Summary:

- Broadcom reported strong Q2 earnings with a double beat and raise, increased full year sales guidance, and a stock split announcement.

- The company saw significant growth in its AI hardware sales while focusing on cutting VMWare costs post-acquisition.

- Broadcom is making great progress incorporating VMWare into its core business, with a focus on simplifying product offerings and transitioning to a subscription model.

- Given the growth outlook and likelihood of significant margin expansion, I maintain a Buy rating on Broadcom.

Sundry Photography

Prelude

I initiated coverage of Broadcom Inc (NASDAQ:AVGO)(NEOE:AVGO:CA) following the Q1 earnings report with a Buy rating. The stock has performed well since that article, and I reiterate my Buy rating following the Q2 report. Let’s dive into the Q2 report and discuss why it strengthened my conviction in Broadcom.

Q2 2024 Earnings

Broadcom is a semiconductor and software company with a broad range of offerings. The company posted a double beat and raise with Non-GAAP EPS of $10.96 beating by $0.12 and revenue of $12.5b beating by $480m. The company announced a dividend of $5.25 per share and a ten-for-one stock split effective July 15th, 2024. Meanwhile, the company increased full year sales guidance to $51b, which beat the consensus estimate of $50.28b

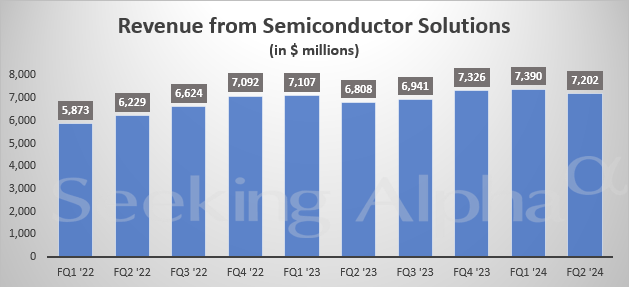

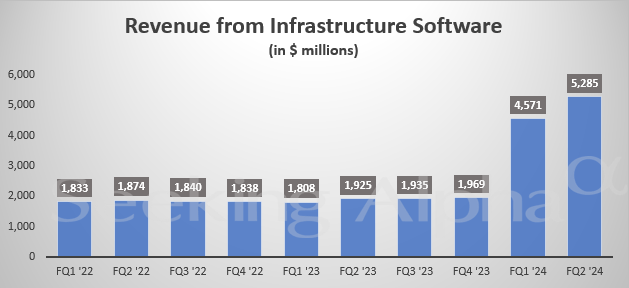

Broadcom’s semiconductor solutions segment generated 58% of sales on the quarter, reaching $7.2b. Infrastructure software brought in $5.3b, leading to net revenue of $12.5b. Total sales increased 43% YoY including VMware and 12% excluding VMware. The VMware acquisition began showing in the Q1 results of this year. Sales grew 4.4% from Q1 driven mostly by 17% QoQ growth in the infrastructure software division. The company enjoyed a GAAP gross margin of 63.7%, up 200bps QoQ. Short term acquisition related amortization costs continue to keep gross margin significantly below last year. On a non-GAAP basis, gross margin reached 76.2% growing 60bps YoY and 90bps QoQ.

True to the Broadcom model, the company has been relentlessly cutting costs post-acquisition. OpEx grew from $2.1b to $4.8b YoY but fell 9% from the $5.3b recorded in Q1 ’24. Operating margin boomed accordingly, growing from 17.4% in Q1 to 23.7% in Q2, yet it remains down from 45.9% this quarter last year. The company managed to decrease selling, general and administrative expense from $1.6b to $1.3b QoQ and I expect further cost savings here moving forward. Interest expense more than doubled from last year and naturally pressured net income. The impacts of the VMware acquisition will take a few more quarters to completely filter through, so the market is largely ignoring the -39% YoY decline in GAAP net income. Net income rose 60% from Q1 and Q2 net margin was 17.0%. On a non-GAAP basis, net income reached a record $5.4b marking a 43.2% net margin. This was up QoQ but remains down significantly YoY. Shares outstanding rose 12% YoY with most stock-based comp expense in the R&D segment.

Broadcom has made remarkable progress on the incorporating VMware into its core business to date and the income statement will continue to show the work being done in the coming quarters.

A sizable chunk of $2b in cash was used to pay off long-term debt, which is down from $73.4b in Q1 to $71.6b in Q2. Broadcom’s assets have grown $100b since October 2023 mostly because of major increases in Goodwill and Intangible Assets related to the acquisition. While the income statement is rock solid and clearly moving in the right direction, $70b in debt and a rapidly dwindling cash pile (down from $14b in October 2023 to $9.8b in May 2024), while only earning $2b, represents meaningful risk for Broadcom. If revenues were to begin contracting, interest expense will become a considerable issue for earnings growth in the future. At this time, I do not expect this risk to materialize, but it’s worth monitoring for investors.

Meanwhile, Broadcom’s operations generated $4.6b in cash this quarter, down from $4.8b last quarter and up slightly from $4.5b last year. This was driven by a considerable quarterly change in accounts receivables from $1.7b in Q1 to $(513m) in Q2. Free cash flow came in at $4.5b, representing 36% of sales.

The company did not pursue any stock buybacks this quarter, a welcome sign for investors that would prefer debt repayments to share repurchases at these prices. The company borrowed an additional $30b last quarter and cash paid for interest rose 26% QoQ to $946m.

Earnings Call Review

With the financials covered, let’s discuss the earnings call and some important comments made on it. First off, the 12% sales growth excluding VMware was driven mostly by 280% YoY growth in AI revenue. The $3.1b in AI revenue helped to offset cyclical weakness from enterprises and telecoms. Yet the strong growth wasn’t enough as semiconductor solution sales shrunk QoQ. Broadcom expects AI revenue of $11b for fiscal 2024, with a roughly 60/40 split between accelerators and networking.

Networking revenue exploded 44% YoY and reached $3.8b and now represents 53% of segment sales. Networking demand was driven by both AI networking and custom silicon. Segment mix has increasingly favored networking as more data center clusters have deployed, which bodes well with Nvidia’s (NVDA) “AI factory” approach. Broadly speaking, networking spend will total around 20-30% of GPU spend for AI data centers. Accordingly, as Nvidia’s GPU shipments have skyrocketed, Broadcom’s unit shipments for networking switches, PCIe switches, and network interface cards (“NICS”) did as well. In fact, they all doubled YoY. While Nvidia gets the glitz and glamour of the AI hardware revolution, Broadcom is quietly powering the fabric upon which AI runs. According to the company, 7 of the largest 8 AI clusters use Broadcom Ethernet solutions.

Meanwhile, Broadcom continues to enjoy extremely strong revenue growth from the Google (GOOG) TPU contract that is the cornerstone of Broadcom’s custom silicon business.

Seeking Alpha

The infrastructure software segment included $2.7b in revenue contribution from VMware which was up 28.5% QoQ. Broadcom has simplified VMware’s product offerings extraordinarily, reducing over 8,000 SKUs to just 4 core product offerings. Meanwhile, the Hock Tan led conglomerate is also transitioning VMware products to a subscription model. Hock also noted that nearly 3,000 of the largest 10,000 customers have pursued subscriptions that enable them to build a self-service on-prem virtual private cloud. The company has begun tracking ABV, annualized booking value, for VMware. This figure grew 58% QoQ from $1.2b to $1.9b. ABV is an annualized view of revenue earned yearly from multi-year contracts. For Broadcom’s entire software stack, ABV grew from $1.9 to $2.8b QoQ. The company expects VMware sales will accelerate toward a $4b quarterly run rate.

For the infrastructure software segment specifically, gross margin was a fantastic 88% while operating margin was 60%. Hock noted that overall margins should return to historical averages by fiscal 2025.

Seeking Alpha

The company intends to continue paying $2b of debt off quarterly through fiscal ’24, initially favoring the $28b of floating rate debt which carries a weighted average rate of 6.6% and 2.8 average years to maturity. The company also has $48b in fixed rate debt with a weighted average coupon rate of 3.5% and 8.2 average years to maturity.

Broadcom is leading the transition to 800 gigabit optical interconnects while investing to develop “1.6 terabit connectivity”. Management expects the release of the 100 terabit Tomahawk 6 networking switch by late 2025. They are currently about 2-3 years ahead of the competition in networking switches and this would solidify that lead.

Investor Takeaway

These results speak for themselves. Broadcom has a strong and demonstrable competitive advantage. Unit shipments are exploding, the company is winning designs for next-gen custom silicon, and many of the leading AI factories are networked with Broadcom hardware. This company exists at the center of a very rosy long-term picture. We are amidst a hardware spending megacycle powered by AI. A huge acceleration in AI revenue cancelled out broad based cyclical slowdowns in other segments for the company. Management expects these cyclical headwinds to turn more positive throughout the remainder of 2024, and with AI spend expected to remain robust moving forward, the 2025 picture remains extremely positive. Further, the VMware integration is going very well as the company continues to cut down on complexity and costs while simplifying product offerings for customers.

Broadcom was in the perfect place at the perfect time to reap the benefits of the blossoming AI industry. While Nvidia is powering AI, Broadcom is connecting it. The company is consistently de-levering and executing flawlessly at scale while investing heavily to maintain its compelling lead. I reiterate my Buy rating on Broadcom.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AVGO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.