Summary:

- Broadcom unleashed a three-year AI outlook that likely stunned even the most bullish AVGO investors, which sent the stock surging.

- Management projected AI SAM of $60B-$90B by 2027, as hyperscalers seek custom AI chips to diversify their reliance on Nvidia.

- Broadcom has transformed itself into an AI powerhouse, built on its market-leading custom chips and networking prowess.

- Apple is reportedly working with Broadcom on its custom AI chip, bolstering its growth momentum.

- I argue why AVGO’s surge has likely captured its near-term upside as investors rushed into the stock. Avoid joining the FOMO rush for now.

Sundry Photography

Broadcom: Stellar AI Outlook Sent AVGO Surging

Broadcom Inc. (NASDAQ:AVGO) investors who bought aggressively at its recent November 2024 pullback have been well-rewarded as the stock surged to a new post-earnings high. The semiconductor bellwether missed its revenue estimates for its fiscal fourth quarter. However, Broadcom provided a stellar three-year AI growth outlook, establishing its ambitions to lead the market in custom AI chips. Therefore, management’s confidence underscores the significant growth opportunity ahead predicated on Broadcom’s technological prowess.

In my previous Broadcom article, I highlighted why investors should not be overly concerned with AVGO’s then relative underperformance. The chip designer has a well-diversified portfolio while boasting industry-leading profitability metrics. In addition, it’s the market leader in custom AI chips. I explained it’s increasingly critical as AI takes centerstage, given the expensive costs involved in scaling up AI clusters even further.

That thesis played out in Broadcom’s FQ4 earnings release on December 12 as CEO Hock Tan highlighted the “massive” AI growth prospects for Broadcom over the next three years. Accordingly, the company posted AI revenue of $12.2B for FY2024, up from just $3.8B in the previous fiscal year. Broadcom’s AI chops encompass its AI networking and custom XPUs opportunities with the leading hyperscalers. The recent blockbuster earnings release posted by Broadcom’s arch-rival Marvell (MRVL) has afforded a preamble into the bright prospects for custom AI chips, given the need to diversify from Nvidia’s (NVDA) merchant chips dominance.

Custom AI Chips Are The New Gold

Accordingly, Broadcom updated its AI custom chips and networking SAM to between $60B and $90B by 2027. Given its AI revenue of just $12.2B in FY2024, it’s crystal clear why the market sent AVGO surging to a new high this week, corroborating the significant opportunities that lie ahead. Broadcom’s commitment to taking the lion’s share of the assessed SAM doesn’t require it to gain 100% control of the market. Management underscored the need to engage in higher-value opportunities that fulfill its profitability requirements. Furthermore, Broadcom indicated that the upgraded SAM hasn’t accounted for two potential hyperscalers in the pipeline, bolstering its SAM prospects.

As a result, analysts have rushed to raise AVGO’s average price targets, baking in much higher optimism on its ability to actualize the AI growth inflection. There were concerns about whether Broadcom could face delays on a revised processor for Google (GOOGL) (GOOG). However, Tan’s breathtaking outlook over the next three years suggests any potential delays aren’t expected to adversely affect its momentum.

The Information reported on a new custom AI chip partnership between Broadcom and Apple (AAPL). While Apple is expected to maintain control over the main chip designs, the Cupertino company is leveraging Broadcom’s expertise in AI networking. Therefore, it has likely mitigated the market’s concerns about Broadcom potentially losing some parts of the wireless business to Apple’s vertical integration efforts. Accordingly, Apple’s Promixa project aims to develop a “homegrown chip for Bluetooth and Wi-Fi connections” from 2025, leading to uncertainties on its current partnership with Broadcom.

Despite that, management assured investors that its collaboration with its “North American customer” remains secure. Apple’s “seasonal launch” was instrumental in lifting Broadcom’s wireless revenue by 30% QoQ, bolstered by a 7% YoY increase in semiconductor content. Hence, Broadcom articulated that its engagement with Apple is expected to remain significant, as both companies have “multi-year roadmaps across various technologies.” Coupled with Apple’s reported tie-up with Broadcom on its custom AI chips, I’m not unduly concerned with Apple’s efforts to expand its wireless in-house efforts, potentially affecting AVGO.

Amazon (AMZN) is reportedly one of the main hyperscalers customers that could join Broadcom’s partnership as the leading cloud computing companies expand their efforts in custom chips. AWS’s recent developer event underscores the transition from focusing on third-party chips and models. Amazon aims to develop a sharper competitive advantage with its custom AI chips and in-house models. Hence, I believe there’s a need for Amazon to bolster its efforts, leveraging Broadcom’s expertise and developing more advanced AI chips to outcompete its hyperscaler peers. Therefore, the race for AI supremacy is expected to intensify as hyperscalers seek alternative AI custom chip solutions for customers seeking to optimize their TCOs while scaling out their AI clusters.

As a result, the market seems to have lowered the execution risks on Broadcom’s non-AI revenue segments. Given the massive SAM presented, investors are likely much less concerned about the recovery momentum of its non-AI business. Accordingly, management indicated that non-AI semiconductor revenue fell 23% YoY. However, the worst is likely over, suggesting we are in the early stages of a more gradual recovery phase.

These segments aren’t expected to post the AI revenue growth prospects enunciated earlier, with long-term expectations of “mid-single digit” growth. Hence, investors must be cautious when considering AVGO’s transformation into an AI-focused semiconductor bellwether, given its non-AI business exposure. Notwithstanding these uncertainties, Broadcom highlighted that it has completed its VMware acquisition, lowering the assessed integration risks, as Broadcom looks to improve its operating leverage from its surging AI business moving ahead.

AVGO Stock: Long-Term Prospects Boosted

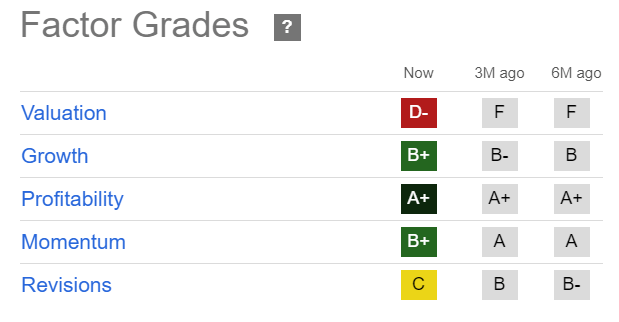

AVGO Quant Grades (Seeking Alpha)

AVGO’s valuation has improved (from an “F” to a “D-” grade) over the past six months, even though it’s still assessed at a premium over its tech sector peers (XLK). As the market reassesses management’s incredible midpoint SAM of $75B, there could be potential for substantially more if it manages to snag partnerships with Microsoft (MSFT) and Amazon. Hence, it’s clear that AVGO’s premium valuation is predicated on its solid “B+” growth grade, suggesting investors must view its opportunity as an AI-focused growth play.

Moreover, AVGO’s forward-adjusted EPS multiple of 28x is less than 10% above its sector median. When adjusted for growth, its forward-adjusted PEG ratio of 1.33 is more than 30% under its sector median, suggesting possible undervaluation.

Is AVGO Stock A Buy, Sell, Or Hold?

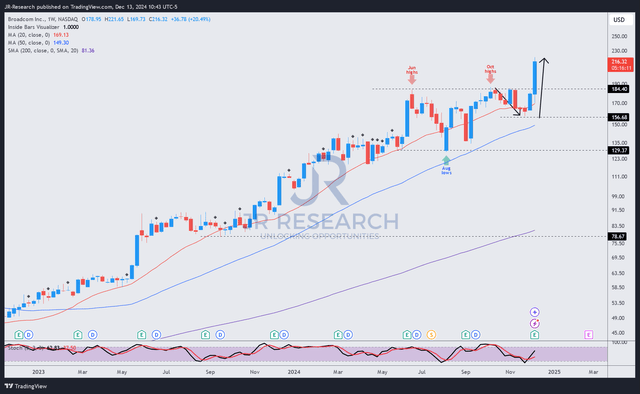

AVGO price chart (weekly, medium-term, adjusted for dividends) (TradingView)

AVGO’s surging run over the past two weeks has finally broken above the resistance level that has stymied its upward momentum since June 2024. It has corroborated my confidence in AVGO’s long-term uptrend bias, as bullish investors rushed in to partake in the stock’s possible breakout move.

Although I have conviction in Broadcom’s strong fundamentals and technological prowess to scale its custom AI chips and networking opportunities, the stock isn’t immune to pullbacks. Moreover, the market breadth in the S&P 500 (SPX) (SPY) has weakened recently, suggesting underlying cracks beneath the surface have started to emerge. Therefore, investors are encouraged to consider the broader market implications when assessing whether to possibly participate in the stock’s breakout opportunity.

My assessment suggests AVGO remains a solid prospect to buy on its next possible retracement, given its significantly upgraded outlook and relatively reasonable growth-adjusted valuations. However, its price action suggests near-term optimism is reflected, as investors who picked the lows in August and November 2024 benefited. Hence, I believe it’s timely for me to return to the sidelines as we await another opportunity to buy AVGO on pullbacks. I urge investors to remain patient and not join the FOMO crowd in attempting to chase AVGO’s upside further for now.

Rating: Downgrade to Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AVGO, NVDA, GOOGL, AMZN, AAPL, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!