Summary:

- We’re downgrading Broadcom to a hold from buy for the near term due to the potential downside from Apple’s reduced reliance on AVGO for iPhone 17.

- Our mid-term outlook for AVGO remains positive, driven by AI-related networking ICs and customer ASIC accelerators with key clients like Google and Meta.

- AVGO’s valuation is high but has reset over the past month, and our opinion remains justified for the company’s position in 2025.

Michael H

We’re downgrading Broadcom Inc. (NASDAQ:AVGO) to a hold from a buy for the near term due to the heightened risk of reduced reliance from AVGO’s largest customer, Apple Inc. (AAPL), on its services for iPhone 17. Our mid-term positive outlook on AVGO remains intact based on our belief that AVGO stock should outperform the semi-peer group on the new product cycle for AI-related networking ICs and customer ASIC accelerators with leading players in the space as its customers. Having said that, we see some near-term turmoil from the news that Apple plans on rapidly lowering its reliance on AVGO in its new 2H25 product, iPhone 17.

Just last year, the two signed a multibillion-dollar deal for AVGO to “develop 5G radio frequency components—including FBAR filters—and cutting-edge wireless connectivity components.” In late October, however, the news broke that for the next-gen iPhone, “Apple plans to use its own Wi-Fi chips, which will be made by TSMC’s N7 process and support the latest Wi-Fi 7 spec.” Ming-Chi Kuo’s tweet below outlines the details. A chunk of Apple’s orders goes into AVGO’s wireless sales, which saw a 5% Q/Q and 1% Y/Y rebound last quarter to $1.7B.

X

In the mid to long term, we’re not concerned about the risk of Apple’s reduced reliance on AVGO because while Apple used to be AVGO’s largest customer, the latter has since expanded its circles with its in-house ASIC positioning, making Alphabet Inc. (GOOG) (GOOGL) one its largest customers working on TPUs (Tensor Processing Units), more recently Meta Platforms, Inc. (META) and potentially soon OpenAI.

We think AVGO, for example, is more resilient to losing Apple’s business than, say, QUALCOMM Incorporated (QCOM), with Apple planning to replace QCOM’s 5G modems with in-house. Our investment thesis on AVGO’s outperformance next year is closely tied to our belief that while it may see some share loss on the networking front to NVIDIA Corporation (NVDA), we believe the higher ASP (average selling price) of its new product cycle will offset any potential share loss; we discussed this in detail in our October article. We think longer-term investors can begin to add at current levels but expect some more near-term downside for the stock before its AI-related booster in 2025. Apple bringing a lot of its work in-house will likely weigh on AVGO further into the back end of the year. We think investors should wait for this negative to be priced into the stock to jump in at more attractive entry points. Having said that, we don’t think it’s too early per se for the longer-term investors to begin courting the stock.

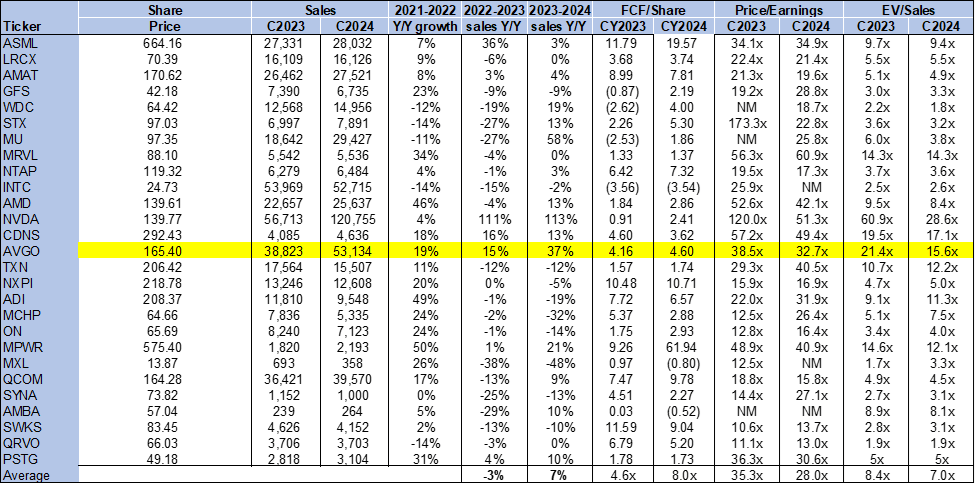

Valuation & Word on Wall Street

AVGO is still expensive, trading above the peer group average, although the valuation has reset a bit compared to our article in early October. The stock trades at 15.6x EV/C2024 Sales versus a group average of 7.0x and a previous ratio of 16.7x. On a P/E basis, the stock trades at 32.7x C2024 compared to a peer group average of 28.0x and a previous ratio of 35.0x. We continue to believe AVGO is better positioned after last quarter’s consensus revisions for FY24 to achieve the expected future growth.

The following chart outlines AVGO’s valuation against the peer group average.

TechStockPros

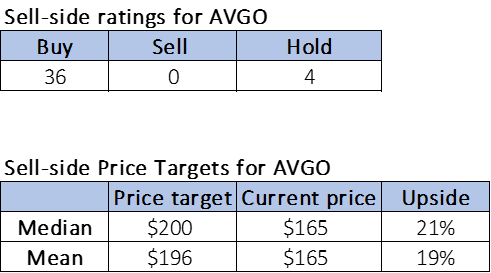

Wall Street remains bullish on the stock. Similar to early October, of the 40 analysts covering the stock, 36 are buy-rated, and the remaining four are hold-rated. The stock is currently priced at $165 per share, lower than the $177 per share in our last article. The median and mean price targets are higher than in October at $200 and $196, respectively, for a potential upside of 19-21%. The following outlines sell-side ratings and price targets on AVGO.

TechStockPros

What to do with the stock

AVGO stock is up 78% since our upgrade to buy in early December of last year, versus the S&P 500 up 28%. We think there is some near-term headache from Apple’s potential diversification to in-house solutions, and hence, we would advise investors to let the negatives play out and then swoop into the stock. AVGO’s RSI is around 39, and we think investors should add if it circles or even dips into oversold territory.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Tired of losing money? Our Tech Contrarians team of Wall Street analysts sifts through the noise in the tech industry and captures outperformers through a coveted research process. We let the work speak for itself here.