Summary:

- Market pundits are predicting the AI to be bubble bursting in days or weeks, causing speculation and concern, especially for high-growth stocks like Broadcom.

- Recent volatility is not related to AI bubble; pullback in Broadcom seen as a strong buying opportunity due to strong AI spending outlook.

- Broadcom expected to benefit from increased AI capex by Big Tech companies, leading to robust revenue growth and margin expansion, suggesting strong upside potential.

- The secret to Broadcom’s growth formula lies in its pricing power, which implies +60% adj. EBITDA margins, which sufficiently warrants its +20x valuation multiple.

G0d4ather

Investment Thesis

Market pundits and technological watchers have used the current conditions of extreme volatility seen playing out globally in the last few days to ramp up their discourse about the AI bubble bursting. Some have even revised their outlook, calling for the AI bubble to burst in “days or weeks from now.”

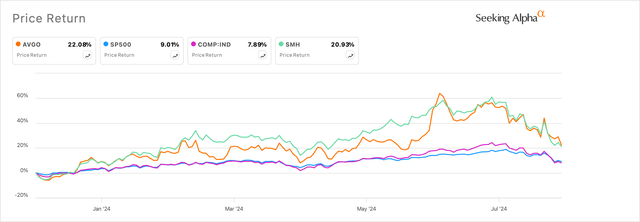

Such comments have caused immense speculation & concern among stocks that are experiencing high growth, especially those stocks that have run far higher than the markets in H1 FY24. Broadcom (NASDAQ:AVGO) is one of those names in the semiconductor industry that has been subject to similar treatments, with the market falling 21% from its YTD highs after creating record all-time highs in June this year.

Exhibit A: Broadcom’s stock has pulled back 21% from its record all time highs this year (Seeking Alpha)

However, I argue that the concerns surrounding the AI bubble are misplaced and that the recent volatility arose from market conditions that had nothing to do with the AI bubble. More importantly, this pullback in Broadcom creates a buying opportunity for investors, given its robust outlook.

I am initiating my rating on Broadcom by recommending a ‘Strong Buy’.

The “AI Bubble” Has Room To Expand & AI Capex Offers Meaningful Proof

The only reason I call this an AI bubble is if I compare the current escalation in market capitalization of many stocks to the U.S. Fed’s definition of asset bubbles in 2015 as “an upward price movement over an extended range that then implodes.”

Part of that asset bubble definition suddenly seemed to catch the market’s attention over the past week as global volatility surged over the weekend. Many AI/market pundits were quick to rush in and advertise their respective “pound-the-table” moments where they had been calling for the AI bubble to burst.

However, I believe this is not true, and investors should remember that the source of volatility was rather from global market events unfolding with the Japanese yen (USD:JPY) surging after Japan’s Bank of Japan surprised global markets with their first rate hike in over a decade. The surging Japanese yen caused an unraveling in the Yen carry trade, forcing global investors to scale back their positions, especially in those assets that have massively run up through the year. I have recently explained this in detail in my post on Bitcoin and why I expect the volatility to normalize in the near term.

Having established the fundamental reason for the recent sell-off, which has nothing to do with the AI bubble bursting, I will also reiterate the strength of AI spending, of which Broadcom is a beneficiary.

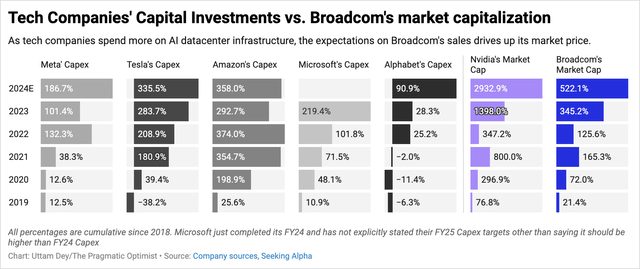

After perusing through many of Big Tech’s earnings calls, I have added a chart below that shows the expected rise in capex since 2018 on a cumulative basis.

Exhibit B: Broadcom’s market cap rise versus the cumulative increase in Big Tech’s capex since 2018. (Company filings, Earnings Calls, Seeking Alpha)

As seen above, many large players such as Amazon (AMZN), Alphabet’s Google (GOOG), and Meta Platforms (META) are expected to see significant increases in their capex this year, with Google and Meta Platforms projecting the largest of all increases in 2024. Most of the Big Tech names that I mentioned are large customers of Broadcom and will support the mid-term growth rates of Broadcom’s revenue stream.

How Broadcom Participates In The Next Phase Of The “AI Bubble”

What is clearly visible from Exhibit B above is the timing of the increase in capex by the companies I mentioned in the earlier section. All these companies seemed to ramp up their capex spend through 2022, and the timing of these increased investments converges on two things: First is the launch of ChatGPT, launched at the end of 2022. Second is the rising revenue growth seen at Broadcom in Exhibit C below.

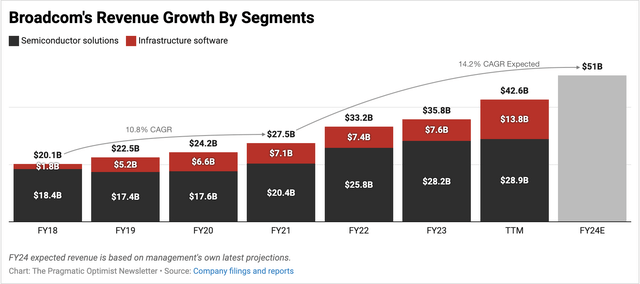

Exhibit C: Broadcom’s revenue growth rates on a compounded basis have exceeded its pre-pandemic growth rates. (Company filings)

As seen above, the 10–11% top line growth that Broadcom would consistently deliver before and during the pandemic suddenly increased starting in 2022 and is expected to grow by a CAGR of 14.2%, assuming management’s expectations of the company’s sales this year. While Broadcom has not been the exact beneficiary of AI Capex seen in FY23 as compared to Nvidia (NVDA), I expect the next few years to be stronger for Broadcom as its custom AI chips business helps the company’s hyperscaler customers design their own AI chips and wean off dependency from Nvidia.

Reports of Meta Platforms and Google using Broadcom to scale the v3 and v7 versions of their respective ASICs (application-specific integrated circuits) coincide with the increased capex spend by these two companies, as illustrated in Exhibit B above, as well as with comments from Broadcom’s most recent earnings call, where management said:

For fiscal ’24, we expect revenue from AI to be much stronger at over $11 billion. Non-AI semiconductor revenue has bottomed in Q2 and is likely to recover modestly for the second half of fiscal ’24. On infrastructure software, we’re making very strong progress in integrating VMware and accelerating its growth. Pulling all these three key factors together, we are raising our fiscal ’24 revenue guidance to $51 billion.

I expect Broadcom to sell strongly into the demand for its custom AI semiconductor solutions, which should stay elevated over the next few years, implying at least 23% compounded growth through FY26. Selling strongly into demand also means that Broadcom can pursue its higher pricing strategy, implying either sustaining current adj. EBITDA margins or expanding them.

Valuation Suggests Strong Upside for Broadcom

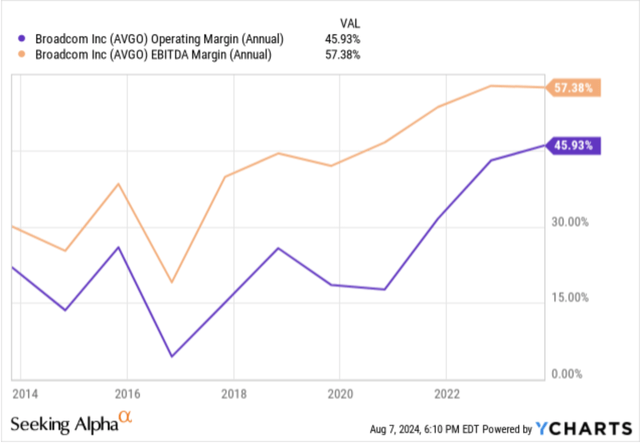

In addition to the strong +23% CAGR top-line growth that I expect for Broadcom, I also believe the company will be able to deliver robust earnings growth. As can be seen in Exhibit D below, Broadcom has been expanding its margins by massive levels since the pre-pandemic. These margin expansions reflect strong pricing power and will continue to support the margin expansion in the coming years.

Exhibit D: Broadcom’s margins have robustly expanded from before the pandemic. (YCharts)

Broadcom’s management expects they will deliver 61% adjusted EBITDA margins in FY24, and I believe the company can continue to sustain these margins through FY26. What further gives me confidence in Broadcom to maintain these margins is the recent credit upgrade from Fitch Ratings this week, who also believe Broadcom can sustain adj. EBITDA margins “in the low-60%.”

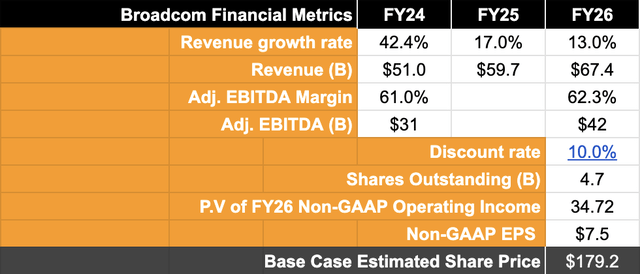

Based on these assumptions, I expect Broadcom to deliver a 22-23% CAGR in adj. EBITDA through FY26, as illustrated in Exhibit E. My valuation model below assumes a discount rate of 10%.

Exhibit E: Author’s valuation model points to strong upside in Broadcom’s stock (Author)

Based on this valuation and expectation of 22-23% CAGR EBITDA growth, I believe a forward PE of 30-31x would have been warranted.

Note on Broadcom’s Debt: However, since the company holds large amounts of debt, it would impact the valuation multiple. Per the 10-Q, Broadcom carries $71.6 billion of debt and ~$9.8 billion in cash and equivalents. This does seem like a substantial volume of debt for Broadcom to carry, but taking into account its estimated FY24 adj. EBITDA margin of ~61%, that implies an adj. leverage ratio of ~2x, which is reasonably manageable in my opinion. Still, such substantial volumes of debt will mean Broadcom incurs interest expenses of ~$2.8 billion per year.

If I factor in these interest expenses, I believe Broadcom should be valued at ~24x forward earnings, which implies 31–32% upside from current levels.

Risks & Other Factors To Consider

One of the primary attractive qualities of Broadcom’s stock is its industry-leading adj. EBITDA margins. Hence, any threat to those margins would directly diminish the valuation multiple that my model applies.

At the moment, an unknown factor is the extent to which Taiwan Semiconductor’s (NYSE:TSM) reported price hikes may impact Broadcom’s handsome margins. ~90% of Broadcom’s chip production is managed by Taiwan Semi. The details of the capacity contracts that Taiwan Semi’s price increases impact are still unknown. I do not expect a significant impact yet, at least not until next year.

In addition, there is still some risk from Broadcom’s exposure to China due to heightened geopolitical risks. Roughly a third of Broadcom’s revenue is exposed to China, either via shipment or delivery of Broadcom’s product. With revenue from China staying relatively flat since FY21, the company appears to be taking measures to diversify its revenue streams on a geographic basis. Then, there are also developments of China’s ByteDance working with Broadcom on their own 5nm ASIC customer AI chips.

In terms of market volatility, I expect this to normalize in the immediate term which should restore stability in markets soon. BoJ has recently issued another clarification stating its intention to abstain from raising interest rates amid unstable financial market conditions.

Takeaway

After the recent volatile pullback in markets, Broadcom looks all set to begin another rally as its valuation appears attractive once again. The demand for custom AI chips being led by Broadcom’s hyperscaler customers will lead to strong revenue growth for the San Jose, CA-headquartered company and allow Broadcom to sustain its industry-leading +60% adj. EBITDA margins.

I believe the next phase of AI is still underway, and Broadcom will be a strong beneficiary. Hence, I recommend a Strong Buy on Broadcom.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.