Summary:

- Broadcom, Inc. has seen a YTD gain of 65.83% in 2024, driven by strong demand for AI infrastructure and semiconductor hardware.

- Despite surpassing earnings and revenue estimates, Broadcom’s net losses were impacted by a one-time $4.5 billion tax provision.

- Elevated valuation metrics (forward PE, PS, price-book ratios) place Broadcom at the higher end of its peer group, limiting the potential for a “strong buy” rating.

- I will hold my long position in Broadcom, awaiting clearer evidence of the current uptrend’s potential end.

Sundry Photography

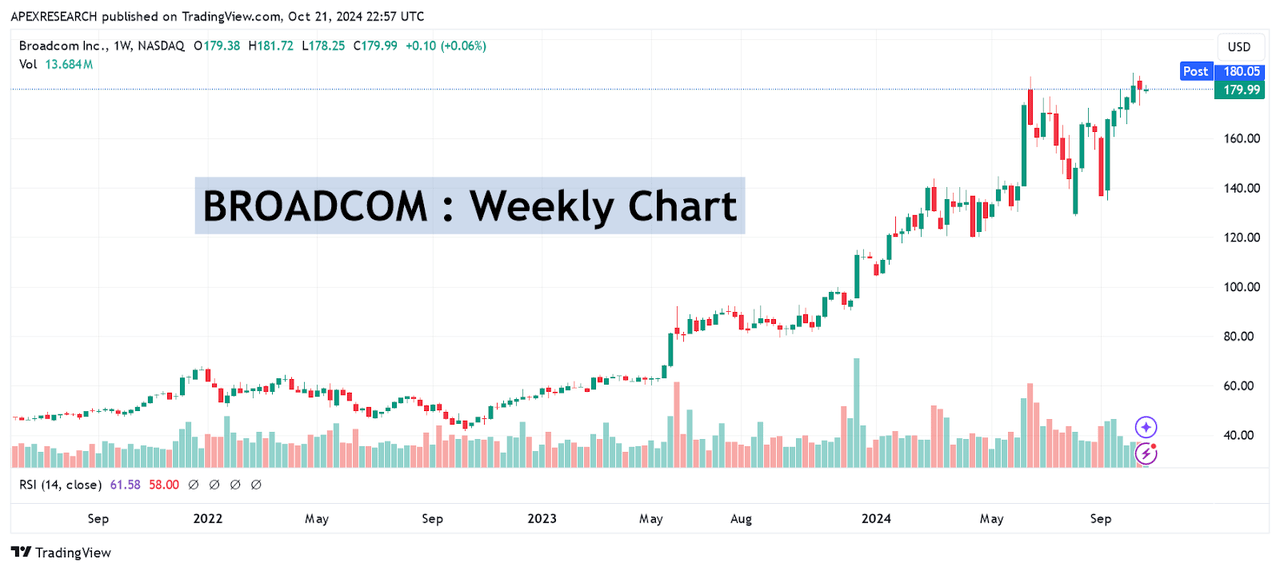

By all accounts, Broadcom Inc. (NASDAQ:AVGO) has had quite an interesting year in 2024. On a YTD basis, the stock has already seen tremendous gains of 65.83%, and it is becoming quite clear that the market now has a firm understanding of Broadcom’s true position within the realm of artificial intelligence infrastructure development. On October 7th, 2024, Broadcom share prices reached a new record high at $186.42 and these substantial price movements have led many investors to wonder about whether these strong rallies can continue into 2025.

AVGO: Weekly Price Chart (Income Generator via TradingView)

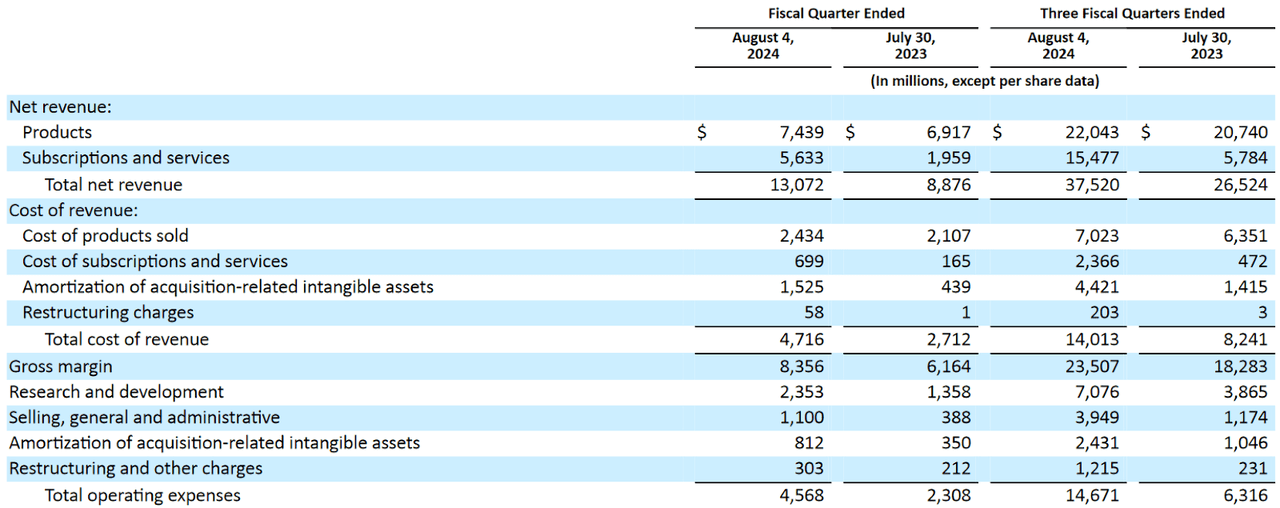

For the fiscal third quarter period, Broadcom recorded adjusted earnings of $1.24 per share, and this surpassed consensus estimates calling for $1.20 per share. On the revenue side, the beat was less substantial, but the company did record $13.07 in revenues for the period and this did surpass consensus estimates calling for $12.97 billion.

Broadcom: Fiscal Third Quarter Earnings Figures (Broadcom: Fiscal Third Quarter Earnings Presentation)

Net losses for the period were seen at -$1.88 billion, and this figure marks a strong contrast when compared to the net income of $6.12 billion that was seen during the same period in the prior year. However, the severity of these differences can be attributed in large part to a $4.5 billion tax provision that was associated with an internal IP transfer. As a result, this one-time negative will not have significant ripple effects for the next earnings release, and guidance for the fiscal fourth quarter suggests that revenues will now be seen at $14 billion for the period.

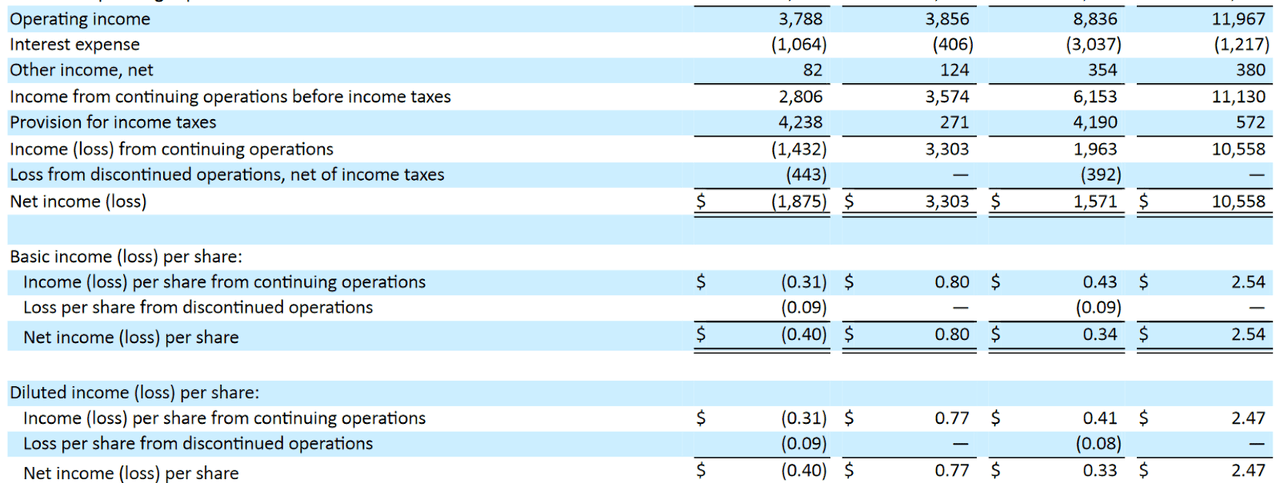

Broadcom: Fiscal Third Quarter Earnings Figures (Broadcom: Fiscal Third Quarter Earnings Presentation)

Overall, the stable results that were produced during Broadcom’s third-quarter period were driven by impressive demand for semiconductor hardware that is used in the development of artificial intelligence systems and from continued positives that can be directly attributed to the acquisition of VMware. Semiconductor revenues saw annualized gains of 5% (at $7.27 billion), which shows that this segment is still outperforming revenue figures from infrastructure software (which came in at $5.8 billion).

Broadcom: Fiscal Third Quarter Earnings Figures (Broadcom: Fiscal Third Quarter Earnings Presentation)

Currently, full-year fiscal 2024 guidance figures imply that artificial intelligence components and other custom hardware products might generate as much as $12 billion in revenue for Broadcom during the period (indicating a sequential improvement in guidance equal to roughly $1 billion).

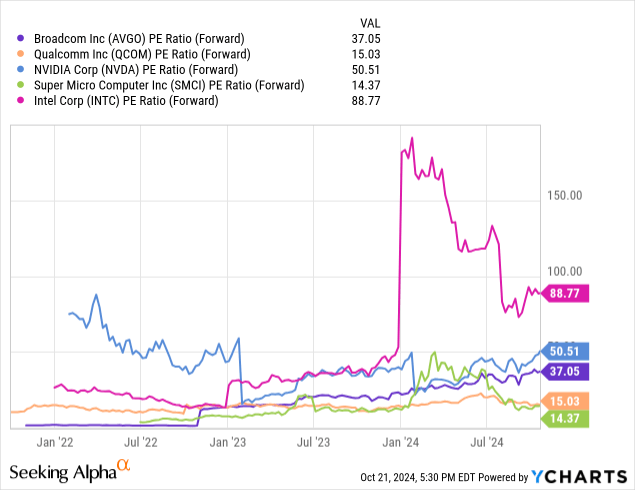

AVGO: Comparative Price to Earnings Valuations (YCharts)

When viewing Broadcom from the perspective of its comparative forward price-earnings valuation (37.05x), the results are a bit underwhelming. In other words, we can see examples from companies that are firmly centered within the artificial intelligence industry that are currently trading at more expensive valuations. Specifically, both Intel Corp. (INTC) at 88.77x and Nvidia Corp. (NVDA) at 50.51x are trading at much higher valuations at the moment. But other companies currently look more attractive, and examples would have to include Qualcomm Inc. (QCOM) at 15.03x and Super Micro Computer, Inc. (SMCI) at just 14.37x. Of course, Super Micro Computer has its own problematic issues, but I have proposed a bullish game plan for trading this stock in my article “Super Micro Computer: Buy The Crash“.

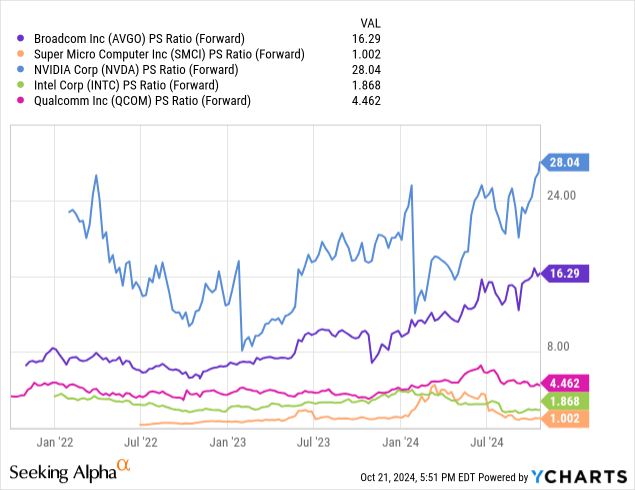

AVGO: Comparative Price to Sales Valuations (YCharts)

Unfortunately, the picture looks even less favorable if we are valuing these companies using the forward price-sales metric. In this case, Broadcom is still trading near the top of the pack (at 16.29x) and only one company in this peer grouping is trading at a higher valuation (Nvidia is currently trading at 28.04x forward sales figures). Of course, this means that Qualcomm (at 4.46x), Intel (at 1.87x), and Super Micro Computer (at 1.002x) are all currently trading at more attractive valuations.

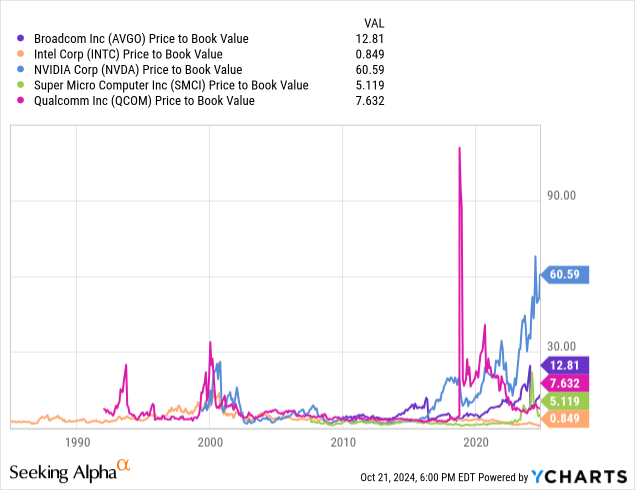

AVGO: Comparative Price to Book Valuations (YCharts)

Finally, we will look at how these companies compare when viewed through the lens of the price-book metric, but here we see similar results. Once again, Nvidia is working as a bit of an outlier with its elevated price-book ratio of 60.59x. Broadcom has the next lowest valuation (at 12.81x) and then there is a bit of a drop-off when we are evaluating the other companies within this industry peer grouping. Qualcomm is currently trading at just 7.63x but, as we can see in the chart shown above, this is a company that has a bit of an erratic history when assessing the company using this valuation metric. Essentially, this does suggest that Qualcomm might be vulnerable to unpredictable spikes in the future. However, there are still two companies that are trading at much lower valuations right now, and these can be found with Super Micro Computer (at 5.12x) and Intel (at just 0.85x).

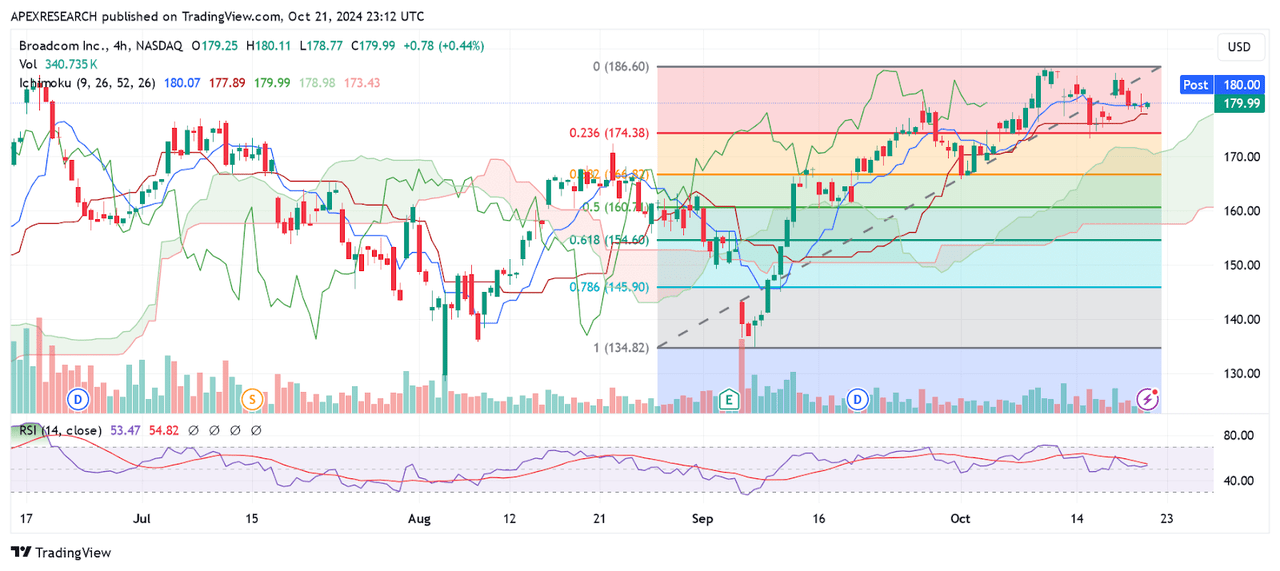

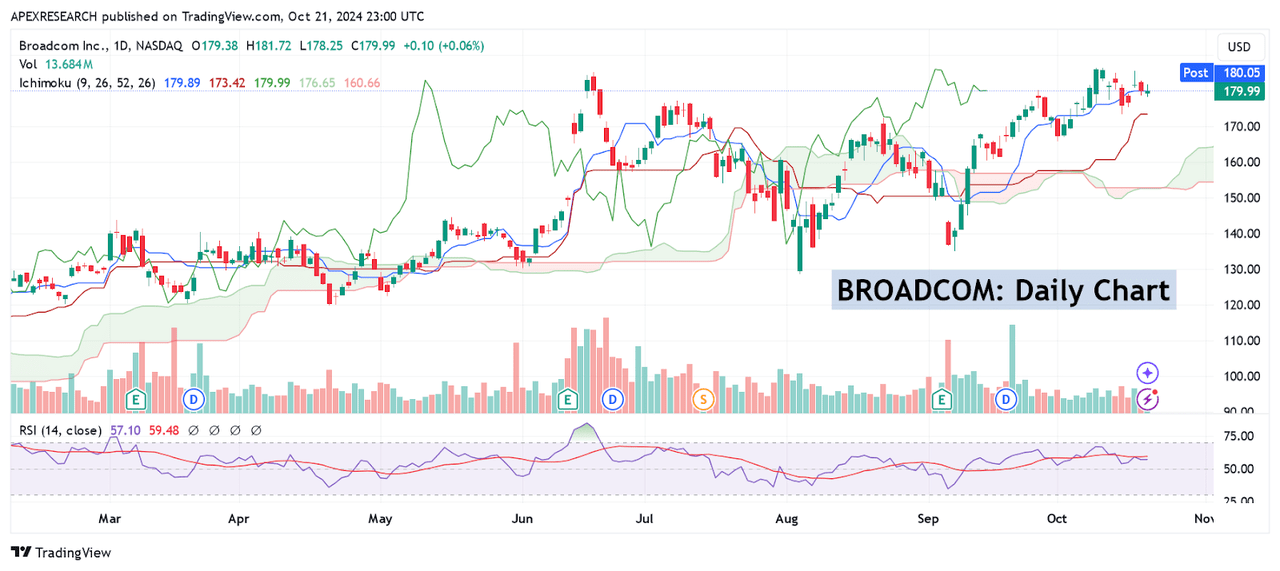

AVGO: Critical Support and Resistance Levels (Income Generator via TradingView)

Of course, Broadcom’s elevated valuation metrics have been dramatically influenced by the fact that trends in share prices are now trading within close proximity to record levels. Fortunately, an assessment of the intermediate-term price history can give us a better understanding of when those types of trends might start to reverse (or continue moving higher). On the bearish side of the equation, a downside break through the October 1st, 2024 lows (at $165.80) would begin to erode the bullish outlook. In addition to being an important region of historical support, this area also aligns closely with the 38.2% Fibonacci retracement level of the ascending move from $134.90 (the September 9th low) to $186.43 (Broadcom’s record high posted on October 9th), which is located near $166.80.

AVGO: Reversal Pivot Zones for Bullish Outlook (Income Generator via TradingView)

However, in my view, this would not yet be the level at which to begin selling the stock. Rather, I would start to view AVGO as being contained within a more neutral/consolidative trend pattern that would still have the potential to allow the stock to form a base before generating another run higher. If we see further downside price movements through the $134.90 level, I would then turn my outlook to bearish in ways that might justify revising the outlook to a “sell” rating. Ultimately, the reason I am focusing on this level, in particular, comes from the fact that downward trend movements through this area could trip stop-losses below this historical support zone and generate negative momentum that might breach prior lows. Specifically, the August 5th, 2024 low (at $128.50) does not rest very far below this area and this is why I feel that an initial breach of support at $134.90 could generate enough downside follow-through to be problematic for investors currently holding long positions in this stock.

Overall, I believe that the most recent quarterly earnings figures were quite strong (especially when we account for the one-time figures that will not be present when the current quarter report is released) and I think that the stock’s recent upward movements into record territory are justified given the stability of the company’s quarterly performance figures. However, I cannot view the stock in a light that is positive enough to warrant a “strong buy” rating because there are simply too many elevated valuation metrics (for example, forward PE, forward PS, or price-book ratios) that place Broadcom toward the upper-end of its industry peer group. As a result, I will continue to hold my long position in this stock until I see better evidence that the current uptrend is coming to an end.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AVGO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.