Summary:

- Broadcom Inc.’s AI business grew by 280% year-over-year in Q2 FY24, with networking products driving growth.

- The company anticipates AI revenue will reach 25% of group revenue by FY24.

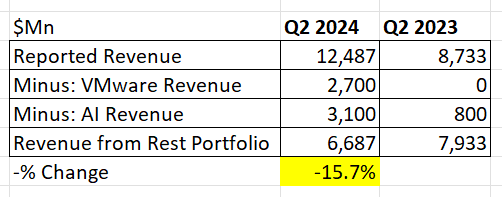

- Broadcom’s legacy software businesses are a concern, with revenue declining by 15.7% year-over-year in Q2 FY24.

JHVEPhoto

I had a “Sell” rating for Broadcom Inc. (NASDAQ:AVGO) in my previous report, highlighting its strong growth in the AI semiconductor business and the issue of holding numerous legacy software businesses. The company released its fiscal Q2 FY24 results on June 12th with the AI business growing by 280% year-over-year. The company anticipates its AI revenue will reach 25% of group revenue by FY24.

I appreciate Broadcom’s position in the AI networking and storage markets; however; I am not comfortable with its other legacy portfolios. I maintain a “Sell” rating with a fair value of $1,200 per share.

Strong Growth in AI and Weak in Other Businesses

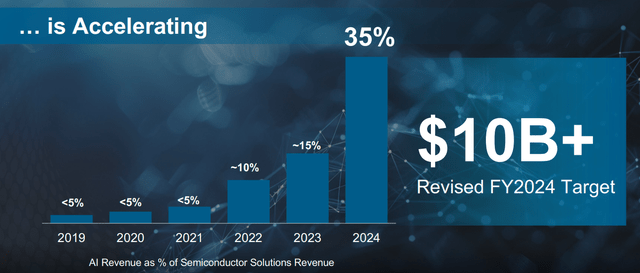

As discussed in my previous coverage, Broadcom has a highly differentiated portfolio in the AI semiconductor business. In Q2 FY24, its AI revenue reached $3.1 billion, growing 280% year-over-year, which is quite remarkable. The primary growth driver is its AI networking products, achieved through partnerships with major networking vendors including Arista Networks, Inc. (ANET), Dell Technologies Inc. (DELL), and Super Micro Computer, Inc. (SMCI). Broadcom’s networking business grew by 44% year-over-year, representing 53% of its total semiconductor business. The company anticipates its AI business will reach 35% of total semiconductor revenue, or 20% of group revenue by FY24, as depicted in the chart below.

Broadcom Investor Presentation

In the near future, I anticipate its AI business will continue to grow for the following reasons:

- Hyperscalers and enterprises are rapidly deploying data centers for AI machine learning and inference workloads. The AI training and inference workloads necessitate tremendous demands on networking devices, connecting GPU and servers.

- As discussed in the earnings call, Broadcom is leading the transition of optical interconnects in AI data centers to 800 gigabit bandwidth. The technology transition could potentially accelerate Broadcom’s growth in Ethernet switching and routing silicon, optical, and copper PHYs, as well as fiber optic transmitters.

- Broadcom is also working with major hyperscalers to develop their own AI accelerators. As reported by the media, Broadcom won the deal with Alphabet Inc. (GOOG), (GOOGL) to develop Google’s AI chip, the TPU v7. In addition, Broadcom is working with Meta Platforms, Inc. (META) with its 3rd generation AI chip (MTIA 3). Broadcom and Marvell Technology, Inc. (MRVL) are the only two companies capable of providing custom silicon to hyperscalers.

I fully understand the market favors Broadcom because of its AI-related business; however, it is worth noting that AI business will only represent 20% of total revenue by FY24. Broadcom still has lots of legacy business lines.

The following table is used to calculate the growth from Broadcom’s other businesses, excluding the impact of VMware acquisition and AI growth. The revenue from the rest of the portfolio decreased from $7.9 billion in Q2 FY23 to $6.6 billion in Q2 FY24, indicating a 15.7% year-over-year decline.

Broadcom Earnings, Author’s Calculations

As emphasized in my previous reports, I believe their historical acquisitions were focused on legacy software businesses. Specifically, its acquisitions of CA Technologies and Symantec are not smart moves, in my opinion. CA Tech is servicing the legacy mainframe market, and Symantec is losing its competitive advantages to new cybersecurity players such as Palo Alto Networks, Inc. (PANW), CrowdStrike Holdings, Inc. (CRWD) and Zscaler, Inc. (ZS) etc. Symantec is not well positioned in some fast-growth markets like end-point security, cloud, and identity security.

WMware Update

As hinted over the earnings call, since Broadcom acquired WMware, Broadcom started to change VMware’s 8,000 products to four core offerings, strengthen the sales force, and eliminate channel conflicts. The company has made solid progress toward a subscription licensing model. While Broadcom is on the right path to integrating VMware’s business, I think the transition from a perpetual licensing model to a subscription could present some potential renewal risks for VMware’s existing customers.

Many enterprise customers purchased VMware’s data center virtualization because of the perpetual licensing model, which does not require ongoing fees for the virtualization services. However, with the subscription model, customers might consider other alternatives such as Microsoft Corporation’s (MSFT) Hyper-V. Additionally, small customers might consider using Proxmox, an open-source solution for virtualization.

It is too early to judge if VMware can succeed in its business model transition; however, it does create plenty of uncertainties for the future.

FY24 Outlook & Valuation Update

For the FY24’s growth, I am considering the following factors:

- AI revenue: Broadcom generated $4.2 billion in AI revenue in FY23 and $3.1 billion in Q2 FY24. Based on the current run rate, it is highly likely that the company can reach $10 billion in AI revenue in FY24, assuming the current rapid growth in AI persists in the near future.

- VMware: The business is potentially reaching a run rate of $11-$12 billion in FY24, as communicated over the earnings call. With the transition towards a subscription model, VMware could potentially have a higher recurring business model. Having said that, I expect VMware is going to lose some customers due to its business model change. To be conservative, I assume VMware will contribute $10 billion in revenue in FY24.

- Rest of the Business: The rest of the businesses generated around $31.6 billion in revenue in FY23. Specifically, the broadband business will face a challenging year in FY24, as telcos are cutting their investments and related operating costs. Industrial business is going to decline due to weak industrial activities in factory automation, renewables, and the automotive market. Assuming a flattish growth rate for the rest of the portfolio, the total revenues would be around $51 billion in FY24.

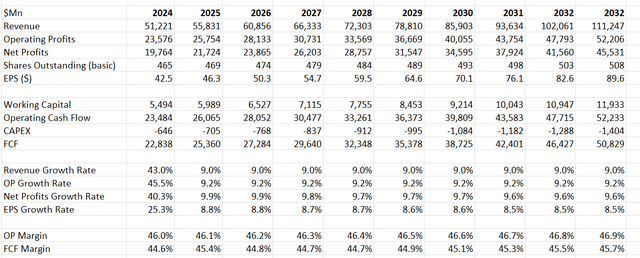

For the growth beyond FY24, I am assuming:

- AI-related business will grow by 30%+, aligning with the overall AI computing market growth. The AI business will contribute 6%+ growth to the topline, based on my calculations.

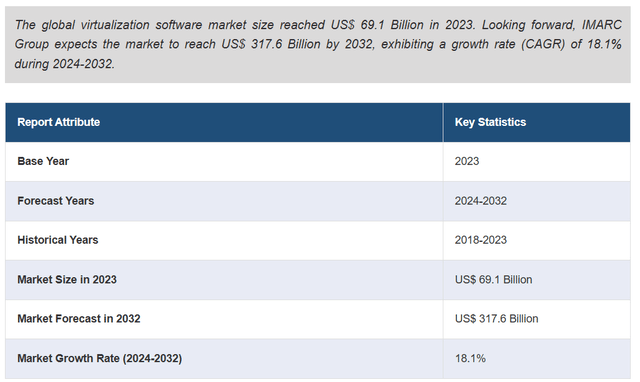

- VMware: Imarc Group predicts the global virtualization software market will grow at a CAGR of 18.1% from 2024-2032, driven by the increasing demand for computing.

Worth noting is that the virtualization software market is a highly competitive market, and it is unknown whether VMware’s business model transition could be successful. Therefore, I assume VMware will grow by 15% annually, contributing 3% growth to the top line.

- I continue to believe Broadcom’s legacy business will continue to experience structural decline or low growth in the future, particularly in their mainframe, antivirus, and wireless, etc. I assume no growth for the rest of the businesses in the future.

Putting together, I calculate Broadcom can grow its revenue by 9% beyond FY24. The margin expansion will primarily come from operating leverage from its COGS. The gross margin for its semiconductor business is significantly lower than its software business; therefore, a fast-growing AI business will cause near-term pressure on its gross margin.

In the model, I calculate that Broadcom will grow its operating expenses by 8.7% from FY25, resulting in 10bps margin expansion. The DCF summary can be found below:

Broadcom DCF – Author’s Calculations

The WACC is calculated to be 8.12% assuming: a risk free rate of 4.2% (US 10Y treasury yield); a beta of 1.36 (Seeking Alpha); an equity risk premium of 7%; a cost of debt of 7%; tax rate of 10%; equity balance of $24 billion; and debt balance of $74 billion.

Discounting all the future free cash flow, the fair value is calculated to be $1,200 per share.

Risks

- High Debt Level: Broadcom ended the quarter with $74 billion in gross debts and $9.8 billion in cash. During the quarter, they repaid $2 billion of floating debts at a 6.6% interest rate. The company plans to continue repaying its debt for the remainder of the year. As a semiconductor company, I prefer they have a small amount of debt on its balance sheet.

- Shares Dilution: Due to the acquisition of VMware, the number of total shares outstanding increased by 12% year-over-year. While the company repurchased $5.8 billion of its own shares in FY23, its total shares were up 1.5% as the shares buyback couldn’t fully offset the stock-based compensations.

As my thesis is a “Sell,” I am thinking about what could continue sending its stock price higher in the future. The near-term upside catalyst should be the ramp-up of AI accelerators co-developed with hyperscalers including Meta and Alphabet. When these hyperscalers start to use these chips in their cloud platform for AI computing, the market could potentially be over-optimistic about Broadcom’s growth prospects in the future.

Conclusion

I am encouraged by Broadcom Inc.’s strategic position in the AI networking, storage, and custom silicon market. However, investors need to be aware of the company’s legacy portfolios, which declined by 15% in the quarter. I maintain my “Sell” rating for Broadcom Inc. stock with a fair value of $1,200 per share.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.