Summary:

- Broadcom beat Q2 earnings and top-line estimates easily, with a post-earnings share price rally of 12%.

- The semiconductor company benefits from investor interest in its artificial intelligence products, such as custom AI chips.

- Broadcom announced a 10-for-1 stock split to make shares more affordable.

- Despite significant top-line momentum and a Q/Q revenue acceleration, shares of Broadcom appear expensive relative to other chipmakers with stronger EPS projects.

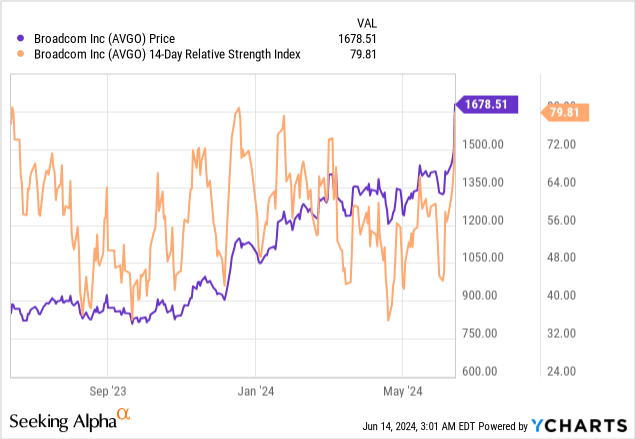

- Shares of AVGO are currently heavily overbought, based off RSI, as well.

alvarez/E+ via Getty Images

Broadcom (NASDAQ:AVGO) delivered better than expected earnings results for the second fiscal quarter on Wednesday that helped to make quite an impression: the firm saw double-digit top-line momentum, beat earnings and top-line estimates by wide margins, due to strong demand for the company’s AI products, and Broadcom announced a 10-for-1 stock split which is set to make shares more appealing to investors.

However, shares of the tech firm are quite expensive now and trade well above Broadcom’s longer term price-to-earnings average. The current interest in Broadcom is driven chiefly by the company’s exposure to AI products, but since shares are expensive and overbought based off of RSI (which is trading above a value of 70, indicating overbought sentiment), I believe investors may want to think about taking profits here.

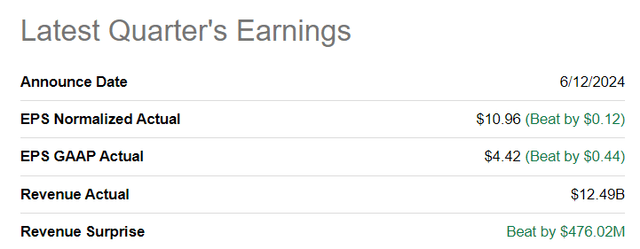

Broadcom beats earnings and top-line estimates easily

Broadcom surpassed earnings and top-line predictions comfortably on Wednesday with the firm reporting $10.96 per-share in adjusted earnings on revenues of $12.5B. The company beat estimates due to ramping demand for its AI products, resulting in a post-earnings share price rally of approximately 12%.

Seeking Alpha

Broadcom benefits from investor interest in company with AI exposure

Broadcom is a semiconductor and industrial software company that has considerable exposure in five key areas: networking, wireless, storage, broadband and industrial. The company’s products are needed to build Data Centers, which are in increasing demand due to broad-scale adoption of AI-powered applications, especially in the enterprise market. A little more than half, 58%, of the company’s revenues are generated in its semiconductor business, while 42% of revenues fall into the industrial software segment.

Broadcom and other semiconductor-focused companies are investing billions of dollars to get their product line-ups ready to support artificial intelligence applications. With demand for AI chips being red-hot at the moment, due to companies investing into large language models, Broadcom is seeing some serious top-line growth. Broadcom, as an example, is investing heavily into AI accelerators for the company’s hyperscale customers that is driving top-line growth.

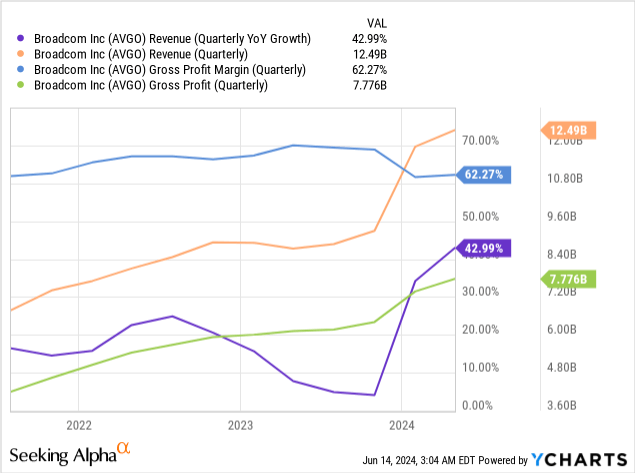

In the second fiscal quarter, Broadcom generated $12.5B in revenues, showing a year-over-year increase of 43%. Compared to the previous quarter, Broadcom saw a revenue acceleration of 9 PP driven by growing demand for the company’s custom AI chips. In Q2’24, Broadcom also had a high gross margin of 62% which only marginally changed compared to the previous quarter. With a revenue acceleration, strong gross margins and exposure to the AI chip industry, investors have been falling over themselves lately to get a piece of the action.

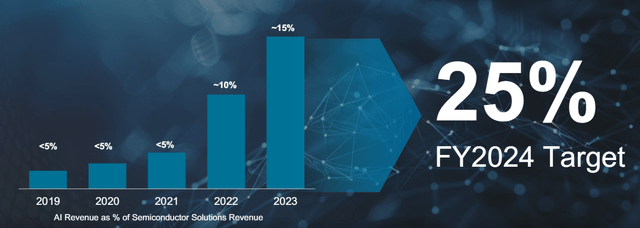

What excites investors here is that the company is ramping up its revenue share that is driven by artificial intelligence products. Demand for the company’s AI products is booming right now, which caused Broadband to guide for a 25% revenue share related to its AI products (as part of its semiconductor solutions segment) in the current fiscal year. This means that compared to FY 2022, the company is set to see a 2.5X factor increase related to AI-related revenues.

Broadcom

10-for-1 stock split

Broadcom’s price increased 257% in the last three years and with shares trading at $1,679 at the current time, the high price tag may prevent some investors from building some exposure to the company. This thinking is the reason behind Broadcom announcing a 10-for-1 stock split on Wednesday. Trading on a split-adjusted basis will start on July 15, 2024. The stock split could make the shares more affordable (although not cheaper) to investors and potentially improve liquidity.

Above average dividend growth

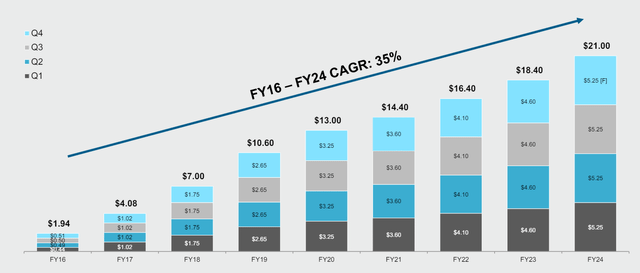

Broadcom is a dividend champ that over time distributed a significant amount of cash flow to its shareholders, which is what makes the company stand out from other semiconductor-focus enterprises. In FY 2024, the semiconductor and software company increased its full-year dividend by a massive 14.3% to an annualized payout of $21.

Broadcom

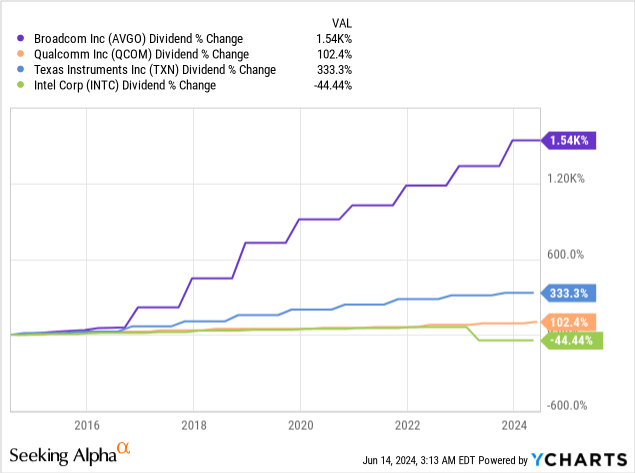

Compared to rival tech companies that also invest heavily in AI chip technology — namely Qualcomm (QCOM), Texas Instruments (TXN) or Intel (INTC) — Broadcom has offered investors the fastest dividend growth. From a dividend perspective, Broadcom has been a real winner here in the last decade and outpaced other chip-focused hardware companies significantly in terms of dividend growth.

Beware the FOMO rally

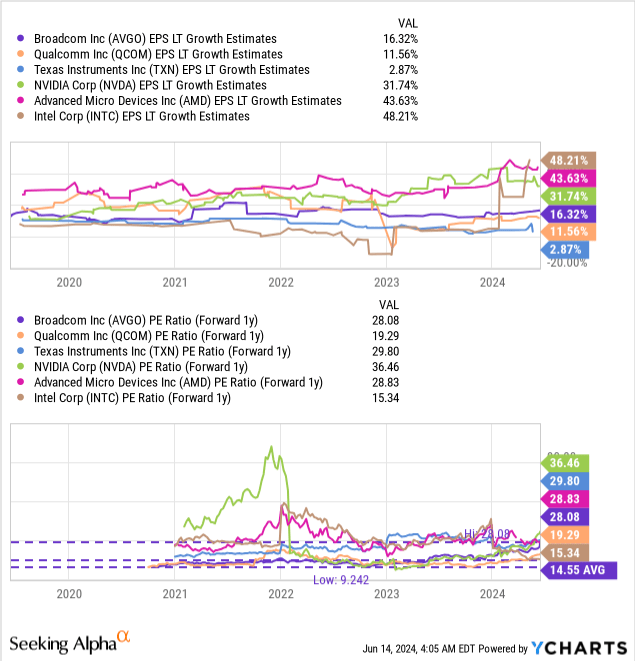

Broadcom is currently on a good run, which is driven by an improvement in the firm’s fundamentals (revenue growth, high gross margins), but the company’s valuation appears stretched based off of earnings regardless. In fact, I would argue that a large part of the recent share price rally is driven by investors fearing to miss out on the company’s AI exposure, which in turn has led to the firm’s valuation reach a nose-bleed level. Shares of Broadcom are currently valued at 28.1X earnings and analysts expect a 16% EPS growth rate in the long term.

Nvidia (NVDA), which got a head-start in the AI business due to its early development of the H100 GPU, is set to grow nearly twice as fast as Broadcom and companies are standing in lines around the block to get their hands on Nvidia’s latest GPU products… which is the reason why Nvidia is selling at a sector high P/E ratio of 36.5X and many investors, including me, have warned about a possible overheating of the AI bubble in the past (although I have been wrong about this so far).

Broadcom has traded at an average P/E ratio of 14.6X in the last five years, which means investors value the company at about twice the historical valuation average right now… which indicates to me that shares are overpriced. Considering that Broadcom’s shares also trade at about the same P/E ratio than AMD, but AMD is expected to grow its earnings 2.7X faster than Broadcom in the long term, I believe the latter would be a much better valuation deal here for investors seeking AI exposure, especially since AMD is aggressively pushing new AI chips and the company could soon have its own ‘Nvidia moment‘.

Broadcom could reasonably trade at 25X forward earnings, in my opinion, considering that the semiconductor firm does have an impressive dividend growth record and that its revenues are ramping up nicely. The multiplier also takes into account that Broadcom is growing its AI-related revenue share and has high gross margins. A 25X P/E ratio implies a fair value of $1,500 per-share (based off of a consensus EPS estimate for FY 2025 of $59.77), implying approximately 10% correction potential. If AVGO revalues to its longer term valuation average of 14.6X P/E, shares could have much more drastic revaluation potential of 48%. This would likely only be the case if the AI bubble pops and investors broadly sell AI stocks.

Broadcom’s risks

I believe the biggest risk here is that although Broadcom has clearly been a winner lately, investors are getting carried away here simply because of the company’s AI exposure. While revenues are growing nicely, the valuation gains seen by companies like Broadcom and Nvidia are very rich and likely not sustainable as competition heats up. What would change my mind about Broadcom is if the company saw further revenue acceleration, expanded its gross margins and benefited from significant EPS upside revisions.

Closing thoughts

Broadcom delivered a solid Q2’24 earnings sheet on Wednesday that was defined by double-digit top-line momentum, revenue acceleration and very strong gross margins. Investors cheered the announcement of a 10-for-1 stock split, which won’t make the shares cheaper, but they are going to be more affordable for investors. From a valuation point of view, I believe shares of Broadcom are overvalued due chiefly to investor enthusiasm about AI stocks in general. Given that Broadcom’s valuation based off of P/E has completed decoupled from its historical average (and that shares are overbought based off of RSI), I believe investors are potentially looking at serious correction risks!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA, AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.