Summary:

- We’re reiterating our buy on Broadcom for FY25.

- We expect possible share loss to NVDA in Ethernet switching and industry transition to NVDA’s proprietary NVLink will be manageable through higher ASP.

- VMware should also continue to boost AVGO’s infrastructure software sales, contributing to long-term growth and integration success.

- We think AVGO is gearing up for its next leg of growth and recommend mid- to long-term investors add the name to their radar.

Devrimb

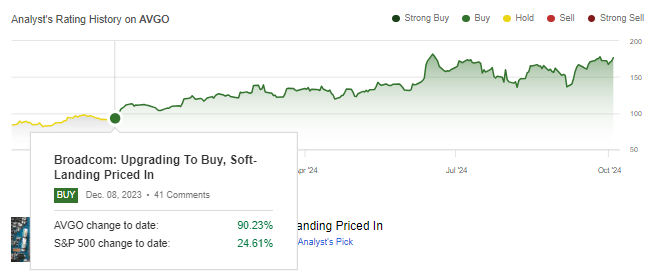

Broadcom (NASDAQ:AVGO) is up ~90% since our upgrade to buy in early December of last year versus the S&P 500, up ~25% during the same period. We maintain our buy rating on AVGO but update our thesis. We upgraded AVGO to a buy after 4QFY23 when the company de-risked its outlook of FY24, lowering the FY24 revenue guide to $50B, trailing consensus of $52.34B. Our belief was that AVGO would be able to show upside surprise “supported by a new product cycle and increased content in FY24 in AI acceleration, cloud networking, broadband access, and enterprise storage end-markets.” We think this thesis has played out based on AVGO’s financial performance and stock price performance over the past three quarters. Now, we expect the stock to outperform relative to the semi-peer group on its new product cycle for AI-related networking ICs and customer ASIC accelerators, with Meta, Google, and ByteDance as its current AI ASIC customers and management is eyeing OpenAI next.

We do expect some competition pressure from Wall Street’s AI darling, Nvidia (NVDA), with the risk of AVGO losing its share of NVDA in Ethernet switching and the industry transition to NVDA’s proprietary NVLink. In spite of this, we continue to expect AVGO to be an outperformer as we believe the higher ASP (average selling price) of its new product cycle will offset any potential share loss to NVDA and the industry transition.

The following chart outlines our rating history on AVGO and its outperformance against the S&P 500.

Seeking Alpha

The company just announced its industry-first merchant silicon 50G PON solution with an Embedded neural processing unit (NPU) to enhance AI/ML capabilities and deliver 40x speed and lower latency than current solutions; this product will come with a higher price tag than 25G PON and 10G PON. For reference, PON is a “passive optical network structure that utilizes a single fiber optic line to transmit signals to multiple users” and “requires relatively simple optical network terminals (ONTs) at the user end,” which lowers end-user cost. Additionally, management introduced Bailly 51.2-Tbps co-packaged optics Ethernet switch earlier this year, which offers 8x improvement in silicon area and reduces power consumption by 70% compared to the traditional plug transceivers, making it a fit for large-scale AI clusters. The jump in tech performance protects AVGO because it allows higher ASP to support top-line growth.

We also think AVGO’s longer-term golden ticket is its work on AI custom ASIC, which should actively expand its serviceable addressable market or SAM and support more outperformance. The higher ASP of the new product cycle should support top-line reacceleration in FY25, particularly noting the heightened AI-related demand that will not mind the higher price tag.

What about VMware?

The VMware acquisition was a definite win for the company, and FY24 so far can confirm it. The company’s Infrastructure Software sales grew 150% Y/Y to $4.57B in Q1, 175% Y/Y to $5.29B in Q2, 200% Y/Y to $557M in Q3 and are guided to hit $6B next quarter, representing a 3.5% Q/Q growth. The acquisition injected momentum into the company’s software side of the business, which was more of an afterthought compared to their semiconductor sales, so much so that the business only generated $1.97B in sales around a year ago in 4QFY23.

The $69B acquisition closed in late November of last year after facing a tough 18 months of regulatory scrutiny that caused the deal’s closing date to be delayed three times. VMware fits within AVGO to provide “enterprise customers an expanded portfolio of business-critical infrastructure solutions to accelerate innovation and enable greater choice and flexibility to build, run, manage, connect and protect applications at scale.” Management noted on last quarter’s earnings call that “VMware bookings continue to accelerate” was one of the three takeaways of the quarter, alongside AI revenue growth and non-AI semi-revenue stabilization.

Out of the $5.8B in Infrastructure software sales that AVGO achieved in Q3, VMware contributed $3.8B, and management’s commentary shows VMware integrating nicely, with CEO Hock Tan stating:

We booked more than 15 million CPU costs of VCF, representing over 80% of the total VMware products we booked during the quarter.”

Management is also working on driving down the costs that VMware brings with it and doing so successfully, with VMware spending down $1.3B in Q3 compared to $1.6B in Q2. One of the other consequences that come with the integration of VMware is pricing; since the acquisition, prices have increased for VMware’s virtual machines due to AVGO management swapping “VMware’s points-based licensing model for a White Label program in the name of simplification.” This helped boost the Infrastructure software revenue in addition to organic VMware revenue growth. We think the Y/Y comparison will become tougher next year but see momentum for 2025. We expect to see more upside in the long term from management imposing a subscription business model on the VMware core virtualization business.

Valuation & Word on Wall Street

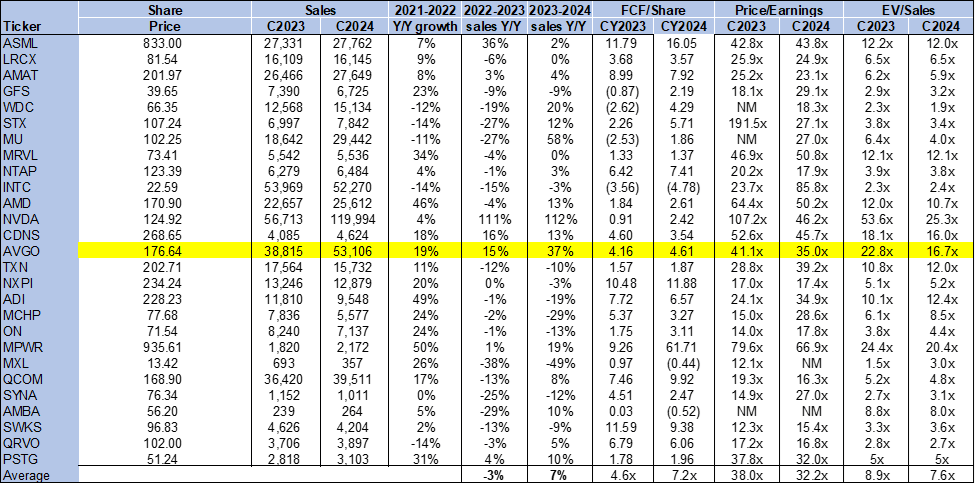

AVGO stock is not cheaper than it was last December. In fact, the stock remains expensive relative to the semi-peer group. On a P/E basis, the stock trades at 35.0x C2024, compared to a peer group average of 32.2x and a previous ratio of 21.3x. The stock is trading at 16.7x EV/C2024 sales versus the peer group average of 7.6x and a previous ratio of 10.5x last December. We don’t think investors should shy away from this stock on its valuation. The market is pricing optimistically for future AI-related revenues, particularly from its custom AI ASIC ramp, and we think AVGO is better positioned after the consensus revisions for FY24 to achieve the expected future growth.

The following chart outlines AVGO’s valuation against the peer group average.

Techstockpros

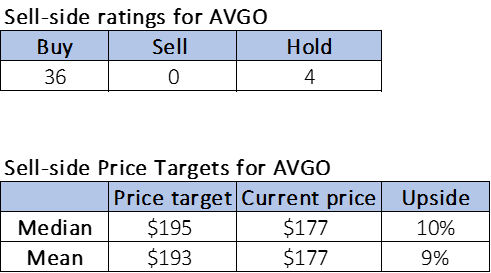

Since our last note, Wall Street has shifted more heavily to a bullish outlook on AVGO. Of the 40 analysts covering the stock, 36 are buy-rated, and the remaining four are hold-rated (not too different from 23 buy-ratings and six hold-ratings last December). The stock is currently priced at around $177 after executing a 10-for-1 stock split on July 12th. The median sell-side price target is $195, while the mean is $193 for a potential 9-10% upside (again more or less in line with the upside proposed last December for 10-13%).

The following outlines sell-side ratings and price targets on AVGO.

Techstockpros

What to do with the stock?

We reiterate our buy on AVGO, but now for new reasons. We think AVGO will outperform in 2025, not with a share gain or even share retention, but on higher ASP for the new product cycle. In our opinion, AVGO will be an in-line performer for the near term before accelerating in 2025. We think mid-to-long-term investors should add this name to their radar, especially after Q3 got so much bad news out of the way, i.e., priced into the stock and outlook. Management is guiding Q4 sales to grow 7% Q/Q to $14.0B, trailing consensus slightly at $14.1B with Broadband sales to be up Q/Q but down 40% Y/Y, Wireless sales expected to increase 20% Q/Q but be flat Y/Y, and Server/Storage sales expected to expand 5-9% Q/Q. Management did raise FY24 guidance on non-AI semi-sales stabilization and AI demand strength in Q3 and now expects FY24 sales to be $51.5B up from $51B, with AI sales expected to contribute $12B in sales, up from the previous $11B. We think Broadband has hit bottom in Q3 and should see recovery in FY25. We like management, their discipline compared to other semis, and their risk-reward for next year.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Tired of losing money? Our Tech Contrarians team of Wall Street analysts sifts through the noise in the tech industry and captures outperformers through a coveted research process. We let the work speak for itself here.