Summary:

- Broadcom Inc. is one of the main beneficiaries of AI spending, rewarding shareholders with a 52% year-to-date gain.

- Broadcom’s booming AI-related chip sales and successful acquisition of VMware position the company well to lower Apple’s dependency.

- This BBB-rated company is one of the best bets to play the AI investment theme with 25% of the sales generative by AI chips, with a long growth runway ahead.

- Despite its wide-moat, Broadcom’s forward valuation carries significantly less premium compared to its peers NVDA and AMD.

- I rate Broadcom as BUY, being one of the best AI companies money can buy today, with a share price target of $200 by the end of the year.

G0d4ather

Broadcom Inc. (NASDAQ:AVGO) has been one of the main beneficiaries of the AI investment narrative, ever since Chat-GPT’s introduction in November 2022, showcasing to the world the power of generative AI solutions.

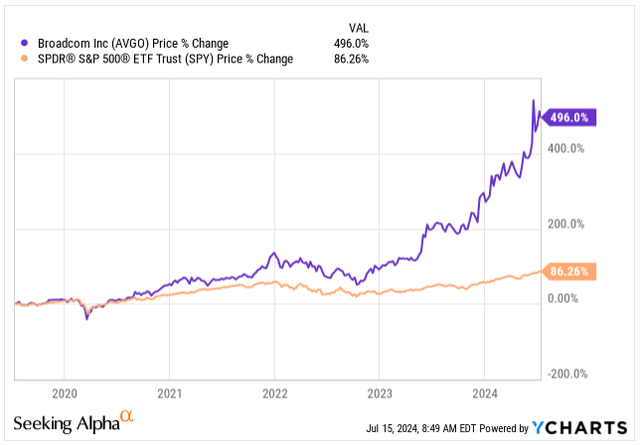

Broadcom is a true example of a compounder at its finest. The company has a very healthy balance sheet with a triple-B rating from S&P Global and the stock is up 496% in a span of the last 5 years, thanks to its best-of-breed custom chips offering designed for specific needs of major companies like Apple (AAPL), Cisco Systems (CSCO) and Google (GOOGL).

Price Development (Seeking Alpha)

Partially helped by the 10:1 stock split effective as of 15th July, making the stock more accessible to a wider range of investors and employees, Broadcom is up 52% year-to-date, compared to less than 18% gain of S&P 500.

The parabolic rise in the stock’s price shouldn’t scare you. Instead, it is well-supported by the improving fundamentals, with Broadcom’s impressive operational efficiency, generating massive cash flow, while trimming unnecessary expenses.

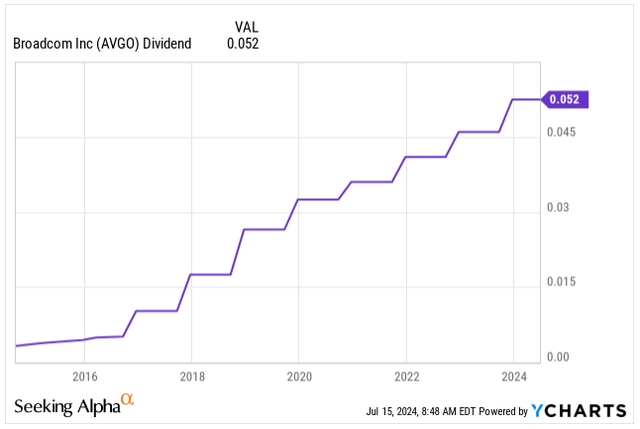

As a dividend growth investor in my heart, it’s difficult to find a better place to be, than invested in Broadcom.

Following the superb performance, the company offers a rather unattractive 1.2% dividend yield, however, in the last 10 years alone, the dividend grew by 1,540% with much more room for growth in the future supported by very effective capital allocation and benefiting from the AI booming spending.

Dividend Per Share (Seeking Alpha)

Broadcom’s unique custom chip offering sets it apart from competitors such as Nvidia (NVDA), Intel (INTC), and Advanced Micro Devices (AMD) which offer predominantly one-fits-all solutions. This differentiation positions Broadcom exceptionally well as AI spending booms, unlocking major growth in its networking semiconductor sales.

The company is no longer a bargain, trading at a Forward P/E of 35.6x for its FY24 forecasted earnings, well above its historical valuation standards, however, we need to be mindful of the new growth driver.

Broadcom remains relatively cheaper compared to Nvidia and AMD, so what’s next for the company and is it a good investment after its parabolic rise?

Broadcom’s Business Overview

The chances are you are already well-acquainted with Broadcom’s business, thanks to its massive $791B market cap, placing it in the 10th spot in the market-weighted S&P 500 with 1.6% weight.

However, in case you are not familiar, Broadcom is predominantly selling semiconductor hardware focusing on so-called, application-specific integrated circuits better known as (ASICS), or simply put custom chips.

Custom chips are more of a niche product, compared to the GPUs sold by Nvidia which are one-size-fits-all in data centers, and that’s precisely what makes Broadcom unique with a more diversified portfolio.

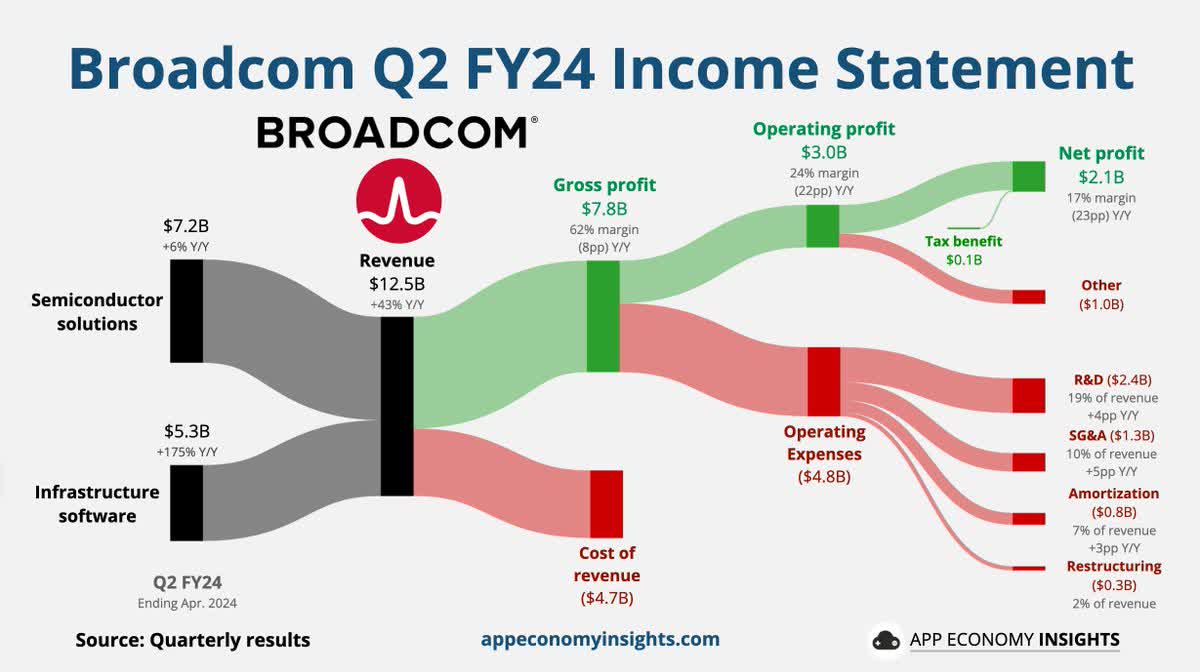

The networking and wireless chips business segments are Broadcom’s crown jewels responsible for its market-dominant position today with semiconductor sales representing 58% of its revenue during Q2 FY24.

AVGO Q2 Earnings (App Economy Insights)

The custom chips, designed specifically to meet the unique needs of its customers, pose the risk of overreliance on a single customer.

That used to be the case for Broadcom as well with its thin-film bulk acoustic resonator which the company is exclusively selling to Apple for iPhones, representing 20% of the chipmaker’s revenue in 2023 and 2022. One can argue Apple’s success of the last decade contributed to Broadcom’s growth significantly.

Over the years, Broadcom has built strategic partnerships with other major equipment vendors such as Arista Networks (ANET) and Cisco Systems.

Even as Broadcom’s business experiences organic growth, the majority of its past success can be attributed to strategic acquisitions of small and large firms alike, which helped to shape the portfolio and improve operational efficiency by cutting costs and streamlining its business. The company has proved to be a superb capital allocator with 30% ROE and 12% ROI in the past 5 years, well above the industry’s averages.

In order to tackle semiconductors and Apple’s sales dependency, the company has been strategically acquiring companies in the infrastructure software space acquiring CA Technologies back in 2018, Symantec’s security division in 2019, and as of 2023, the multi-cloud provider VMware for a staggering $61B.

The acquisition of VMware should help to de-risk Broadcom’s portfolio, bringing more balance with highly competitive software sales expected to reach up to 50% of the company’s revenue over the medium term.

Instead of chasing small deals, Broadcom is strategically targeting large enterprises and governments with its infrastructure software offerings as the switching costs tend to be much higher, ensuring lasting business partnerships.

What’s Next for Broadcom?

739%.

That’s how much revenue growth Broadcom has delivered in the past decade.

Naturally, moving forward, replicating similar top-line growth will be a challenging task thanks to its already substantial size.

Yet, after the management has raised its forecast from an initial $50B, the revenue is expected to hit $51B in FY24, growing 39% YoY mostly thanks to the inorganic growth from VMware.

Still quite conservative guidance in my opinion, however, the management has signaled more cost-cutting as initially expected for VMware, which should further help to expand, the already high margins.

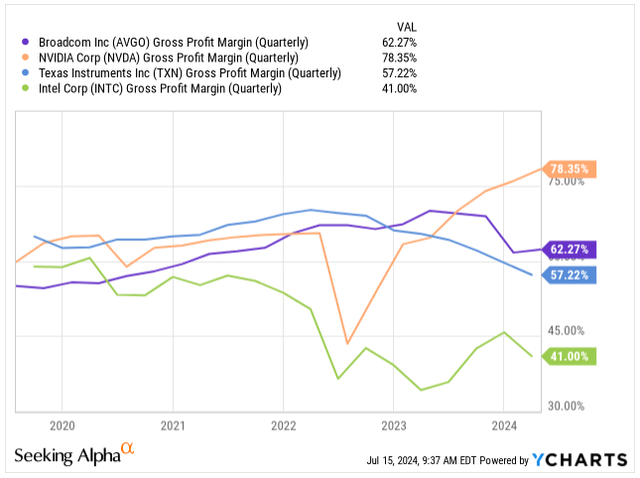

Gross Margin Comparison (Seeking Alpha)

If we look at the Q2 FY24 earnings through a lens of organic growth instead, the revenue has grown by 12% YoY with AI sales being responsible for almost all of the growth.

Broadcom is indeed seeing a positive shift with strong demand for networking chips, and AI accelerators used in generative AI infrastructure. The sales of AI Broadcom’s AI chips increased 35% YoY, reaching $3.1B in Q2.

The AI chips are now poised to reach $11B in sales this fiscal year, which would represent 25% of the company’s sales. From my point of view, this is still quite a conservative estimate and management is being cautious in case the economy takes a turn, hindering the AI spending narrative by majors such as Google, Meta Platforms (META), and Microsoft (MSFT).

If the bull case for AI persists, Broadcom is extremely well-positioned to keep benefiting from generative AI spending being the 2nd largest semiconductor company behind Nvidia. If Broadcom manages to keep the AI chips growth rate at around 35%, in the following fiscal year, the AI sales have the potential to account for more than 32% of the company’s sales.

However, let’s not forget that for now Broadcom’s 33% semiconductor sales come from non-AI applications and this area of business is under threat with sales falling 30% YoY, thanks to the cyclical downturn in the legacy economy, witnessed by other chip-makers alike.

Analysts are forecasting the generative AI market could reach $1.3T by 2032, growing at a staggering annualized rate of 42%. The expectation is that AI infrastructure and large language model training are the key areas to see booming spending before the industry shifts towards more customer-oriented used cases, benefiting Broadcom greatly.

Valuation

The key area of concern, as with all companies with a strong momentum, is the valuation.

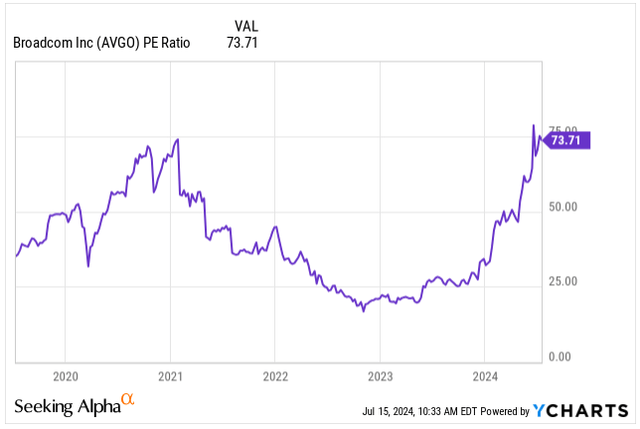

Looking at the valuation through a standard P/E ratio does not make much sense. As you can see below, the P/E ratio right now is at 73.7x its earnings, well above the average of its past 5 years.

Instead, understanding the forward growth and how long the company can compound is the key.

The analysts polled by S&P Global are forecasting the following growth in the next years:

- Expected EPS in FY24: $4.78, YoY growth of 13%

- Expected EPS in FY25: $6.00, YoY growth of 26%

- Expected EPS in FY26: $6.95, YoY growth of 16%

The analysts’ track record has always been rather conservative, with Broadcom delivering 60% of the time above their forecasts, while 40% of the time the company has hit the projections.

As a result of the conservative EPS growth forecasts, Broadcom’s forward P/E valuation is on the rather pessimistic side as well:

- Forward P/E FY24: 35.6x

- Forward P/E FY25: 28.3x

- Forward P/E FY26: 24.4x

Yet, Broadcom’s valuation implies a significantly lower premium compared to Nvidia’s forward valuation (FY Adjusted):

- Forward P/E FY25: 48.3x

- Forward P/E FY26: 36.4x

- Forward P/E FY27: 31.3x

And similarly to AMD’s forward valuation:

- Forward P/E FY24: 51.7x

- Forward P/E FY26: 33.4x

- Forward P/E FY24: 24.7x

From the data, we can see that Broadcom’s valuation in fact carries the least premium in each of the subsequent years with the EPS growth already embedded inside of the forward valuation.

I view Broadcom as one of the best AI plays money can buy today, carrying the least premium in relation to its peers while having a wide moat, a well-diversified portfolio of hardware and software, and sustainable EPS growth.

I anticipate that Broadcom’s shares will trade around $200 per share by the end of the year, implying an 18% upside from today’s share price, boosted by stronger-than-expected AI-chip-related sales, reaching at least $13B by the end of FY24 with a positive momentum into FY25.

Takeaway

All in all, Broadcom is the 2nd best bet on the AI spending behind Nvidia.

Even though only 25% of Broadcom’s sales are generated by chips with AI applications, particularly its networking and accelerator chips, the company is seeing tremendous demand.

The AI chips experienced 35% YoY sales growth in Q2, expected to keep growing in the following years as the AI spending booms and the generative AI industry grows at an unprecedented rate.

The strong demand for AI chips, alongside the successful acquisition of VMware, helped Broadcom to diversify away from Apple’s 20% sales dependency in the past 2 years while maintaining industry-leading profit margins.

As with most companies with strong momentum, the valuation remains a challenge, yet I view Broadcom at today’s price in relation to its forward EPS growth as reasonably priced with a BUY rating.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AVGO, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.