Summary:

- Broadcom is an excellent opportunity to ride the AI future outside of GPUs.

- It is unique in its aggregation of firms – it has a high-value semiconductor business and a sticky SaaS business.

- There is a tremendous amount of operating efficiency in their business.

- Recurring, sustainable higher quality software revenues from the VMware acquisition.

G0d4ather

Broadcom (NASDAQ:AVGO) was often overlooked as a commodity/cyclical player in the semiconductor industry for a long time under Nvidia’s (NVDA) and Advanced Micro Devices’ (AMD) shadows.

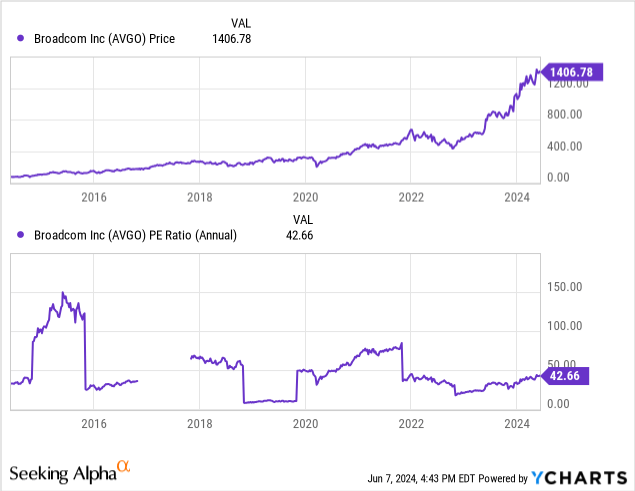

It was a huge opportunity when the stock was available in the 700’s last year at just 18-20 x earnings. Now at $1,400 the stock sells for 30x FY2024 adjusted earnings of $47 and 12 x sales of $50Bn. Is it still worth it, or have we missed the bus?

I don’t believe we’ve missed the bus and while returns may be muted initially, in the long run this company has a lot going for it and I plan to continue adding on declines. My cost now is just about $1,360, and I hope to average it down. My investment is for a 3-5-year period, expecting the stock to double in 5 years on earnings and revenue and adjusted earnings growth of 14% and 21% respectively.

Here are my major reasons to still buy the stock.

- AI leadership in ASIC’s and networking equipment for datacenters.

- The Apple relationship as the best in breed product.

- Recurring, sustainable higher quality software revenues from the VMware acquisition.

- Excellent 10-year financial record weathering troughs.

The AI Future

The custom AI or ASIC (Application Specific Integrated Circuit) chip market is dominated by the likes of Alphabet (GOOG) Meta Platforms (META) and Amazon (AMZN), should continue to grow. It was born out of the need to drive down the costs and capital expenditure of their own AI and ML (Machine Learning) portfolio and applications, which were extended to their customers as part of AI cloud services. Broadcom expects to play a significant role in artificial intelligence chips, with Alphabet being their largest customer. I believe datacenter giants like Alphabet, Amazon and Microsoft will allocate more resources towards TPU’s (Tensor Processing Units) in their efforts to wean away from their dependence on Nvidia.

Broadcom reported $1.5 billion of AI revenues in Q1 FY24 for a run rate of $6 billion per year. Citi Analyst, Christopher Danely, said in a research note that the company’s AI revenue will double from $4 billion in FY2023 to $8 billion in FY2024, and he expects the AI business will offset the correction in the semi-business.

Looking further out, Mizuho analyst Vijay Rakesh said:

Broadcom’s AI revenue will likely grow from $8 billion in 2024 to $20 billion in the calendar year 2027, thanks to its custom ASIC AI portfolio.

JPMorgan estimated the ASIC market would be dominated by Broadcom and Marvell (MRVL), growing at 20% per year.

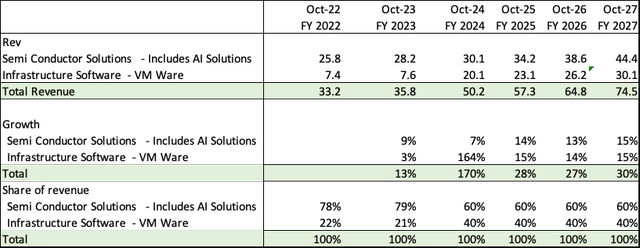

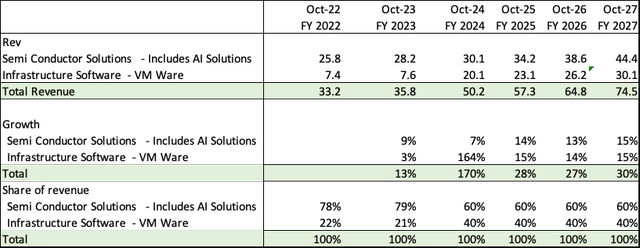

Broadcom Revenue Segments (Broadcom, Seeking Alpha, Fountainhead)

Broadcom has two revenue segments, semiconductor solutions and infrastructure software. AI solutions are included under semiconductor solutions, which should grow 13% to 15% in the next three years, much faster than the current 9% and 7% on the back of AI sales, which could go up to 50% of overall chip sales in the next five years.

Besides ASIC’s, Broadcom will also benefit from its networking gear (merchant switch and routing) sales to hyper-scalers, which need high-speed networks. Networking is absolutely critical for AI development, and Broadcom can easily use both products for the same clients, which is a big competitive advantage over single product suppliers.

Broadcom is no R&D slouch, with an average annual spend on R&D of $3.6Bn in the last 10 years, growing R&D spend at a CAGR of 25% from $695Mn to $5.6Bn last year, keeping pace with its revenue growth of 27% in the same time frame. This R&D strength is hugely instrumental for their networking chip business success, where it could take $50-$100Mn in costs to build out a new chip, and Broadcom has several chip lines to take advantage of customized and new requirements.

The Apple relationship is a moat

Supplying to Apple (AAPL), invariably means having the best-in-class product. Broadcom supplies filters for the iPhone. These are thin FBAR filters with better filtering and lower power consumption because of their smaller size. As we move on to 5G and higher, clear reception on the iPhones becomes a necessity, and Broadcom has been successful in keeping Apple as a customer because of quality. This requires high-quality engineering and as I mentioned earlier, Broadcom’s strong R&D prowess ensures that they dominate this slice of the market. This is a strong relationship and a moat; Broadcom produces this in-house in spite of being a fabless chipmaker to guard its technological lead.

High-quality software revenues from VMware

The VMware business, which Broadcom acquired in November 2023 is included in Infrastructure Solutions, allowing it to catapult revenues from $7.6Bn to $20.1Bn in that segment in FY2024, growing at 164% to 40% of overall revenues. Post-acquisition, this should also grow in the mid-teen range for the next three years.

Broadcom Revenue Segments (Broadcom, Seeking Alpha, Fountainhead)

Broadcom dominates the market for virtualization and mainframe software, with a solid presence in DevOps software and cybersecurity as well. The biggest competitive advantage in this segment is switching costs. Cheaper solutions won’t cut it and I believe, here, Broadcom’s core R&D strength allows it to add modules and product lines to maintain share and reduce churn. 80% of their large clients use more than 5 solutions. This is an embedded land and expand business and should continue to be a strong grower for Broadcom. The one area of weakness is Symantec, which is perceived as a legacy player, and to counter that, Broadcom has combined Carbon Black with it to position both as a comprehensive end point detection and response solution.

The concentrated selling of several products/solutions to few large enterprise customers increases their entrenchment and reduces churn, because of switching costs and the need to replace them with more than one vendor. These are recurring subscription business with high margins.

The VMWare acquisition helps reduce cyclicality from Broadcom’s traditional, cyclical commodity semiconductor sales.

The integration process is expected to take a year and will initially have a drag on profit margins due to transition costs. In the longer run, the margins should improve as merger synergies work their way into the system.

Excellent 10-year financial record

Broadcom has been a great performer in the last 10 years with revenue, operating income and EPS CAGR’s of 27%, 38% and 32% respectively. These are GAAP numbers! and like Lam Research’s (LRCX) excellent track record belies its categorization as a commodity cyclical. Sure, Broadcom did have two weak years with an operating income drop of 22% and EPS drops of 33% and 9% in 2019 and 2020, but it has consistently high gross and operating margins in the 70s since 2019 and operating margins in the mid-twenties until FY 2021, before jumping to the mid-forties in FY 2022 and FY 2023, with better SG&A expenses management in FY 2021, FY 2022 and FY 2023. This is a seasoned player knowing a thing or two about operations at scale and I for one, was poorer not doing a deeper dive earlier.

Broadcom sells high volumes of products to a concentrated level of customers. For the fiscal quarter ended February 4, 2024, sales to distributors accounted for 51% of their net revenue and sales to Apple and their top five end customers, accounted for approximately 17% and 40%, respectively, of total product revenue. This is also a very competitive market and ASP’s decline more often than they increase, so the enormous margins and cash flow generation bear testimony to a very well scaled and well-run operation. Too often the phrase “volume-based pricing” scares me from buying commodity stocks, but the numbers suggest that Broadcom is a very formidable player in their space.

Weaknesses and Threats

Commodity businesses: The broadband and storage business competes mainly on price, and it is still a large part of revenues. While AI and VMware continue to grow, this will weigh on overall revenues and earnings.

Virtualization is also a legacy, maturing business and while still growing is likely to face headwinds.

While 44% operating margins are definitely worth cheering for, this indicates cost savings and synergies from strategic acquisitions and less spend on organic growth. At this rate, one would worry about overpaying for acquisitions to grow.

Competitive threats abound in several of its business lines – there are obvious threats in AI and semis with hyperscalers capable of doing the work in house, with threats from Cisco and Arista for networking. Being a supplier to Apple has never been an easy relationship and Qualcomm can vouch for the huge drop in its stock price when Apple decided to try and make their own modems, though they came back and extended their contract when they realized that it was a tough business to start.

April 2024 Quarterly Results

Broadcom reports on June 12th, 2024, for the quarter ended April 2024, with consensus earnings and revenue estimates of 10.84 and 12.01Bn, respectively.

My investment case is strongly based on a long-term buy and hold – as a solid, efficient business with growth from AI and from recurring and sustainable enterprise software, so I don’t believe hits or misses will make a difference in my decision or thesis. Nonetheless, there have been several upgrades and given the speed at which AI is going, I wouldn’t be surprised if guidance is raised further.

Investment Case

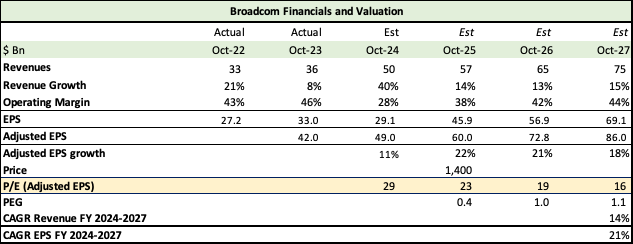

Broadcom Financial Forecast (Broadcom, Seeking Alpha, Fountainhead)

VMWare should add about $13Bn of Enterprise Software Revenue to Broadcom’s coffers in FY2024. Post-merger, the $50Bn behemoth should grow at a CAGR of 14% with both revenue segments growing around 13% to 15% per year. Adjusted earnings should grow faster at a CAGR of 21% as operating margins go back over 40%.

For sure, as the product mix improves towards software and subscription solutions, Broadcom’s margins and multiples will improve, but until then, non-cash charges for the merger, including impairments and expensing of RSU’s for the merger will hurt earnings. I have included both GAAP and Adjusted EPS in the table above for investors to judge for themselves. Seeking Alpha consensus estimates carry adjusted earnings per share, and I believe they’re fairly reasonable.

Based on these estimates, Broadcom sells for 29x FY24 adjusted earnings and 23x FY25 adjusted earnings. With adjusted earnings growing at a CAGR of 21% the PEG ratio is low between 0.4 and 1.1.

AI revenue growth does augur well for Broadcom, with an estimated AI revenue of $6Bn in FY24, Broadcom is north of AMD’s AI revenue of $4Mn, placing it in a rare group of AI producers.

What also impresses me is that even as Broadcom had a weaker product line -up in the last 10 years with some of its products not performing, it still did extremely well with 32% earnings growth. The decision to focus on a steadier subscription business like VMware and on AI is a welcome step in the right direction. Instead of supplying millions of low margin parts with no discernible differences to distributors – the higher margin businesses make it a different and better company, and you can see it in a stronger multiple of 29x earnings and a share price that has doubled in the past year.

I’m willing to take the risk that the stock could move sideways for the next 6 months to a year, especially with a 98% gain in the past year, and will continue to accumulate on declines.

Besides its financial performance, there are strategic strengths that make Broadcom an excellent investment.

It is unique in its aggregation of firms – it has a high-value semiconductor business and a sticky SaaS business, which it can actually cross-sell!

I also believe that the bundling of enterprise software with network equipment and semiconductors to enterprise customers could lead to positive revenue surprises down the road.

It has managed acquisitions very well in the past, which could have been very messy in the hands of a less experienced operator. Instead, they made over 40% in operating margins and generated over $92Bn in operating cash in the last ten years! There is a tremendous amount of operating efficiency in their business.

Besides, the competitive advantages of the technological leadership in FBAR filters for iPhones, and the AI opportunity make it a compelling buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AVGO, NVDA, AMD, GOOG, AMZN, AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.