Summary:

- Broadcom’s Q1 FY2024 earnings report Thursday was a remarkable demonstration of the company’s strategic vision concerning the VMWare acquisition.

- The company is also seeing strong demand for its hyperscaler AI custom silicon solutions and its high-speed networking products.

- Today, I’ll review the Q1 earnings report, delve into the strategy of the VMWare acquisition, and touch on Broadcom’s valuation based on FY24 guidance.

- Broadcom’s Q1 earnings report showed the CEO Hock Tan at his best: Wheelin’ and Dealin’ while digesting his biggest acquisition to date.

- Bottom line: Despite the recent run-up in the stock price, Broadcom is still very reasonably valued in light of its FY24 adjusted EBITDA estimate and growth prospects. I reiterate my Buy recommendation.

VMware office in Bellevue, Washington, USA JHVEPhoto/iStock Editorial via Getty Images

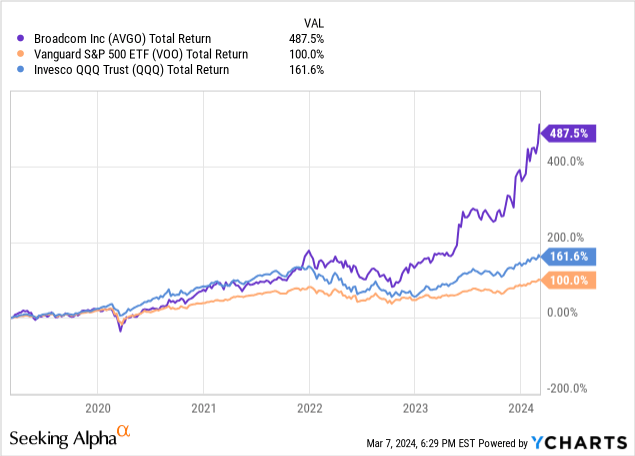

Broadcom Inc.’s (NASDAQ:AVGO) Q1 FY2024 earnings report was released after the close Thursday and all eyes were focused on the performance and go-forward commentary of two main facets of its business: The recent VMWare acquisition and AI-related custom semiconductors and high-speed networking demand. The company did not disappoint on either front. Today, I’ll review Broadcom’s Q1 report and discuss the company’s prospects going forward based on CEO Hock Tan’s commentary on the Q1 conference call. But I want to start off by pointing out that Broadcom has been a fantastic investment – with five-year total returns crushing the broad market averages as represented by the Vanguard S&P 500 ETF (VOO) and the Invesco QQQ Trust ETF (QQQ):

I’ll then discuss why the Q1 report is indicative of why Broadcom will likely continue to lead the broad market averages over the coming five years as well.

Investment Thesis

I have covered Broadcom extensively on Seeking Alpha and – despite its strong stock price appreciation – have always rated the company either a Buy or Strong Buy. And, despite the recent run-up in the stock price (see graphic above), I still rate the company a Buy. After all, the investment thesis for investing in Broadcom is relatively simple and easy to understand:

- Broadcom is the acknowledged leader in high-speed networking and arguably operates the best high-speed networking development platform (both hardware and software – i.e., validation) on the planet. This advantage always seems to keep Broadcom one step (if not two…) ahead of the competition.

- Broadcom focuses only on high-margin businesses in which it’s a market leader. That ensures the company is a free cash flow generating machine (more on this in the discussion of the Q1 results below).

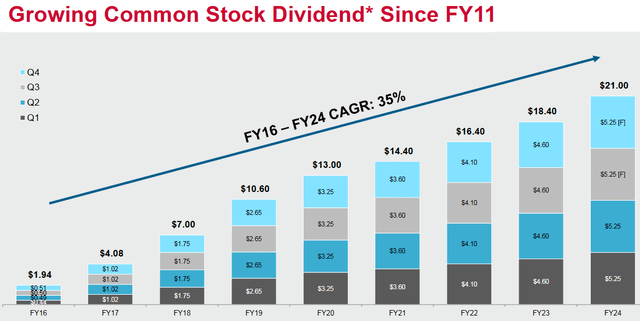

- Broadcom uses its free cash flow to reward shareholders with excellent dividend growth and share buybacks. Indeed, Broadcom has arguably been the best dividend growth stock in the entire S&P 500: The annual dividend has tripled from $7.00 to $21.00 in just six years (see chart below).

- Broadcom CEO Hock Tan is – in my opinion – one of the best high-tech CEOs on the planet, with perhaps only NVIDIA Corporation (NVDA) CEO Jensen Huang being in his class. For example, consider reading my Seeking Alpha piece CEO Shakedown: Hock Tan Vs. Tim Cook. Hint: Hock Tan won that battle, just as I suggested he would.

With that as background, let’s now take a look at the Q1 FY24 earnings report.

Earnings

In my opinion, Broadcom’s Q1 FY24 earnings report was another Hock Tan masterpiece and an absolute thing of beauty. I say that because it shows Hock Tan at his best: Wheelin’ and Dealin’ with his biggest takeover to date – VMWare.

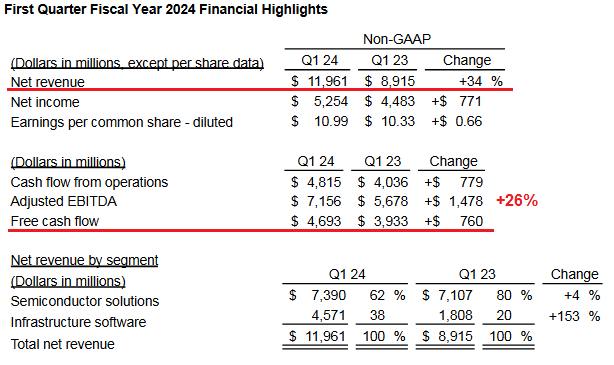

The basic high-level results are shown below. I’m only showing non-GAAP earnings results because in my opinion, and considering the VMware acquisition, the GAAP earnings are practically irrelevant.

Broadcom

Highlights are as follows:

- Q1 top-line revenue of $11.96 billion was up 34% year-over-year.

- Revenue growth was almost entirely due to a 153% yoy jump in Infrastructure Software revenue growth (to $4.57 billion, or 38% of total revenue) as a result of contributions from the VMWare acquisition. Note that after closing in late November, VMWare contributed only 10.5 weeks in the 14-week Q1 quarter. That is, Q2 will be the first full quarter of VMWare results and will be correspondingly stronger.

- Q1 adjusted EBITDA came in at $7.16 billion – up 26% yoy.

- Quarterly free cash flow of $4.69 billion (39% of revenue) was up $760 million yoy.

- Non-GAAP earnings per share of $10.99 were up 6.4%.

Now, while these results were generally considered a strong beat on both the top and bottom lines, it’s only when you look under the hood that you see the beauty of Hock Tan’s latest conquest. I say that because of the following:

While Q1 FCF was only 39% of revenue. Some companies would kill for that kind of FCF margin, but in Q4 FY22, Broadcom’s high-margin business model actually delivered FCF that was 50.8% of total revenue – see Broadcom Stock: A 20:1 Split Is Likely. However, Broadcom achieved its free-cash-flow margin despite interest expense that more than doubled yoy to $926 million. That’s because AVGO ended the quarter with $73.5 billion in long-term debt, up from $37.6 billion in Q1 of FY22. AVGO also had significantly higher operating expenses (R&D and SG&A) due to the VMWare acquisition – which also incurred $292 million in acquisition-related expenses.

This rather remarkable FCF achievement despite the short-term acquisition-related headwinds was demonstrated because – just like Broadcom – VMWare was (and is…) also a very high-margin free cash flow generating machine. I explained this in my previous Seeking Alpha article Broadcom Stock: The Beauty Within – and Why VMWare Will Add To It wherein I showed that VMWare – over the previous 12 months – had generated ~$5 billion in annual free cash flow and easily had the potential to deliver an estimated $6 billion annual up-take in AVGO’s FCF post the close. The Q1 results just further reinforced my opinion on the issue.

The next observation is that AVGO ended the quarter with $11.86 billion in cash and cash equivalents. While that was down from $14.19 billion from the year earlier quarter, what makes that remarkable is that it’s despite the following developments during the quarter:

- Broadcom repurchased and eliminated 7.7 million shares for $8.29 billion (average price an estimated $1076.62/share).

- Broadcom spent $2.44 billion on the $5.25/share quarterly dividend payment.

- Broadcom has already paid down debt by “$3 billion to date in 2024.”

- Broadcom had a total stock-based compensation of $1.57 billion (keeping the worker bees well-supplied with honey…), which was up more than double the $638 million in stock-based compensation in Q1 of FY22.

Again, all this shows the genius of Hock Tan – who was really wheelin’ & dealin’ big-time during Q1. Anyone who has ever doubted Hock Tan’s CEO strengths when digesting large acquisitions (both financially and strategically) has been proven wrong. Even though it’s still early days, Tan already is well on his way with a very successful digestion of the VMWare acquisition.

Strategic Vision

While all the financial metrics I just described are very impressive, it’s the underlying strategic vision of the VMWare acquisition that’s most inspirational to me. While early on I wrote on Seeking Alpha that I was relatively “ambivalent” about the VMWare acquisition (and the relatively high valuation paid for the company), that was only because I didn’t understand Hock Tan’s vision. That is, until I listened in on the Q4 conference call in December when I learned what the strategic rationale was all along – and what was, in my opinion, the foundation of why Hock Tan decided to buy VMWare in the first place. I reported on this strategic angle in my last article on Broadcom and although it’s a lengthy Hock Tan quote, it bears repeating here because it is very important for Broadcom investors to understand the critical nature of the Nvidia partnership with VMWare:

Well, as you may be aware, in the last VM Explore in Las Vegas, VMware came out and announced in partnership with Nvidia, the VMware Private AI Cloud Foundation. Another way of describing it is, that the VMware Cloud Foundation Software Stack, the whole VCF stack runs Nvidia coder, which runs the Nvidia GPU. That is the partnership. So, if you’re an enterprise, it’s a very easy step to get into gen AI analytics because the data center that you as an enterprise own on-prem that runs VCF will by default run the Nvidia GPU software stack as well.

Another way to put it, it virtualizes the Nvidia GPU. That’s the VMware software stack as well. So it’s a very strong attraction in our – from our perspective to, in fact, accelerate thinking of a lot of enterprises to adopting the whole VCF site. It’s simply because not only does it virtualize the data centers and make your data on-prem data center much more resilient, easier to manage, and lower cost to manage, but it has the added benefit, a big attraction this is of being able to right away start running AI workloads.

As you know, Nvidia is clearly dominating the AI GPU market and demonstrating dramatic growth in orders. So this partnership with VMWare – that enables customers to run Nvidia GPUs with the VMWare Cloud Foundation’s full-stack – is a huge competitive advantage and is in the best interest of both Nvidia and VMWare (i.e., Broadcom) to succeed. This aspect of the VMWare acquisition was flushed out in more detail by Hock Tan on the Q1 conference call Thursday afternoon:

This is simply a result of our strategy with VMware. We are focused on upselling customers, particularly those who are already running their compute workloads with vSphere virtualization tools to upgrade to VMware Cloud Foundation, otherwise branded as VCF. VCF is the complete software stack, integrating compute, storage, and networking that virtualizes and modernizes our customers’ data centers. This on-prem self-service cloud platform provides our customers a complement and an alternative to the public cloud.

And in fact, on a VM Explore last August, VMware and Nvidia entered into a partnership called VMware Private AI Foundation, which enables VCF to run GPUs. This allows customers to deploy their AI models on-prem. And wherever they do business without having to compromise on privacy and data – in control of their data. And we’re seeing this capability drive strong demand for VCF, from enterprises seeking to run their growing AI workloads on-prem. Reflecting all these factors for the full year, we reiterate our fiscal 2024 guidance for software revenue of $20 billion.

What this means is simply that Broadcom’s customers can run VMWare’s virtualization software on Nvidia GPUs and do so on-premises – bypassing public cloud providers and ensuring more security and privacy for their data and foundational models. So, whether you are a large corporation, a small upstart, or a nation-state – you can control your own “AI destiny” on premises with a combination of VMWare virtualization software and Nvidia GPUs. Fantastic!

VMWare: “Very, Very Successful”

Although it’s still early days, the bottom line on the VMWare acquisition was summed up very succinctly by Hock Tan on the Q1 conference call:

We just have closed on the deal – well, we closed on the deal in late November, and we are now March, early March. So we had the benefit of at least three months, but we have been very prepared to launch and focus on this push initiative on private cloud, VCF. And the results have been very much what we expect it to be, which is very, very successful.

And why wouldn’t it be? Nvidia’s success pretty much guarantees Broadcom’s success with VMWare (and vice versa). As a result, Broadcom reported that consolidated bookings in the Enterprise Software segment grew sequentially in Q1 from less than $600 million to $1.8 billion and is expected to grow to over $3 billion in Q2. “Revenue from VMware will grow double-digit percentage sequentially, quarter-over-quarter, through the rest of the fiscal year.”

Lastly, in the software arena, Broadcom has decided to keep Carbon Black – which it had previously put up for sale – and integrate it into Symantec. Doing so, Tan said Broadcom would generate much better shareholder value than “taking a one-shot divestiture on this asset,” which he pointed out is not particularly large to begin with. So this is a relatively unimportant side note with respect to the big-picture strategy with VMWare.

Semiconductor Segment

I’ve spent the majority of this article on software developments due to the dramatic impact of the VMWare acquisition in Q1, but I want to touch on the Semiconductor Segment as well. Q1 networking revenue of $3.3 billion grew 46% yoy and represented 45% of Semiconductor Segment revenue. Semiconductor Segment revenue – which continued to see declines in broadband, servers and storage, and relatively stagnant wireless sales – was largely driven by “strong demand for our custom AI accelerators at our 2 hyperscale customers.” This strength extends beyond AI accelerators (i.e., networking). Now, I know that one of Broadcom’s hyperscale partners is Alphabet Inc. (GOOG) (GOOGL) – after all, Broadcom has been partnering with Google on AI TPUs for many years. Honestly, I’m not sure if the other hyperscale customer is Amazon.com, Inc. (AMZN) or Microsoft Corporation (MSFT), but it doesn’t really matter because those companies are No. 1 and No. 2 in cloud computing, and both are likely looking for much cheaper and alternative GPU solutions as compared to Nvidia.

Speaking of Nvidia (again), note that the company is really pushing its InfiniBand networking solutions (i.e., they want to own it all, the GPUs, the CUDA software, and the networking to keep the GPUs fed with low-latency high-bandwidth data). However, don’t count Broadcom out: The company is just killing it with its Tomahawk 5 800G switches, DSPs, and optical components – all of which are “experiencing strong demand at hyperscale customers as well as large-scale enterprises deploying AI data centers.” Indeed, for FY2024, Broadcom now expects networking revenue to grow 35%+ yoy compared to its previous guidance of 30% annual growth.

Going Forward

Broadcom traded wildly in the after-hours session post the Q1 earnings release, and as Hock Tan made rather bullish comments on the conference call (which started around 5:15 p.m. EST, and you can see the pop higher as Hock Tan began speaking):

Yet by 8 p.m., the stock had given up practically all the gains made during the regular trading session. However, I suspect that AVGO stock may trade better than many expect on Friday given the bullish comments during the conference call (at least they were bullish to me).

However, perhaps investors weren’t satisfied given that Broadcom reiterated its previous guidance:

- Fiscal 2024 annual revenue guidance of approximately $50.0 billion including contribution from VMware (a 40% increase yoy).

- Fiscal 2024 annual Adjusted EBITDA guidance of approximately 60% of projected revenue.

Now, investors should consider two things here:

First off, Broadcom has historically been quite conservative on guidance and typically under-promises and over-delivers (which is certainly better than the alternative). That being the case, I expect Broadcom will raise FY24 guidance in either Q2 or Q3 as 2H visibility improves (especially on the VMWare up-selling initiatives).

Secondly, from a valuation perspective, FY24 adjusted EBITDA guidance of ~60% of $50 billion in revenue implies an adjusted EBITDA of $30 billion. Currently, AVGO’s market cap is $652 billion with net debt of $61.7 billion. That equates to a total estimated enterprise value of EV = $714 billion – which works out to be roughly 23.8x FY24 estimated adjusted EBITDA.

That is why I said earlier that, despite the stock price’s recent run-up, I still rate the stock a buy: An estimated 23.8x FY24 adjusted EBITDA is still arguably cheap for Broadcom given its strong free cash flow profile, its generous dividend, and its growth opportunities in VMWare up-selling, AI custom semiconductors, and high-speed networking products.

Summary and Conclusion

Despite the financial reporting I saw on CNBC and Bloomberg, Broadcom’s Q1 report was remarkable, and it seemed to me that many of the “financial analysts” simply didn’t “get it,” or the strategic vision of VMWare and the strategic partnership with Nvidia to run Nvidia GPUs with its VCF virtualization full-stack software. Me? I thought the Q1 results and commentary on the Q1 conference displayed – once again – the strategic genius of Hock Tan and his remarkable CEO financial management skills: always focusing on high-margin, free cash flow, and focusing on doing a few things better than anyone else. In fact, I’ll end with what CEO Hock Tan said of his relatively simple philosophy on the Q1 conference call:

… we have a philosophy in running our business, Broadcom. And maybe other people have a different philosophy. Let me tell you my simple philosophy, which I’ve articulated over time, every now and then, which is very clear to my management team and to the whole of Broadcom.

You do what you’re good at. And you do – you keep doubling down on things you know you are better than anybody else. And you just keep doubling down because nobody else will catch up to you if you keep running out of the pack. But do not do something that you think you can do, but somebody else is doing a much better job than you are. That’s my philosophy.

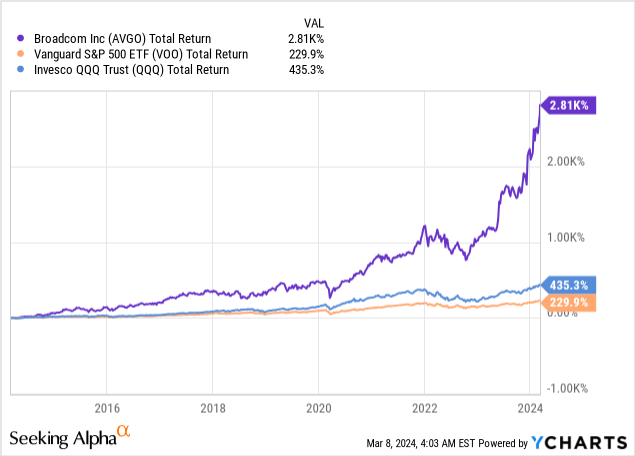

I emphasize this point because, at the end of the day, investors are not just investing in a company and its assets and products – they’re investing in the skills of the CEO and the executive management team. Broadcom has proven, over and over again, that its CEO and executive management team is top-notch and among the very best in the entire technology sector. The proof is in the company’s 10-year total returns versus the broad market averages as represented, once again, by the S&P500 and Nasdaq-100 ETFs (VOO and QQQ, respectively):

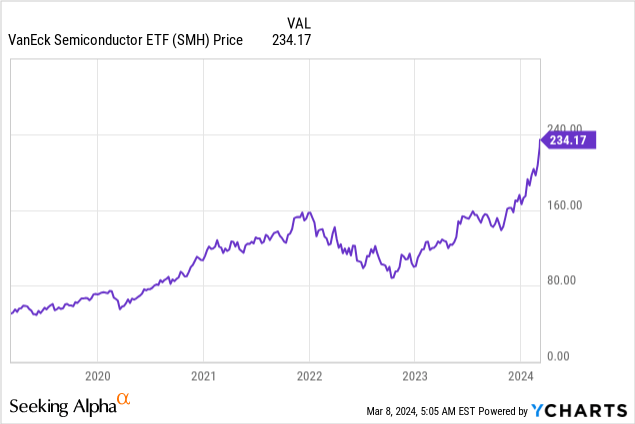

Lastly, Broadcom’s report is – in my opinion – quite bullish for the semiconductor industry as a whole, specifically companies like Taiwan Semiconductor Manufacturing Company Limited (TSM) – which makes the majority of AVGO’s high-performance chips – as well as one of my favorite ETFs that I have been strongly promoting on Seeking Alpha for years now: The VanEck Semiconductor ETF (SMH), which has an extremely bullish five-year chart:

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AVGO, VOO, QQQ, GOOG, AMZN, SMH either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am an electronics engineer, not a CFA. The information and data presented in this article were obtained from company documents and/or sources believed to be reliable, but have not been independently verified. Therefore, the author cannot guarantee their accuracy. Please do your own research and contact a qualified investment advisor. I am not responsible for the investment decisions you make.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.