Summary:

- Broadcom’s stock surged 25% following strong Q4 results, driven by the VMware acquisition and significant AI revenue growth.

- Despite impressive growth, Broadcom’s high valuation and debt levels make it a risky investment at current prices.

- Broadcom’s economic moat is debatable, but it benefits from the AI and Industry 4.0 megatrends, ensuring high demand for its products.

- Wait for a price setback before investing, as current valuations reflect FOMO rather than a sound investment opportunity.

JHVEPhoto

Friday the 13th is usually not associated with positive news, but for Broadcom Inc. (NASDAQ:AVGO) investors, it was probably a day of joy. Following fourth quarter results, the stock jumped about 25% in value. I have already written about several semiconductor companies and with AI and industry 4.0 leading to a more connected world and a high demand for chips, these companies are certainly interesting for investors in the coming decade(s).

Usually, I am searching for companies with a wide economic moat and being able to defend themselves against competitors. In the following article, we will look at Broadcom for the first time and answer not only the question if Broadcom has a wide economic moat, but also answer the question whether Broadcom is a good investment.

The Outperformer

When covering a business for the first time, I almost always start with a small business description, but you can skip this part if you are already familiar with Broadcom. The company is a leading designer, developer, and supplier of semiconductors and infrastructure software. Broadcom’s product offerings serve the data center, networking, software, broadband, wireless, storage, and industrial markets.

Broadcom December 2024 Presentation

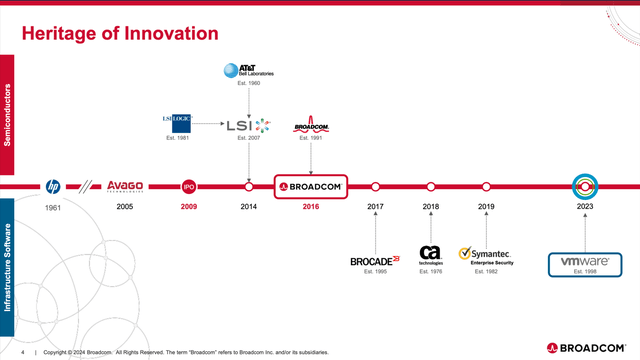

The company was “founded” in 1961 as a spin-off from Hewlett-Packard and is headquartered in Palo Alto. Today, the company is generating more than $50 billion in annual revenue, has about 40,000 employees and is among the 10 most valuable companies in the world. Additionally, the company has over 21,000 patents and therefore one of the broadest IP portfolios in the industry.

Broadcom December 2024 Presentation

One part of the company’s growth strategy was by acquisitions. And aside from the acquisition in 2016 which formed the Broadcom company as we know it today, especially the recent acquisition of VMware is worth mentioning. The acquisition was announced in May 2022 and completed in the last weeks of 2023 (beginning of Broadcom’s fiscal year 2024). Broadcom paid $61 billion in cash and stock for the acquisition, and it especially strengthened the company’s second business segment – Infrastructure Software.

Broadcom December 2024 Presentation

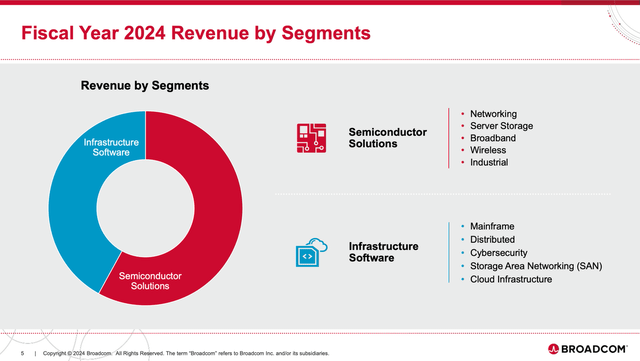

Broadcom is reporting in two different business segments:

- Semiconductor Solutions: In fiscal 2024, this segment generated $30,096 million in revenue and was responsible for 58% of total revenue. The end markets for this segment are broadband, networking, wireless, server storage and industrial.

- Infrastructure Software: In fiscal 2024, this segment generated $21,478 million in revenue and therefore 42% of total revenue. The product portfolio here consists of mainframe software, distributed software, cybersecurity, payment security as well as cloud infrastructure.

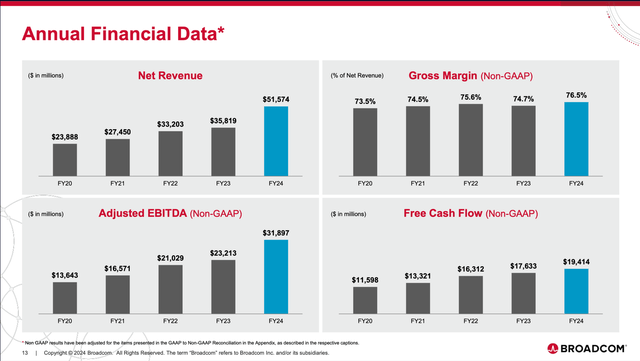

And when looking at overall results for fiscal 2024, the year was extremely successful for Broadcom. Net revenue increased from $35,819 million in fiscal 2023 to $51,574 million in fiscal 2024 – resulting in 44.0% year-over-year growth. Of course, these growth rates stemmed mostly from the VMware acquisition. Organic revenue growth – excluding the acquisition – was 9% year-over-year. Operating income declined from $16,207 million in fiscal 2023 to $13,463 million – resulting in a 16.9% year-over-year decline. But when excluding the transition costs, operating profit grew 42% year-over-year.

Broadcom December 2024 Presentation

Diluted income per share declined from $3.30 in fiscal 2023 to $1.23 in fiscal 2024 – resulting in a steep decline of 62.7% year-over-year. And finally, free cash flow increased from $17,633 million in fiscal 2023 to $19,414 million in fiscal 2024 – resulting in 10.1% year-over-year growth. When excluding restructuring and integration costs, free cash flow was $21.9 billion, resulting in 22% year-over-year growth.

Growth

When trying to answer the question if Broadcom can continue to grow with a high pace in the years to come, we can start by looking at the guidance for the next quarter. Management is expecting revenue of $14.6 billion in the first quarter of fiscal 2025 – resulting in 22% growth compared to the previous year. And adjusted EBITDA margin is expected to be 66%

But one single quarter is certainly not enough to draw conclusions for long-term investors. For the next five years – till fiscal 2029 – analysts are expecting earnings per share to grow with a CAGR of 23.5%. And not only are analysts expecting high growth rates for earnings per share in the next few years, but growth expectations were constantly raised in the recent past.

Broadcom EPS Estimates (Seeking Alpha)

One way to grow for Broadcom is by acquisitions and in fiscal 2024, Broadcom grew its top line mostly by the VMware acquisition. During the last earnings call, management pointed out that the integration was largely completed. One way to grow is by driving down spending for VMware and improving margins as a consequence. In Q4/24 spending was brought down to $1.2 billion compared to $1.3 billion in the previous year and about $2.4 billion quarterly spending before the acquisition. The operating margin before the acquisition was less than 30% and exiting 2024 it reached a margin of 70%.

Aside from the acquisition, management mentioned a second growth driver during the last earnings call – AI. In fiscal 2024, Broadcom generated $12.2 billion in AI revenue, resulting in 220% year-over-year growth – growth that stemmed especially from the strength in custom AI accelerators or XPUs and networking. And in the next few years, management is optimistic about its AI revenue as well as its non-AI revenue. During the last earnings call, management commented:

Let me outline a longer-term perspective on how we see our semiconductor business evolving over the next three years. On the broad portfolio of non-AI semiconductors with its multiple end-markets, we saw a cyclical bottom in fiscal 2024 at $17.8 billion. We expect a recovery from this level at the industry’s historical growth rate of mid-single digits. In [sharp contrast] (ph), we see our opportunity over the next three years in AI as massive. Specific hyperscalers have begun their respective journeys to develop their own custom AI accelerators or XPUs, as well as network these XPUs with open and scalable Ethernet connectivity.

For each of them, this represents a multi-year, not a quarter-to-quarter journey. As you know, we currently have three hyper-scale customers who have developed their own multi-generational AI XPU roadmap to be deployed at varying rates over the next three years. In 2027, we believe each of them plans to deploy 1 million XPU clusters across a single fabric. We expect this to represent an AI revenue Serviceable Addressable Market, or SAM, for XPUs and network in the range of $60 billion to $90 billion in fiscal 2027 alone.

Huge acquisitions often have a negative impact on the balance sheet and in the case of Broadcom, the acquisition of VMware was certainly such a major acquisition. But Broadcom did not only pay in cash but also issued new shares, limiting the impact on the balance sheet. Nevertheless, on November 3, 2024, Broadcom had $1,271 million in short-term debt and $66,295 million in long-term debt.

In absolute numbers, this sounds like a lot of debt, but we must put these metrics in relation to other numbers to determine if the debt could be a problem or not. First, we can compare the total debt to the total stockholders’ equity of $67,678 million. This results in a debt-equity ratio of 1.00. And while the D/E ratio is not perfect (it could be lower), there is certainly no reason to be worried.

However, this ratio is not the best we can use. One huge problem is, for example, the huge amounts of goodwill, Broadcom has on its balance sheet. On November 3, 2024, especially following the acquisition of VMware, goodwill was $97,873 million and therefore higher than the total stockholders’ equity. Goodwill is also responsible for 59% of total assets, and goodwill is not the kind of asset a company wants to have on its balance sheet.

Instead of the D/E ratio, we rather compare the total debt to the operating income or free cash flow the company can generate annually. In fiscal 2024, Broadcom generated a free cash flow of $19,414 million and after subtracting $9,348 million in cash and cash equivalents (which could be used to repay debt), it would take 3 years of the current free cash flow to repay the outstanding debt. Especially for a business growing at a high pace, this is certainly acceptable and no reason to worry.

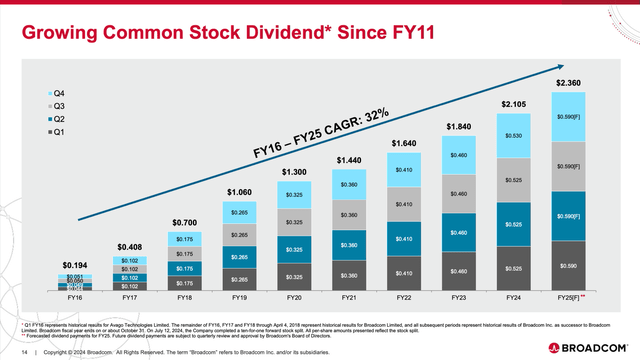

As long as we are talking about the balance sheet and the company’s ability to repay the outstanding debt, we should also mention the dividend. In the last twelve months, the company paid $9,814 million in dividends and therefore needs half of its free cash flow already for dividend payments.

Broadcom December 2024 Presentation

And it seems like the dividend is paying an important role for Broadcom. Since the company initiated a dividend in fiscal 2011, it raised the dividend for 14 consecutive years now. Right now, Broadcom is paying a quarterly dividend of $0.59, resulting in a dividend yield slightly above 1%.

Wide Economic Moat?

I am usually searching for companies with a. wide economic moat around the business. But in my article about Qualcomm, I already pointed out that semiconductors can be seen as a commodity:

And in the case of semiconductors, we can speak of a commodity to some degree. And commodities are often very difficult – especially when a company is trying to generate a wide economic moat. In such a case, cost advantages are mostly possible when a company is able to lower its costs and produce cheaper compared to its competitors. For commodities, the price is often determined by the market and for all market participants the same, meaning the individual companies don’t have any pricing power. Of course, semiconductors are not really a commodity – like oil, salt or petroleum. Semiconductors can differentiate in quality and a company might charge a higher price for a semiconductor that is seen as better by the market. The problem remains that competitors might copy innovations over time and produce chips with similar quality – and this is undermining pricing power.

And as long as we see semiconductors as a commodity, there is only one way to create an economic moat around a business – by cost advantages. Commodities are characterized by a buying decision based almost entirely on the price and no company having pricing power, as the customers will usually buy the cheapest “version” of the same product.

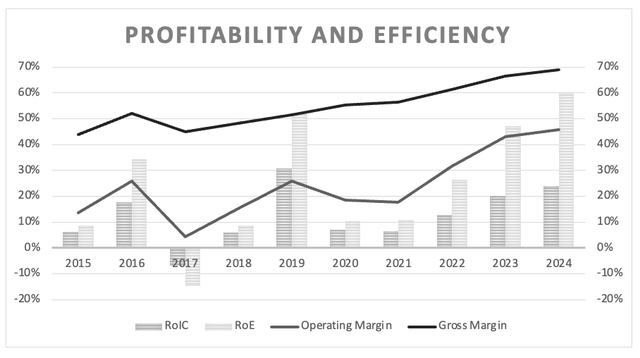

When looking at the gross margin of Broadcom in the last ten years, we see a picture of constantly improvement, which is actually a good sign and a strong hint of pricing power. And the operating margin is fluctuating much more but also improved at an impressive pace in the last ten years – which is certainly a good sign for any business.

Broadcom: Margins and Return on Invested Capital (Author’s work)

Aside from margins, we can also look at the return on invested capital as a high ROIC is another strong hint for a wide economic moat. In the last ten years, Broadcom reported an ROIC of 12.43% and in the last five years the number improved to 14.09%.

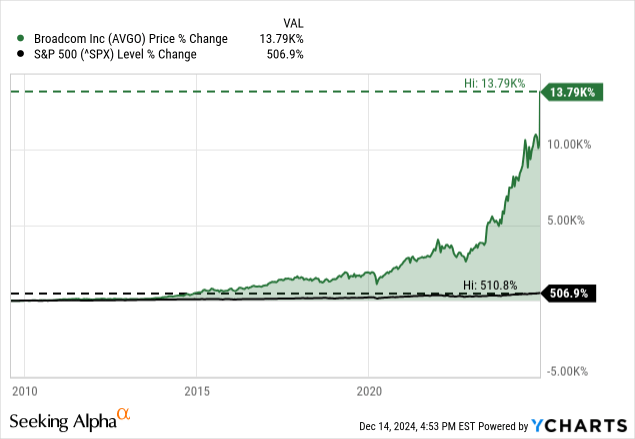

Another metric we can look at to answer the question if a company has a wide economic moat around its business is the stock performance in comparison to a major index – for example, the S&P 500. In the case of Broadcom, we have data for the last 15 years – since the IPO in 2009. While the S&P 500 increased 507% since 2009, Broadcom increased 13,790% in the same timeframe (not including dividends).

But when trying to establish the narrative about a wide economic moat around Broadcom based on the stock outperformance, we should be very cautious. The company is immensely profiting from a trend and that can lead to an impressive outperformance, but that by itself is not enough to establish a wide economic moat around a business.

Broadcom has another “problem” – Apple, Inc. (AAPL) is accounting for 20% of its sales in 2022 and 2023 (and probably a similar amount in 2024). And when one customer is responsible for a fifth of total revenue, that customer often has pricing power over the business – undermining the ability to create an economic moat.

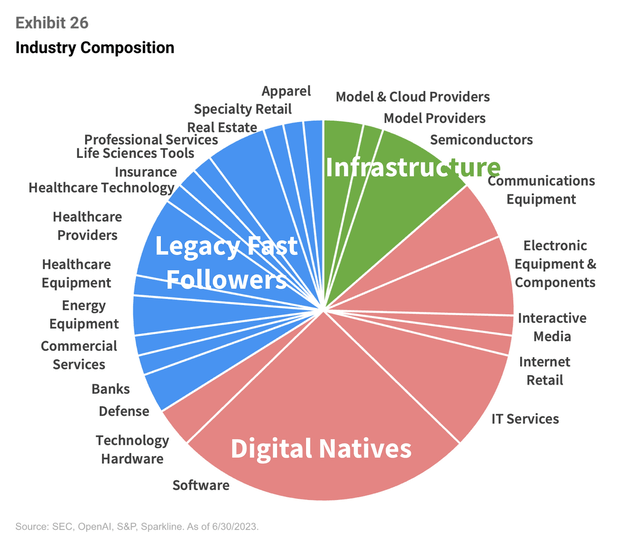

When just looking at the metrics, Broadcom might have a wide economic moat around its business, but the company could also just profit from an underlying, long-lasting trend. And an investment in Broadcom is following the concept of investing in picks and shovels during a gold rush. We are probably all familiar with the investing concept of trying to find gold during a gold rush (a hope that will only play out for a selected few) but rather sell the picks and shovels to those hoping to find gold because everybody will need those, and the sellers will have made money even if nobody finds gold.

The concept is also applying to artificial intelligence (AI). And companies like NVIDIA, Qualcomm or Broadcom are producing the picks and shovels – they are selling the basic equipment every company participating in the AI (hype) needs. Among some other companies, these are clearly the company providing the infrastructure – in this case the semiconductors.

Sparkline Capital

And while these companies are not demanding the biggest part of the whole pie, they are the companies actually making money in the first phase. In many cases, these infrastructure companies are the only ones actually making money (or at least being highly profitable) while most other business have to spend heavily without seeing a positive impact on the bottom line yet.

In my opinion, Broadcom is not a commodity business, as calling semiconductors just a commodity is leaving out what semiconductors also are – a high-technology product with a high level of research and development necessary. But aside from the question if Broadcom actually has a wide economic moat, it will most likely profit from a megatrend – industry 4.0. The high level of interconnectedness between almost every product will lead to a high demand for chips and semiconductors, and Broadcom is one of the companies meeting the demand.

Intrinsic Value Calculation

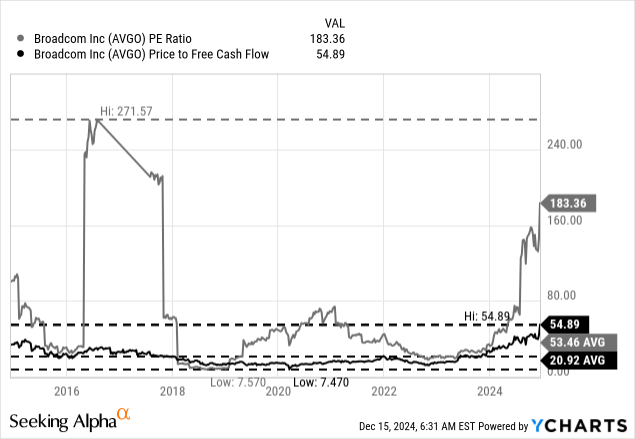

Aside from the questionable economic moat around the business, there is another problem, making it not the best long-term investment right now. When looking at the price-earnings ratio, we see that Broadcom is not the best investment right now as the stock is trading for a valuation multiple of 183, which is in itself an extremely high valuation multiple and clearly above the 10-year average, which was 53.46.

However, we can point out that the price-earnings ratio is not the best metric to use right now, as high restructuring costs and other expenses that are rather one-time items had a negative impact on the bottom line. Instead, we can use the non-GAAP, adjusted earnings per share of $4.87 in fiscal 2024. Using this numbers results in 46 times earnings. Additionally, we can look at the price-free-cash-flow ratio, which is 55 right now.

And although valuation multiples around 50 seem more reasonable than 180 times earnings, but still have to acknowledge that almost 50 times free cash flow is anything but cheap, and we should be very cautious if we can still invest in the stock. To determine what growth rates are necessary right now to make the stock fairly valued, we can use a discount cash flow calculation. As basis, we are using a discount rate of 10% (the annual return we like to achieve) and the last reported number of shares outstanding, which was 4,828 million. Although we should point out that Broadcom is expecting about 4.9 billion shares outstanding in Q1/25 in its guidance. Additionally, we take the free cash flow of the last four quarters as basis in our calculation ($19,414 million).

In order to be fairly valued, the stock has to grow about 22% annually for the next ten years, followed by 4% growth till perpetuity. We can argue this is more or less in line with analysts’ assumptions for the next few years, and therefore Broadcom can be seen as fairly valued. Nevertheless, I would be very cautious if the company is able to keep up these high growth rates for 10 years and rather see the stock overvalued at this point.

Conclusion

Similar to many other semiconductor companies like Qualcomm (QCOM), NVIDIA (NVDA) or Skyworks Solutions (SWKS), I would question if Broadcom has a wide economic moat around its business. And this makes the company vulnerable to competitors (in theory). But on the other hand, Broadcom might profit from a long-lasting AI trend leading to high growth rates for a long time.

And although we can be very optimistic about the business, I don’t think Broadcom is a good investment right now. I personally missed these investment opportunities two years ago, but investing right now has some characteristics of FOMO, as the stock is too expensive to be a good investment. We must wait for a setback before Broadcom can be a “Buy” again.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.