Summary:

- The stock price is showing consolidation after a 20% surge following strong Q2 FY2024 earnings, due to significant expansion in valuation multiples.

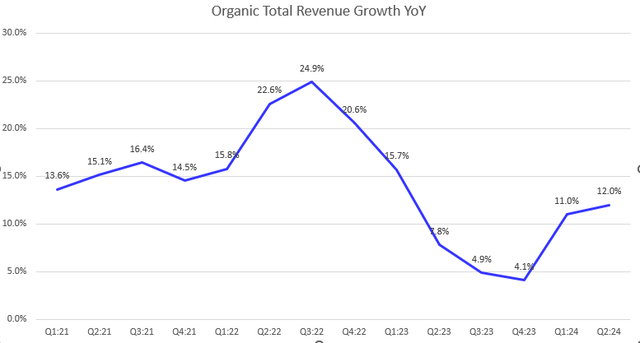

- The company grew only 12% YoY in Q2 FY2024 and 11% YoY in Q1 FY2024 in organic total revenue, excluding VMware’s revenue contribution, up from high single-digit growth in FY2023.

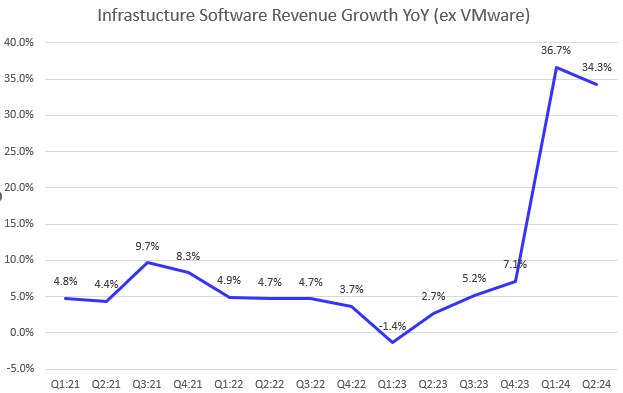

- Revenue growth for AVGO is largely driven by VMware, with impressive Infrastructure Software growth and potential for nearly 100% YoY growth in 1Q FY2025E.

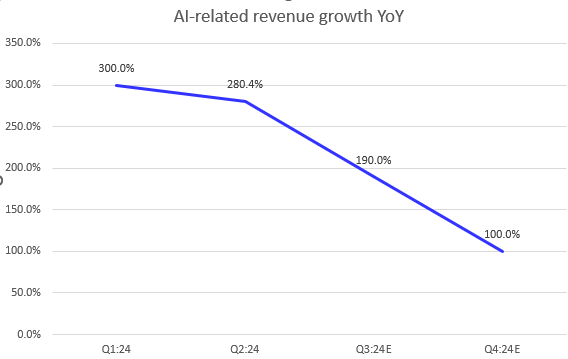

- AI-related revenue has increased 280% for Broadcom, but the segment remains at 25% of its total revenue in the last quarter.

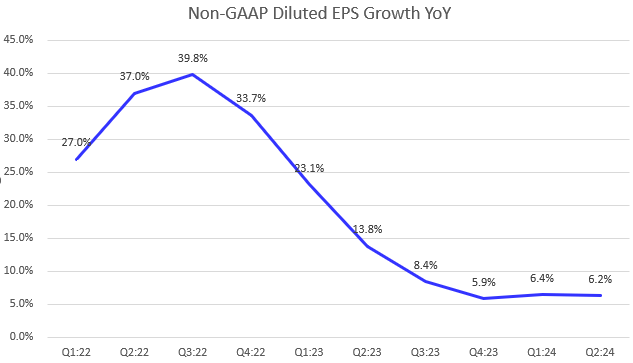

- The company’s net income margin has been declining, with mid-single-digit non-GAAP EPS growth over the past three quarters.

Georgijevic

Investment Thesis

Broadcom Inc. (NASDAQ:AVGO) recently surged 20%, driven largely by a strong Q2 FY2024 earnings report. Like other semiconductor stocks, AVGO has seen significant price jumps due to the GenAI tailwinds, which is driving tremendous demand for Ethernet solutions and custom AI accelerators. The company has shown a strong rebound in revenue growth in the past two quarters and continues to accelerate its momentum.

The company has already reached a revenue growth inflection point, leading to a doubling of its stock price in the last 12 months. While it trades at a premium valuation similar to other semiconductor stocks, last week’s 10% pullback may suggest a consolidation. I understand that recent price moves might be due to momentum, especially seen after the announcement of a 10-1 stock split. Therefore, I’m issuing a hold rating after the recent pullback as the price could potentially decline further given its current valuations.

AI-Related Revenue Has Increased 280%

The company model

While the company doesn’t provide a detailed breakdown of revenue specifically for its AI-related business, we can get some insights from past earnings calls. In the 4Q FY2023 earnings call, management indicated that GenAI revenue was approximately $1.5 billion, representing about 20% of the semiconductor revenue (roughly $7.3 billion x 20% = $1.46 billion). They also forecasted that this revenue would nearly double year-over-year. Based on this, I estimate that AI revenue in Q4 FY2024 could reach around $2.92 billion. I believe there are several growth drivers contributing to its AI revenue.

For example, back in early 2023, AVGO introduced the world’s fastest Ethernet switch chips with 51.2 Tbps. They are currently gearing up to launch their next-generation three-nanometer Tomahawk 6 with speeds up to 100 Tbps. The new products are scheduled to launch in late 2025 and are expected to significantly boost its AI networking revenue.

In 1Q FY2024 earnings call, the company reported a 400% YoY growth in AI revenue, reaching $2.3 billion, implying AI revenue was $575 million in Q1 FY2023. In Q2 FY2024, the management said AI revenue grew by 280% YoY to $3.1 billion. These numbers demonstrate AVGO’s remarkable AI revenue growth trajectory in FY2024. While AI revenue currently represents only 25% of total revenue, I believe that the percentage of AI revenue will eventually dominate, thereby significantly increase its top-line growth.

Revenue Growth is Largely Driven by VMware

The company model

While it’s impressive that AVGO achieved an overall Infrastructure Software growth of 175% YoY in the 2Q FY2024 Press Release, the company did not separate revenue contributions from the recent VMware acquisition. This omission is misleading and makes the YoY growth number less comparable to previous data. Excluding the $2.1 billion and $2.7 billion revenue contributions from VMware in 1Q and 2Q FY2024, the organic revenue growth YoY for AVGO would drop to 34.3% YoY, down from 36.7% YoY in the previous quarter.

I believe that revenue from VMware will be a growth engine for AVGO’s Infrastructure Software segment and total revenue. The company indicated in the earnings call that it will accelerate towards a $4 billion per quarter run rate, implying the potential for nearly 100% YoY growth in 1Q FY2025E (Up from 2.1 billion in 1Q FY2024).

The company only grew 12% YoY in total revenue excluding VMware, largely driven by a 280% YoY increase in AI-related revenue. Looking at the chart above, we can see that AVGO’s organic total revenue has shown reacceleration since 4Q FY2023. However, unlike NVIDIA’s (NVDA) +280% YoY growth in total revenue, I have not seen a clear growth rebound in its top-line revenue yet, as AI revenue is still a small portion of total revenue. Additionally, the growth is still currently below the FY2022 trajectory. Therefore, we are seeing a very early stage of a growth rebound story, but AVGO’s valuation multiples have been expanding significantly, which, I believe, is a warning sign for investors.

In addition, I don’t see margin expansion for AVGO despite strong growth in the AI revenue segment. Instead, the company’s margins have been declining. Its net profit margin in 2Q FY2024 was 43.2%, down from 43.9% in 1Q FY2024 and 51.4% in 2Q FY2023. This decline will likely result in weak growth in its bottom line.

Weak Earnings Growth

The company model

AVGO has experienced a 46% YoY decline in GAAP EPS for 2Q FY2024. For modeling purposes, management advised analysts to disregard GAAP net income and cash flow for FY2024, due to restructuring and integration costs from the VMware acquisition.

Let’s look at the adjusted earnings numbers instead. AVGO’s adjusted EPS trajectory has been flat and weak, with non-GAAP diluted EPS growing only 6.2% YoY in 2Q FY2024, down from 13.8% YoY in 2Q FY2023. I believe the company is currently prioritizing its top-line growth, which has resulted in no rebound in EPS growth yet. While the recent rally in the stock price, its non-GAAP P/E fwd is becoming more expensive.

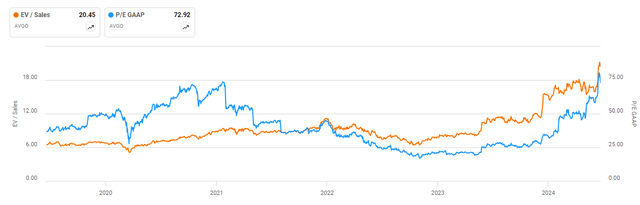

Valuation

Despite last week’s pullback, AVGO is currently trading near its all-time high EV/Sales TTM of 20.45x. As seen in the chart, this multiple reached its peak back in FY2022, driven by a robust +20% YoY growth in total revenue. Given the current growth rates in the low teens, the question arises: why is the multiple almost double the previous high of 11x observed in FY2022? I think it’s due to the high-growth synergies from VMware and a strong growth outlook for its AI-related revenue. Therefore, most of the growth tailwinds have already been priced into its current valuation.

Additionally, the stock’s P/E GAAP TTM is 73x, driven largely by restructuring and integration costs. Looking ahead, on a non-GAAP basis, the multiple is expected to come down to 36x, which is lower than peers like Marvell (MRVL) at 51x and MACOM (MTSI) at 41x. However, AVGO’s non-GAAP P/E fwd of 36x is slightly higher than the low 30x of the SOX index and the Nasdaq 100 index.

Conclusion

In sum, I believe AVGO has seen impressive growth in AI-related revenue, up 400% YoY to $2.3 billion and continuing strong into H2 FY2024. This highlights AVGO’s leadership in semiconductors, driven by synergies with VMware and a bullish outlook for AI-related products. However, the current AI revenue still represents a small portion of its total revenue. The company’s net income margin has been declining, accompanied by a mid-single-digit non-GAAP EPS growth trajectory. Moreover, with a forward non-GAAP P/E of 36x, slightly above industry benchmarks like the SOX index and Nasdaq 100, AVGO’s valuation appears not cheap, suggesting substantial growth expectations are already priced in. Lastly, the stock started to consolidate after a relentless rally, down 10% last week. Therefore, I remain cautious and issued a hold for the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.