Summary:

- Recent market volatility is likely driven by concerns over AI overvaluation and overinvestment, which impacts Broadcom as well.

- While Broadcom has benefited from AI, its growth is supported by a broader range of tailwinds, including cybersecurity, connectivity, and data management solutions.

- Broadcom’s earnings and valuation multiples have the potential for further expansion, supporting a “Buy” rating on the stock.

JHVEPhoto

Introduction

The past few weeks have been volatile for the US market. Although the S&P 500 index has been significantly up since 2023, investors can easily panic when they see back-to-back declines in stock prices, which could lead to further drops. Fortunately, this cycle didn’t last long, and the market is nearly back at its all-time high levels.

The reasons for this decline have been discussed extensively. Some people attribute it to the Yen reverse carry trade, while others blame the new economic data, such as higher unemployment, which may indicate a recession. I attribute the decline more to concerns about overvaluation and overinvestment in AI.

Artificial intelligence has been the biggest driver of the stock market in the last year. It only makes sense that the stock prices would decline if the market believes the technology will not grow as much, or will not result in a meaningful increase in earnings. Monetization issues, for example, remain a significant risk.

That is why, I believe the AI and semiconductor space needs to be examined further. I published an article on Advanced Micro Devices (AMD) last week, which specializes in GPUs and other semiconductor products primarily for computing, gaming, and data centers. Today, we are going to analyze Broadcom (NASDAQ:AVGO), a more diversified provider of semiconductor and infrastructure software solutions.

I believe the story with Broadcom is significantly different. Although it often gets grouped with other semiconductor players benefiting from AI, Broadcom is more diversified and has many tailwinds. While I see risk in the AI space, I think Broadcom will continue to win. With a stock price that looks inexpensive, I rate it a “Buy”.

Business Description

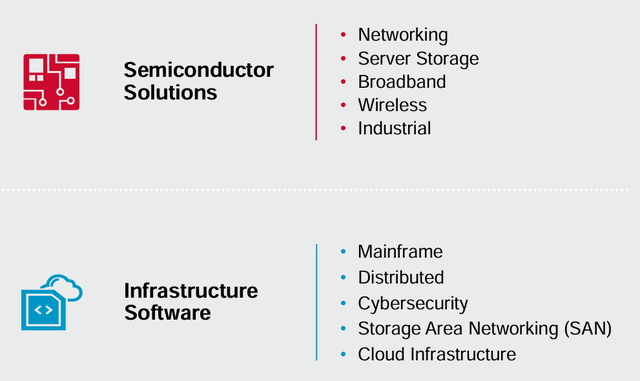

Broadcom is a diversified semiconductor and infrastructure solutions company. It operates under two segments.

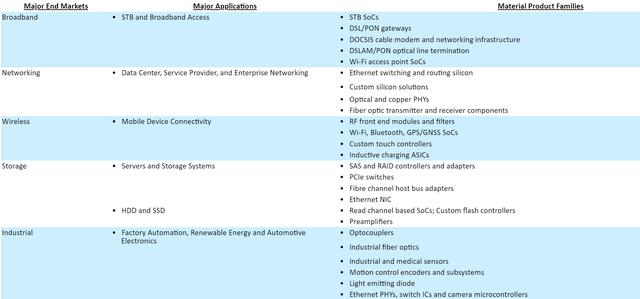

The larger segment is semiconductor solutions. It contributed to nearly 70% of revenue in 2023. Under this segment, Broadcom sells digital and mixed-signal products that are used by data centers, service providers, and enterprises for their networks. It also offers wireless connectivity and inductive charging solutions for the wireless market. In addition, Broadcom provides products that enable data storage, data transfer, and industrial applications. Below is a summary of its products and end markets under this segment.

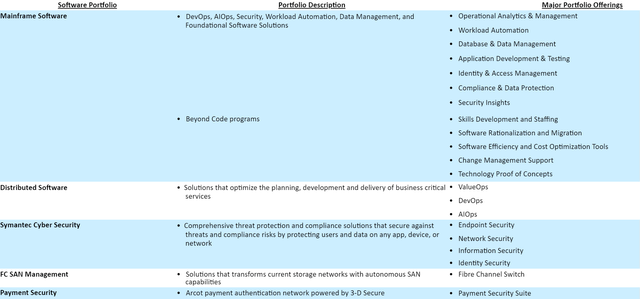

The second segment is called infrastructure software. With solutions provided under this segment, Broadcom offers software to build, run, manage, connect, and protect applications and data across hybrid IT environments.

As seen below, these enable data management, workload automation, planning, threat protection, and secure payments.

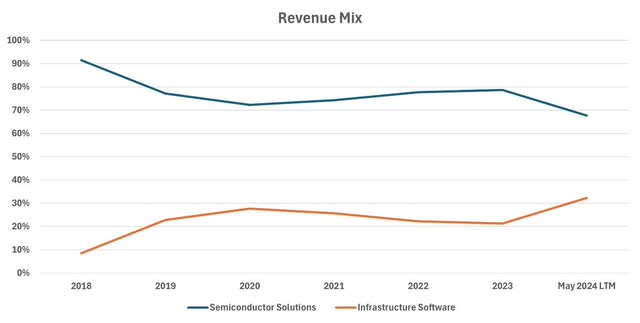

This infrastructure solutions business has been growing faster than semiconductor solutions, highlighting Broadcom’s diversification. Revenue from infrastructure solutions as a percentage of total revenue has increased from below 10% in 2018 to above 30% in May 2024 when considering the last twelve months.

This growth in 2024 is partly due to the acquisition of VMWare, a large provider of private and hybrid cloud environments to enterprises.

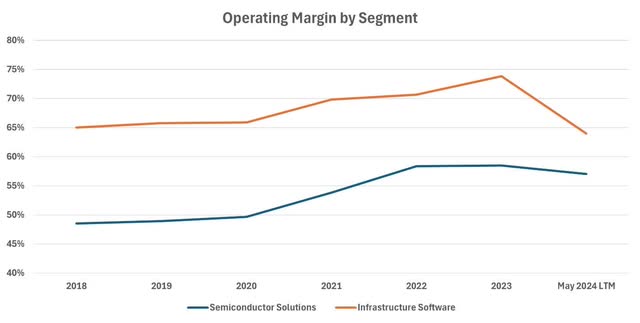

This segment is the higher profitability business, so its growth has made the overall company more profitable.

AI Trends Are Not Bad Despite Concerns

I discussed the near future of AI and potential risks in my previous article. As that discussion is also relevant to Broadcom, I will summarize it here.

Firstly, it is clear that Nvidia (NVDA) has dominated the market so far. It has the superior products that customers prefer. That is why its stock significantly outperformed the broader semiconductor industry.

However, recent reports indicate that other players are starting to get a substantial share of the market. While Nvidia will probably remain the largest player by far, others may benefit more from technological advancements than they have in the past, and their stock performances may start to catch up.

Secondly, concerns about overspending on AI seem valid to me. Companies cannot keep investing in an area just because it seems like a growth opportunity. It needs to be an area that brings in profits. Large technology companies like Alphabet (GOOGL), and Microsoft (MSFT) have failed to explain to the public how exactly they would monetize their AI offerings. New products seem like easily replicable features, and the companies don’t even charge extra for them. If these companies realize that they will struggle to monetize these investments, they may cut spending, which would have a huge impact on the semiconductor industry.

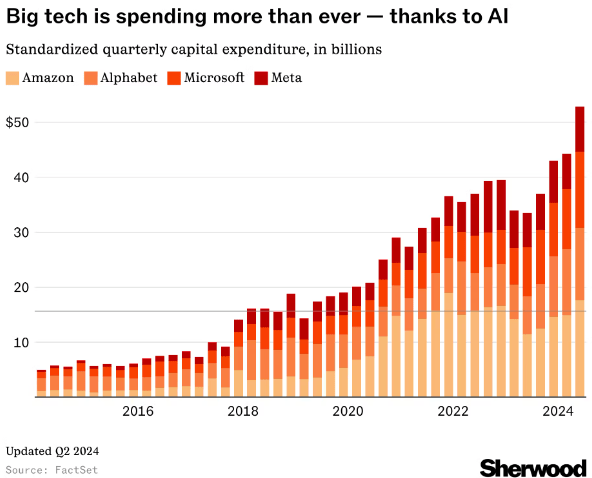

On a more optimistic note, these companies are still investing heavily. Their capital expenditures are at record-high levels, and this cash mostly goes to companies building the artificial intelligence infrastructure, such as chip designers.

sherwood.news

AI Is Not The Only Driver Of Business

As I mentioned at the beginning of this article, Broadcom is a diversified company. Not only does it have two different segments that have different drivers, but it has diversified offerings within those segments as well.

The semiconductor business spans a wide range of areas such as data storage, wireless, networking, and industrial, while the infrastructure solutions business helps with many issues from securing payments to workload automation. These are essential services for enterprises.

The wireless business is promising in particular. Broadcom provides wireless communication chips and many other products that are used in various Apple devices. These sales accounted for approximately 20% of total revenue in 2023. This is a very stable business where Broadcom seems to face limited competition thanks to strong contracts. The continued growth of Apple, potentially driven by new AI features in newer models, would benefit Broadcom.

In addition, as technology advances, we will need more cybersecurity, connectivity, and data management solutions. The infrastructure solutions business directly serves these end markets and is well-positioned for growth. As this business grows, Broadcom will continue to increase its profitability.

Broadcom Company Overview Presentation – June 2024

Valuation

I will be using two different approaches to understand if the stock trades at a discount, at a premium, or is fairly valued.

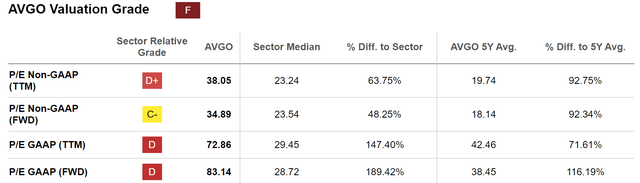

Firstly, let’s examine the multiples the stock trades at. Seeking Alpha’s valuation grade indicates that the stock is expensive based on a number of multiples, as seen below. The stock trades at a premium compared to Broadcom’s peers and its historical average.

However, the fact that the percentage difference to the 5-year average multiple shows another side of the story. Market expectations have been increasing for the future of this company. Another perspective on this data is presented below.

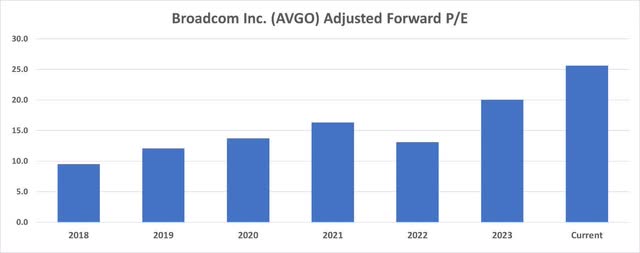

The company’s adjusted forward P/E has been expanding consistently, with the exception of 2022. It is now trading at an all-time high fwd. P/E. Note that my numbers may be slightly different than Seeking Alpha’s as I make adjustments to the reported financials to have a better understanding of the underlying business.

The goal of these adjustments is to leave only the real operating items in the financial statements. Some adjustments include adding back (removing) non-operating expenses (income) such as one-off unusual items to earnings, adjusting for unusual tax benefits and tax shields, removing excess cash from assets (as explained below), and capitalizing certain expenses like R&D and leases (if the company isn’t already capitalizing them) as I believe they are investments made for the future.

I believe a Fwd. P/E of 25.6 is not expensive for the company. The P/E ratio of the S&P 500 is currently at 27.45. Broadcom has better growth opportunities than most companies in the market. Therefore, I believe there is room for multiples to expand further.

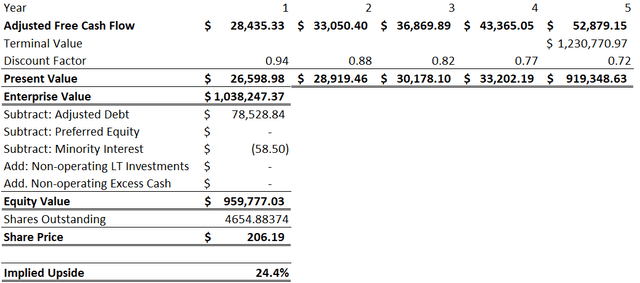

In addition, I will share my DCF calculations.

My earnings and free cash flow expectations from the company are in line with Wall Street’s estimates seen on S&P Capital IQ. I expect both to expand significantly thanks to increased demand for the company’s products. I believe the company will generate an adjusted free cash flow of $28.4 billion in FY2024 and more than $50 billion in FY2028.

For this model, I am using a terminal growth rate of 2.5%, slightly above long-term inflation targets, a long-term risk-free rate of 2%, a market risk premium of 5.7%, and the stock’s 5-year equity beta.

How I handle cash might be different. I believe shareholders have a claim on excess cash, but cash that will be used for operating expenses during the year should not be included in the valuation. That portion of cash is operating that investors cannot claim. At the moment, the company doesn’t seem to have any excess cash.

Using the assumptions above, we find an equity value of $959.8 billion, translating to a target share price of $206.19. This implies a 24% upside at the time of this article’s writing.

In addition to this upside potential, the stock currently has a dividend yield of 1.27%.

Conclusion

The stock market has been volatile lately, and I believe this is largely due to the concerns about the overinvestment in and monetization of artificial intelligence, which has a huge impact on semiconductor companies. However, while companies like AMD might be heavily affected by this, Broadcom benefits from additional tailwinds.

It is a lot more diversified than the market gives it credit for. It benefits from the surge in artificial intelligence, wireless technology, cybersecurity, the need for more efficient enterprise software, and more.

Although the stock appears expensive at first glance due to the stock trading at higher multiples compared to its own history and peers, I believe both earnings and multiples have room to expand. The stock price should increase as the market recognizes this trend.

Therefore, I believe Broadcom deserves a “Buy” rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.