Summary:

- AVGO’s strong AI prospects are driving up its stock, but it appears slightly overvalued, with a current PE ratio higher than justified by its expected FY26 growth rates.

- AI-related revenues could reach $10B in 2024, but competitive pressures from big tech and a potential slowdown in AI infrastructure demand pose risks.

- A more reasonable PE ratio of 45 suggests a fair price of $178 for FY25, indicating only a 10.3% upside and a speculative risk-to-reward ratio in the medium term.

shulz

I last covered Broadcom (NASDAQ:AVGO) in June; I put out a Hold rating at the time, and since then, the stock has gained 20.5% in price. In my last analysis, I provided a mixture of a traditional discounted cash flow model and valuation multiple peer analysis, which both indicated that Broadcom could be overvalued. Despite this, the stock has continued to rise in price substantially, and in this analysis, I performed a more thorough valuation peer analysis and ascertained that the stock is slightly overvalued, especially as I expect a lower valuation multiple in FY25 as growth slows through FY26.

Furthermore, Broadcom is currently focusing heavily on its value in the AI markets, including potential AI-related revenues that could reach $10B in 2024. Its acquisition of VMware is also showing continued promise of long-term accretion, particularly through its Private AI Foundation. I am most bullish on Broadcom for its position in the AI market, but its valuation has become riskier as a result of the strong market sentiment surrounding this.

Q3 Earnings Expectations & Operational Analysis

Broadcom’s Q3 earnings results are scheduled to be released on 9/5/2024 post-market, and it is expecting 14.2% YoY growth in normalized EPS, as well as YoY revenue growth of approximately 15.1%. This growth is largely driven by the integration of VMware and the increasing demand for AI products. Furthermore, the AI segment is a significant driver of Broadcom’s growth, with expectations that its AI-related revenues could reach $10B in 2024, which is up from $4.2B in 2023. This trend in AI demand is also supporting its partnerships with major tech companies for custom AI chips.

Broadcom continues to innovate, particularly in enhancing connectivity for Edge AI workloads. Its recent product enhancements, such as the VMware VeloCloud Edge appliances, are designed to improve connectivity and support for edge computing. The company’s strategic emphasis on AI, which includes the VMware Private AI Foundation, is a reason to be bullish on AVGO operationally. The Private AI Foundation, in partnership with Nvidia (NVDA), is positioned to deliver high performance for GenAI models. It includes capabilities like GPU monitoring, live migration, load balancing, and virtualization of GPUs using Nvidia NVLink and NVSwitch.

The company is also evolving to build a strong base of recurring revenue. This is evidenced by its transition of VMware products from perpetual licenses to subscription models to strengthen the stability of its revenues. Management has also been increasing the average duration of its deals by securing multiyear contracts for a long time now. This strengthens its revenue predictions and also develops customer relationships by committing them to longer-term engagements.

Additionally, Broadcom announced a ten-for-one forward stock split, which took effect in July 2024. This has made the stock more accessible and is likely to be discussed in the Q3 earnings call.

Financial & Valuation Analysis, Including FY25 Fair Value Estimate

In my opinion, Broadcom is likely best assessed based on its historical and forward growth rates and valuation multiples relative to its peers Intel (INTC), Nvidia, Cisco (CSCO), and Qualcomm (QCOM) to gauge if it is fairly valued.

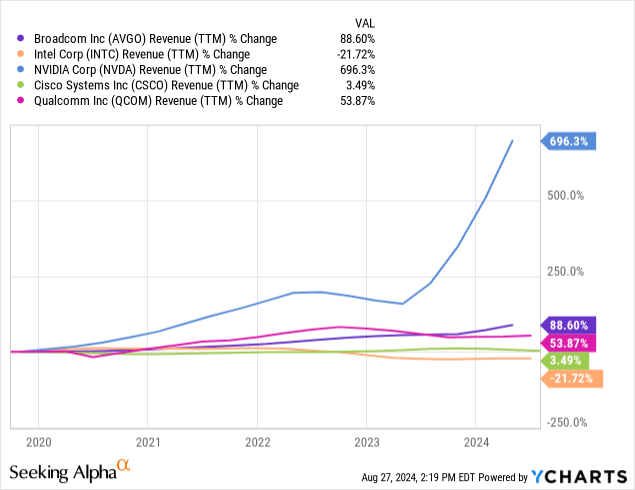

Firstly, Broadcom has the second highest 5-year % change in revenues in my peer set, second only to Nvidia, which is the obvious outlier.

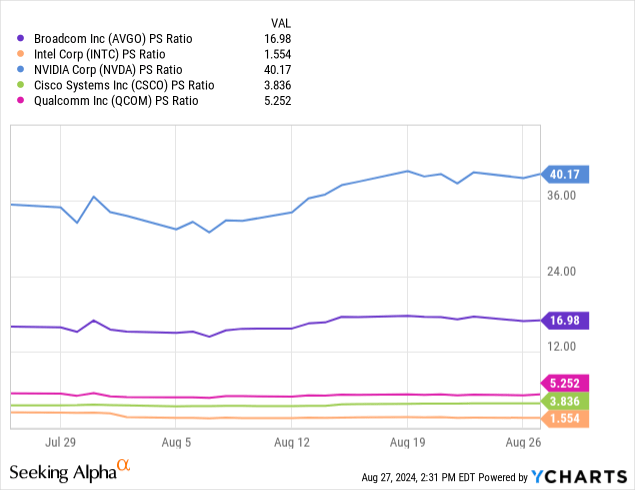

Secondly, Broadcom also has the second-highest PS ratio. This is a good sign initially, but its PS ratio is notably a lot higher than it should be when assessing its historical growth rates relative to its peers.

However, it is Broadcom’s future revenue growth rates that are expected by analysts that make Broadcom seem more reasonably valued at this time. The result of this charting analysis shows Broadcom to be overvalued on a PS ratio and revenue growth basis relative to peers. This is made evident by the ratio of QCOM’s forward growth estimate of 9.26% to AVGO’s 16.7%, a ratio of 0.55, compared to the ratio of AVGO’s PS ratio of 17 to QCOM’s 5.25, a ratio of 3.24.

| AVGO | INTC | NVDA | CSCO | QCOM | |

| Sales Growth Estimate | 16.7% for the fiscal period ending October 2025 | 8.82% for the fiscal period ending December 2025 | 38.51% for the fiscal period ending January 2026 | 4.5% for the fiscal period ending July 2026 | 9.26% for the fiscal period ending September 2025 |

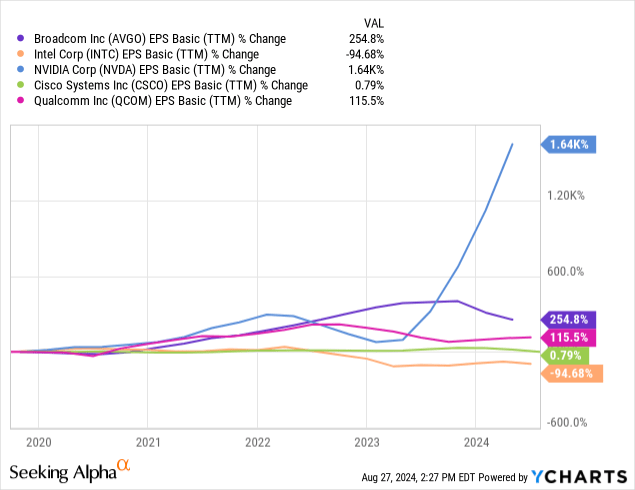

Furthermore, on an earnings basis, Broadcom also looks slightly overvalued to me. This is made evident by a disparity in similar ratios that I presented in my revenue/PS analysis compared to peers, but based on earnings rather than sales.

| AVGO | INTC | NVDA | CSCO | QCOM | |

| Normalized EPS Growth Estimate | 27.66% for the fiscal period ending October 2025 | 366.42% for the fiscal period ending December 2025 | 38.92% for the fiscal period ending January 2026 | 8.4% for the fiscal period ending July 2026 | 11.9% for the fiscal period ending September 2025 |

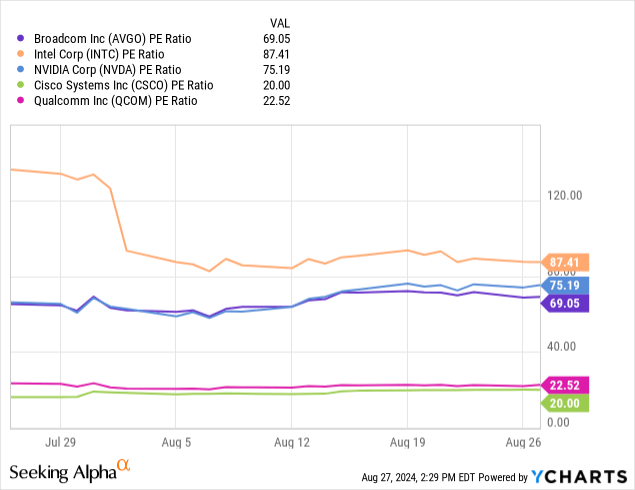

The last two data sets, in particular, are revealing. They show that AVGO has a normalized EPS growth estimate of 27.66% compared to QCOM’s 11.9%, a ratio of 2.3. However, AVGO has a GAAP PE ratio of 69 compared to QCOM’s 22.5, a ratio of 3. Furthermore, AVGO has a normalized EPS growth estimate of 27.66% compared to CSCO’s 8.4%, a ratio of 3.3. AVGO has a GAAP PE ratio of 69 compared to QCOM’s 20, a ratio of 3.45.

The result of this detailed quantitative peer analysis is that AVGO certainly offers no margin of safety in its valuation, and I believe that it is likely slightly overvalued. I believe a PE ratio of 45 (closer to its 5-year average of 40) would be more reasonable for the stock in FY25 as its normalized EPS growth is expected to be only a 16% increase in FY26, compared to 14% as its forward 5-year average. If the stock trades at this PE ratio during FY25 and hits its $3.96 GAAP EPS estimate, this indicates a fair price for AVGO of $178 in FY25.

Edge Competition & Cyclical Volatility Risks

Big tech companies, including Google (GOOGL) (GOOG), Amazon (AMZN), and Microsoft (MSFT) are heavily investing in AI-driven edge computing. This creates pressure for Broadcom in this market, and as edge devices become more widespread, its ability to compete in this field will be paramount. Broadcom is focusing on integrating more advanced connectivity options, such as 5G, into its edge solutions. Also, it is making enhancements to the VMware Edge Compute Stack, including features like edge fleet management and SaaS delivery models to simplify the management of large-scale infrastructures. However, companies like AWS, Google Cloud, and Microsoft Azure can integrate edge computing capabilities with their existing cloud services, offering seamless cloud-to-edge solutions—this could potentially outpace Broadcom’s offerings. In addition, it is worth remembering that advanced LLMs developed by big tech can enhance real-time data processing and analytics platforms in edge computing, providing a competitive advantage over Broadcom.

Additionally, demand for semiconductors is currently surging amid AI and 5G, which is currently highly accretive to the company and will continue to be so through FY25. However, FY26 will likely see a significant slowdown in growth, and AVGO investors need to be prepared for price fluctuations, which is likely in the near future because of its present high valuation and the semiconductor demand slowdown on its way. Largely, this slowdown is a result of AI infrastructures reaching a peak of initial growth in development, and also questions from big tech and other SME tech firms questioning the ROI of their data center capex. In my opinion, this is a high-risk time to invest in Broadcom, primarily for this reason.

Conclusion

In my opinion, AVGO’s valuation is currently too high, and this affects the risk-to-reward in the medium term significantly. As its fundamental growth rates look set to contract toward their historical norm in FY26, I am expecting a significant contraction in valuation multiples over the next 12 months. As a result of my fair price estimate of $178, I consider any alpha gained from the stock over the next 12 months to be largely speculative, as this indicates only a 10.3% upside. My thesis is further reinforced by competitive pressures from big tech and cyclical macro pressures from the current AI infrastructure demand slowing down.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.