Summary:

- Broadcom Inc. has benefitted from the AI narrative, rallying over 90% in the last year.

- While AI revenues are growing fast, organic growth is only 12%, and this does not justify the current valuation.

- Broadcom Inc. is expensive even for an AI company when we loot at metrics like PEG.

lolostock/iStock via Getty Images

Thesis Summary

Broadcom Inc. (NASDAQ:AVGO) has seen a 90% rally in its stock price in the last year. The company has benefited from increased demand for data servers and posted strong results in the last quarter.

However, even with lofty projections and the AI tailwind, Broadcom’s shares seem far too expensive at these levels.

Investors are eager to find the next Nvidia (NVDA), driving up the price of anything that even smells of AI, and this, in my opinion, has led to an overvaluation of this company.

Yes, plenty of companies in this sector command high valuations, but they have also witnessed explosive growth in revenue and earnings. While AVGO has done well, its outlook does not justify its valuation.

In fact, we can already see that by most meaningful metrics, AVGO is overvalued when compared to some of its peers.

For this reason, I am initiating coverage on Broadcom with a sell rating.

Latest Earnings

Broadcom reported Q2 earnings a couple of weeks ago, and investors have been pleased with the results and the guidance.

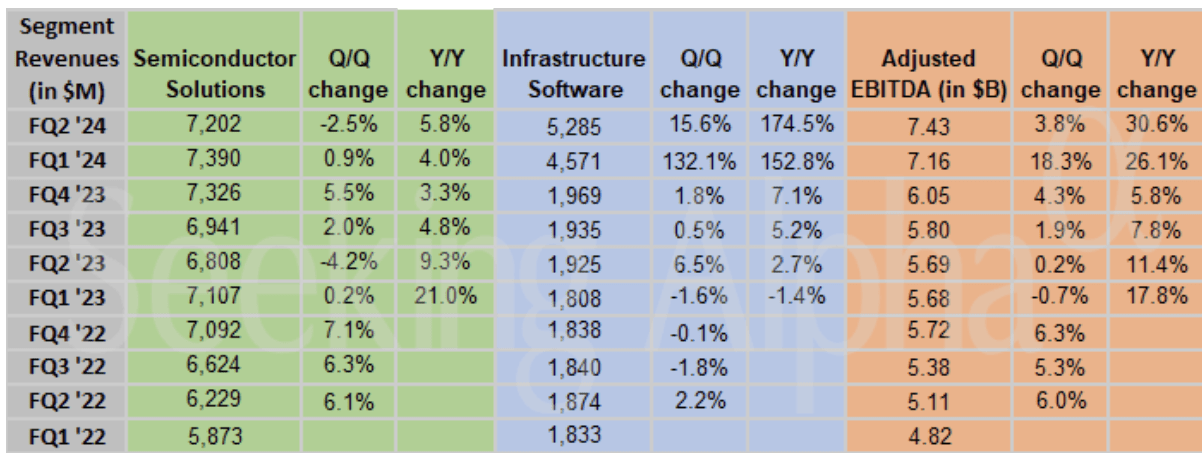

AVGO Revenues (SA)

We can see above the breakdown of Broadcom’s revenue. Semiconductor solutions grew 5.8% YoY, but actually fell on a sequential basis. Within that, investors cheered the fact that Network revenues grew by 44%, YoY, accounting now for 53% of the segment.

Meanwhile, we can see that Infrastructure Software revenue was up 174.5% YoY and 15.6% QoQ. However, we have to bear in mind that this includes the revenues from the acquisition of VMware.

Without this, organic growth was 12%, but this was mostly driven by a 280% increase YoY in AI revenues, which investors certainly liked. This helped cover up the weakness in some of the other segments.

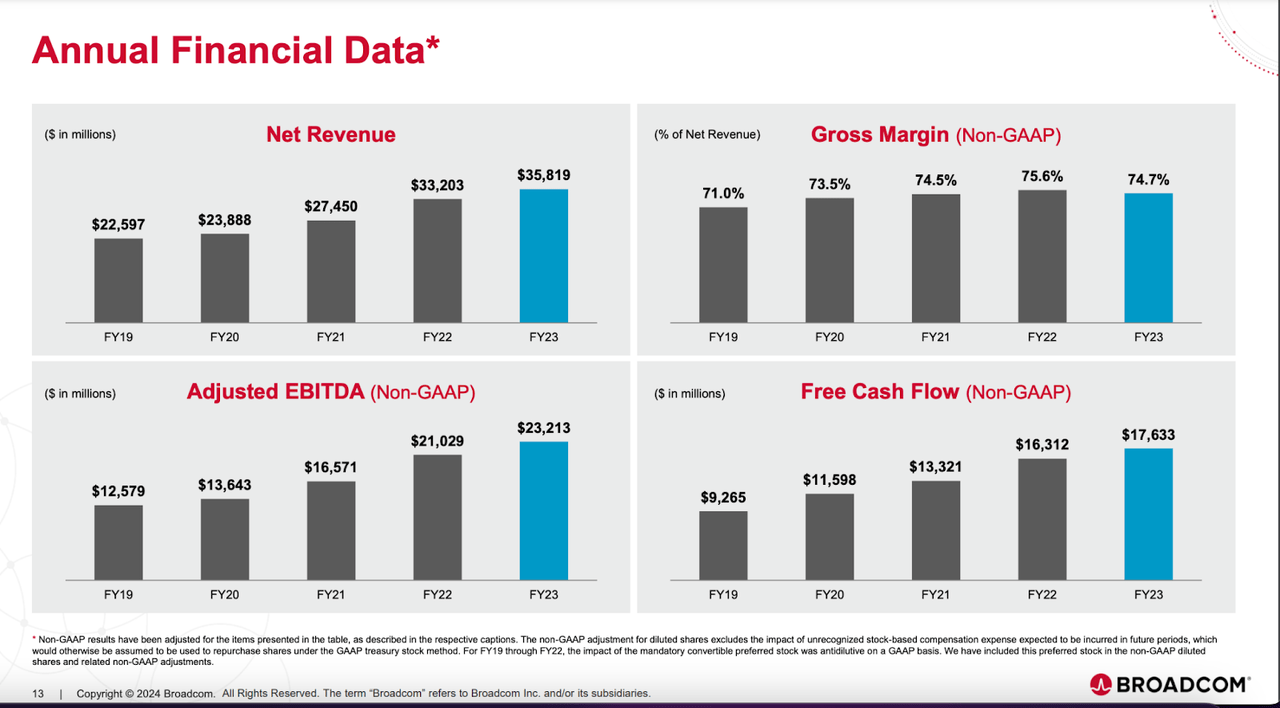

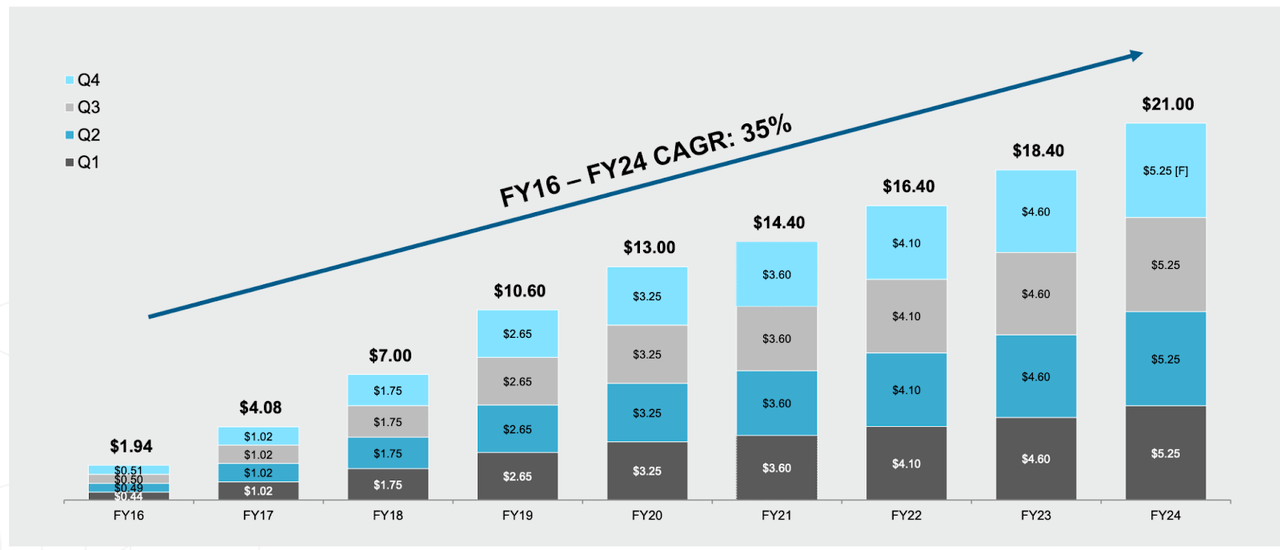

Annual Financial Data (Investor Presentation)

The company is now guiding for $51.0 billion in revenues in 2024, a YoY increase of 42%. EBITDA should be around 60% of this, so that would be around $30 billion in EBITDA, a 30% YoY increase.

Margins have seen a compression following the acquisition of VMware, but the CEO noted they should return to their historical average by 2025.

Overall, my takeaways from the earnings call are that the VMware acquisition has been a good one, and that AI revenues are on the rise.

The AI Hype Rally

But does this justify the current rally?

Before we break down why Broadcom is overvalued, let’s try to understand how it became so overvalued. There are at least three factors that have contributed

-

The upcoming stock split

-

AI Narrative

-

Dividend increase.

A stock split can certainly help boost sentiment. AVGO is set to undergo a 10-1 stock split, which will certainly contribute towards pulling in some more retail demand. Though, by itself, this is not enough.

The main driver of this rally is the fact that AI revenues grew 280%. However, this is somewhat misleading, since AI revenues were pretty small to begin with.

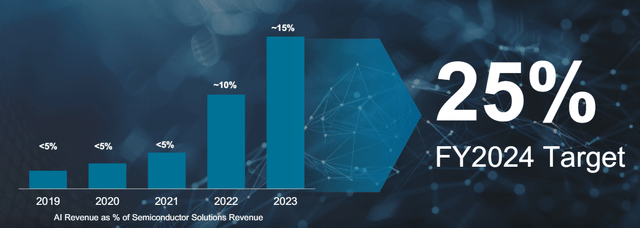

AI Revenues (Investor Presentation)

Yes, more than tripling AI revenues is great, but we must consider they were almost non-existent before 2022. Plus, this helps cover up the fact that other forms of revenue are actually declining.

The VMware acquisition also aids in this confusion, since it makes it seem like AVGO is doubling its revenues. As mentioned above, organic growth was a reasonably strong 12%, but nowhere near what we’ve seen with the likes of Nvidia, a true beneficiary of AI.

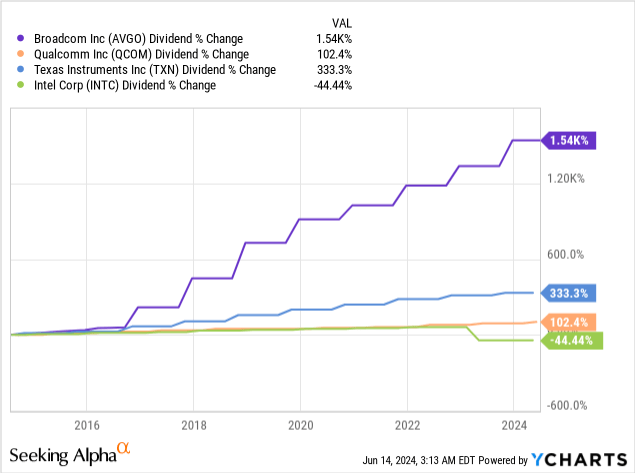

AVGO Dividend (Investor Presentation)

Lastly, I would also throw in the handsome dividend increase, and the fact that AVGO does outperform its peers in this regard.

AVGO and peers dividend (SA)

For dividend investors eager to get a piece of the AI narrative, AVGO is the best, and arguably one of the few options.

Overvalued AI Company

But investor enthusiasm will eventually be replaced by the cold hard valuation metrics. AVGO is incredibly expensive, even for an “AI company.”

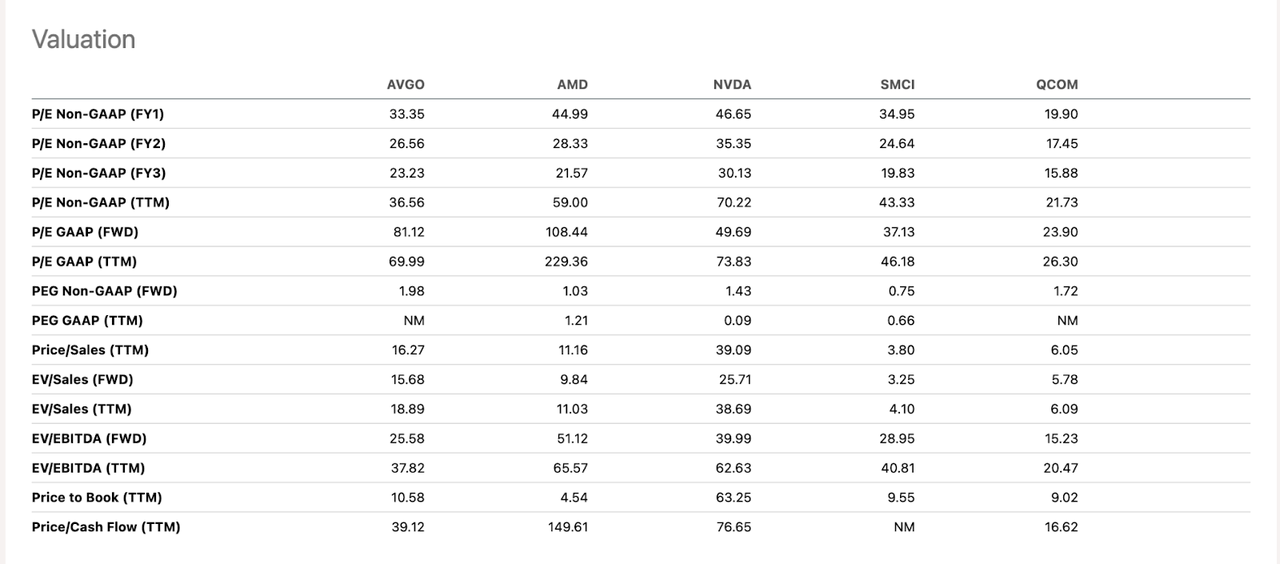

In the image above we can see a valuation comparison of AVGO, Advanced Micro Devices (AMD), Nvidia, Super Micro Computer (SMCI) and Qualcomm (QCOM).

AVGO stands out as the most overvalued if we look at the forward PEG. Trading at almost two times its future earnings growth, this is even more expensive than Nvidia. The PE GAAP (TTM) is actually quite close to Nvidia’s, at just under 70.

Arguably, it does have a more “reasonable” Price/cash flow of just under 40, which is cheap compared to Nvdiia and AMD.

Still, AVGO is clearly being put in the same basket as companies like AMD, Nvidia, and SMCI, which have shown much more impressive growth.

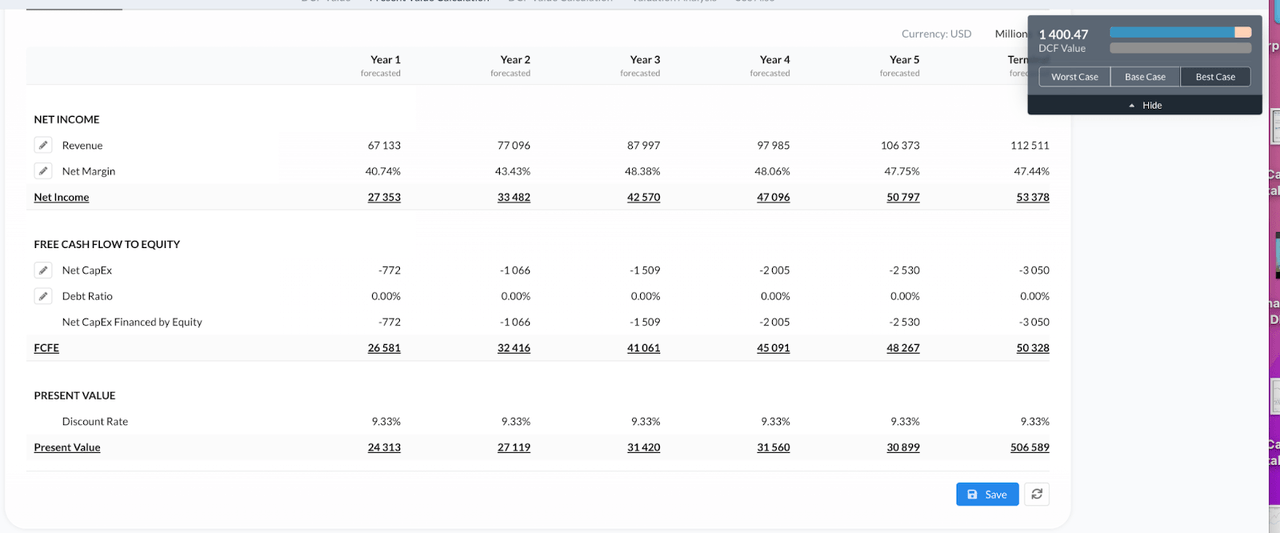

Even using optimistic assumptions for a DCF valuation, AVGO comes out as overvalued.

Even assuming that AVGO can grow revenues to $106 billion in the next five years, while also increasing its net margin to over 47%, the Alphaspread DCF model gives us a target price of $1400.

Final Thoughts

In conclusion, while Broadcom Inc. has done well to position itself as a beneficiary of AI, and the acquisition of VMware was in my opinion a success, the current price does not reflect the company’s true value.

Broadcom Inc.’s valuation has detached from reality, and I think it’s just a matter of time before we see this come back down.

But, in the famous words of John Maynard Keynes, “the market can stay irrational longer than you can stay solvent.” This price may yet take a while to correct.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Macro moves markets, and this is what I do at The Pragmatic Investor

Join today and enjoy:

– Weekly Macro Newsletter

– Access to our Portfolio

– Deep dive reports on stocks.

– Regular news updates

Start your free trial right now!