Summary:

- Broadcom is a strong AI stock with growth potential in the enterprise market.

- During the last quarter, Broadcom beat earnings expectations, with potential for continued outperformance.

- Broadcom’s long-term presence in the AI market could lead to significant sales and profitability growth, but faces competition and economic risks.

JHVEPhoto

Many people may think of Nvidia (NVDA) when discussing AI. However, one AI stock the market may want to pay more attention to is Broadcom (NASDAQ:AVGO). Broadcom provides market-leading AI networking and connectivity solutions, revolutionizing the industry. Broadcom has significant growth potential in the lucrative AI enterprise market.

Moreover, Broadcom could improve its profitability and efficiency metrics, enabling a relatively high P/E multiple and expanding its stock price as it advances. Broadcom recently beat its estimates and offered solid guidance. Furthermore, Broadcom is preparing to release earnings on September 5th.

Broadcom should have another solid quarter, likely making its stock a strong buy going into earnings, as well as a solid buy in the intermediate and long term.

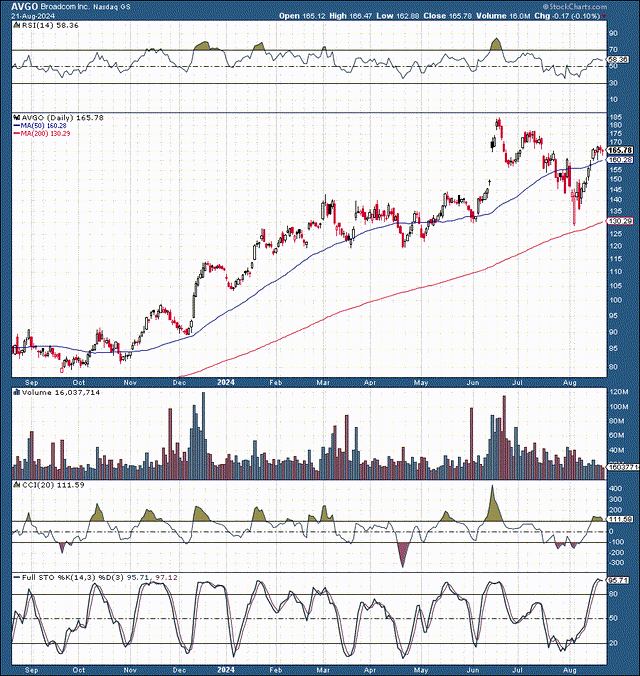

Technically: AVGO Looks Better

Technically, Broadcom’s stock surged during the AI boom in recent years. One of the primary reasons for Broadcom’s advances has been its timely and effective acquisition of AI darling VMware. However, Broadcom appreciated too quickly, going vertical and reaching a blowoff top in June. The stock had a solid correction after reaching its near-term top, declining by roughly 30% during the decline phase. Now, the stock appears to be around an inflection level and may move higher after going through more consolidation around the $150-170 level zone here.

Another Excellent Report Likely

Broadcom surged following its most recent earnings announcement because its results were solid. Broadcom reported an EPS of $10.96, $0.12 better than expected. Moreover, Broadcom reported revenues of $12.49B, a 43% YoY increase and a $480M over the consensus estimate. The company reported a healthy cash flow of approximately $4.45B, about 36% of sales.

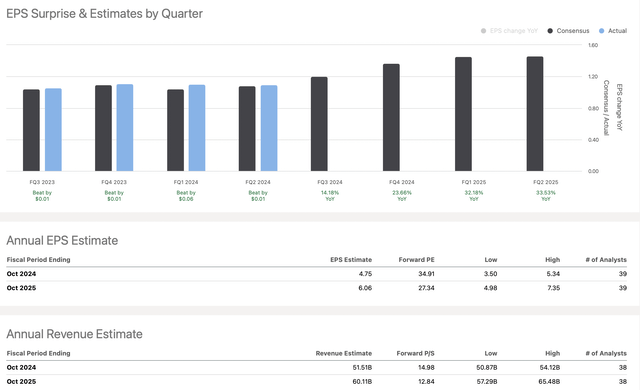

Broadcom – Likely to Beat Estimates

EPS vs. estimates (seekingalpha.com )

Broadcom has illustrated a slight outperformance rate, and the modest outperformance may continue. While the consensus EPS estimates are around $4.75 for this year and $6 for next year, Broadcom could do better. Broadcom has only missed EPS and sales estimates in one out of its last twenty quarters, implying there is a high probability for Broadcom to beat the consensus estimates instead.

Therefore, Broadcom could report around $5 in EPS this year and around $7 in 2025. With its stock around $160, Broadcom’s forward P/E ratio may be around 23 if it earns around $7 next year and 27 if it earns around $6. Provided its tenacity for outperforming consensus estimates, Broadcom could be trading around a 23-25 forward P/E, which is relatively inexpensive for a company in Broadcom’s advantageous market position.

Moreover, there is a high probability for more growth ahead, a dynamic that makes Broadcom appear cheap right now.

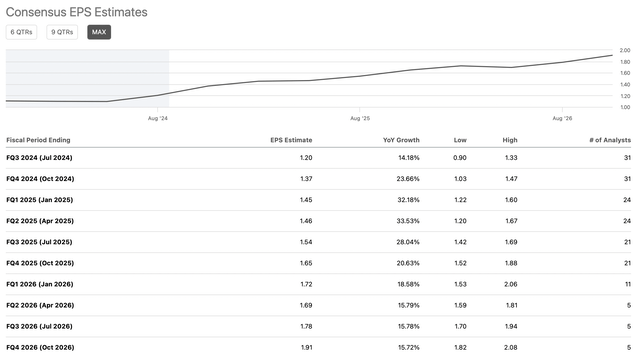

Broadcom Could Hit Higher-End EPS Estimates

EPS estimates (stockcharts.com )

The consensus EPS estimate for Broadcom’s upcoming quarter is $1.20. However, given its strong history of beating estimates, Broadcom could outperform, delivering around $1.30 instead of the consensus figure. Also, due to Broadcom’s relatively long growth runway, we may see solid double-digit sales and EPS growth for several years ahead. This dynamic should enable Broadcom’s stock to grow into its multiple and continue its long-term stock expansion.

Broadcom’s Long-Term AI Presence

Despite not being the default AI company many people think of, Broadcom has significant potential in the AI market. Broadcom is one of the leading companies in enterprise AI. Its leading position in the connectivity and AI infrastructure segment allows Broadcom’s products and services to enable the various components of an organization to work seamlessly. Broadcom achieves its objective by providing cutting-edge networking and other infrastructure equipment relevant to AI and other vital elements.

Before the split occurred, Broadcom received a price target of $2,400 from Rosenblatt. Split adjusted, the price target is $240, roughly 50% above Broadcom’s current stock price. The firm highlights Broadcom’s competitive advantage in the AI landscape, emphasizing its “open” standards approach compared to Nvidia’s “mixed model.”

Other analysts indicate that Broadcom’s moat is based on improved confidence in the durability of Broadcom’s technological lead in smartphone and networking chips. Broadcom’s moat is also its diversified portfolio of products, and its ability to combine all the elements, providing the “entire package” for its customers.

The global AI market has enormous growth ahead (36.6% CAGR 2024-2030), and being a leading global player in one of the most significant AI segments should enable Broadcom to expand its sales and increase its profitability in future years. This dynamic could lead to multiple expansion and a considerably higher stock price in future years.

Where Broadcom’s stock could be in the future

| Year | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue Bs | $63 | $72 | $82 | $92 | $104 | $117 |

|

Revenue growth |

21% | 14% | 14% | 13% | 13% | 12% |

| EPS | $6.50 | $7.75 | $9.30 | $11.10 | $13.20 | $15.50 |

| EPS growth | 30% | 19% | 20% | 20% | 19% | 18% |

| Forward P/E | 25 | 26 | 27 | 27 | 26 | 25 |

| Stock price | $194 | $242 | $300 | $356 | $402 | $450 |

Source: The Financial Prophet

Broadcom has the potential to increase sales and profitability considerably in future years due to its preeminent position in the lucrative enterprise AI market. Broadcom connects crucial elements, enabling the organization’s network to work seamlessly and effectively, incorporating AI and other critical factors. Due to its likely ability to increase sales and expand profitability, Broadcom has a high probability of seeing its stock price rise substantially in future years.

Risks to Broadcom

Broadcom has a bright future, but there are also risks ahead. First, Broadcom faces competition from other companies looking to capitalize on the AI networking space. There is the risk of a slower-than-anticipated economy impacting demand. The higher interest rate for a longer-duration dynamic may also negatively impact sales and profitability. Expectations are high, and the company must meet or beat estimates. If it is not successful in achieving its high mark, the stock could suffer. Investors should examine these and other risks before investing in Broadcom.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA, AVGO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long a diversified portfolio with hedges.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2023 47% return) and achieve optimal results in any market.

- The Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement my Covered Call Dividend Plan and earn 50% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Join The Financial Prophet And Become A Better Investor!

Join The Financial Prophet And Become A Better Investor!

Don’t Hesitate! Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now and start beating the market for less than $1 a day!