Summary:

- Broadcom is expected to report stronger-than-expected Q3’24 earnings, driven by a rebound in networking equipment sales and VMware’s transition to a subscription model.

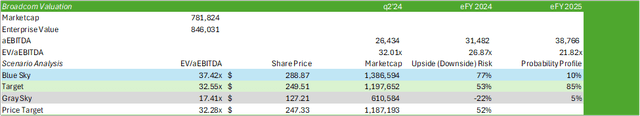

- Analysts have revised EPS expectations upwards, and I maintain a BUY rating with a price target of $247/share, based on a 32.28x eFY25 EV/aEBITDA.

- Broadcom’s growth is fueled by demand for AI-enabled infrastructure, faster interconnections, and improvements in VMware’s sales, targeting a $4b run rate.

G0d4ather

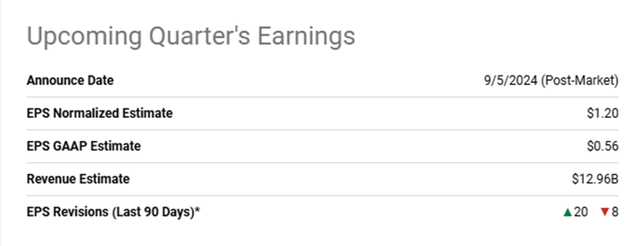

Broadcom (NASDAQ:AVGO) will be releasing their eq3’24 earnings on September 5, 2024, after market close. Given the sequential rebound in networking equipment sales in CYq2’24 by companies like Cisco (CSCO) and Arista Networks (ANET), I have reason to believe Broadcom will realize a stronger-than-expected quarter.

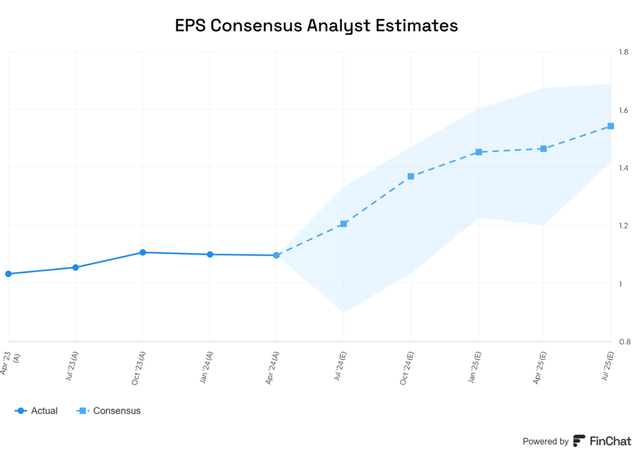

Analysts have revised expected EPS in the last 90 days up 20x and down 8x, suggesting a strong skew to the upside. Given my forecast for eFY25 operations, I am reiterating my BUY rating for AVGO shares with a price target of $247/share at 32.28x eFY25 EV/aEBITDA.

You can review my previous report covering AVGO here:

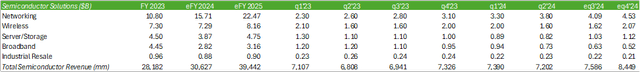

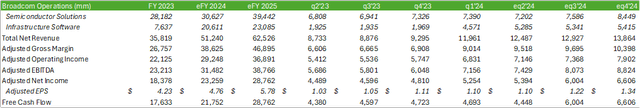

Consensus estimates for eq3’24 are $12.9b in revenue and an EPS of $1.20/share. My forecast for the quarter is $12.9b in revenue and an EPS of $1.22/share. For all of eFY24, I’m forecasting Broadcom to generate $51.24b in net revenue and an EPS of $4.76/share. Much of the growth is driven by the post-bottoming of network equipment sales and the conversion from perpetual licenses to SaaS for VMware.

Investment Thesis For Broadcom

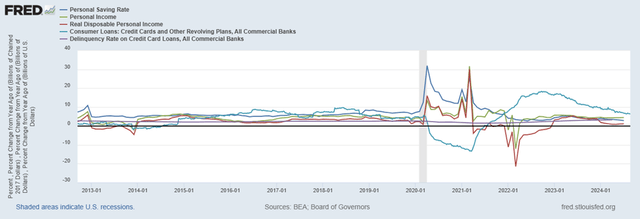

Broadcom has built out their expertise across traditional compute and AI acceleration chips that coexist with GPUs for acceleration. Network equipment integrators, such as Cisco and Arista Networks, have each suggested that the network equipment inventory digestion is behind enterprises and that sales are recovering sequentially. This should be a strong indicator for Broadcom that sales for their DSPs, optical lasers, and PIN diodes will improve as AI data centers begin rolling out faster interconnects, such as 800G bandwidth, and inevitably 1.6T connectivity. The improved network requirements may be driven by the next generation of GPUs hitting the market, such as Nvidia’s (NVDA) Blackwell architecture or Advanced Micro Devices’ (AMD) MI400.

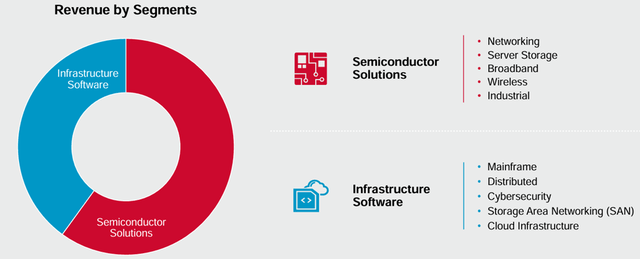

Broadcom Operations

Q2’24 was the first quarter Broadcom reported a full quarter inclusive of VMware. Total infrastructure increased by 175% to $5,285mm, $2.7b of which was the result of VMware. VMware sales improved by 28% on a sequential basis from $2.1b, suggesting that the firm’s transition from licensing to a subscription-based model is working to the firm’s advantage. Around 3,000 of the largest 10,000 VMware customers have transitioned to the self-service model that Broadcom has enabled. Given the growth trajectory, management forecasts VMware to reach a $4b run rate; however, the target date remains unknown.

Management unveiled their strategy to gear VMware towards this $4b run rate on August 27, 2024. This includes a combination of fixed wireless access and satellite connections to support the VMware VeloCloud Edge 710 and the introduction to their VMware VeloCloud Edge 720 and 740 appliances, VMware VeloCloud SASE and Edge Compute Stack to enhance the product offering.

From a cost perspective, management continues eliminating redundant functions, incurring $2b in restructuring and integration charges in 1h24. Management forecasts VMware margins to improve towards the “classic Broadcom” software margin by eFY25.

Looking at the semiconductor subsegments, I have reason to believe that networking will continue its sequential growth trend as networking equipment sales continue to improve as reported by the equipment aggregators. I believe much of the growth within Broadcom’s networking subsegment will be driven by the increasing demand for faster interconnections for AI-enabled infrastructure as more enterprises and hyperscalers invest in GPUs. Within networking, Broadcom doubled the number of switches sold on a year-over-year basis, driven by PAM-5 and Jericho 3. These products were deployed in collaboration with Arista Networks, Dell (DELL), Juniper (JNPR), and Super Micro Computer (SMCI). Looking further down the road, management anticipates releasing Tomahawk 6 in late 2025.

I’m forecasting wireless to remain relatively flat on a year-over-year basis given the flat handheld device market. I have reason to believe that consumers will not likely upgrade their handheld devices to the next generation of smartphones unless out of necessity. This thesis is primarily driven by the challenging inflationary environment as it relates to consumer spending.

Server storage connectivity may be in a position to rebound in e2h24 given the growing demand for data storage for AI/ML applications. Management suggested that q2’24 was the bottom for the subsegment and anticipates e2h24 to be the beginning of the rebound. Though Dell reported a -5% year-over-year decline in storage sales in their recent q2’25 report, this was a sequential improvement of 5.6% sequentially.

Broadband is likely to remain in decline as telcos continue their long burn for 5g equipment. Management is forecasting this subsegment to bottom in e2h24 and recover in eFY25. The outlook for this subsegment is a decline in the high-30% range, worse than the initial guidance of low-30%.

Broadcom Financials

Looking at operations, I’m forecasting total revenue to come in at $12,927mm for eq3’24 with an aEBITDA margin of 62%. This will translate to $1.22/share in adjusted EPS and $6b in free cash flow for the quarter. I believe growth will accelerate across segments in eFY25 as network equipment sales improve across Broadcom’s customers paired with a stronger server/storage market. I do anticipate wireless to grow at a higher rate in eFY25 with the expectation of improvements to the next generation of AI-enabled smartphones.

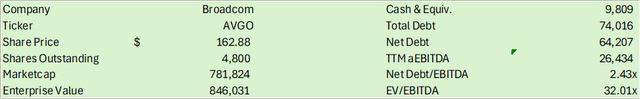

Looking at Broadcom’s balance sheet, management remains adamant in paying down their floating rate debt. The firm paid down $2b in q2’24 with an additional $4b expected to be paid down in equal increments throughout the duration of eFY24. As of q2’24, Broadcom has $9.8b in cash on the balance sheet, providing the appropriate bandwidth to pay down in these increments from cash and operations.

Risks Associated With Broadcom

I anticipate Broadcom to realize a strong eq3’24 on the basis of infrastructure and network equipment aggregators experiencing strong CYq2’24 results. Given that Broadcom’s sales likely foreshadow the aggregator’s expected growth, my eq3’24 forecast may not align with the CYq2’24 reporting from these customers.

Bull Case

AI data centers continue to be built out with more complex requirements for higher speeds and availability. This will drive networking and server/storage sales for Broadcom as hyperscalers and enterprises turn to higher data rates for improved performance of their AI/ML models. Enterprise sales will likely accelerate as AI applications turn to production, requiring faster campus networking speeds, driving the need for investments in private data centers. The infrastructure aggregators have suggested that storage is beginning to rebound, which will turn to a return to growth for Broadcom. Management has laid out a strong roadmap for VMware in reaching a quarterly run rate of $4b in revenue, up from $2.7b in q2’24.

Bear Case For Broadcom

The current state of the economy appears to be relatively cloudy as enterprises attempt to retain margins and growth. If IT budgets remain relatively flat going forward with minimal investments towards next-generation AI infrastructure, Broadcom may not realize the same growth path and require the firm to lean more heavily into sales to hyperscalers. Broadcom may reach a breaking point in converting VMware customers to their subscription-based service, pushing out their $4b run rate target.

Valuation & Shareholder Value

AVGO shares currently trade at 32x EV/aEBITDA, the midpoint of their historical trading range for the last year. This gives me reason to believe AVGO shares are appropriately priced on a TTM basis.

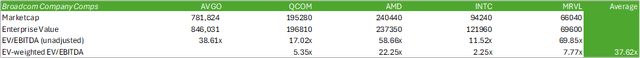

Looking at Broadcom’s peer group, AVGO shares appear to be priced at a premium above the peer weighted-average EV/EBITDA of 37.62x.

Despite this premium, I believe there is significant room for price appreciation given Broadcom’s growth strategy across semiconductor solutions & infrastructure software, particularly as a result of networking and VMware sales improvements. Using my internal valuation model based on historical trading premiums, I believe AVGO shares should be priced at $247/share at 32.28x eFY25 EV/aEBITDA. I reiterate my BUY rating for AVGO shares with an expected price appreciation of 52%.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.