Summary:

- My previous Broadcom earnings preview aged quite successfully, and today, I want to share my opinion about the Q4 earnings release scheduled for March 7.

- I am optimistic about the upcoming earnings release and think that consensus EPS estimates are too conservative, and AVGO will likely deliver a solid beat.

- My valuation analysis suggests that the stock is still very attractively valued.

Justin Sullivan

Investment Thesis

My previous Broadcom (NASDAQ:AVGO) bullish earnings preview aged extremely well, because the stock surged after the strong previous earnings release. Since early December 2023, the stock rallied by more than 50%, substantially outpacing the broader U.S. market. Today, I want to update my thesis about the company, and it is pre-earnings period for AVGO once again. Therefore, I am also previewing the upcoming earnings release as well. AVGO delivered a solid previous quarter and a massive revenue growth in Q4 is projected by consensus. On the other hand, the bottom line is expected to be almost flat, and I cannot agree with it since AVGO historically demonstrated a solid correlation between the revenue growth and profitability expansion. Recent developments in the AI industry also suggest that the management is likely to be optimistic about the company’s nearest future. Furthermore, my valuation analysis suggests that the stock is still very attractively valued. All in all, I reiterate my “Strong Buy” rating for AVGO.

Recent Developments And Earnings Preview

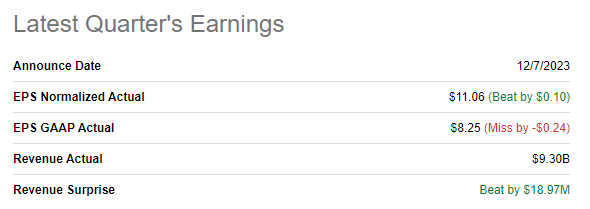

I am not going deep into the previous earnings release, but I have to highlight that AVGO slightly topped consensus estimates and provided a notable guidance boost during the FQ4 2023 earnings release. Revenue grew YoY by 4% and the adjusted EPS expanded from $10.45 to $11.06.

Seeking Alpha

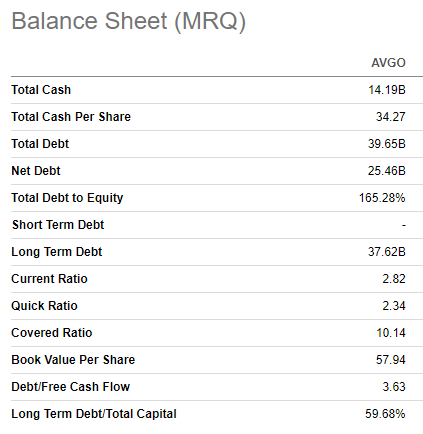

The EPS improvement was achieved thanks to the operating margin YoY improvement by almost one percentage point. For a large-scale business like AVGO, expanding the operating margin is usually a bullish sign to me, indicating that the management consistently seeks for the operating excellence. The free cash flow [FCF] shrank by about half a billion, but there was a more aggressive deleveraging in Q4, which is also good for investors. Overall, with a $3 billion FCF, the company’s balance sheet improved and AVGO had $14 billion in cash as of the latest reporting date.

Seeking Alpha

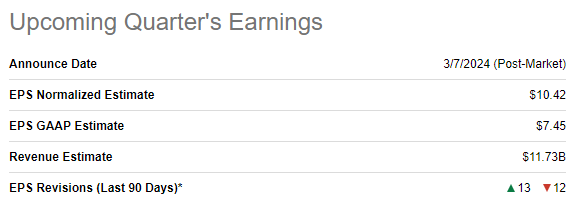

With the last quarter’s performance and financial position discussed, I am now free to proceed with my forward-looking analysis. The upcoming earnings release is scheduled for March 7. Q1 revenue is projected by consensus at $11.7 billion, a massive 31% YoY growth. I would also like to emphasize that a 26% sequential growth is projected, while last year the dynamic between Q4 2022 and Q1 2023 was almost flat. Despite an expected massive revenue growth, consensus expects the adjusted EPS to be almost flat on a YoY basis, which does not look sound to me. During the latest earnings call, there were no indications from the management that could have hinted at potential margin deterioration. Therefore, I believe that EPS estimates are way too conservative, and a beat is very likely here if the company delivers the expected revenue growth. It is also crucial to know that AVGO’s earnings surprise history has been flawless since FQ1 2020, which adds to my optimism as well.

Seeking Alpha

The company continues refining its portfolio of assets after last year’s VMWare acquisition in order to exclude units that are overlapping and do not create synergies. According to the latest news, AVGO’s End-User Computing Division will be divested in a transaction valued at about $4 billion. Given the scale of AVGO, these divestments are unlikely to significantly affect earnings or valuation, but the good part is that the divested units will not require the management’s involvement anymore. Apart from seeking a more efficient corporate structure, AVGO also continues paying a lot of attention to innovation. Several new developments across 5G and Edge Computing were presented by VMWare during the recent Mobile World Congress. Therefore, I am unsurprised that Citi recently called AVGO among the top names to benefit from the robust secular trends for AI.

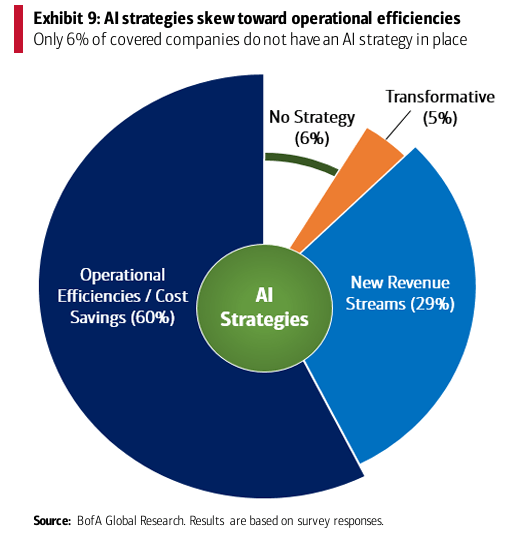

The rapid expansion of AI capabilities is a big secular tailwind for AVGO. In my recent article about Super Micro Computer (SMCI), I mentioned that analysts from BofA Securities expect the AI servers market to compound at a 50% CAGR over the next three years, which suggests massive demand for hardware that is capable of meeting requirements from AI models. The recent public speech from NVIDIA’s CEO, Jensen Huang, also adds optimism to me. He said that it is likely that the generative AI-driven demand is likely to remain robust within the next five years.

BofA Global Research

The AI trend indeed does not look like just hype. According to a survey from BofA, only 6% of 3,500 companies surveyed in the U.S. do not have an AI strategy. The vast majority, 60% of these companies expect AI to help drive operating efficiencies and/or cost savings. That said, it is highly likely that businesses will continue investing consistently in generative AI capabilities. Therefore, I expect the management of AVGO to be quite optimistic about the company’s foreseeable future during the upcoming earnings call.

Valuation Update

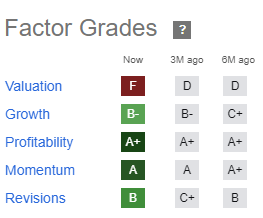

The stock more than doubled over the last 12 months with a 135% rally. The start of 2024 was also quite optimistic, with a 25% YTD stock price increase. Overall, the stock currently trades at an all-time high. Valuation ratios are high, but overvaluation from the multiples perspective is inherent in the stock. AVGO had a low “D” valuation grade from Seeking Alpha Quant three and six months ago. Therefore, I think it is better to refer to the discounted cash flow [DCF] approach.

Seeking Alpha

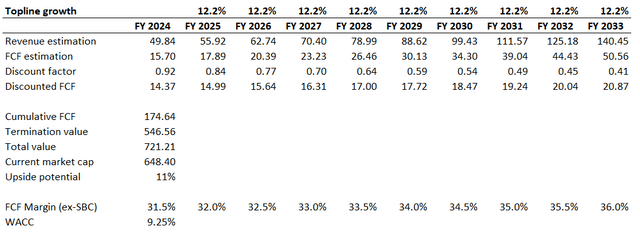

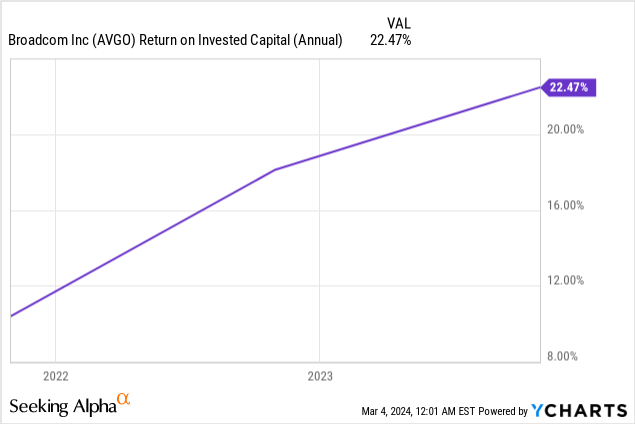

Last time I used a 10% WACC, but it was before the Fed announced three rate cuts in 2024. I am assuming that each cut from the Fed will be a 25 basis points decrease. Therefore, this time I am using a 9.25% WACC for AVGO. I am slightly adjusting my FCF margin assumptions to reflect the updated TTM performance, but no material changes here. For my base case scenario, I am using the same long-term 12.2% revenue CAGR, which I consider fair given all the tailwinds AVGO is poised to capture. I am also eliminating the net debt from my calculations because in the case of AVGO high debt is actually a benefit for the company and not a burden, given its sky-high ROIC in recent years.

After all amendments made to my December 2023 DCF model, it suggests that the stock is still undervalued. Calculations suggest that the company’s fair value is slightly above $720 billion, which is 11% higher than the current market cap. For a highly profitable and strategically firmly positioned company like AVGO, an 11% discount looks like a gift, in my opinion.

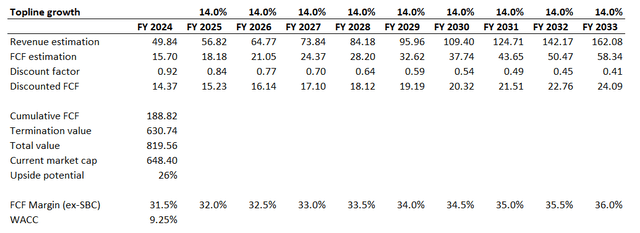

Meanwhile, we are currently in a reality where semiconductor stars are crushing earnings and boosting notably their guidance. The AI-driven demand surge for computing capacity is a big tailwind; therefore, I also want to simulate a more optimistic scenario with a more aggressive revenue growth trajectory. Upgrading the long-term revenue CAGR from 12.2% to 14% gives a big boost to the business’s fair value. All other assumptions are untouched.

With a CAGR expanded to 14%, the company’s fair value skyrockets to almost $820 billion. This is 26% higher than the current market cap, meaning the stock will highly likely surge in case of a new guidance boost. Given recent strong earnings from NVIDIA (NVDA) with solid guidance upgrades, I think there is high probability that AVGO’s management might boost guidance as well.

Risks To Consider

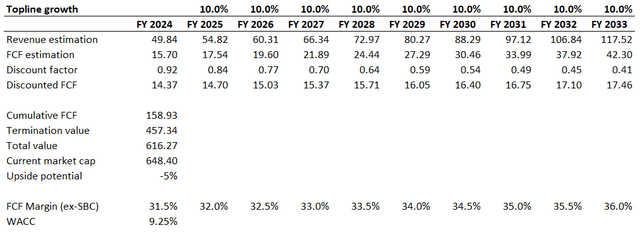

When we calculate different revenue growth scenarios, it is crucial to understand that the DCF is sensitive to changes in estimates in both ways, and a long-term revenue forecast downgrade might hit the stock’s fair price severely. I consider guidance cuts as extremely unlikely, but to balance out my thesis, it will be fair to calculate how the business’s fair value will look like in the case of a guidance downgrade. With a long-term revenue CAGR decelerated to 10%, the business’s fair value drops to $616 billion, which is 5% lower than the current market cap.

Broadcom has been historically driving its growth via strategic acquisitions. The bigger the company becomes, the more scrutiny its potential acquisitions get from regulators. For example, former U.S. president, Donald Trump blocked the deal to acquire QUALCOMM (QCOM) in 2018 due to “national security concerns”. Therefore, Broadcom can potentially face the same regulatory obstacles in the future due to antitrust issues. This in turn might limit Broadcom’s ability to sustain its stellar revenue growth trajectory.

Bottom Line

To conclude, Broadcom is still a “Strong Buy” before the upcoming earnings release. The company is well positioned in the current environment of surging demand for cutting-edge hardware compatible with high requirements from sophisticated AI models. The valuation is still attractive, and I think that consensus EPS estimates for the upcoming earnings release are very conservative and likely beatable by AVGO.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AVGO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.