Summary:

- Broadcom excels in cutting-edge connectivity chips but shows limited growth, making its 37x forward PE ratio seem high for its performance.

- The VMWare acquisition boosted AVGO’s revenue, but core business growth remains mediocre, with only a 4% increase in FQ3 2024.

- Selling the unprofitable EUC segment will enhance profitability, potentially doubling net income, and improving gross margins after initial acquisition-related dips.

- Despite positive AI and data center tailwinds, Broadcom’s valuation is high, and future EPS growth is partly debt-financed, justifying a ‘Hold’ rating.

G0d4ather

Investment Thesis

I think Broadcom (NASDAQ:AVGO) is a great company. They sell the chips that go in connectivity devices such as routers, Wi-Fi hubs, and data center switches. They focus on the most cutting-edge technologies, commanding premium prices that are mirrored in their astronomical gross margins.

But at the same time, they seem to have reached maturity. Sure, the semiconductor market is booming on the back of the AI bonanza, and Broadcom sells the chips used to connect these AI servers. But for a 37x forward PE, one would expect more solid growth, which Broadcom doesn’t deliver.

Revenue Growth

Broadcom sales this year benefited from the acquisition of VMWare, a software company specializing in cloud infrastructure applications. VMWare is a great company and has ties to many enterprises that run hybrid cloud infrastructure. It added billions in subscription revenue to Broadcom this year after the deal closed in November 2023.

However, when stripping VMWare’s contribution to this year’s sales to level the comparison with the prior period before the VMWare acquisition, we see mediocre growth in Broadcom’s ‘core’ business.

| Net revenue (billions $) | FQ3 August 4, 2024 | FQ3 July 30, 2023* | YoY Change |

| Total Sales | $ 13,072 | $ 8,876 | 47% |

| VMWare Sales Contribution to Total | $ 3,833 | $ 3408* | 12% |

| Sales Excluding VMWare Contribution | $ 9,239 | $ 8,876 | 4% |

*Note: VMWare sales for FQ3 2023 were derived from its SEC filings before the Broadcom acquisition. There is a small four-day misalignment in 2023 sales, where FQ3 sales were recorded for the period ended August 4, 2023, not July 30, 2023.

Excluding VMWare, Broadcom FQ3 2024 (fiscal quarter ended August 4, 2024) sales grew by a mere 4%. The same dynamics apply to the three fiscal quarters ended August 4, 2024, with sales excluding VMWare growing 9%, much less than the reported 41% top-line figure that includes VMWare sales.

| Net revenue (billions $) | Three fiscal quarters ended August 4, 2024 | Three fiscal quarters ended July 30, 2023 | YoY Change |

| Total net revenue | $ 37,520 | $ 26,524 | 41% |

| VMWare Revenue | $ 8,609 | 6,685 | 29% |

| Sales Excluding VMWare Contribution | $ 28,911 | $ 26,524 | 9% |

What is interesting is VMWare performance under Broadcom. YoY sales grew by 29% this year. Growth slowed to 12% in the latest quarter, but this isn’t something to frown at. It is not uncommon for sales to decline after an M&A as customers review their strategic relations. This didn’t happen here. Moreover, on July 1, 2024, Broadcom sold the End-User Computing ‘EUC’ business segment, which was part of VMware. EUC sales average about $1 billion each quarter. If EUC wasn’t sold, we could have seen a 20% YoY increase in VMWare sales in FQ3.

When the company reports its FQ4 results (for the three months ended October 2024) we should see improved profitability.

Profitability

Broadcom’s profitability will likely jump in the coming few quarters. On July 1, 2024, the company sold the EUC business to KKR. Although this has impacted revenue growth, it will create better profits because the EUC segment was unprofitable in the last quarter, weighing down profitability by $443 million in losses ($361 million in EUC net income losses, and $84 million in restructuring costs related to the sale of EUC). If Broadcom had sold EUC earlier (or bought VMWare without EUC), FQ3 2024’s net income would have been nearly double the $477 million it reported during the quarter.

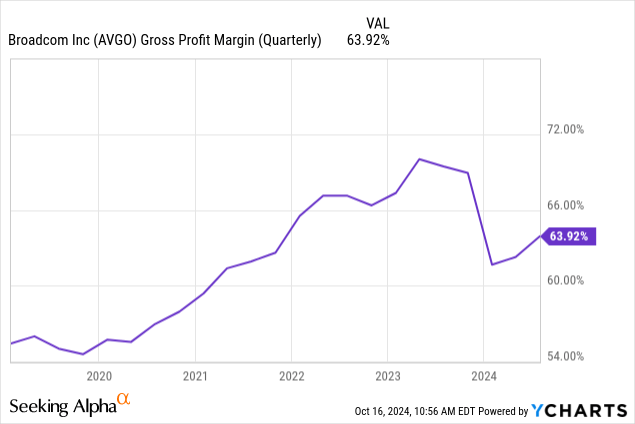

In terms of gross margins, we saw a dip this year after the VMWare acquisition, but I believe this is temporary. We already saw a partial rebound in gross margins in the past two quarters. VMWare enjoyed higher gross margins than Broadcom before the acquisition, leading me to conclude that this has more with some reorganization costs seeping into COGS, including the Amortization of intangible assets recorded when Broadcom bought VMWare.

Valuation

Broadcom isn’t cheap. Wall Street expects an EPS of $6.2 next fiscal year (Twelve months ended October 2025), up 28% from 2024 expectations. The sale of EUC is a temporary net income growth driver, as it won’t weigh down on profitability next year as it did this year. The rest is perhaps organic growth on the back of a proliferating data center market. There is a lot to be optimistic about. A potential iPhone renewal supercycle comes to mind on the back of the fundamental changes Apple (AAPL) made to bring its flagship device to the AI era. This will likely revitalize Broadcom’s wireless segment after many quarters of sluggish performance. Then we should also account for a potential rebound in segments that suffered from the typical cyclicality in the tech hardware sector. We have seen some of these dynamics manifested in recent quarters. Non-AI data center networking is rebounding, as ‘traditional’ data center projects pick up pace after being overshadowed by AI data center infrastructure spending. Storage is another area where things could improve. Server storage connectivity solution sales declined YoY last quarter, a continuation of a broader downward trend that extends to 2023. Such cyclicality is typically followed by a rebound.

Still, even when considering all these positive tailwinds, a $6.2 EPS translates to a forward 2025 PE ratio of 27x, which falls at the upper bound of the industry range.

| Company | 2025 forward P/E ratio |

| NVIDIA (NVDA) | 33 |

| Marvell Technology Group Ltd. (MRVL) | 32.3 |

| Analog Devices, Inc. (ADI) | 30.3 |

| Texas Instruments (TXN) | 30 |

| AMD (AMD) | 29 |

| Teradyne, Inc. (TER) | 27.3 |

| Broadcom (AVGO) | 27 |

| KLA Corp (KLAC) | 23.5 |

| Taiwan Semiconductor (TSM) | 22.6 |

| GlobalFoundries Inc. (GFS) | 20.5 |

| Applied Materials (AMAT) | 19.2 |

| ON Semiconductor (ON) | 17.5 |

| Skyworks Solutions, Inc. (SWKS) | 15.4 |

| Qualcomm (QCOM) | 15.3 |

| NXP Semiconductors N.V. (NXPI) | 15.3 |

| Infineon Technologies AG (OTCQX:IFNNY) | 14.6 |

| STMicroelectronics N.V (STM) | 12.2 |

| Micron (MU) | 8.5 |

Final Thoughts and How I Might Be Wrong

Broadcom profits will likely surge in the coming quarters. It sold an unprofitable segment that weighed down on profits this year, namely the EUC segment it inherited from the VMWare acquisition. Then you have the AI tailwinds manifested in the increased demand for data center switches, routers, and other connectivity solutions as the world embarks on its mission to increase computing capacity to support large language models and other generative AI applications.

Beyond AI, Broadcom’s business segments that underperformed in the past 18 months will likely recover next year, further supporting its growth. Such dynamics are typical in the industry.

More broadly, Broadcom is benefiting from a burgeoning data center industry. It has become the favorite partner for the likes of Meta (META) and Alphabet (GOOG) in supporting their roadmap for in-house semiconductor design.

Given all these favorable dynamics, our ‘Hold’ rating might disappoint.

But then, Broadcom’s valuation falls at the upper bound of the industry range. Its high gross margins also are an invitation for new market entrants, who will most likely increase on the back of US Federal Government subsidies for the microchip industry.

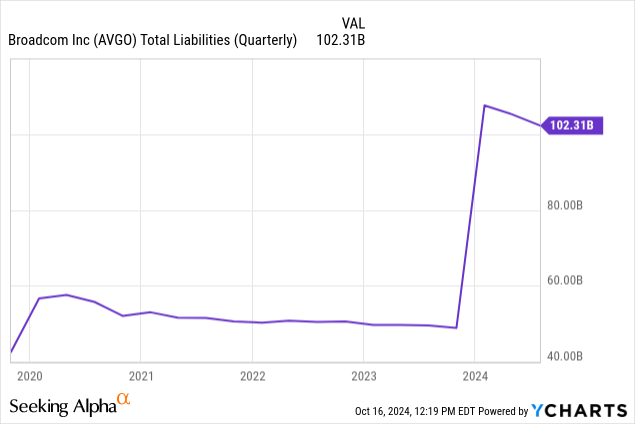

Finally, one can’t help but incorporate the fact that Broadcom’s future EPS growth is partly supported by the massive leveraging of its balance sheet to acquire VMWare. The deal cost the company about $90 billion, which it financed largely through debt. Without such leveraging, one can’t help but wonder about Broadcom’s future growth and whether it will keep up with its hefty valuation.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.