pay a dividend at all.

With Broadcom being exposed to substantial AI tailwinds and paying a growing dividend, I think that AVGO has a unique role to play in a passive income investors’ portfolio.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AVGO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.