Summary:

- AVGO’s robust growth through custom silicon along with the increasing networking demand supports the excellent top-line expansion, despite the recent market rotation.

- The high-margin subscriptions/ services segment and strong enterprise backlog further bolster its long-term prospects, with another dividend raise likely by the end of 2024.

- Despite the elevated debts from the VMware acquisition, AVGO’s rich free cash flow and commitment to shareholder returns make it a compelling high-growth investment thesis.

- Despite the double-digit capital appreciation prospects, we shall also discuss why investors may want to observe the stock’s movement before adding to an improved margin of safety.

Jose Luis Pelaez Inc

AVGO’s High Growth Investment Thesis Remains Cheap

We previously covered Broadcom (NASDAQ:AVGO) in February 2024, discussing why we had reiterated our Buy rating, thanks to the accelerating profitable growth reported in FQ1’24 and the raised AI-related sales guidance in FY2024.

Combined with the excellent shareholder returns and the robust generative AI trends through the infrastructure layer to SaaS layer, we believed that every moderate pullback was an opportunity to dollar cost average.

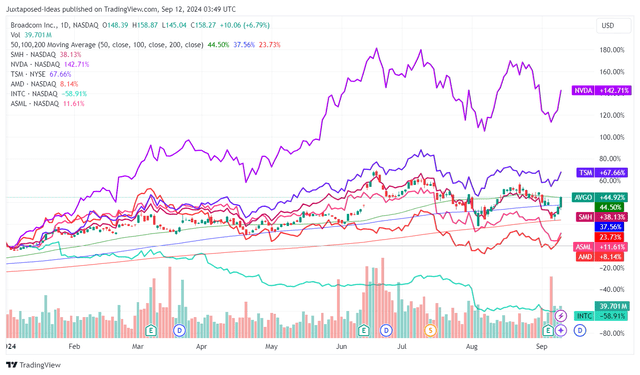

AVGO YTD Stock Price

Since then, AVGO has mostly traded sideways at +4.8%, similar to the wider market at +2.3%, as the market rotated from high growth stocks by mid July 2024, with the same pattern also observed in numerous semiconductor stocks and ETF.

Part of the headwinds may be attributed to tougher YoY comparisons at +122% reported by the king of semiconductor stocks, Nvidia (NVDA) in the recent FQ2’25 earnings call, compared to a year ago at +101% in FQ2’24 and the previous quarter at +262% in FQ1’25.

While demand for AI accelerators remain robust as guided by Jensen Huang for the FQ3’25 quarter with projected revenue growth of +79.3% YoY, it is apparent that the triple digit YoY growth is not sustainable as discussed in our previous NVDA article here.

These developments matter, since AVGO has previously guided FY2024 AI-related revenues of over $10B (+66.6% YoY), with it comprising over 20% of its projected overall revenues.

For now, its prospects appear to be robust, with the management already raising its FY2024 AI-related revenues guidance to approximately $12B (+100% YoY) in the recent FQ3’24 earnings call, with it implying minimal growth headwinds while being significantly aided by the highly accretive VMware acquisition.

This is also why AVGO has raised their FY2024 overall revenue guidance to $51.5B (+5.1% YoY pro forma/ +43.8% YoY) with improved adj EBITDA margins of 61.5% (-3.3 points YoY).

This is compared to the original guidance of $50B (+2% YoY post forma/ +39.6% YoY) and 60% (-4.8 points YoY) offered in the FQ4’23 earnings call, respectively.

Much of AVGO’s tailwinds are attributed to the growing Custom Application-Specific Integrated Circuits [ASIC] demand from the global hyperscalers, which have been “creating as much as possible their own compute silicon.“

Readers must note that the hyperscalers have been accelerating the “deployments of their GPUs, next-generation XPU ASIC programs, and networking into their data centers here in the second half of the year,” with further upside already visible through 2025.

While hyperscalers have placed orders for NVDA’s next-gen GPUs, as observed with Alphabet (GOOG) at $10B, Meta (META) at $10B, and Microsoft (MSFT) at $1.62B, with Amazon (AMZN) also opting to swap Grace Hopper orders for Blackwell, AVGO has already highlighted the immense opportunity in the custom AI accelerator market, which have been growing by 3.5x YoY.

Combined with the fact that ASIC comprises 70% of AVGO’s AI-related revenues, we are not surprised by these highly promising developments indeed, with the semiconductor company’s well diversified capabilities across software and hardware coming into play here.

If anything, AVGO’s high margin subscriptions/ services segment continues to demonstrate robust top-line growth to $5.63B (+6.4% QoQ/ non comparable YoY) with increasingly rich gross profit margins of 87.5% (+1 points QoQ/ +3.3 YoY).

The robust enterprise demand has also been observed in the relatively stable multiyear remaining performance obligations of $21.2B (-7.4% QoQ/ inline YoY) and growing VMware Cloud Foundation annualized booking value of $2.5B in FQ3’24 (+32% QoQ) – as reported by the management:

The VMware business continues to book very well, as we convert our customers very much in two ways, one, from perpetual to a subscription license, but also those subscription license for the full stack of VCF. And that has been very successful, as I indicated, given the high ratio of VCF subscribers, new subscribers that we have achieved.

And we see this trend continuing in Q4 very much so and also very likely through into ’25. So in terms of directional trend, other than the indication I’m giving you – than the guidance I’m giving you in Q4 ‘24, directionally, we continue to see accelerated bookings and by extension, accelerated growth. (Seeking Alpha)

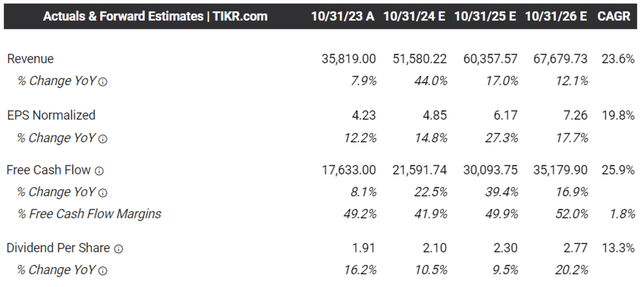

The Consensus Forward Estimates

As a result of the robust development surrounding its ASIC and SaaS prospects, it is unsurprising that the consensus have already raised their forward estimates, with AVGO expected to generate an accelerated top/ bottom-line growth at a CAGR of +23.6%/ +19.8% through FY2026.

This is compared to the previous consensus estimates at a CAGR of +5.2%/ +7.8% and historical growth at a CAGR of +15.2%/ +15.7% between FY2016 and FY2023, respectively.

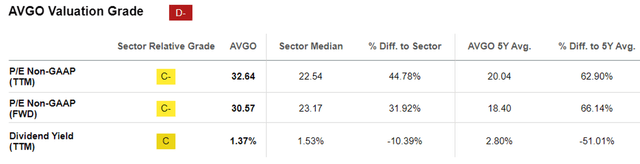

AVGO Valuations

And it is for these reasons that we believe AVGO is not expensive at FWD P/E non-GAAP valuations of 30.57x, up from its 1Y mean of 25.09x and 5Y mean of 18.40x.

This is attributed to the relatively reasonably FWD PEG non-GAAP ratio of 1.16x, based on the projected expansion in its adj EPS from the LTM adj EPS of $4.55 ending FQ3’24 and the consensus FY2026 adj EPS estimates of $7.26 at a CAGR of +26.3%.

Even when compared to the sector median of 1.78x and its semiconductor peers, such as NVDA at 1.04x, TSM at 0.93x, AMD at 0.98x, INTC at 1.83x, and ASML at 1.63x, we believe that AVGO continues to trade reasonably, offering interested investors with the improved margin of safety after the drastic pullback from the June 2024 peak.

So, Is AVGO Stock A Buy, Sell, or Hold?

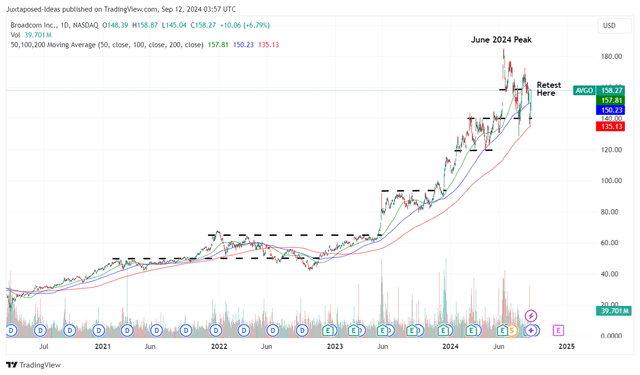

AVGO 4Y Stock Price

For now, after the stock split exuberance has been moderated and the market rotation well behind us, it is apparent that AVGO remains well supported at the recent floor at $140s, with it already on its way to retest the intermediate resistance levels of $160s at the time of writing.

For context, we had offered a fair value estimate of $120 (after 10 for 1 stock split) in our last article, based on the LTM adj EPS of $4.29 and the previous FWD P/E valuations of 28.11x.

Based on the LTM adj EPS of $4.55 ending FQ3’24 and the upgraded FWD P/E non-GAAP valuations of 30.57x, we are looking at an updated fair value estimate of $139.10 – with it near to AVGO’s recently established support levels of $140s.

Based on the consensus raised FY2026 adj EPS estimates from $6.54 to $7.26, we are looking at an updated long-term price target of $221.90 as well, with it implying an excellent upside potential of +40.2% from the current levels.

Lastly, readers may also look forward to another dividend raise by the end of 2024, as per AVGO’s historical trends. Based on the last raise by +14.1% and the 5Y Dividend Growth Rate of +15.9%, we may be looking at an approximate annualized payout of $2.42 per share (+14%).

While the forward dividend yields of 1.5% may appear to be underwhelming compared to its 4Y average yields of 2.55% and the US Treasury Yields of between 3.46% and 4.99%, investors may consider subscribing to a DRIP program, allowing them to regularly accumulate additional shares on a quarterly basis.

As a result of the highly attractive risk/ reward ratio, we are reiterating our Buy rating for AVGO stock.

Risk Warning

Thanks to the VMWare acquisition, AVGO’s long-term debts have risen dramatically to $69.95B by the latest quarter (-5.4% QoQ/ +77.8% YoY), with it triggering an expanded annualized interest expenses of $4.24B (+1.9% QoQ/ +165% YoY).

While the semiconductor company continues to generate rich Free Cash Flow of $18.65B over the LTM (+7.3% sequentially), its path towards deleveraging may be prolonged attributed to the $9.23B in dividend obligations (+24% YoY) and the management’s laser focus on returning great value to long-term shareholders.

As a result, readers may want to temper their near-term expectations, with AVGO’s bottom-line performance likely to be impacted prior to the improvement in its balance sheet health.

At the same time, with the stock market in the fear territory, there may be near-term volatility, with us cautioning interested investors to wait for a moderate pullback before adding according to their risk appetite and dollar cost averages.

Patience may be more prudent for now.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AVGO, NVDA, ASML, TSM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.