Summary:

- Broadcom is a key player in AI solutions with diversified offerings, high profitability, and potential for growth in semiconductor products.

- AI revolution is not the only secular shift that Broadcom can benefit from because it also has strong potential to capitalize on a projected 19.4% CAGR for the IoT industry.

- Intrinsic value calculations suggest that AVGO is currently trading at a discount, which is quite attractive for such a fundamentally strong company.

G0d4ather

My thesis

Broadcom’s (NASDAQ:AVGO) AI-related revenue is soaring and is expected to represent more than a third of the total by the end of FY2024. This is a strong indicator of the company having strong AI exposure, and the market already knows it as the stock price almost tripled since January 2023. The company’s intrinsic value is higher than the current market capitalization by 9%, and this potential upside might be unattractive for some investors. However, the DCF model is built on conservative assumptions and does not price in decrease in interest rates soon.

Broadcom’s surge in AI revenues is not a coincidence or a one-off event. The company’s revenue is extremely diversified with various offerings, it has an extremely wide intellectual property base, and continues investing billions in developing new technologies. Insanely high profitability metrics underscore AVGO’s extensive pricing power backed by the technological strength of its products. The management has ambitions to make AVGO one of the major AI beneficiaries, and the pace of rolling out new products and features proves that the team is working hard. Recent reports suggest that we are still far from the bubble in AI, meaning that AVGO is still a very attractive opportunity deserving a Strong Buy rating.

AVGO stock analysis

AVGO is among Nasdaq 100 top-ten best performing stocks in the first half of 2024. As a semiconductor stock, AVGO has been one of the main darlings of the AI-driven rally which started since the beginning of 2023.

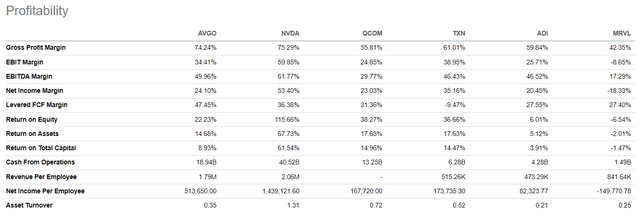

Broadcom is an essential company amid the expansion of AI solutions because of the company’s focus on complex semiconductor products that are vital for building systems that enable high-performance computing. But Broadcom’s products are not only aimed for data centers, but also for a broad range of other applications like broadband access, telecom equipment, smartphones, factory automation. The company does not only sell hardware but has been expanding into software as well in recent years. Other companies in the below table are closer competitors, but none of them demonstrate such a massive free cash flow (FCF) margin.

For a non-IT person like me, it is difficult to assess the technical characteristics and advantages of Broadcom’s semiconductor products, but accounting records sometimes speak quite loudly. Broadcom’s profitability screams about the company’s immense pricing power. Several profitability ratios of AVGO are comparable to Nvidia (NVDA), the major AI star of recent years. AVGO and NVDA are not directly competing as products of these companies mostly complement each other rather than overlapping.

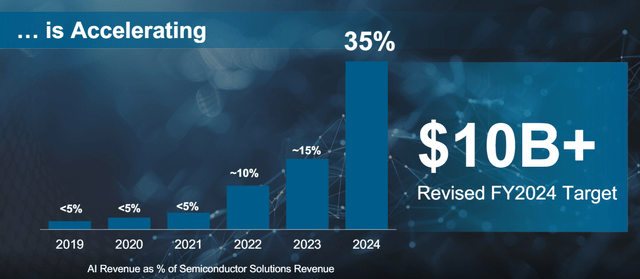

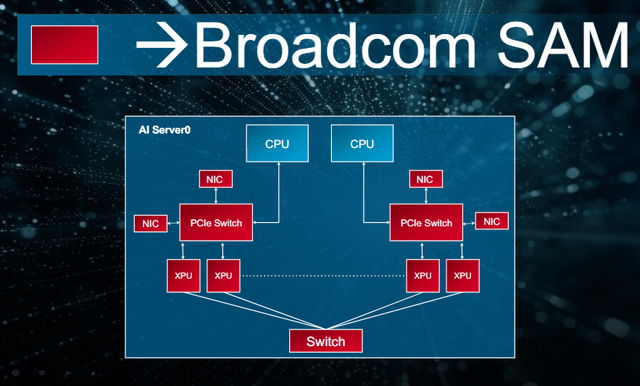

Broadcom’s AI revenue is soaring and is expected to represent 35% of the total by the end of FY2024, compared to below 5% in FY2021. A 35% forecast is ten percentage points higher than the management’s previous guidance, meaning that the demand is soaring. Broadcom’s success in AI is not surprising given the accelerating global AI spending and Broadcom’s crucial role in this trend. While CPUs and GPUs are the brains of data centers, in the below picture it is shown that Broadcom’s products are vital in connecting these “brains”.

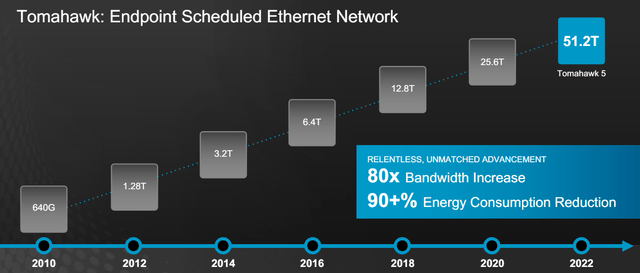

Broadcom’s positioning as a cornerstone of AI servers for data centers is likely very strong because the company heavily invests in developing new products, and the below timeline of its Tomahawk networking offering speaks volumes. Since the launch of the product in 2010, the company’s relentless commitment to innovate helped in increasing its bandwidth by 80 times while reducing energy consumption by 90%.

The company is unlikely to stop innovating as it had 910 pending U.S. patents pending as of the end of the last fiscal year, in addition to 15,400 patents which were already in the company’s intellectual property portfolio. According to the 10-K, with all key patents expiring closer to 2042.

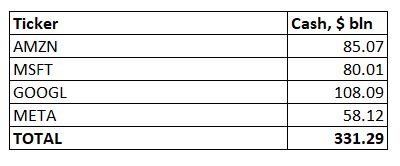

With such a crucial meaning for AI servers and commitment to maintain technological excellence, AVGO is likely to benefit from massive investments in data centers from the largest U.S. tech companies like Microsoft (MSFT), Google (GOOGL), Amazon (AMZN), and Meta (META). Over the last six months, all these giants announced plans to invest tens of billions in data centers across the world. This aggressive spending on data centers is unlikely to end soon because these companies have accumulated massive cash reserves since the Pandemic. In the below table, I summarized cash balances of these giants as of the end of FQ1. The total cash balance of these companies is $331 billion, meaning there are massive reserves to invest in the AI infrastructure.

DT Invest

Broadcom’s future growth potential is not only about AI servers and data centers. There is another potentially strong driver of long-term growth, which are semiconductor products for the Internet-of-Things industry (IoT). It is expected to become a $1.5 trillion market by 2031, showing a 19.4% CAGR. To understand how huge the IoT industry is expected to be, statista.com suggests that the global smartphones market totaled $0.5 trillion in 2023. According to Broadcom’s Director of Product Marketing, the company’s chips have strong potential to be used across different IoT areas and verticals.

Intrinsic value calculation

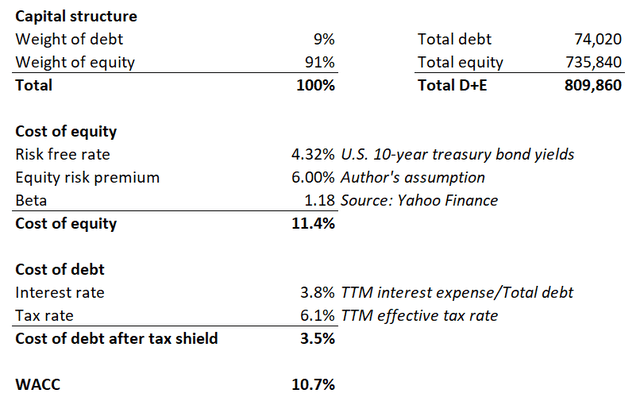

I value growth stocks using the discounted cash flow (DCF) approach. A central variable in a DCF model is its discount rate, which is the weighted average cost of capital (WACC). AVGO’s WACC is 10.7%, based on the below working.

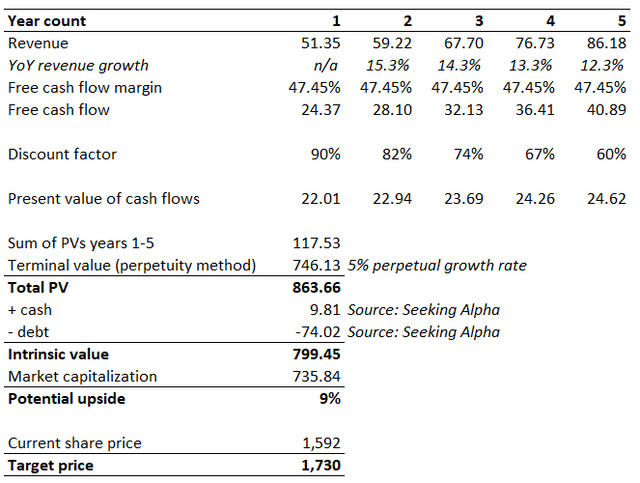

I consider consensus revenue estimates as a reliable source for my DCF’s revenue assumptions for years 1-2. Due to its scale and popularity, the company’s financial metrics forecasts are extensively covered by Wall Street analysts for the next three years, which adds credibility to my revenue growth assumptions. For years 3-5 I implement a steady 100 basis points per year CAGR decrease. The year 1 free cash flow margin is as usual the levered TTM level of 47.45%. AVGO’s FCF margin is very high and projecting further improvements might be too optimistic. Therefore, the FCF margin assumption will be constant for all five years. An aggressive 5% perpetual growth rate is used due to AVGO’s robust AI exposure and historical revenue growth rates.

A 5% perpetual growth rate might be questionable for AVGO bears. I think that since the perpetual growth rate significantly impacts the total intrinsic value, I have to spend some time on explaining my reasoning. I want to prove that a 5% rate is reasonable by looking both forward and backwards. According to stockanalysis.com, Broadcom’s revenue was $1.4 billion in 2006 and grew to $35.8 billion by 2023. It means that the average compound annual revenue growth rate was 21% over the last seventeen years.

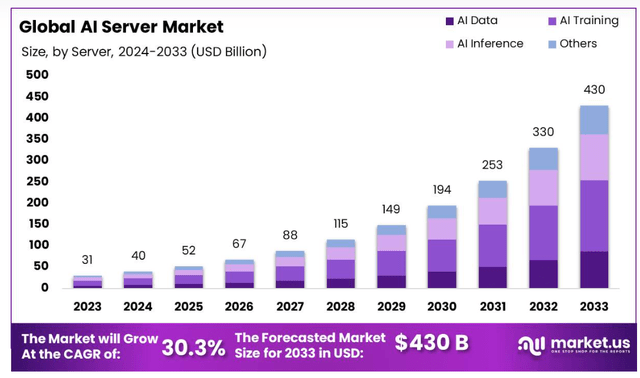

From the forward-looking perspective, a 5% perpetual growth rate also looks justified. AVGO’s offerings are central for AI servers, as was shown in my analysis. According to market.us, the global AI server market will become a $430 billion industry by 2033. The projected industry’s CAGR is 30.3%, and AVGO’s exposure to this industry is rapidly expanding. Based on AVGO’s historical revenue growth and potential in AI servers, I think that a 5% perpetual growth rate might be even pessimistic.

Broadcom’s intrinsic value is almost $800 billion. A 9% discount for AVGO looks like a good deal, especially considering conservative revenue growth assumptions used in my DCF. Furthermore, as interest rates are expected to start declining soon, discount rates will soften as well.

What can go wrong with my thesis?

A close to 50% FCF margin is extremely high, and potential future competition might diminish AVGO’s high profitability. There is no guarantee that AVGO will be able to sustain this FCF levels over the next decade or even the next five years. The FCF margin shrinkage might negatively affect the company’s intrinsic value.

Being a technological company also means that there are significant risks of the company’s products and services becoming obsolete and non-competitive in case AVGO fails to drive innovation. The competition for talented engineers is extremely high as there are many other companies larger than AVGO (for example the four giants mentioned above that have total cash of $330 billion) that are highly likely to offer better compensation.

Broadcom’s goodwill more than doubled compared to last year after the VMware acquisition. As of the last report, goodwill amounted to $98 billion. In case the VMware investment does not pay off, AVGO will be recognizing a multi-billion impairment charge. This will significantly negatively affect the company’s EPS, and ultimately the valuation.

Summary

There are many more reasons to be bullish than bearish when we speak about Broadcom. The management’s determination to make AVGO an essential part of the AI revolution is strong, and stellar past performance increases chances of succeeding again.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in AVGO over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.