Summary:

- I maintain a “Sell” rating on Broadcom Inc. stock with a fair value of $120 per share following its fiscal Q3 earnings due to concerns over legacy business declines and VMware integration issues.

- Broadcom’s termination of VMware’s perpetual license model and controversial pricing changes may drive partners to competitors, risking long-term growth.

- Despite strong AI ASIC and networking chip prospects, Broadcom’s legacy software and integration challenges with VMware hinder overall growth potential.

- Broadcom’s semiconductor solutions show promise, but infrastructure software faces competitive pressures, limiting overall revenue growth to an estimated 8.3% annually from FY25 onwards.

G0d4ather

I presented my “Sell” thesis on Broadcom Inc. (NASDAQ:AVGO) in my previous coverage in June 2024, noting that aside from AI and VMware, Broadcom’s legacy businesses declined by 15% in revenue. Broadcom released its Q3 result on September 5th after the market close, projecting $12 billion in AI revenue for FY24. While I am optimistic about their custom ASCI and AI networking businesses, I remain concerned about their legacy software portfolio, as well as the integration of VMware. I maintain a “Sell” rating with a fair value of $120 per share.

VMware’s Integration Is Unlikely to Be Successful

Since Broadcom completed the acquisition of VMware last November, Broadcom has begun integrating VMware’s business and making controversial changes. I don’t believe Broadcom can integrate VMware business successfully for the following reasons:

- Broadcom terminated VMware’s perpetual license model to promote VMware’s software subscription model. The termination could potentially push their partners to distribute VMware’s competitor products such as those from Microsoft Corporation (MSFT) and Nutanix, Inc. (NTNX), which may offer cheaper solutions for customers. For instance, during Nutanix’s latest earnings call, the company indicated that they secured some large deals because of Broadcom-VMware integration.

- As reported by the media, Broadcom now only sells product bundles, which in some extreme cases has led to price increases of 500%-600%. I think the business model change might benefit Broadcom’s growth in the short term; however, partners and customers might eventually seek more affordable alternatives in the future.

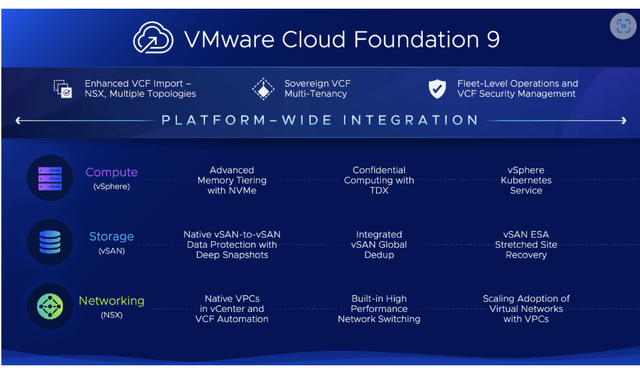

- In August 2024, VMware announced their new VMware Cloud Foundation 9 (VCF 9), a cloud-based platform consolidating all the applications and third-party software. While I think VCF 9 aligns better with Broadcom’s AI business solutions, it is unlikely to help VMware gain any competitive advantages. As shown in the slide below, VCF 9 provides solutions for compute, storage and networking layers. However, VMware’s core strength lies primarily in their vSphere solutions within the Compute layer, and VCF 9 has to rely on partners to deliver a holistic cloud platform.

Broadcom Investor Presentation

- Dell Technologies Inc. (DELL) has already terminated its VMware reseller business in 2024, according to the SEC filing on January 30th, 2024. In addition, Cisco Systems, Inc. (CSCO) announced a global strategic partnership with Nutanix to provide a complete hybrid cloud solution to customers. It is evident that VMware has been losing some key partners as a result of Broadcom’s integration.

Custom AI ASIC Chip and AI Networking

I think both custom AI ASCI and networking chips are core growth drivers for Broadcom. The company aims to achieve $12 billion in AI revenue in FY24, representing more than 20% of total revenues.

As indicated in my previous report, both Broadcom and Marvell Technology, Inc. (MRVL) are leaders in the technology of custom AI ASIC chips, providing tailored accelerators in partnership with major hyperscalers and internet operators such as Alphabet Inc. (GOOG), (GOOGL), Microsoft Corporation (MSFT), Meta Platforms, Inc. (META), Amazon.com, Inc. (AMZN) and ByteDance. As reported by the media, Broadcom has successfully secured 3nm AI ASIC chip deals with Alphabet and Meta.

Over the past five years, Broadcom has invested significantly in their 3nm and 2nm ASIC technology, positioning them well to benefit from the rising demand for custom accelerators. Additionally, the management indicates that custom ASIC is a high margin business, with longer R&D development cycles.

Broadcom also offers networking chips for switching manufacturers such as Arista Networks, Inc. (ANET), Dell, Juniper Networks, Inc. (JNPR) and Super Micro Computer, Inc. (SMCI). Broadcom is poised to grow their networking business rapidly in the near future, driven by data center building up and increasing demands for networking connectivity. During the recent quarterly earnings, major AI Ethernet networking companies reported strong growth in the data center market. For instance, Dell delivered 80% year-over-year growth in their Server and Networking business in Q2.

As such, I favor Broadcom’s leading position in the AI ASIC chip and AI networking markets, which will continue to be the primary growth driver for the company.

Outlook and Valuation

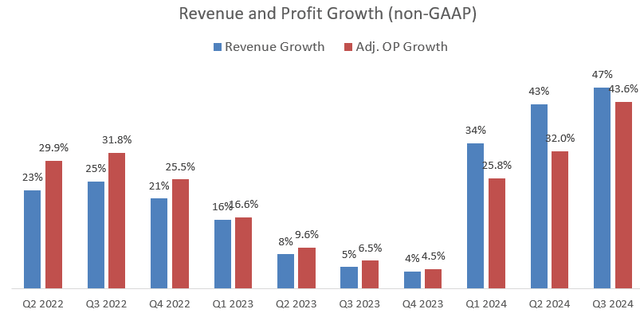

In Q3, Broadcom delivered 47% growth in revenue and 43.6% growth in adjusted operating profits. The semiconductor segment only grew by 5% year-over-year, and the infrastructure software grew by 200%, primarily driven by VMware’s consolidation. Excluding VMware, Broadcom only grew their revenue by 4% during the quarter, which is not impressive.

As the company has already reported three quarters, I don’t anticipate any major surprises for their FY24 financial result. For the normalized growth rate from FY25 onwards, I am considering the following factors:

- Semiconductor solutions: As mentioned previously, the custom ASIC and AI networking will be key growth drivers for their Semiconductor solution business. During Marvell’s Q2 earnings call, their management indicated that the overall custom ASIC market will accelerate in the second half of FY24, as most hyperscalers ramp up their custom ASIC accelerator productions. I think Broadcom’s 2nm and 3nm ASIC technology could significantly boost their Semiconductor solutions growth in FY25. I estimate that the Semiconductor solution business will grow by 10% annually from FY25 onwards.

- Infrastructure software: My main concern with Broadcom lies in their Infrastructure software segment. As mentioned in my previous article, Broadcom has acquired several legacy software companies in the past, such as CA and Symantec. It is unlikely for Broadcom to grow their revenue in the mainframe business, a diminishing industry. In addition, Symantec has been facing increasing competition from other security companies such as Palo Alto Networks, Inc. (PANW), CrowdStrike Holdings, Inc. (CRWD) and Zscaler, Inc. (ZS). As such, I only assume 2% organic revenue growth for the infrastructure software segment.

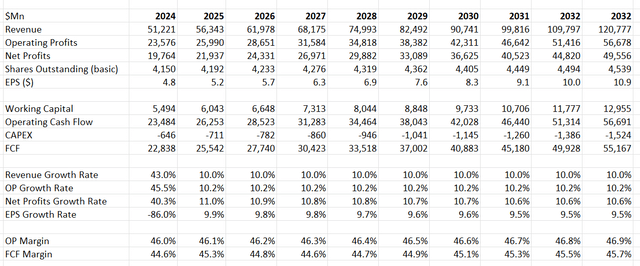

Overall, I calculate that Broadcom will grow their revenue by 8.3% annually from FY25 onwards. As custom ASIC and AI networking businesses carry higher gross margins, I forecast Broadcom will deliver 10bps margin expansion from gross profits due to a favorable revenue mix. With these parameters, the DCF summary can be found as follows:

The WACC is calculated to be 12% assuming a risk free rate of 3.7%, a beta of 1.36, an equity risk premium of 7%, a cost of debt of 7%, equity of $717 billion, debt of $74 billion, and a tax rate of 10%. The fair value of Broadcom’s stock price is calculated to be $120 per share.

Upside Risks

As I give Broadcom a “Sell” rating, I am considering factors that could trigger a change in my rating:

Infrastructure Software will account for less than 20% of total revenue at the end of FY24. It is quite possible for Broadcom to separate their software into an independent company in the future. If that is the case, I think it could be highly positive for Broadcom’s stock price, and such separation might unlock shareholder value. It is clear that the software and semiconductor businesses are entirely different in nature, with no clear synergies between them.

In addition, if hyperscalers accelerate the production of custom ASIC in 2024, Broadcom might achieve higher revenue from AI in FY24, exceeding $12 billion. In that case, this could lead to an overly optimistic market outlook for custom ASIC growth in FY25, sending the stock price much higher. It’s worth noting that Broadcom increased their AI revenue guidance from $11 billion to $12 billion this quarter.

Conclusion

I am not comfortable with Broadcom’s acquisition strategy in the software market, and I doubt the company can integrate VMware effectively in the near future. I reiterate a “Sell” rating with a fair value of $120 per share.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.