Summary:

- Broadcom’s recent earnings beat expectations, but guidance fell short, leading to a “sell-the-news” reaction. However, this presents a buying opportunity.

- Broadcom’s stock is relatively inexpensive with a forward P/E ratio around 20x – 22x, and it has strong potential for future EPS growth and multiple expansion.

- Despite a 30% correction, Wall Street remains bullish with price targets ranging from $155 to $240, indicating significant upside potential.

- Risks include competition, economic slowdown, and high interest rates, but Broadcom’s long-term growth prospects in the AI enterprise market remain strong.

BlackJack3D

I wrote about Broadcom Inc. (NASDAQ:AVGO) stock before earnings. Broadcom reported better-than-expected earnings results but failed to deliver the desired guidance. This “sell-the-news” dynamic became a familiar theme this past earnings season. NVIDIA Corporation (NVDA) and other market-leading stocks have declined post-earnings, many after providing better than anticipated earnings and solid guidance, like Broadcom.

While we may see a mild, transitory slowdown in the AI enterprise market, it is likely not the time to give up on Broadcom’s stock. Instead, the recent slowdown phase provides intermediate and long-term buying opportunities for Broadcom investors looking to capitalize on the growth likely to materialize from the enterprise AI space in the coming years.

Also, Broadcom’s stock is relatively inexpensive right now. It trades at about 22 times forward EPS estimates, which appears cheap for a company in its advantageous market-leading position. Moreover, Broadcom could experience higher than anticipated EPS growth, and there is a high probability it can outperform future estimates despite the temporary growth slowdown phase. Due to the constructive setup and bullish dynamic, Broadcom’s stock could appreciate considerably in future years.

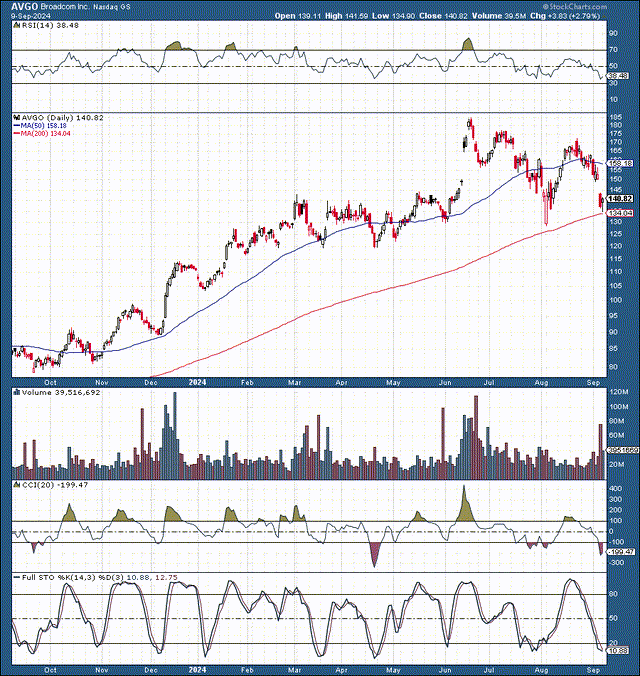

Technical Standpoint – The Image Remains Bullish

Broadcom’s stock hit a near-term blow-off top several months ago. Since then, Broadcom has been in pullback/consolidation mode. Broadcom’s correction has been about 30% from peak to trough, and the stock is still about 25% below its all-time high level. Also, we’ve seen two successful tests of the 200-day MA support, and technical indicators like the full stochastic, RSI, CCI, and others suggest that momentum could improve in Broadcom’s stock soon. Technically, nothing prevents it from moving to new ATHs in the next up-wave, which could begin at any time now.

Broadcom Earnings – So, Why The Drop?

Broadcom reported an EPS of $1.24 and revenues of $13.07B in its most recent quarterly announcement. The EPS figure was a three-cent beat, and sales beat by $110M. One issue here is that the market has become so optimistic regarding AI that it wants stronger beats, and perhaps more importantly, it wants to see more robust guidance.

For Q4 (fiscal 2024), Broadcom provided $14B in sales guidance, slightly lower than the $14.04B the market expected. Nonetheless, there is a very small shortfall here, and Broadcom is likely sandbagging its guidance and should easily beat $14B when it reports fiscal Q4 later this year. Also, Broadcom’s growth could increase, and it has a considerably long growth runway, so Broadcom’s stock could move much higher.

Broadcom’s Outperformance Likely To Continue

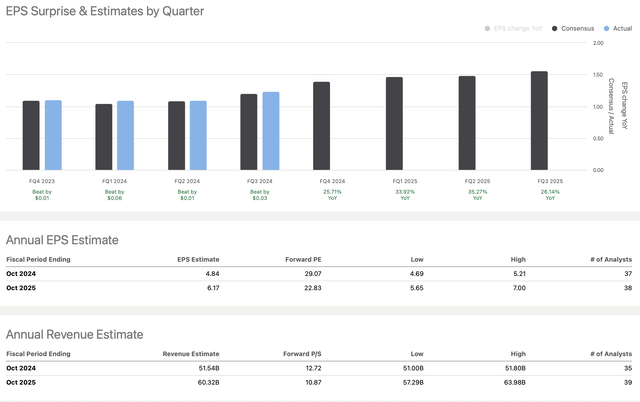

EPS vs. estimates (StockCharts.com)

Broadcom has missed EPS and sales estimates only once in its last 20 quarters (5 years). Broadcom’s TTM consensus EPS estimate was $4.43, but Broadcom reported $4.55, a modest 3% outperformance rate. Therefore, we could see a similar 3-5% outperformance rate in the future. Also, Broadcom will likely experience a big earnings jump soon.

The fiscal 2025 consensus estimate is for $6.17 in EPS. Applying a modest 3-5% outperformance rate enables a likely EPS of about $6.36-$6.48 ($6.42 average estimate) for next year. Currently, Broadcom trades around $140, illustrating a potential sub-22 forward P/E ratio for its stock.

This P/E ratio is relatively cheap, given Broadcom’s excellent sales and earnings growth potential and long growth runway. Therefore, we could see substantial earnings growth and multiple expansion in future years. Given that Broadcom’s P/E ratio could expand to the 27-30 range, its stock could increase to approximately $173 – $193 over the next year (roughly 23% – 38% upside potential).

Wall Street Remains Bullish On Broadcom

Price targets (seekingalpha.com)

Despite the recent volatility, Wall Street remains bullish on Broadcom. Also, I must draw your attention to the fact that while Broadcom’s stock has corrected by 25% to 30%, its price targets have not come down, illustrating the high level of conviction behind its stock and its significant earnings power.

Remarkably, the average price target for Broadcom is around $193, nearly 40% above its current stock price. Also, the lowest price targets are around $155, about 11% higher than Broadcom’s current depressed levels. Finally, the higher-end, bullish case scenario price targets go up to $240, representing the potential for about a 70% gain over the next one year.

Where Broadcom’s stock could be in the future:

| Year | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue Bs | $63 | $72 | $82 | $92 | $104 | $117 |

|

Revenue growth |

21% | 14% | 14% | 13% | 13% | 12% |

| EPS | $6.50 | $7.75 | $9.30 | $11.10 | $13.20 | $15.50 |

| EPS growth | 30% | 19% | 20% | 20% | 19% | 18% |

| Forward P/E | 25 | 26 | 27 | 27 | 26 | 25 |

| Stock price | $194 | $242 | $300 | $356 | $402 | $450 |

Source: The Financial Prophet

Broadcom’s $14B guidance vs. the $14.04 estimate does not impact my intermediate and long-term projections for Broadcom. Despite the lackluster growth environment, growth should improve in future quarters, likely improving profitability and driving higher valuations. A 20-22 forward P/E ratio may be too low for Broadcom as it has substantial EPS and sales growth potential and momentum, and its multiple could expand to 25-30 or higher in the coming years. Therefore, Broadcom’s stock has a high probability of appreciation, and it may be one of the top long-term buy-and-hold candidates right now.

Risks To Broadcom

Broadcom faces risks due to competition looking to capitalize on the lucrative AI enterprise space. There is also the risk of a slower-than-anticipated economy hurting demand. The higher interest rate for a longer dynamic may also be detrimental for Broadcom as companies may be nervous to invest or wait for more accessible monetary periods. Expectations remain incredibly high, and the company must perform optimally to continue beating estimates. The slightest disappointments could lead to considerable downsides to its stock. Investors should examine these and other risks before investing in Broadcom.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AVGO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long a diversified portfolio with hedges.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2023 47% return) and achieve optimal results in any market.

- The Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement my Covered Call Dividend Plan and earn 50% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Join The Financial Prophet And Become A Better Investor!

Join The Financial Prophet And Become A Better Investor!

Don’t Hesitate! Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now and start beating the market for less than $1 a day!