Summary:

- Broadcom’s FY24 ended with strong growth in networking chips, driven by custom AI ASICs and improved server & storage chip performance, hinting at a strong runway for eFY25.

- The integration of VMware significantly boosted AVGO’s revenue and margins. Management anticipates improved margins going forward for infrastructure software.

- Management forecasts continued growth in AI accelerators and networking, expecting a serviceable addressable market of $60–90 billion by FY27, despite potential margin pressures.

J Studios

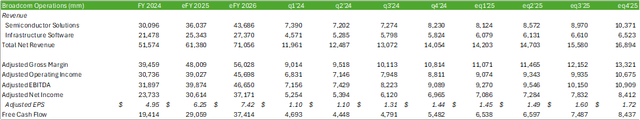

Broadcom (NASDAQ:AVGO) reported a strong end of FY24 with re-accelerated growth in its networking chip segment, primarily driven by growth in custom AI ASICs. In addition to this, the firm is realizing sequential improvement in its Server & Storage chips as the next refresh cycle for general compute servers commences, as noted by infrastructure aggregator Hewlett Packard Enterprise (HPE). Given the tailwinds in both AI and general compute, I have reason to believe Broadcom will realize improved growth paired with margin accretion as a result of its integration with VMware. I am upgrading my rating for AVGO shares to a STRONG BUY with a price target of $281/share at 30.24x eFY26 EV/aEBITDA.

Broadcom Operations

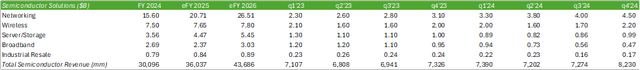

Broadcom closed FY24 with 51% top-line growth on a year-over-year basis in q4’24, primarily as a result of VMware integration. Net of VMware, revenue grew by 11%. Outside of VMware, revenue was driven by Broadcom’s custom AI accelerators and networking, growing by 220% to $12.2b in FY24. AI semiconductor revenue grew by 150% in q4’24 to $3.7b. Accordingly, these accounted for 41% of semiconductor revenue in FY24.

Management is expecting Broadcom’s non-AI semiconductors to begin realizing a recovery in eFY25, with mid-single-digit growth after bottoming in FY24. They also expect AI accelerators to drive growth over the next three years as hyperscalers begin developing their own custom silicon chips. This includes Microsoft (MSFT), Alphabet (GOOG), and Amazon (AMZN), each developing custom silicon solutions tailored for their respective data centers in order to optimize cost per performance. Though these solutions will compete with Nvidia (NVDA) GPUs, the premise behind the custom XPUs will allow for customers to have additional options that may better suit their AI modeling needs.

One of the growth drivers as it relates to this will be data center interconnectivity. This is the fabric that interconnects the compute power, allowing for systems to “talk” to each other. Network fabric will be scaled as clusters become larger with more complex models. Management anticipates the serviceable addressable market [SAM] to be in the range of $60-90b in FY27.

Despite this being a large growth opportunity for Broadcom, a higher AI XPU mix may result in tighter gross margins as custom silicon is more costly to produce. This resulted in a 220bps year-over-year headwind in q4’24.

Networking grew by 45% on a year-over-year basis to $4.5b in q4’24 driven by AI networking growth. Broadcom doubled its AI XPU shipments across its 3 hyperscaler customers in q4’24. The firm also realized 4x growth in AI connectivity revenue, primarily driven by Tomahawk and Jericho shipments. Management is expecting continued momentum going into eq1’25 driven by hyperscaler deployments of Jericho3-AI. In addition to this, Broadcom will be ramping up its next generation 3nm XPUs and anticipates volume shipments in e2h25.

Server & storage connectivity has been recovering since it bottomed out in q2’24, improving by 20% off the bottom in q4’24. Management is anticipating server & storage to continue improving going into eFY25.

Wireless realized 7% year-over-year growth to $2.2b in q4’24 driven by higher content, primarily as a result of a seasonal launch by one of the firm’s North American customers. Management is expecting wireless to decline sequentially and remain flat on a year-over-year basis. In broadband, management is expecting eq1’25 to be a quarter of recovery, as the firm received multiple orders across its service provider customers throughout q4’24.

As part of the VMware acquisition that closed at the beginning of FY24, management is now expecting incremental adjusted EBITDA to significantly exceed the initial target of $8.5b, surpassing this figure earlier than in the original 3-year timeframe. VMware Cloud Foundations [VCF] accounted for 70% of the CPU costs, which totaled $21mm in q4’24. Management has made strides in making VMware more profitable. In q4’24, the firm reduced spending down to $1.2b, down from an average of $2.4b per quarter pre-acquisition.

Broadcom Financial Position

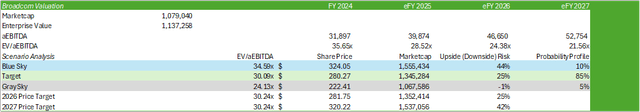

Looking out to eq1’25, I’m forecasting Broadcom to generate $14.2b in net revenue, driven by growth in Infrastructure Software sales. I’m forecasting Broadcom to realize strong tailwinds going into the duration of eFY25 in Semiconductor Solutions as the firm rolls out custom ASICs across its hyperscaler customers. I anticipate this trajectory to accelerate throughout eFY27 as the firm realizes stronger penetration for custom silicon solutions with its hyperscaler customers.

I’m also anticipating server & storage to begin recovering throughout eFY25 with tailwinds going into eFY26 as the general compute space realizes a recovery as a result of the next server refresh cycle. I’m anticipating broadband to remain soft throughout e1h25 and realize some recovery in the back-half of eFY25.

For eFY25, I’m forecasting Broadcom to generate $39.8b in adjusted EBITDA, driven by improved margins through the integration improvements of VMware.

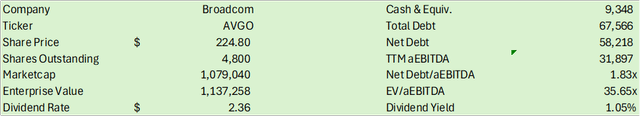

In q4’24, Broadcom reduced its total debt load by $2.5b with cash on the balance sheet. In addition to this, the firm replaced $5b in floating rate debt with newly issued senior notes. All of this has resulted in an average fixed rate of 3.7% with an average duration of 7.6 years on the firm’s fixed notes. Management is expecting to pay down $495mm in fixed-rate debt in q1’25. Management noted on the q4’24 earnings call that they will focus attention on lowering Broadcom’s interest payments by reducing its debt position with excess cash generated from operations. As of q4’24, Broadcom had a net debt of $58b for a net debt/aEBITDA ratio of 1.83x.

Risks Related To Broadcom

Bull Case

Broadcom is focusing more attention on custom ASICs for the hyperscalers, potentially leading to a strong growth trajectory for the firm as AI clusters become larger for training LLMs. The hyperscalers are heavily investing in compute as they expand their data center footprint as a result of demand outstripping supply. As a result of this, the major hyperscalers are investing in custom ASICs to compete with more modular chips offered by Nvidia and AMD (AMD) for training and inferencing, allowing for customers to have more optionality and potentially better performance per dollar spent. In addition to this, as clusters become more complex, investment in data center interconnect will grow to optimize speed and efficiency between GPUs/XPUs.

Broadcom has also fully integrated VMware into its operations, allowing for the firm to improve operating margins going forward.

Bear Case

Despite the high growth for custom silicon, chip designers such as Broadcom may realize tighter margins as these chips are more costly to make. If general compute and campus networking doesn’t recover with AI growth, Broadcom may be in a position of tighter operating margins and lower cash flow generation in the coming quarters.

Valuation & Shareholder Value

Broadcom increased its dividend to a forward rate of $2.36/share, yielding 1.05% at the current trading level.

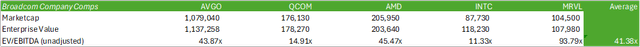

Looking at peer comps, AVGO shares trade at the higher end of the range at 43.87x EV/EBITDA on an unadjusted basis.

Given the firm’s position in custom ASICs for the hyperscalers, the firm may be in a position of strong growth, as seen with its peer Marvell Technology (MRVL). This gives me reason to believe that the firm may continue trading at a premium to its market peers.

Using an internal valuation model based on my eFY26 adjusted EBITDA forecast and AVGO shares’ historical trading premium, I believe shares should be priced at $281/share at 30.24x eFY26 EV/aEBITDA. Given the strong long-term growth trajectory of the firm, I am upgrading my rating to a STRONG BUY.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MRVL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.