Summary:

- Broadcom entered 2024 with strong momentum, reporting record revenue of $35.8 billion in fiscal year 2023.

- Q1 2024 results beat estimates, with revenue of $11.96 billion and non-GAAP EPS of $10.99, representing 34% YoY revenue growth.

- The company is now in a phase of de-levering the VMWare acquisition, which had numerous headwinds in its GAAP financials.

- AI continues to be a growth vector for Broadcom on numerous fronts, validating my belief that Broadcom will be a long-term compounder.

Justin Sullivan

Thesis

I’m initiating coverage of Broadcom (NASDAQ:AVGO) with a Buy rating on strong demand for its networking chips, the value-add of the VMWare acquisition in its software portfolio, and its very strong custom silicon business.

Broadcom’s bull case extends far past AI hype, but this company is a major beneficiary of AI spend – networking, a category which Broadcom enjoys a deep moat, is second only to processors in AI spend. It recently closed one of the largest acquisitions in recent history, bringing VMware’s industry leading virtualization software into its growing software portfolio. Management noted repeatedly on the call the strong booking pipeline and pricing power that VMWare has. Finally, they are a stalwart in the custom silicon market with Google and Meta as its two leading customers.

This business benefits from AI immensely but will be successful long-term even if strong AI demand tailwinds fade in the coming years. Therefore, I feel Broadcom offers a compelling long-term compounding opportunity even with the AI premium priced in.

Q4 Earnings Review

Broadcom entered 2024 with strong momentum off of a record $35.8b of revenue in fiscal year 2023. They invested over $5b in R&D last year and maintain a robust portfolio of more than 23,000 patents.

It built on this momentum in the March 7th Q1 2024 report by beating top-line estimates of $11.72b by $240m and beating EPS estimate of $10.42 by $0.57. Revenue came in at $11.96b and non-GAAP EPS at $10.99. This report represents 34% YoY revenue growth and 17% YoY growth in non-GAAP net income. Excluding VMWare, total revenue grew 11% YoY and software revenue grew 20% YoY.

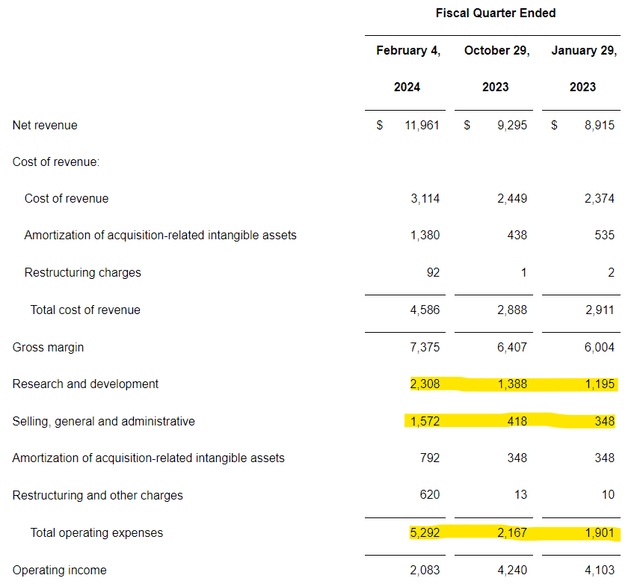

Broadcom generated $4.8b in cash from operations leading to $4.7b in free cashflow. Meanwhile, GAAP net income was down materially to $1.3b for the quarter. It was down $2.4b YoY primarily because of material increases in R&D and SG&A expenses related to VMWare’s core business.

The company repurchased 7.7m shares for $8.3b total during the quarter ($1,077/share average) and announced a quarterly dividend of $5.25/share. They spent only $122m in CapEx in Q1, illustrating the strong operating leverage that Broadcom enjoys. There is very little incremental capital required to continue driving growth.

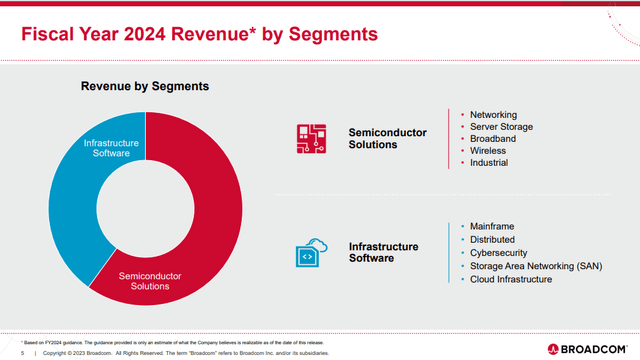

Management entered the year expecting semiconductor sales to outpace infrastructure software sales, a trend that the Q1 report confirmed. Q1 semiconductor revenues came in at $7.39b growing 4% YoY while infrastructure software solutions were $4.57b growing 153% YoY. The strong software growth is mostly attributed to the inclusion of VMWare sales in the report for the first time.

Broadcom Q4 2023 Shareholder Presentation

Broadcom’s gross margin eroded significantly in the quarter, falling from 73.4% in Q1 2023 to 61.7% mostly because of acquisition related amortization costs.

Broadcom had a notable uptick in R&D expense, contributing in part to the significant GAAP net income erosion. SG&A expense also more than quadrupled YoY.

This makes sense. Historically, Broadcom has focused on two things after a major acquisition.

First, they de-lever. They are already doing this, with $3b of cash moving off the balance sheet to pay off debt. Second, they bring the acquired company onto the Broadcom sales and internal operations platforms. The VMWare acquisition closed in November of 2023, so the expense reductions will likely come later in 2024. For now, investors will have to be comfortable with significantly lower GAAP margins.

The notable difference between GAAP and Non-GAAP net income is also driven partly by a quadrupling of stock-based comp expense YoY. Stock-based comp will continue to be higher due to expanded headcount, but as Broadcom eliminates redundant roles in the new organization, the stock-based comp growth rate will slow.

The company guided for $50b of revenue in FY 2024, which would represent almost 40% YoY growth, largely aided by VMWare upselling and strong AI demand.

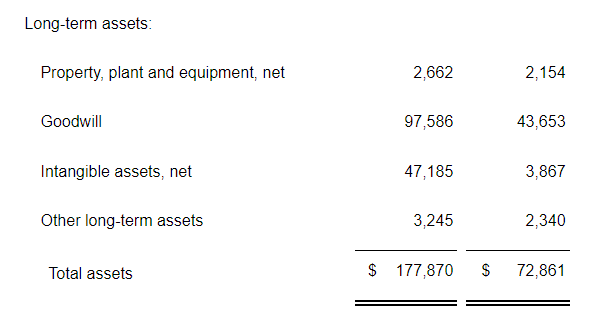

Looking at the balance sheet, the VMWare acquisition had major impacts to Broadcom’s long-term assets, specifically Goodwill and Intangible assets:

Broadcom Q1 2024 report

On the liabilities side, long-term debt more than doubled QoQ because of the acquisition, highlighting why de-levering will be so important in the coming years.

Broadcom ended the quarter with over $11b in cash.

The company will likely halt dividend hikes while they focus on paying off long-term debt. I expect GAAP net income to return to growth once the newly combined organization eliminates redundant roles and hits its stride throughout 2024.

Overall, this was a very strong report. Management revised previous AI driven sales guidance upwards by $2.5b, the software business continued growing at a fast clip excluding VMWare and management noted strong bookings from VMWare, and the company is already beginning to de-lever. Broadcom was firing on all cylinders in Q1 2024.

With that, let’s now turn to the path forward.

Looking Ahead

Broadcom continues to enjoy numerous attractive growth prospects, namely AI. Hock Tan, the company CEO, noted a $10b guide for AI use cases between networking and custom silicon. This was revised upward from $7.5b in Q4. Hock noted there are only two major custom silicon customers, Google and Meta, yet 70% of AI revenue will be attributed to custom silicon. Meanwhile 30% will go to networking. Very notably, Hock mentioned on the earnings call that Broadcom gets enough lead time from hyperscale customers that they do not face a supply crunch right now.

Networking is second only to processors in total AI spend, according to leading semiconductor research firm Semianalysis. The major infrastructure buildout by big cloud service providers (“CSPs”) is a strong tailwind for Broadcom’s revenue growth.

Meanwhile, they have strong product offerings in mature industries like broadband (wireless connection) and mobile handsets. They offer a range of mobile chips including RF Front End chips (used to tune into specific radio frequencies and filter out others), touch controllers (ASICs for touch screens), and inductive charging ASICs for wireless charging. While these won’t offer extremely high growth, Broadcom will continue to enjoy a very strong gross margin in these segments. This will continue to benefit shareholders by providing ample cash for debt repayments, share repurchases, and dividend growth.

On the infrastructure software side of the business, Broadcom is working now to de-lever from the massive VMWare acquisition and is working to extract the value from bringing virtualization into their existing portfolio of software solutions.

Virtualization allows enterprises to divvy up compute resources on physical machines in a digital interface. It allows users to visualize the capacity of servers and divide workloads accordingly and makes the management of on-prem data centers significantly easier.

Virtualizing machines is a non-negotiable in modern data centers, so bundling this with its other software offerings gives Broadcom by far the most comprehensive software package for enterprises, especially as enterprises shift further into a hybrid cloud model. VMWare had a higher gross margin than Broadcom’s pre-acquisition software portfolio, so upselling here should be margin accretive over time.

Hock mentioned that virtual private cloud, used for on-prem enterprise data centers, will be a meaningful growth vector moving forward. Hock noted accelerating bookings for VMWare, and the company will continue to push VMWare to customers.

Moving back to the hardware side of the business, it’s important to discuss Broadcom’s custom silicon accelerator (ASIC, application specific integrated circuit) segment. This is a business that grew operating profits 177x from 2009 to 2021, and management believes growth here is likely to continue.

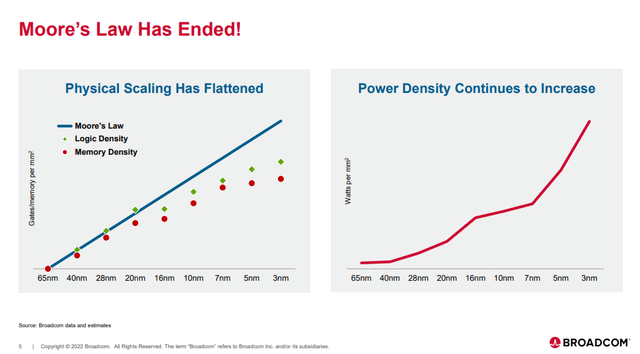

Custom silicon is important for two reasons: 1) hyperscalers want to avoid over-dependence on merchant silicon providers, namely Nvidia (NVDA), and 2) the slowing rate of transistor density scaling has made application-optimized solutions more important.

Broadcom and Deutsche Bank Custom Silicon Teach-In Presentation

General purpose processors (merchant silicon) like Nvidia’s H100 are phenomenal for a wide range of applications, but many big tech companies are shifting toward a custom model.

Google (GOOG) is a major Broadcom custom silicon customer with its TPUs. Meta (META) also designs chips with Broadcom. Meanwhile the industry is shifting more toward a custom model: Apple has been on custom silicon with their ‘A’ and ‘M’ series chips for years, Microsoft (MSFT) is designing custom chips dubbed Maia and Cobalt, and Amazon (AMZN) touts its own custom chips Trainium and Inferentia.

Part of what is driving this growth is what Broadcom calls a “software offload” from general purpose to domain specific (custom) chips. When customers need to perform increasingly complex software tasks, they need to shift workloads from general purpose processors to custom processors.

This industry-wide shift has yet to impact Nvidia, though. It is still the undisputed king of AI hardware, and its merchant silicon is supply constrained. While custom silicon won’t outright replace general purpose hardware, the future data center will be defined by a hybrid approach combining merchant and custom silicon solutions.

Valuation

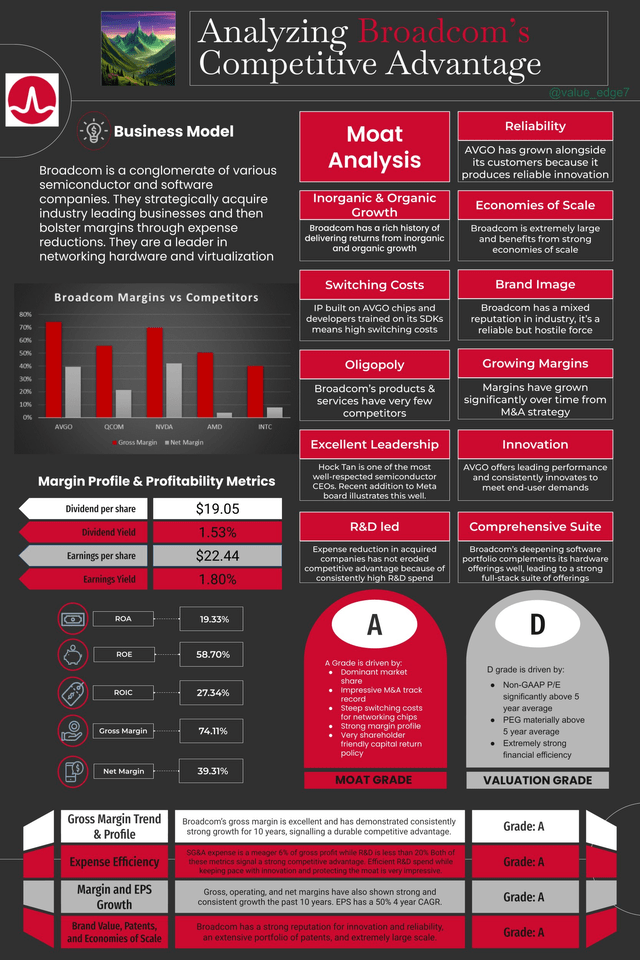

Broadcom remains a leader in fabless chip design and its growing enterprise software package will drive growth moving forward. From a fundamental perspective, it’s hard to find a better business than Broadcom. They have a strong moat, as I illustrated in this Q4 2023 competitive advantage analysis graphic (note: this is not updated with Q1 results):

While I commend the quality of the business, there is a hefty premium priced in by AI hype. While growth prospects are extremely attractive, Broadcom is trading materially above its five-year averages for Non-GAAP PE and PEG:

Seeking Alpha AVGO Valuation Tab

Clearly Broadcom is trading at a premium to historical averages, but this is a trend seen with competitors as well. Nvidia is the outlier with all but its non-GAAP TTM P/E trading at a discount to historical averages. Meanwhile, AMD has a strong PEG but it’s earnings multiples are higher than average. Qualcomm and Marvell show similar trends to Broadcom.

Broadcom does trade at a notably higher premium than the sector median currently. Valuations metrics are forward looking; they are a function of growth expectations. I believe Broadcom presents the most compelling semiconductor growth story aside from Nvidia.

Broadcom has an extremely diversified revenue base and is extending deeper into infrastructure software with VMWare, something I believe will allow Broadcom to continue enjoying its industry-leading margins moving forward. This is one of the best businesses in one of the most exciting industries undergoing a long-term growth explosion. I believe a premium valuation is justified. Broadcom has a durable competitive advantage in numerous end markets and is built to last. As Warren Buffet often says, “it’s better to buy a wonderful business at a fair price than to buy a fair business at a wonderful price”.

Risks

While I do believe the premium valuation is justified, this is the key risk. My thesis is not bulletproof, and if future growth lags expectations, these multiples could contract severely.

AI hype has led to one of the strongest bull markets in history, specifically in semiconductors. SMH, a semiconductor ETF, is up 91% in the past year. Investing in these names is much easier in the depths of a bear market, and premium valuations can lead to material losses. If current market sentiment flips from the frenzy to pessimism, Broadcom will be materially impacted. A recession, higher for longer interest rates, a China/Taiwan conflict, and a slowdown of AI hype are all meaningful risks to Broadcom.

Despite clear risks at this valuation, Broadcom remains a buy for all long-term investors. Considering the current valuation and risks though, I suggest a strategy of slow accumulation rather than a large one-time purchase. Broadcom is a core holding in my long-term portfolio, and I have been accumulating it on a monthly basis. Over time, the market will likely contract from the premium multiples we currently see, and a more compelling risk/reward will make more significant one-time purchases more attractive. However, as of right now I will be proceeding with a slow accumulation strategy.

Closing Thoughts

I am rating Broadcom a Buy after the Q1 report. I believe the report was very strong. The stock is trading at a very high multiple from AI hype while the company will need to focus on de-levering for numerous quarters, Broadcom is a titan of the semiconductor industry and the Q1 report validated my belief that this company will be a long-term compounder.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AVGO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.