Summary:

- Easing monetary policy and significant investments in data centers from major players like BlackRock, Microsoft, and Nvidia position Broadcom to benefit from AI infrastructure demand.

- Stellar recent financial performance, coupled with a strong full-year AI revenue guidance boost, suggests that the integration of VMware is progressing well.

- AVGO’s valuation is attractive compared to peers, with a fair value estimated at $865 billion.

G0d4ather

Investment thesis

My previous bullish thesis about Broadcom (NASDAQ:AVGO) aged extremely well as the stock delivered a 27% return since early June. To add context, the S&P 500 grew by 8% over the same period.

I remain extremely bullish about AVGO. Accelerating revenue growth and notably expanding profitability suggest that integration of VMWare business into AVGO’s line of business is going extremely well. Softening monetary policy will likely boost investments in data centers, and several stellar players continue initiating new ventures that will pour tens of billions into new data centers. As a player that provides vital hardware for cloud and AI infrastructure, AVGO is poised to absorb these tailwinds. Moreover, the expanding importance of VMWare’s offerings helps in making AVGO’s revenue mix stronger and more resilient. The stock is still very attractively valued with a 13% upside potential. All in all, I reiterate a “Strong Buy” rating for AVGO.

Recent developments

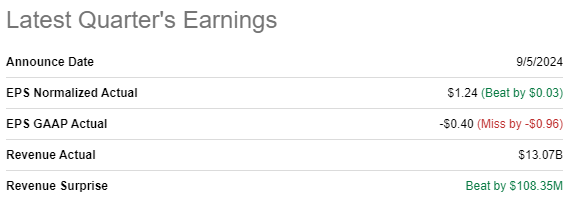

The latest quarterly earnings were released on September 5, when AVGO topped revenue and adjusted EPS estimates. Revenue grew by 47.27% YoY, the adjusted EPS expanded from $1.05 to $1.24. Massive revenue growth is explained by the addition of VMWare’s financials, since it was only the second quarter that consolidated VMWare. However, even without the effect of VMWare, organic dynamic was positive with a 4% increase YoY.

Seeking Alpha

The Semiconductor Solutions segment’s revenue grew by almost 6% YoY, while Infrastructure Software revenue soared by roughly three times on a YoY basis. AI revenues were the major driver for revenue growth, as this business line’s sales surged by multiple times YoY, reaching around $3.2 billion. During the earnings call, the management shared that it now expects the AI-related revenue to be around $12 billion in FY2024. The previous guidance for AI revenue was $11 billion. Networking revenues also substantially contributed to growth, with a 43% YoY growth.

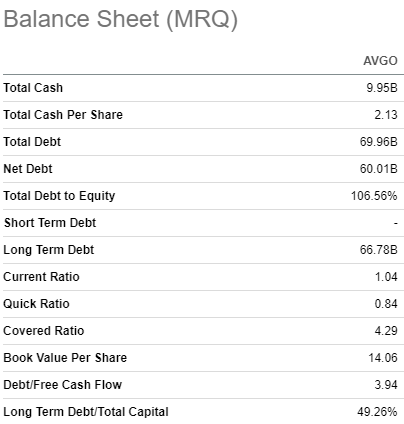

As a result of strong topline performance, AVGO generated $5.3 billion in adjusted free cash flow, around 14% higher on a YoY basis. This helped in maintaining a strong balance sheet with almost $10 billion in cash. Moreover, AVGO’s net debt position has improved significantly on a QoQ basis, decreasing by $4 billion.

Seeking Alpha

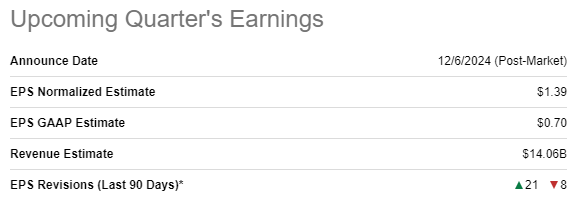

The upcoming earnings release is scheduled for December 6. Wall Street analysts expect quarterly revenue growth to accelerate further. Consensus forecast FQ4 revenue to be $14.1 billion, 51.3% higher on a YoY basis. The adjusted EPS is expected to expand YoY, from $1.11 to $1.39. Wall Street analysts’ expectations about the next earnings release are quite positive, since there were 21 upward EPS revisions over the last 90 days and only 8 downgrades.

Seeking Alpha

We are still almost three months away from the next quarter’s earnings release, but I think that optimism of Wall Street analysts is justified.

The Fed’s recent first interest rates cut since 2020 is a strong tailwind. A less restrictive monetary policy will highly likely boost capital spending, including investments in data centers. As one of the most crucial companies that offers cutting-edge solutions for cloud and AI infrastructure, AVGO is certainly poised to benefit.

Earlier this week it was announced that BlackRock (BLK), Microsoft (MSFT), Nvidia (NVDA) team up to launch a $30B AI infrastructure fund. I think that when such superstars like these three companies decide to partner and pour billions into the project, it is highly likely that the AI momentum is still extremely hot. The company’s CEO, Hock Tan, sees vast opportunities for his company for the next 3-5 years as he predicts that cloud hyper-scalers are highly likely to build a million-accelerator cluster. This expansion represents a significant opportunity for Broadcom, as these clusters will require exponentially more compute power, which the company plans to supply through its innovative XPUs.

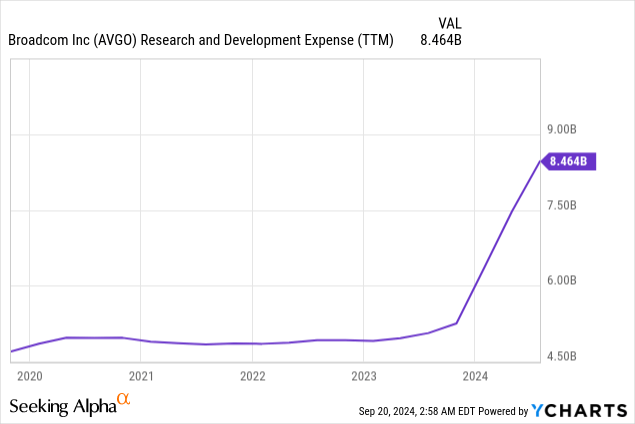

Broadcom has gotten itself prepared for expected accelerated spending in these clusters, as its R&D spending has skyrocketed over the last couple of years. Broadcom’s R&D projects appear to be quite efficient. Some promising upgrades and features were rolled out during the recent VMWare Explore 2024 event.

Broadcom announced VMware Cloud Foundation [VCF] 9, delivering key upgrades to reduce complexity and add more value to private cloud operations. VCF 9 provides a unified platform for operations and automation that reduces management consoles to one, simplifying the entire infrastructure deployment and operations. It also offers advanced memory tiering to boost performance for applications that are memory-intensive, such as AI and real-time analytics. It now supports integrated multi-tenancy and native deployment to deliver increased efficiency in managing resources across the infrastructure and faster provisioning of workloads. There are also enhancements to security with unified security management and advanced data protection features. These latest updates make it easier for businesses to innovate and run their operations in the cloud, without any compromises on performance, efficiency or security.

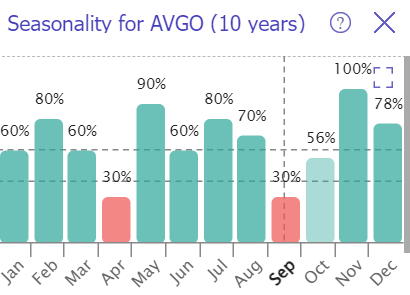

TrendSpider

Another good piece of news is that we are closer to the end of September, the weakest month for AVGO according to its historical seasonality patterns. While October has been historically mixed, the above bar chart suggests that November and December are extremely favorable months for AVGO investors.

Valuation update

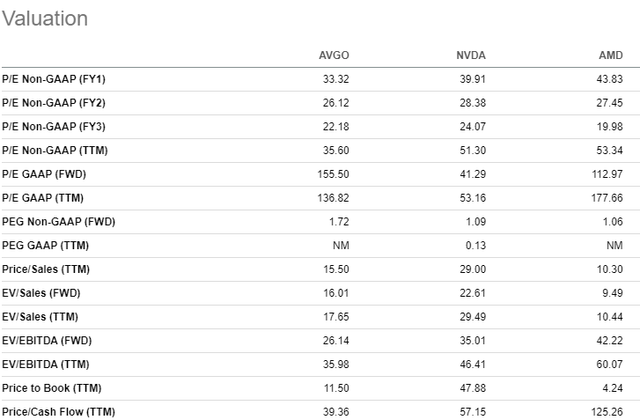

The stock rallied by 97% over the last twelve months and boasts a 50% YTD rally, substantially outperforming the broader U.S. market. Valuation ratios of Broadcom are always high compared to the sector median. On the other hand, since Broadcom is one of the biggest AI darlings, I prefer to compare its multiples to two other large AI winners which are Nvidia (NVDA) and Advanced Micro Devices (AMD).

AVGO’s valuation ratios are lower compared both to NVDA and AMD almost across the board. NVDA’s much higher multiples are justified by unmatched revenue and EBITDA growth. But AMD is far behind AVGO in terms of both YoY and FWD revenue growth, but its multiples are much higher compared to AVGO. Therefore, the stock looks quite attractive based on peer analysis.

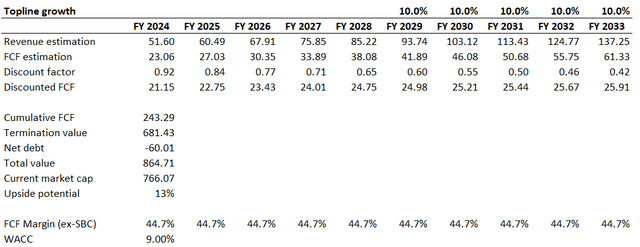

To calculate the upside potential, I need to simulate the discounted cash flow [DCF] model. A 9% WACC is in line with a recommended range from valueinvesting.io, which I consider a reliable source.

The revenue growth trajectory for the next decade is a combination of consensus estimates [FYs 2024-2028] and a 10% revenue CAGR for the years beyond. As a result, we have an 11% CAGR for the entire horizon, approximately in line with long-term growth forecasts for the semiconductor industry. The trailing twelve months FCF ex-stock-based compensation margin is 44.7%, and it is a very high level. Forecasting further expansion from here might be an extremely aggressive assumption even for AVGO. Thus, I prefer to use this level flat for the whole decade.

The business’s fair value is $865 billion, around 13% above the current market cap. Such a discount for a profitability and growth star like AVGO is a gift, in my opinion.

Risks update

With a strongly acquisitive strategy, Broadcom faces risks. Integrating previously acquired companies can introduce inefficiencies and disruption. The cost of acquisitions might increase debt levels and stretch the balance sheet. The company risks overpaying for the acquired businesses, and then suffering poor returns if they underperform. A fast pace of acquisitions might distract management from core operations. Large deals can draw regulatory scrutiny in the form of antitrust reviews. Such reviews can delay or even block deals.

Risk of high revenue concentration is another key risk for AVGO, with sales to the top 5 end customers accounting for approximately 35% of the total FQ3 FY2024 net revenue. This means that Broadcom’s financial health can be influenced by a material change in any of these relationships. The greatest risk is the loss of a key customer, which would lead to a material reduction in revenue. The customers in this group can also be considered a group with significant bargaining power. Any increase in their negotiating leverage would likely lead to a material reduction in Broadcom’s profit margins. If market volatility, which affects these key customers, materializes and causes a decline in revenue, the financial health of the company will be impacted.

It is well-known that Broadcom’s chips are integral to Apple’s (AAPL) iPhone, its iconic product. The iPhone continues to hold strong in the overall U.S. smartphone market and in North America as a whole, but it has lost some market share in China, which has become an important market for Apple, over the past few quarters. If Apple continues to lose out in China, it is likely that Broadcom’s financial performance will take a hit too.

Bottom line

All in all, AVGO is still a “Strong Buy”. The increasingly fast revenue growth and rapidly increasing profit margin of the company are evidence of the successful integration of VMware into Broadcom. The easing of monetary policy will likely result in a boom for data center investment, and a number of large tech companies are launching new business initiatives that will bring tens of billions in investment to data center development.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AVGO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.