Summary:

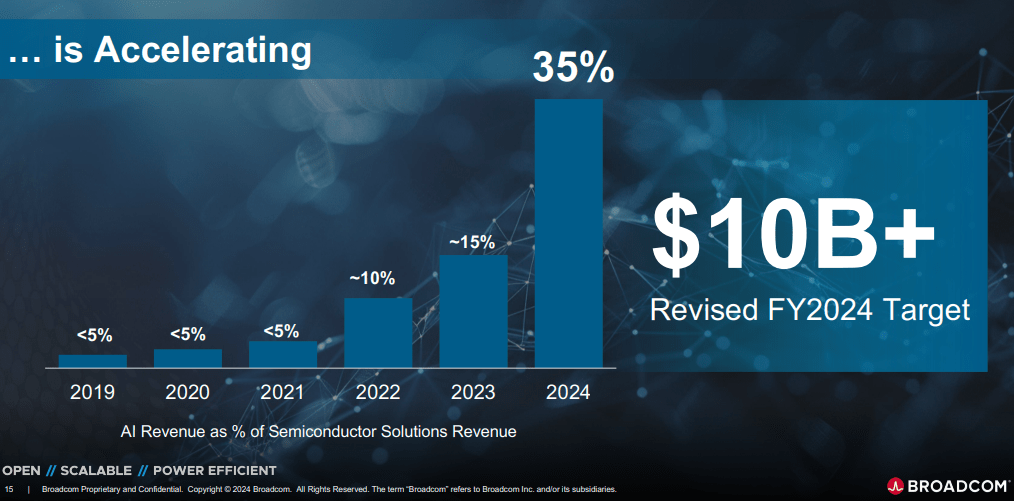

- Broadcom’s FY2024 AI revenue is projected to surpass $12 billion, driven by surging demand and strategic partnerships.

- VMware added $3.8 billion to Q3 revenue, doubling infrastructure software contributions and diversifying Broadcom’s income streams.

- Trump 2.0 proposes a 60% China tariff, potentially disrupting 32% of Broadcom’s revenue tied to Chinese markets.

- Broadcom achieved Q3 gross margins of 77.4% and operating margins of 61%, reflecting cost management and scalability.

- Broadcom’s networking semiconductor revenue grew 43% YoY in Q3, with custom AI accelerators seeing a 3.5x increase.

Sundry Photography

Investment Thesis

Broadcom (NASDAQ:AVGO) is poised for continued growth, driven by surging AI demand and its transformative VMware acquisition, which has diversified its revenue streams into high-margin infrastructure software. Partnerships with OpenAI and TSMC (TSM) underscore its critical role in the evolving AI ecosystem, with FY2024 AI revenue projections now exceeding $12 billion.

However, risks tied to potential Trump 2.0 policies, including elevated AI export controls and tariffs targeting China, could disrupt Broadcom’s supply chain and revenue base. China has contributed over 30% of its revenue in recent years. Geopolitical tensions may also increase costs and erode margins as Broadcom realigns its operations to mitigate regulatory and trade risks.

While Broadcom’s proactive investments and diversified portfolio position it favorably for long-term growth, the outlook is cautiously optimistic, hinging on managing geopolitical uncertainties.

AI Partnerships and Software Diversification Fuel Explosive Growth

Broadcom’s recent partnerships with core industry leaders like OpenAI and TSMC highlight its active supply chain strategy. OpenAI’s custom chip development through Broadcom and TSMC boosts Broadcom’s product demand and provides long-term revenue visibility. Such projects often have multi-year timelines and top-line growth. Additionally, with increasing demand for data centers, chips may double by 2026, and component suppliers (like AVGO) will need to increase output by 30%, with advanced packaging providers potentially tripling production. Broadcom’s proactive investment in AI accelerators, CoWoS, and chip-on-wafer-on-substrate components is pushing the company to capitalize on this projected demand.

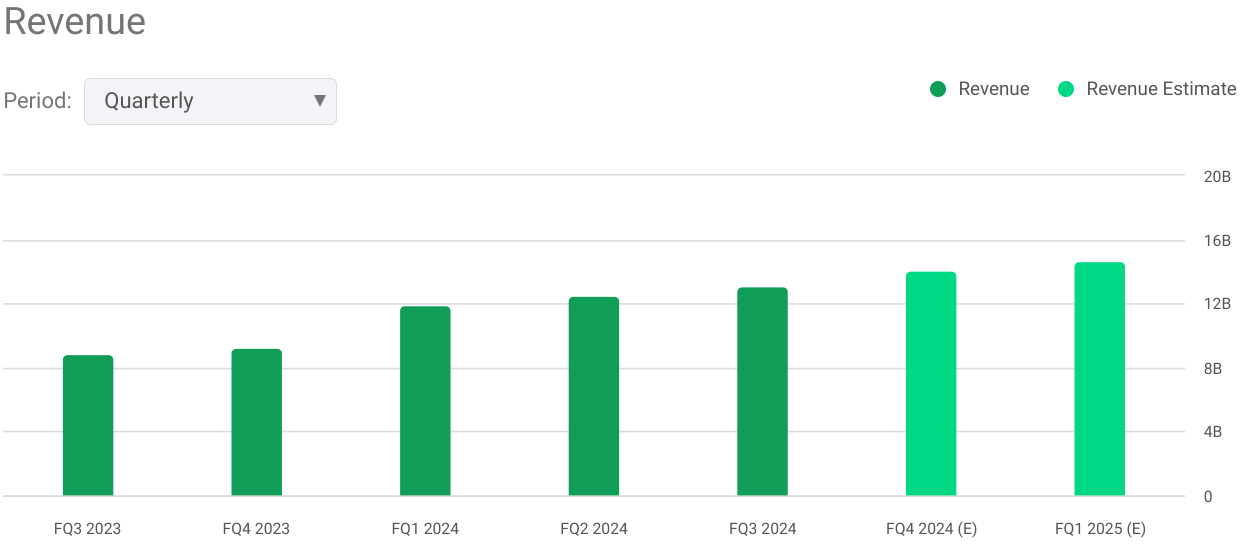

Moreover, Broadcom had Q3 2024 revenue of $13.1 billion with a 47% year-over-year (YoY) increase and substantial growth as it holds strong performance across multiple segments. The semiconductor solutions segment derived $7.3 billion, or 56% of total revenue, which reflects a 5% YoY increase. Meanwhile, infrastructure software contributed $5.8 billion (44% of total revenue), which soared by 2X YoY based on VMware’s contribution. The recent VMware acquisition is undoubtedly transforming Broadcom’s revenue mix and adding stable growth to its top line.

Specifically, VMware led $3.8 billion in infrastructure software revenue, indicating the rapid scaling of this segment. This diversification allows Broadcom to leverage hardware (semiconductor) and software revenue streams, boosting stability against potential sectoral downturns. This shift in the top-line mix is vital as it aligns Broadcom to seize growing demand from cloud computing and private cloud environments. The acquisition aligns with Broadcom’s focus on achieving an adjusted EBITDA of $8.5 billion within three years, signaling sustained growth momentum in software.

seekingalpha.com

Further, the AI-related demand continues to bolster Broadcom’s semiconductor revenue, especially from hyperscalers (large data companies like Google, Amazon, and Microsoft). Broadcom’s Q3 semiconductor revenue in networking was $4 billion, with a 43% YoY rise. Here, custom AI accelerators experiencing a 3.5-fold YoY increase indicate substantial gains from AI hardware. Broadcom’s advanced networking products, such as Tomahawk 5 and Jericho3-AI, grew over fourfold YoY, showcasing a robust response to AI hardware needs.

Broadcom expects Q4 to generate over $3.5 billion in AI-specific revenue and push its FY2024 AI revenue to approximately $12 billion, up from initial projections of over $11 billion. This 10% sequential growth demonstrates Broadcom’s market responsiveness and positions it strongly to capture the AI market as applications expand. Additionally, Broadcom’s partnerships, such as the one with OpenAI, reflect a strategic alignment with high-growth tech players in AI.

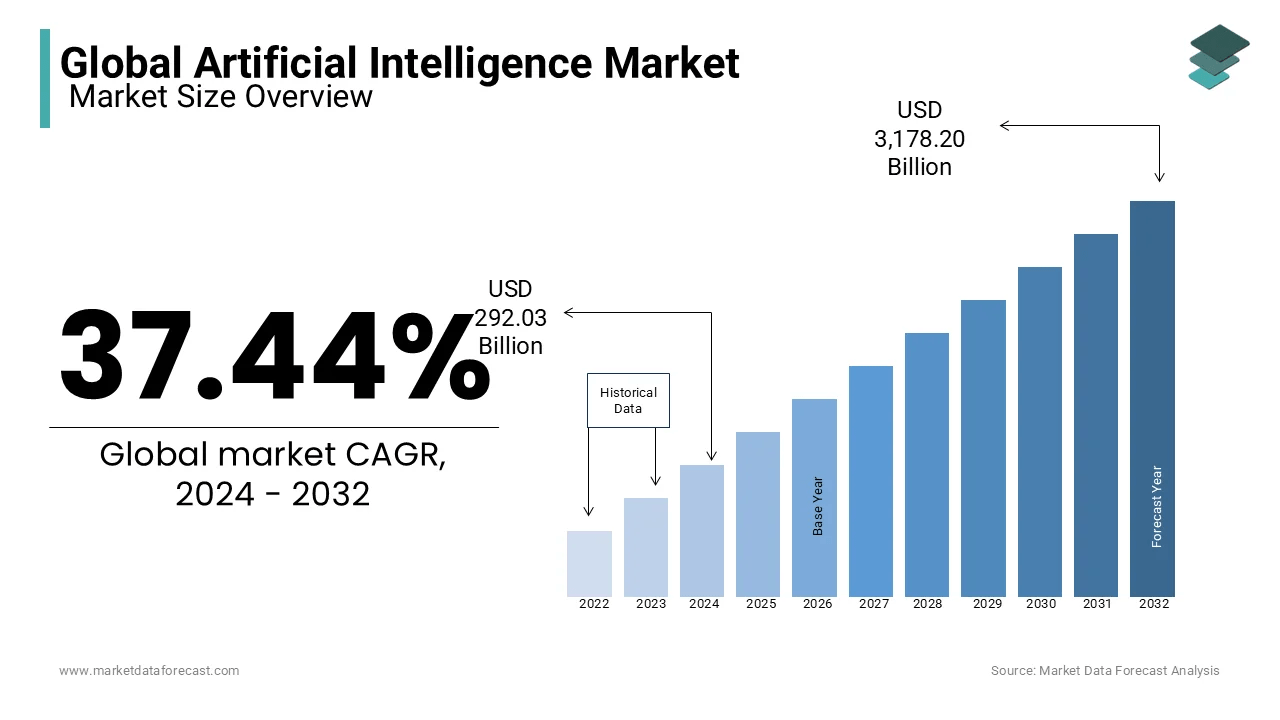

Now, by securing manufacturing capacity with TSMC for OpenAI’s custom chips, Broadcom is a critical partner in the expanding AI chip market. In terms of market opportunity, the market may hit 38% annual growth over the long term (2024-2032).

marketdataforecast.com

At the bottom line, Broadcom’s operational efficiency can be observed in its gross and operating margins. In Q3 2024, Broadcom had a gross margin of 77.4% and an operating margin of 61%, underscoring cost management and economies of scale. Broadcom’s operating margin further improves to 62% when excluding transition costs. This illustrates the impact of scaling and integration synergies post-VMware acquisition. Broadcom’s adjusted EBITDA of $8.2 billion represents 63% of revenue, based on strong AI demand and cost-cutting measures within VMware operations.

Broadcom’s expected adjusted EBITDA in Q4 to approximate 64% of revenue suggests continuous optimization and profitability uplift potential. As a result, Free cash flow in Q3 hit $4.8 billion (37% of revenue) and $5.3 billion (41% of revenue) if one excludes restructuring and integration costs. The stable cash flow provides Broadcom with ample resources to fund growth initiatives like aggressive research for its AI and networking products and debt repayment.

Looking forward, Broadcom’s guidance and consensus estimates for Q4 are robust. A projected consolidated revenue of approximately $14 billion indicates a 51% YoY growth (consensus: 51.54% YoY growth). Within this, semiconductor revenue may hit $8 billion (up 9% YoY), while infrastructure software is anticipated to contribute $6 billion with a stable performance post-VMware integration.

Gross margins may decrease slightly due to a higher semiconductor revenue mix, though adjusted EBITDA may hit approximately 64% of revenue. Broadcom’s full-year 2024 revenue outlook has also been revised to $51.5 billion, reinforcing street confidence in sustained growth. The EBITDA forecast for the fiscal year now stands at 61.5% based on high-margin infrastructure software and continued AI demand. This guidance positions Broadcom advantageously within the semiconductor and software market as demand for AI and private cloud solutions rises.

Broadcom

Trump 2.0: A Double-Edged Sword for Broadcom Amid Heightened Trade Tensions

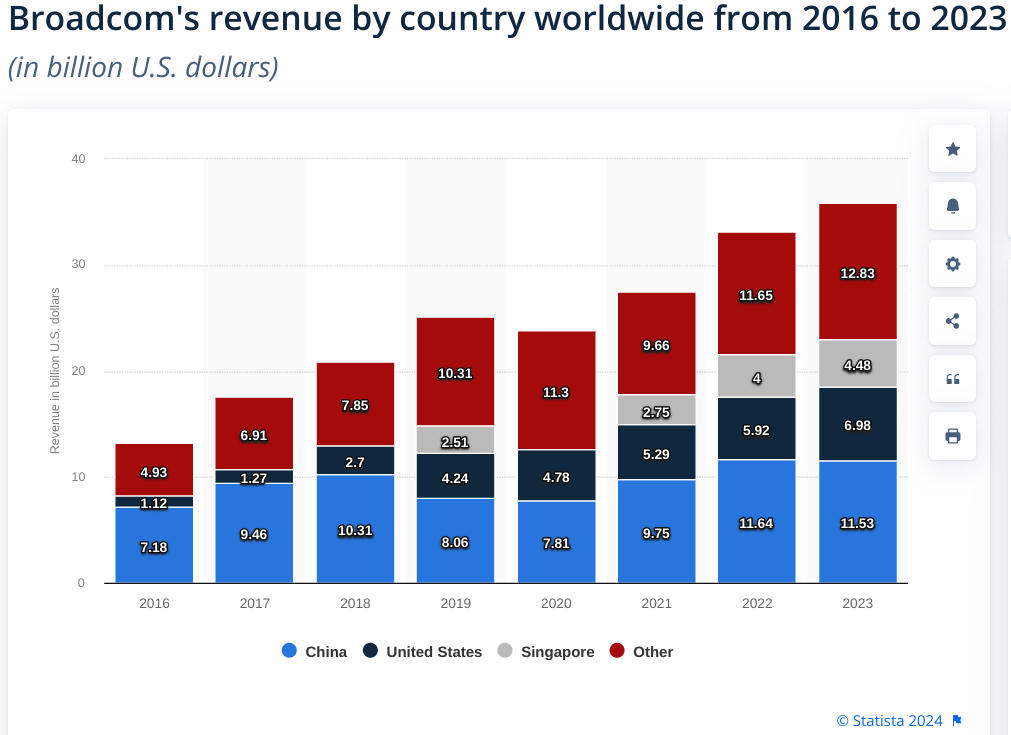

The Trump 2.0 administration is expected to intensify AI-related export controls that began under President Biden. These measures aim to limit China’s access to advanced semiconductor chips and other AI-related technologies, which could include Broadcom’s products. Broadcom’s revenue (32% in 2023 and 35% in 2022) is linked to shipments to China.

Tighter export restrictions could directly disrupt this revenue stream, mainly if Broadcom’s products are categorized as critical technologies restricted from export to China. While Broadcom claims much of its products are incorporated into devices sold in the US or Europe, the initial shipments to China could face regulatory bottlenecks, disrupting supply chains and delaying revenue recognition.

If the administration closes loopholes (e.g., via cloud-based AI chip access or black-market trade), Broadcom may need to navigate more complex compliance requirements, which could raise operational costs and potentially delay market access.

statista.com

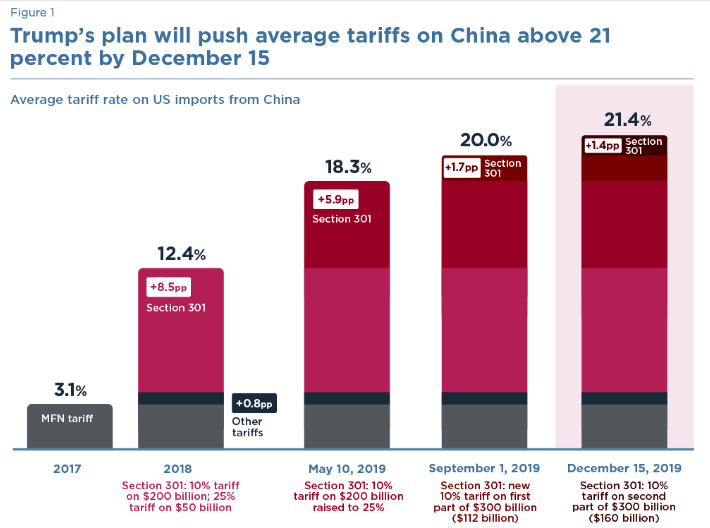

Moreover, the Trump administration will likely reimpose or expand tariffs on a wide range of Chinese goods. These tariffs may decouple the US and Chinese economies, making it harder for Broadcom to do business with Chinese entities. Tariffs may increase the costs of importing components from or exporting products to China and squeeze Broadcom’s profit margins.

Clients seeking to avoid tariffs might turn to non-US suppliers, diminishing Broadcom’s market share in China. This shift would exacerbate the 2023 trend, where Broadcom’s revenue percentage from China dropped from 35% to 32%. Decoupling policies could force Broadcom to realign its supply chain away from China, requiring significant investment in new manufacturing and logistics arrangements. This realignment could increase production costs and disrupt operations in the short term.

piie.com

Unlike the Biden administration, which maintained limited channels for US-China AI-related dialogue, Trump’s administration is expected to take a more aggressive stance. This would likely include reduced collaboration on managing technology risks and a greater focus on securing US leadership in AI and semiconductor technologies. Trump’s administration is likely to promote “Made in America” initiatives more and aggressively push for reducing dependence on Chinese supply chains.

This could include subsidies or incentives for relocating manufacturing to the US or allied nations. An escalation in US-China tensions under Trump 2.0 could exacerbate global economic uncertainty, especially in technology sectors dependent on international cooperation. Broadcom’s exposure to pricing pressures will increase as clients demand lower prices to offset geopolitical risks, potentially eroding margins.

Takeaway

Broadcom demonstrates robust growth prospects driven by surging AI demand, a transformative VMware acquisition, and strategic partnerships with OpenAI and TSMC. With Q3 2024 revenue surging 47% YoY and AI-specific revenue exceeding expectations, Broadcom’s diversified portfolio positions it well for long-term success.

However, geopolitical risks under a potential Trump 2.0 administration pose challenges, including stricter AI export controls and increased tariffs on China, which could disrupt supply chains, escalate costs, and erode margins. While Broadcom remains fundamentally strong, its outlook is cautiously optimistic and reliant on navigating these uncertainties to sustain growth momentum.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.