Summary:

- Broadcom’s stock skidded 10% on Friday despite strong Q3 earnings and a beat on the top/bottom line.

- The company’s robust AI-driven growth, high gross margins, and free cash flow profitability reduce investment risks.

- Broadcom’s valuation has become more attractive, now trading at a forward P/E ratio of 22X, down from near-30X earlier this year.

- Risks include a potential slowdown in AI-related revenue, which could negatively impact Broadcom’s gross margins and investor sentiment.

peshkov

Shares of Broadcom (NASDAQ:AVGO) crashed 10% on Friday after the hardware maker reported better than expected earnings for its third fiscal quarter. Despite a 47% year-over-year increase in revenue in the last quarter, which was driven by a continual boom in the artificial intelligence market, the earnings report fell into a week of weak macro data. Chip stocks had an especially bad week last week as investors panicked over a poor reading of the labor market data. In my opinion, Broadcom is in a buy the dip kind of situation as the company maintained high gross margins and generated a ton of free cash flow. Shares are also much more affordable following last week’s drop.

Previous rating

I rated shares of Broadcom a sell in my work from June — Beware The FOMO Rally — as the hardware company saw a significant acceleration in its top line due to its AI-related growth, which caused a euphoric market reaction. While the AI boom does not seem to be ending — Broadcom guided for $12B in AI-related revenue in the current fiscal year — the market has been more cautious with regard to companies that benefit from it. In my opinion, Friday’s 10% drop is a buying opportunity: the company’s solid top line guidance and robust free cash flow, paired with a significant valuation drawdown since my last coverage in June, make shares more attractive for long-term growth investors.

Broadcom’s strong Q3 earnings report, massive FCF and high margins

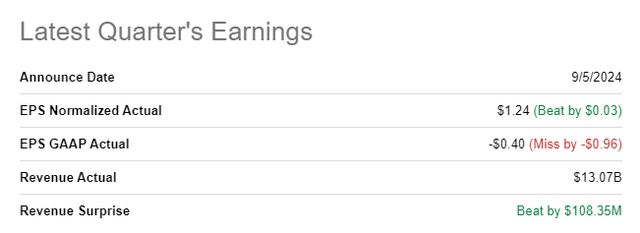

Broadcom edged out consensus estimates on both the top and the bottom line last week: The company had adjusted earnings of $1.24/share, which beat estimates by $0.03/share. The top line came in at $13.07B, beating the consensus estimate by $108M.

Seeking Alpha

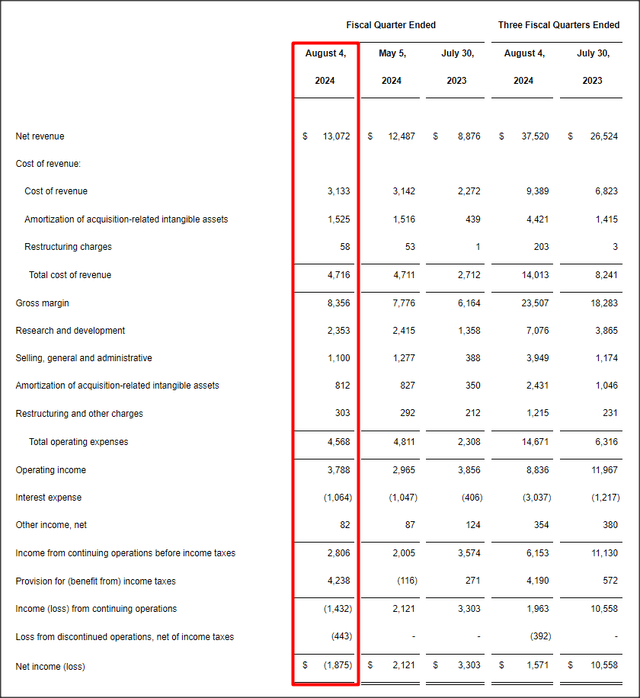

Broadcom generated $13.1B in net revenues in what is the company’s third fiscal quarter, showing 47% year-over-year growth. Broadcom benefits from growing demand for AI infrastructure, which has led to a serious upswing in revenues and gross margins in the last year.

Gross margins especially are a key performance metric for hardware makers and Broadcom is seeing a significant upsurge here: the firm benefited from strong demand for AI parts and other custom products in the last quarter, leading to a gross margin of $8.4B, showing 36% year-over-year growth. The hardware maker generated a gross margin of 64% in the last quarter, compared to 62% in the previous quarter.

Broadcom

Another strength, besides high gross margins, is that Broadcom is highly free cash flow-profitable which, in my opinion, takes a lot of risk out of the equation.

Broadcom generated free cash flow of $4.8B, showing 4% year-over-year growth, resulting in a healthy free cash flow margin of 37% (+1 PP Q/Q). Broadcom’s strong free cash flow limits investments risks with regard to Broadcom, in my opinion, and could also support the company’s share price in the long run, especially if the company were to return a higher free cash flow percentage to shareholders (either through a higher dividend or a new stock buyback plan).

| $millions | Q3’23 | Q4’23 | Q1’24 | Q2’24 | Q3’24 | Y/Y Growth |

| Revenue | $8,876 | $9,295 | $11,961 | $12,487 | $13,072 | 47% |

| Net Cash Provided By Operating Activities | $4,719 | $4,828 | $4,815 | $4,580 | $4,963 | 5% |

| Purchases of PPE | ($122) | ($105) | ($122) | ($132) | ($172) | 41% |

| Free Cash Flow | $4,597 | $4,723 | $4,693 | $4,448 | $4,791 | 4% |

| Free Cash Flow Margin | 52% | 51% | 39% | 36% | 37% | -29% |

(Source: Author)

Outlook for Q4

Broadcom projects a top line of $14.0B for the fourth fiscal quarter, which came in slightly below consensus expectations of $14.1B. The company said that it still benefits from growing spending on AI parts and other custom item it sells, leading to an AI-related revenue forecast of $12.0B in the current fiscal year (+$1.0B compared to previous forecast).

Broadcom’s valuation

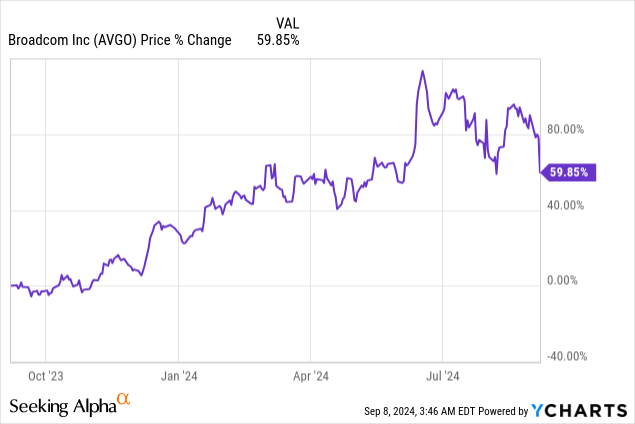

Broadcom’s valuation is no longer as stretched as it was several months ago, when optimism about AI hardware makers including NVIDIA (NVDA) or Super Micro Computer (SMCI) peaked. Last week was an especially bad week for Broadcom to release its earnings as the market reeled from a bad jobs report for August and jobs numbers for July were revised downward.

Broadcom’s 10% slump on Friday, however, has made the stock a lot more affordable for investors: since my last recommendation, Broadcom’s share price has fallen ~20%, and I believe that investors are now dealing with an attractive dip buying opportunity.

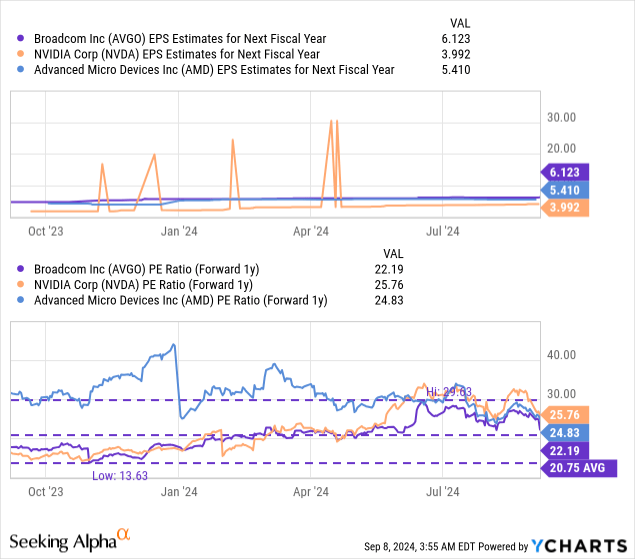

Shares of Broadcom are valued at a forward price-to-earnings ratio of 22.2X, which is about 7% above last year’s P/E average, but significantly down from the near-30X forward P/E ratio we have seen earlier this year. Compared to other fast-growing chip companies, like NVIDIA and AMD (AMD), Broadcom is now trading at a much more attractive valuation ratio.

I believe Broadcom could be valued at a 25X P/E ratio given its strong underlying free cash flow profitability and its ability to expand its gross margins quarter-over-quarter. A 25X fair value P/E ratio implies an intrinsic value, based off of a consensus EPS expectation of $6.12/share, of ~$153 per-share. With shares trading below my fair value estimate and the company issuing solid revenue guidance for the next fiscal quarter, I believe a rating upgrade to buy makes sense.

Risks with Broadcom

A slowdown in AI-related revenue growth could potentially break the spirit of investors that plan on a multi-year AI spending spree. Broadcom is growing quickly, and its gross margins are expanding, which is good news. It’s free cash flow is strong. However, slowing AI spending on hardware and software products could potentially have a negative effect on Broadcom’s gross margin trajectory. What would change my mind about Broadcom is if the company were to see a drop-off in its free cash flow margins or fail to maintain its high gross margins.

Final thoughts

Broadcom reported solid results for its third fiscal quarter last week, but the market clearly didn’t appreciate the company’s earnings scorecard as much as it maybe should have. The reason for this was an accelerating sell-off in the stock market last week, following a weaker than expected reading of the jobs report for the month of August, which created pressure for sectors that have done well lately, AI stocks specifically. However, Broadcom’s outlook for the next quarter is solid, and the company generates a ton of free cash flow. The valuation is now much more appealing than it was in June, resulting in a rating upgrade to buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA, AMD, AVGO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.