Summary:

- AI-led growth acceleration has a long runway in Broadcom’s semiconductor solutions business, driven by shipment volume increases.

- VMware is driving strong margin expansion at a faster-than-expected rate.

- Broad-based upgrades to revenue, gross margins, and operating profit estimates by Wall St. analysts are bullish fundamental signs.

- Valuations are at a premium vs. comps but deservedly so, given strong expected earnings growth upgrades. Technicals relative to the S&P 500 show zero bearish signs.

- The customer concentration risk is abating as new hyperscalers are expected to be onboarded.

Dragon Claws/iStock via Getty Images

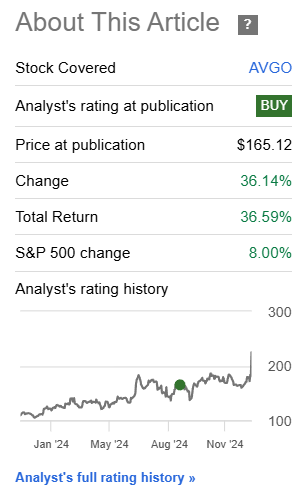

Performance Assessment

My initiating ‘Buy’ coverage on Broadcom (NASDAQ:AVGO) has been playing out well so far, outperforming the S&P 500 (SPY) (SPX) (IVV) (VOO) by +28.59% in total shareholder return:

Performance since Author’s Last Article on Broadcom (Seeking Alpha, Author’s Last Article on Broadcom)

Thesis

I remain bullish after the company’s Q4 FY24 results (the company has a Nov-ending fiscal year):

- AI-led growth acceleration has a long runway

- VMware is driving strong margin expansion

- Broad-based upgrades to fundamental estimates are very bullish

- Valuations are at a premium vs comps, but deservedly so given earnings momentum

- Technicals show zero signs of weakness

- Customer concentration risk may be abating

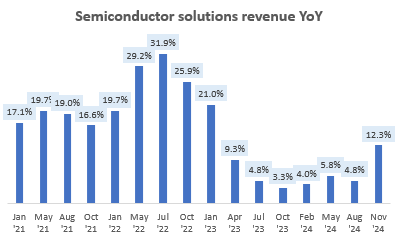

AI-led growth acceleration has a long runway

Broadcom’s semiconductor solutions segment makes up 58.6% of overall revenues as of Q4 FY24. This is seeing a growth acceleration:

Semiconductor Solutions Revenue YoY (Company Filings, Author’s Analysis)

AI and networking solutions are the key drivers of this growth acceleration:

Our AI revenue, which came from strength in custom AI accelerators, or XPUs, and networking…41% of our semiconductor revenue…

– CEO Hock Tan in the Q4 FY24 earnings call

And the demand tailwinds are expected to continue as shipment volumes increase:

doubling of our AI XPU shipments to our 3 hyperscale customers and 4x growth in AI connectivity revenue, driven by our Tomahawk and Jericho shipments globally. In Q1, we expect the momentum in AI connectivity to be as strong as more hyperscalers deploy Jericho3-AI in their fabrics.

– CEO Hock Tan in the Q4 FY24 earnings call

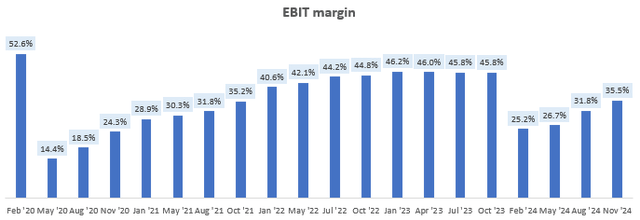

VMware is driving strong margin expansion

Broadcom took an initial margins hit after the acquisition of VMware 4 quarters ago (Feb’24 quarter). However, the company is on a strong improvement track since:

EBIT Margin (Company Filings, Author’s Analysis)

This is driven a lot by VMware’s operating margins reaching 70% in Q4 FY24, which is above expectations:

[VMware] operating margin reached 70% exiting 2024… We are well on the path to delivering incremental adjusted EBITDA at a level that significantly exceeds the $8.5 billion we communicated when we announced the deal. We’re planning to achieve this much earlier than our initial target of 3 years.

– CEO Hock Tan in the Q4 FY24 earnings call

For context, the EBIT margins for Broadcom’s infrastructure solutions business ex of VMware was ticking at low-mid 70% levels. Hence, margin reversion here is leading the overall company back toward at least the 40% EBIT levels.

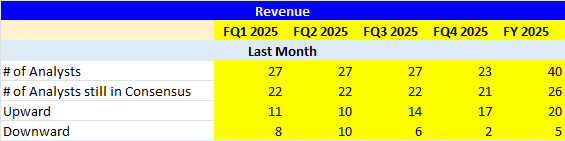

Broad-based upgrades to fundamental estimates are very bullish

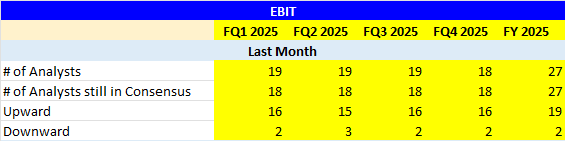

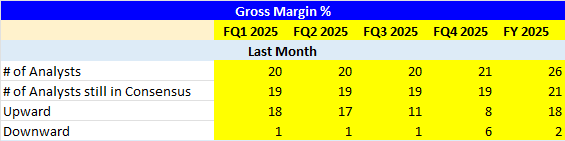

The combination of the growth and margin tailwinds is leading to net upgrades in revenues, gross margins and operating profit levels over the next 4 quarters by Wall St Analysts:

Revenue Upgrades (Capital IQ, Author’s Analysis) EBIT Upgrades (Capital IQ, Author’s Analysis) Gross Margin Upgrades (Capital IQ, Author’s Analysis)

I think this is a very bullish sign that is driving the overall expected earnings growth momentum in the company:

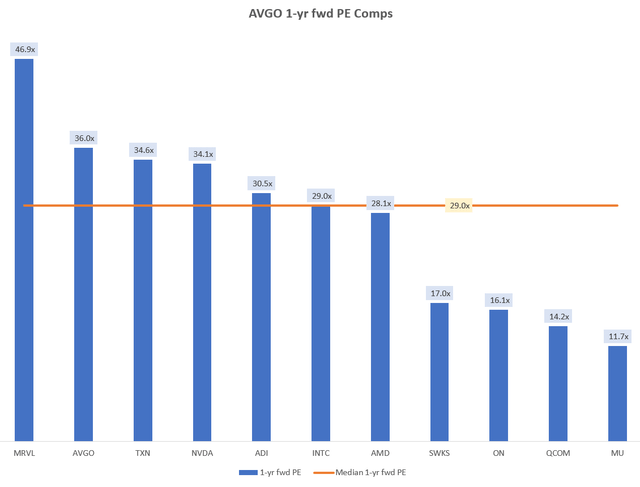

Valuations are at a premium vs comps, but deservedly so given earnings momentum

AVGO is trading at a 1-yr fwd PE of 36.0x, which corresponds to a 24.4% premium to the median comps’ level of 29.0x:

AVGO 1-yr fwd PE Comps (Capital IQ, Author’s Analysis)

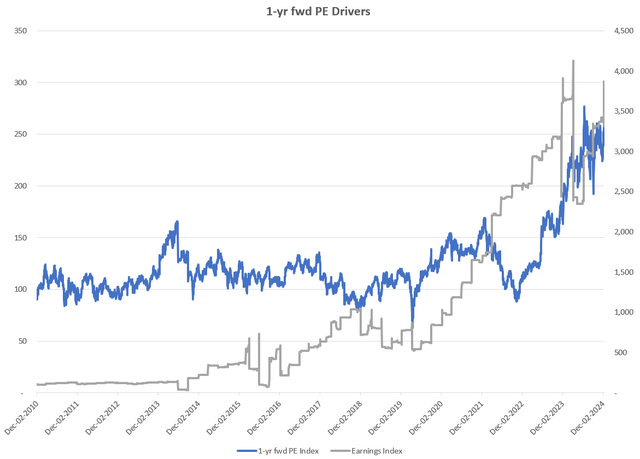

However, I believe this premium is justified given the strong fundamental earnings growth momentum driving the stock’s price action (grey line):

1-yr fwd PE Drivers (Capital IQ, Author’s Analysis)

In my view, a premium valuation driven primarily by earnings upgrades is a healthier sign than one driven primarily by a multiples re-rating of a stock, since that is more likely to be a sign of overhype. I’ve discussed this concept in greater detail in one of my articles on NVIDIA (NVDA) here.

Technicals show zero signs of weakness

If this is your first time reading a Hunting Alpha article using Technical Analysis, you may want to read this post, which explains how and why I read the charts the way I do. All my charts reflect total shareholder return as they are adjusted for dividends/distributions.

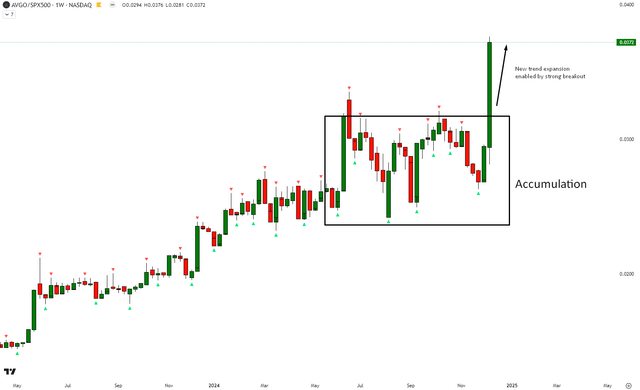

Relative Read of AVGO vs SPX500

AVGO vs SPX500 Technical Analysis (TradingView, Author’s Analysis)

Following a period of accumulation since Jun’24, the ratio prices of AVGO vs SPX500 have printed a strong breakout to the upside after the Q4 FY24 earnings release. I think this is obviously bullish; there are zero signs of bears in the recent price action.

Customer concentration risk may be abating

In my last note on AVGO stock, I had remarked that customer concentration (top 5 make up 35% of net revenues in FY23) was a key risk for the company. However, there are some signs that this risk may be abating as the company is on track to add 2 more hyperscalers to its AI portfolio:

we have been selected by 2 additional hyperscalers and are in advanced development for their own next-generation AI XPUs. We have line of sight to develop these prospects into revenue generating customers before 2027 and could, therefore, expand this [$60-90 billion] SAM (serviceable addressable market) significantly.

– CEO Hock Tan in the Q4 FY24 earnings call

This makes further details on the new customer concentration levels in the FY24 10-K and subsequent 10-Q reports a key monitorable.

Takeaway & Positioning

My ‘Buy’ stance on Broadcom has performed well, generating +28.59% of active return vs the S&P 500. I believe Q4 FY24 results provide ample reasons to remain bullish as the company enjoys continued growth runway driven by increased shipments outlook of its AI and networking products, faster-than-expected margin expansion coming in from VMware, and net upgrades in revenue and margin estimates for the next 4 quarters.

Compared to Aug’24 when I last covered the stock, AVGO is now trading at a premium instead of a small discount vs its comps. However, I believe this is well-deserved given the strong earnings growth driving the appreciation of fundamental value. Technically, relative to the S&P 500, the stock has broken out of a 5-6 month accumulation phase and there are zero signs of bears in the price action.

Lastly, there are early indications that the customer concentration risks may be abating as the company is on-track to onboard 2 more hyperscaler customers. Details on this in the FY24 10-K would be a key monitorable.

In conclusion, I continue to rate AVGO a ‘Buy’.

How to interpret Hunting Alpha’s ratings:

Strong Buy: Expect the company to outperform the S&P 500 on a total shareholder return basis, with higher than usual confidence. I also have a net long position in the security in my personal portfolio.

Buy: Expect the company to outperform the S&P 500 on a total shareholder return basis

Neutral/hold: Expect the company to perform in-line with the S&P 500 on a total shareholder return basis

Sell: Expect the company to underperform the S&P 500 on a total shareholder return basis

Strong Sell: Expect the company to underperform the S&P 500 on a total shareholder return basis, with higher than usual confidence

The typical time-horizon for my views is multiple quarters to more than a year. It is not set in stone. However, I will share updates on my changes in stance in a pinned comment to this article and may also publish a new article discussing the reasons for the change in view.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AVGO, VOO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.